Death Rites......

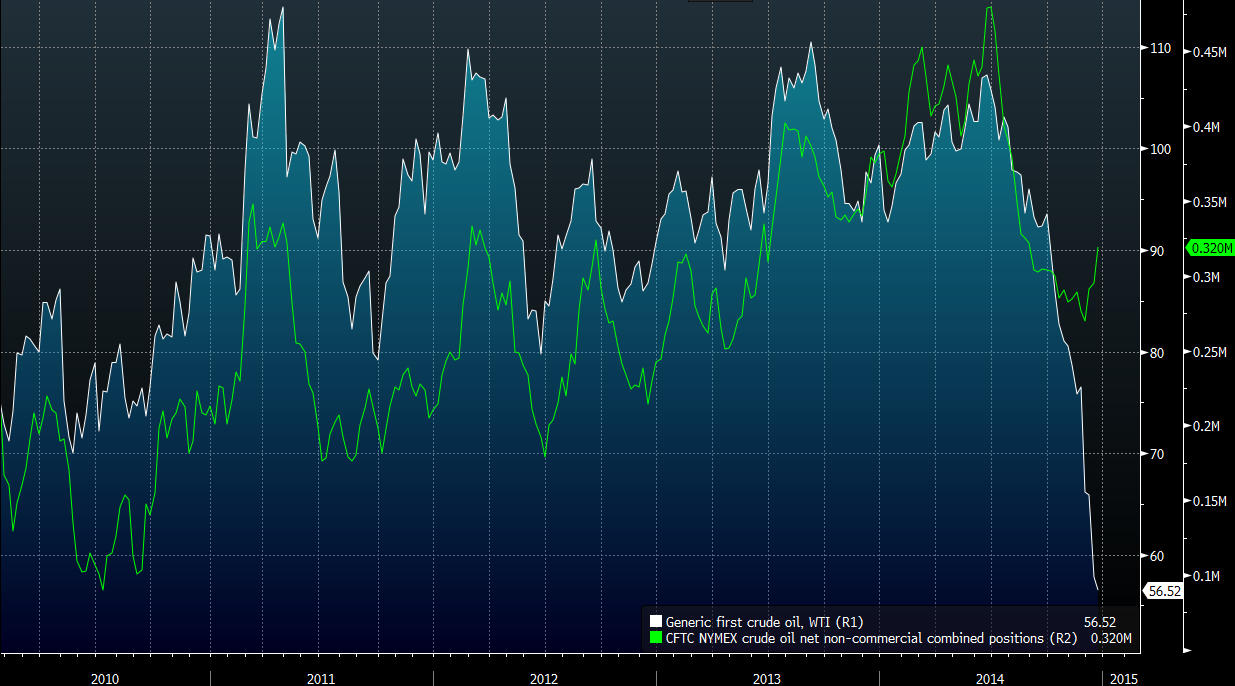

Oil price items....

Saudi Arabia Refuses To Cut Oil Output Even If Non-OPEC Members Do

Submitted by Tyler Durden on 12/21/2014 - 12:45

As even Reuters observes this morning when discussing the ongoing crude rout, "the market slide has triggered conspiracy theories, ranging from the Saudis seeking to curb the U.S. oil boom, to Riyadh looking to undermine Iran and Russia for their support of Syria." It appears said theories will continue raging for a long time, because as Saudi Arabia's oil minister who has been extensively in the news in the past couple (that means "two" as per Janet Yellen) of month explained, the biggest OPEC oil producer said on Sunday it would not cut output to prop up oil markets even if non-OPEC nations did so, in one of the toughest signals yet that the world's top petroleum exporter plans to ride out the market's biggest slump in years, and that the price of crude is not going up any time soon.

