Gata.....

Support for Swiss gold referendum proposal weakens as campaign heats up

Submitted by cpowell on Wed, 2014-11-19 22:04. Section: Daily Dispatches

By Katharina Bart and Jan Harvey

Reuters

Wednesday, November 19, 2014

Reuters

Wednesday, November 19, 2014

Support among Swiss voters for a referendum proposal that would force a huge increase in the central bank's gold reserves has slipped to 38 percent, an opinion poll showed on Wednesday, falling short of the majority backing it needs to become law.

Under the "Save our Swiss gold" proposal, the Swiss National Bank would be banned from selling any of its gold reserves and would have to hold at least 20 percent of its assets in the metal, compared with 7.8 percent last month. ...

Wednesday's poll, conducted by Berne-based research institute gfs.bern in partnership with Swiss broadcaster SRG, showed 47 percent opposed the initiative, which has been led by the right-wing Swiss People's Party, while 15 percent were undecided or gave no answer. ...

... For the remainder of the report:

Gold is being pounded to discourage support for Swiss initiative, Davies tells KWN

Submitted by cpowell on Wed, 2014-11-19 21:41. Section: Daily Dispatches

4:41p ET Wednesday, November 19, 2014

Dear Friend of GATA and Gold:

British fund manager Ben Davies tells King World News today that the recent pounding on gold is part of central bank efforts to deter Swiss voters from supporting the gold initiative that will be decided at referendum on November 30. But Davies adds that the risk and reward factors are now more favorable for gold than for any other investment. An excerpt from the interview is posted at the KWN blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Koos Jansen: Why did European central banks sell gold?

Submitted by cpowell on Wed, 2014-11-19 15:50. Section: Daily Dispatches

10:53a ET Wednesday, November 19, 2014

Dear Friend of GATA and Gold:

Focusing on the Netherlands Central Bank's reduction of its gold reserves, Bullion Star market analyst and GATA consultant Koos Jansen asks why the European central banks sold (or purported to sell) so much gold from the announcement of the Washington Agreement on Gold in 1999 through 2010, when such sales stopped almost completely. Jansen cites a comment by the Dutch treasury secretary in 2011 in support of his speculation that the gold sales may have been intended to help redistribute amd equalize official gold reserves around the world.

This is exactly what the U.S. economists and fund managers Paul Brodsky and Lee Quaintance speculated in 2012 -- that central banks were moving their gold around so that nations would be better prepared for a complete resetting of the world financial system, in which gold would play an important part for building confidence:

Of course on a planet with actual financial journalism, mainstream news organizations would question central banks about this -- and about everything else central banks do. Since we're living on Earth, Jansen's citing the Dutch parliamentary archive and posing the question it suggests will have to suffice today. His commentary is headlined "Why Did European Central Banks Sell Gold?" and it's posted at Bullion Star here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

German gold repatriation movement is going strong, Peter Boehringer tells KWN

Submitted by cpowell on Wed, 2014-11-19 04:54. Section: Daily Dispatches

11:55p ET Tuesday, November 18, 2014

Dear Friend of GATA and Gold:

Contradicting propaganda from mainstream financial news organizations, German Precious Metals Society founder Peter Boehringer, a leader of Germany's gold repatriation movement, tells King World News tonight that the movement is going strong and that citizen action will return the nation's gold reserves to its own soil. An excerpt from the interview is posted at the KWN blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

One way or another, Ukraine's gold reserves have gone away

Submitted by cpowell on Tue, 2014-11-18 18:23. Section: Daily Dispatches

1:23p ET Tuesday, November 18, 2014

Dear Friend of GATA and Gold:

Zero Hedge reports today that one way or another, Ukraine's gold reserves have disappeared:

A report about their supposed removal from Kiev in the dead of night last March is posted at GATA's Internet site here:

The refusal of the gold-vaulting Federal Reserve Bank of New York to disclose to GATA in March whether it had taken custody of the Ukrainian reserves is here:

The U.S. State Department never responded to GATA's inquiry.

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Lending gold pays record high as 400-oz bars are lost to insatiable Asian demand

Submitted by cpowell on Tue, 2014-11-18 04:04. Section: Daily Dispatches

Gold Lending Rate Most Negative Since 2001 on Longer Refining

By Nicholas Larkin and Laura Clarke

Bloomberg News

Monday, November 17, 2014

Bloomberg News

Monday, November 17, 2014

LONDON -- The rate at which gold is lent for dollars is the most negative in 13 years as refineries spend longer recasting bars from vaults to meet demand from Asia, where consumers prefer smaller ingots and jewelry.

The one-month gold forward offered rate was at minus 0.22 percent today, the most negative since March 2001, signaling that dealers are paid to lend metal against cash, rather than paying for the privilege. It's also a form of backwardation, when earlier prices are more expensive than for later dates.

Holdings in gold-backed funds have slid to the lowest since 2009 and prices are near a four-year low as a stronger dollar and improving U.S. economy curbed haven demand. The gold lending rate has turned negative because refiners such as those in Switzerland are turning more bars typically weighing 400 ounces into smaller items such as 1-kilogram products. Indian third-quarter bullion imports more than doubled from a year earlier.

"There's a lot of demand going into Swiss refineries, which are basically transforming those big bars into smaller bars," Bernard Dahdah, an analyst at Natixis SA in London, said today by phone. "The leasable stuff is only for big bars. Once those bars become small bars and they go into households, they become much harder to go back into the market into a leasable form." ...

... For the remainder of the report:

Tweets - 11/21....

Everything You Need to Know About The Swiss Gold Referendum http://www.zerohedge.com/news/2014-11-21/everything-you-need-know-about-swiss-gold-referendum …

Asian Gold Traders Suspicious Of Recent "Turbo Steroid Moves" http://www.zerohedge.com/news/2014-11-21/asian-gold-traders-suspicious-recent-turbo-steroid-moves …

Tweets - 11/19 .....

Jesse's Café Américain: Gold Daily and Silver Weekly Charts - The Bear Mar... http://jessescrossroadscafe.blogspot.com/2014/11/gold-daily-and-silver-weekly-charts_19.html?spref=tw …

Nice read from Jesse , love his mindset !

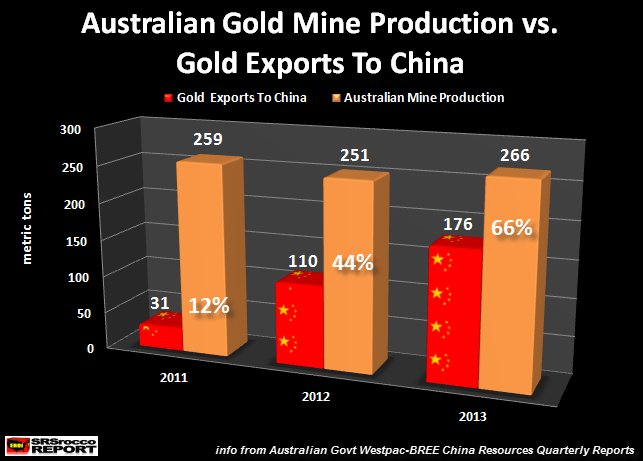

RT: @SRSroccoReport: AUSTRALIA #GOLD EXPORTS TO #CHINA: Two-Thirds Of Mine Supply http://tinyurl.com/qjzd5oh

No comments:

Post a Comment