Saturday, January 18, 2014 1:35 PM

SYRIZA Surges in Greek Polls, Would Win Election if Held Today; Message People Want to Hear; Contagion Guarantee

Support for Prime Minister Antonis Samaras’ New Democracy coalition has finally crumbled to pieces. For the year things had been close between New Democracy and opposition "Radical Left" party SYRIZA.

Not anymore. The Greek Reporter notes SYRIZA Killing New Democracy, PASOK in Attica, a critical Athens region of Greece.

Not anymore. The Greek Reporter notes SYRIZA Killing New Democracy, PASOK in Attica, a critical Athens region of Greece.

A series of scandals, unresolved talks with the country’s international lenders, and the escape of a terrorist seem to be taking their toll on Prime Minister Antonis Samaras’ coalition government and his New Democracy Conservatives, who have fallen 7.7 percent points behind their rival, the Coalition of the Radical Left (SYRIZA) in the critical Attica region including Athens.Message People Want to Hear

SYRIZA, which opposes the austerity measures being imposed by the government, had been battling for the lead in surveys for a year with New Democracy, both sides barely one percent apart, but now has a lead of 24.6-16.9 percent in the poll taken by GPO for Newcast.

That comes in the wake of a series of arrests involving a scandal at the failed state-owned Hellenic Postbank, the defense ministry, a publisher charged with failing to pay his taxes and as Samaras is trying to assert the country is poised to make a comeback. Voters aren’t buying it.

Despite the arrest and prosecution of its leaders on charges of running a criminal gang, the ultra-far right extremists of Golden Dawn remain a steadfast third with 11.1 percent, even though its leader, Nikos Michaloliakos and four other of his party’s Members of Parliament are in jail awaiting trial.

As bad as the results were for Samaras, it was worse for his partner, the PASOK Socialists who got 44 percent of the vote in 2009 when it won the elections. Under current leader Evangelos Venizelos, who gave Samaras his votes to join the coalition and was rewarded by being named Deputy Prime Minister/Foreign Minister, have fallen to 3 percent, the threshold needed to win seats in Parliament.

PASOK is now dead last among the seven parties in the Parliament. The Communist party (KKE) is fourth with 4.9 percent, followed by the Independent Greeks at 4 percent, the Democratic Left (DIMAR) – a former partner in the coalition – at 3.1 percent and also in danger of disappearing as a party next, just ahead of PASOK.

About 13 percent of voters are undecided and while the survey wasn’t nationwide, it covers the most populous area and if the lead holds it would be difficult for New Democracy to catch up and stay in power in the 2016 elections – if the government lasts that long and snap elections aren’t held.

SYRIZA leader Alexis Tsipras, who opposes the austerity measures and said his party wouldn’t repay the $325 billion in loans granted by the Troika of the European Union-International Monetary Fund-European Central Bank (EU-IMF-ECB) has predicted the Leftists will come to power.

He has promised a return to Utopia by restoring pay, cutting taxes, returning pensions to their previous level and no public worker firings as demanded by the Troika. He didn’t say how he would do it without the loans or if Greece continues to be locked out of the markets.

I have no love for leftists. And Tsipras' promise of restoring pay, cutting taxes, and no public worker firiings is of course ridiculous.

Nonetheless, his message is what people want to hear. It's hard to say whether people truly believe in what he is saying or not.

Mathematically, it's impossible to do what he says and maintain a current account surplus as well. Perhaps Tsipras himself even recognizes that.

Regardless, the one thing I am reasonably sure of is Greece will not pay back $325 billion in loans granted by the Troika. I even support that policy.

It would be better if it came with a realistic message to Greek citizens as to what that would mean. Short-term there would be more pain. But long-term it's the right ting to do, if accompanied by badly-needed reforms.

Default Coming One Way or Another

Whether done properly, or with promises that cannot be met, Greece is going to default on that debt. When that happens, German citizens will discover that Chancellor Angela Merkel's promise that German taxpayers won't be impacted is as hollow as most chocolate Easter bunnies.