"Houston, You Have A Problem" - Texas Is Headed For A Recession Due To Oil Crash, JPM Warns

Submitted by Tyler Durden on 12/21/2014 - 10:55

Fast forward to today when we are about to learn that Newton's third law of Keynesian economics states that every boom, has an equal and opposite bust. Which brings us to Texas, the one state that more than any other, has benefited over the past 5 years from the Shale miracle. And now with crude sinking by the day, it is time to unwind all those gains, and give back all those jobs. Did we mention: highly compensated, very well-paying jobs, not the restaurant, clerical, waiter, retail, part-time minimum-wage jobs the "recovery" has been flooded with. Here is JPM's Michael Feroli explaining why Houston suddenly has a very big problem.

Tweets.....

Doubt oil will go much lower: Gartman: Noted investor Dennis Gartman told CNBC he's like to think oil is stabi... http://cnb.cx/1wvnDSE

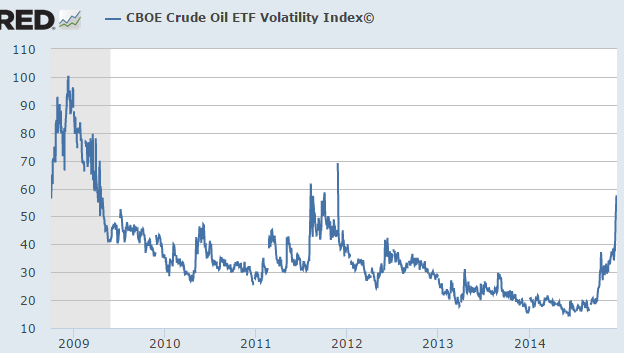

Chart: Oil implied volatility index -

Why The US Is About To Be Flooded With Record Oil Production Due To Plunging Oil Prices http://www.zerohedge.com/news/2014-12-19/why-us-about-be-flooded-record-oil-production-due-plunging-oil-prices …

Canada rig count -40 in past week, from 431 to 391, -9.3% plunge

US Oil Rig Count Tumbles Most In Over 5 Years,"Demand From Oilfield Customers Dropping Rapidly" http://www.zerohedge.com/news/2014-12-19/us-oil-rig-count-tumbles-most-over-5-yearsdemand-oilfield-customers-dropping-rapidly …

ICYMI: "It's A Huge Crisis" - The UK Oil Industry Is "Close To Collapse"

Trade council: 2014 worst year in Venezuelan economic history http://goo.gl/CWXd70

The huge and unexpected drop in the price of crude oil may be as disruptive as the shock of oil price hikes in 1974. http://www.nytimes.com/roomfordebate/2014/12/17/how-cheaper-oil-is-shaping-the-world/energy-still-turns-the-wheels-of-geopolitics?smid=tw-share …

Retweeted 25 times

It's not quite as exciting as the ruble, but the Norwegian krone is back at 1992 levels against the Swedish krona

Norway Surprise - Central Bank Cuts Interest Rates To Record Low Amid Oil Price Plunge https://lnkd.in/dF5dfgG

Connecting dots to Ukraine...

http://globaleconomicanalysis.blogspot.com/2014/12/ukraine-vows-more-for-military-spending.html

****

War Has Made Us Stronger

Ukraine president says "War has made us stronger".

That lie is so stupid my dead grandmother knows it from the grave. The evidence is a CCC- debt rating, a step or so

above

above default, with default imminent.

The story gets even stranger.

To avoid default, Ukraine needs a "Russian contribution to the package” according to Pierre Moscovici, the economic

policy

commissioner for the European Commission.

Amazing Irony

Europe and the US have crippling sanctions on Russia for the conflict in Ukraine, yet the EC wants Russia to bail out

Ukraine

while accusing Russia of invading Ukraine.

Icing on the wonderland-cake is the Russian Ruble has plunged nearly 50% this year, but Ukraine needs money from

Russia

to fight Russia.

Is this complete lunacy or what?

****

http://globaleconomicanalysis.blogspot.com/2014/12/ukraine-vows-more-for-military-spending.html

****

War Has Made Us Stronger

Ukraine president says "War has made us stronger".

That lie is so stupid my dead grandmother knows it from the grave. The evidence is a CCC- debt rating, a step or so

above

above default, with default imminent.

The story gets even stranger.

To avoid default, Ukraine needs a "Russian contribution to the package” according to Pierre Moscovici, the economic

policy

commissioner for the European Commission.

Amazing Irony

Europe and the US have crippling sanctions on Russia for the conflict in Ukraine, yet the EC wants Russia to bail out

Ukraine

while accusing Russia of invading Ukraine.

Icing on the wonderland-cake is the Russian Ruble has plunged nearly 50% this year, but Ukraine needs money from

Russia

to fight Russia.

Is this complete lunacy or what?

****

#Poroshenko orders new #mobilization, #military spending increase

http://www.kyivpost.com/content/ukraine/poroshenko-orders-new-mobilization-military-spending-increase-375750.html …

Ukraine Cut to 'CCC-' by S&P, Outlook Negative (FXE) (UUP) http://www.streetinsider.com/Credit+Ratings/Ukraine+Cut+to+CCC-+by+S%26P%2C+Outlook+Negative+%28FXE%29+%28UUP%29/10113174.html … via @Street_Insider

NBU expects financial assistance from IMF to be increased by $15 bln http://www.unian.info/economics/1023911-nbu-expects-financial-assistance-from-imf-to-be-increased-by-15-bln.htmlBank … of Ukraine expects 15 billion by end of Feb2015

G7 Officials to Discuss Ukraine Funding Gap

BRUSSELS—Senior officials from the Group of Seven developed nations will discuss Ukraine's financing needs on Saturdayafternoon, ...

Poroshenko urges IMF to consider increasing financial aid for Ukraine http://tass.ru/en/world/768259

The IMF estimates that Ukraine would need $15 billion in the short term to avoid a full-blown financial crisis.

UKRAINE FX RESERVES DROPPED TO JUST OVER $9B END NOV:BBG

Jaresko: Ukraine to make second payment to Gazprom by end of year http://www.unian.info/economics/1023156-jaresko-ukraine-to-make-second-payment-to-gazprom-by-end-of-year.html …? Ukraine reserves will be reduced a/o two billion

Ukraine downgraded to CCC-, outlook Negative from CCC by S&P

#Moscow will not give in to #Western pressure over Ukrainian conflict - Experts http://bit.ly/1sNLc9m

#Russia will respond to #UkraineFreedomSupportAct depending on how #Washington is going to implement it - Foreign Ministry

40% of Europeans believe #EU anti-Russian #sanctions should not be lifted #coldshool http://bit.ly/1sFXECH

At @EUCouncil summit EU leaders 2 widen ban on investment in Crimea to target Russian Black Sea oil & gas exploration http://www.reuters.com/article/2014/12/17/us-ukraine-crisis-sanctions-idUSKBN0JV0ZO20141217 …

False Dawn today , Saudis still going to put the hammer down

UPDATE 3-MIDEAST STOCKS-Gulf markets surge after oil rebounds - Zawya https://www.zawya.com/story/Gulf_markets_surge_after_oil_rebounds-TR20141218nL6N0U20VWX3/ … via @zawya Just a small point to consider . This reflect trading from Thursday!

Projections of American economic growth with oil at $40, $60 and $80-a-barrel next year: http://on.wsj.com/1AjqcWS

#Syria is expressing concerns on the irregular supply of #Iran oil, as it has been unable to meet Syrian fuel needs http://almon.co/2bla

The Daily Star

The Daily Star

Moisés Naím

Moisés Naím  Joseph Weisenthal

Joseph Weisenthal

fred walton

fred walton  TASS

TASS  DR

DR

Real Time Economics

Real Time Economics

Foreign Policy

Foreign Policy

No comments:

Post a Comment