Calculating taxpayer responsibility percentages of various countries is simple enough.

Eurozone Financial Stability Contribution Weights

| Country | Guarantee Commitments (EUR) Millions | Percentage |

|---|---|---|

| Austria | € 21,639.19 | 2.78% |

| Belgium | € 27,031.99 | 3.47% |

| Cyprus | € 1,525.68 | 0.20% |

| Estonia | € 1,994.86 | 0.26% |

| Finland | € 13,974.03 | 1.79% |

| France | € 158,487.53 | 20.32% |

| Germany | € 211,045.90 | 27.06% |

| Greece | € 21,897.74 | 2.81% |

| Ireland | € 12,378.15 | 1.59% |

| Italy | € 139,267.81 | 17.86% |

| Luxembourg | € 1,946.94 | 0.25% |

| Malta | € 704.33 | 0.09% |

| Netherlands | € 44,446.32 | 5.70% |

| Portugal | € 19,507.26 | 2.50% |

| Slovakia | € 7,727.57 | 0.99% |

| Slovenia | € 3,664.30 | 0.47% |

| Spain | € 92,543.56 | 11.87% |

| Eurozone 17 | € 779,783.14 | 100% |

The above table from European Financial Stability Facility

Note that Greece is responsible for 2.81% of Greek defaults. How is that going to work?

It doesn't. So take that percentage and spread it around according by revised weight. And what is Spain supposed to do with it's 12% of €325 billion of defaults?

Contagion Guarantee

Thank the economic illiterates at Troika for this setup.

Greece could have defaulted in 2009 with perhaps a €40-50 billion mess to cleanup. In a foolish attempt to prevent contagion, the nannycrats turned a relatively small mess into major €325 billion problem, virtually assuring the contagion they set out to prevent.

Expect to see much use of the word "contagion" in the coming months.

Here is a question I asked in Prisoner's Dilemma Game in Greece; Contagion-Spread Eurozone Breakup More Likely Now; How will Greece NOT pay back €320 billion? So Angela Merkel, when are you going to admit this setup, and what are you going to do about it?

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com/2014/01/greece-needs-another-bailout-before-may.html

( Mish concurs with the Slog... )

Greece Will Default in May Without Another Bailout or Change in Terms

Cash flow analysis shows Greece is in serious trouble again in spite of having a current account surplus.

Specifically, Greece needs a change in payback terms or another bailout or it will default in August, if not May. I use the words "will default" imprecisely.

The only way Greece is making loan payments now is with money from the Troika.

The scam works like this: bailout money is allegedly given to Greece, but Greece cannot really touch it. Instead the money goes right back to the Troika for interest and capital payments, with perhaps a miniscule portion finally getting to Greece.

Realistically, Greece defaults on every payment already.

Greece Bailout Cash Flow

Even this game is in trouble now as Greek Cash Flow Charts show.

Specifically, Greece needs a change in payback terms or another bailout or it will default in August, if not May. I use the words "will default" imprecisely.

The only way Greece is making loan payments now is with money from the Troika.

The scam works like this: bailout money is allegedly given to Greece, but Greece cannot really touch it. Instead the money goes right back to the Troika for interest and capital payments, with perhaps a miniscule portion finally getting to Greece.

Realistically, Greece defaults on every payment already.

Greece Bailout Cash Flow

Even this game is in trouble now as Greek Cash Flow Charts show.

Just two days before New year 2014, Antonis Samaras told his People that Greece would leave its bailout programme next year without needing a third aid package. “In 2014 we will make the big step of exiting the loan agreement,” said the Greek PM in a nationally televised address. “In 2014, Greece will venture out to the markets again [and] start becoming a normal country… There will be no need for new loans and new bailout agreements”.The major point of the primary current account surplus is that Greece now obtains as much in tax revenues as it needs to finance current debt (not counting interest and debt repayments to the Troika).

But figures obtained by The Slog show he lied.

Mr Samaras told the Greeks during October that debt relief would come by Christmas. It didn’t. He is now suggesting there is no budget shortfall. There is.

He says the much-trumpeted €800m surplus obtained last year will help solve the problem. It won’t.

The total payments due in 2014 are €31.6bn. The total loan funds available to meet that sum are €17.5bn. €0.8bn of Greek surplus doesn’t even make a dent in it.

This second chart highlights when the inevitable shortage will become a default issue:

On 20th and 21st of the month, three whopping capital and interest payments become due. The largest of these – a €5.2bn sum – is also at a floating rate, and so could be bigger if confidence fails in the meantime. The funding gap to avoid default here is almost as big as that one sum due – at €4.7bn.

With that help available (and no yield rises) Athens could limp through to Q3. But then on 20th August things go badly pear-shaped again, when two further biggies hit the due date. The funding gap here is €5.6bn. Even if the Troika allowed Greece to bring the Q4 support forward, the gap would still be €3.8bn.

So in the very best, most optimistic scenario, Antonis Samaras needs €8.5bn in fiscal surpluses, and he needs them over the next 16 weeks.

If Greece can remain in a state of surplus, it can tell the Troika to go to hell, declare the bailout debt null and void, and shed its onerous debt burden. I suggest Greece should do just that.

Mike "Mish" Shedlock

Read more at http://globaleconomicanalysis.blogspot.com/2014/01/greece-needs-another-bailout-before-may.html#7zLpD9oABv7RxsL7.99

BREAKING….GREEK DEFAULT OFFICIAL: Without further loans, Greece will default 20-21st May 2014

OFFICIAL EC/IMF FIGURES SHOW SAMARAS CONFIDENCE IS A SHAM

OFFICIAL EC/IMF FIGURES SHOW SAMARAS CONFIDENCE IS A SHAM

Several charts obtained from the EU and IMF finally end the debate about Greece’s funding gap this morning: without further loan support, Greece will default in May. And even if this is forthcoming, the country will default without yet more help in August.

Just two days before New year 2014, Antonis Samaras told his People that Greece would leave its bailout programme next year without needing a third aid package. “In 2014 we will make the big step of exiting the loan agreement,” said the Greek PM in a nationally televised address. “In 2014, Greece will venture out to the markets again [and] start becoming a normal country… There will be no need for new loans and new bailout agreements”.

But figures obtained by The Slog show he lied.

Mr Samaras told the Greeks during October that debt relief would come by Christmas. It didn’t. He is now suggesting there is no budget shortfall. There is.

He says the much-trumpeted €800m surplus obtained last year will help solve the problem. It won’t.

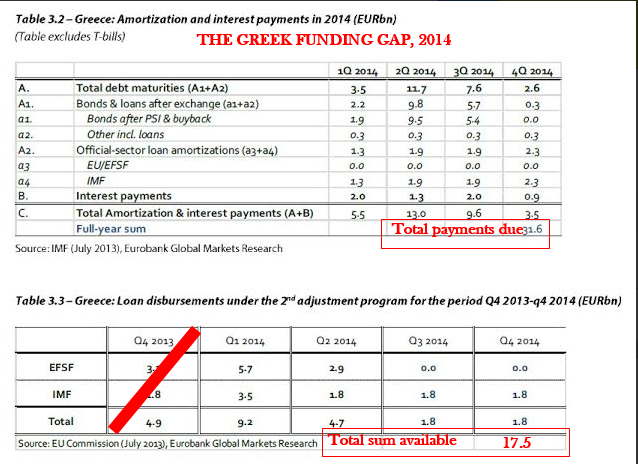

These first two tables show the extent of the Funding Gap.

The total payments due in 2014 are €31.6bn. The total loan funds available to meet that sum are €17.5bn. €0.8bn of Greek surplus doesn’t even make a dent in it.

The total payments due in 2014 are €31.6bn. The total loan funds available to meet that sum are €17.5bn. €0.8bn of Greek surplus doesn’t even make a dent in it.

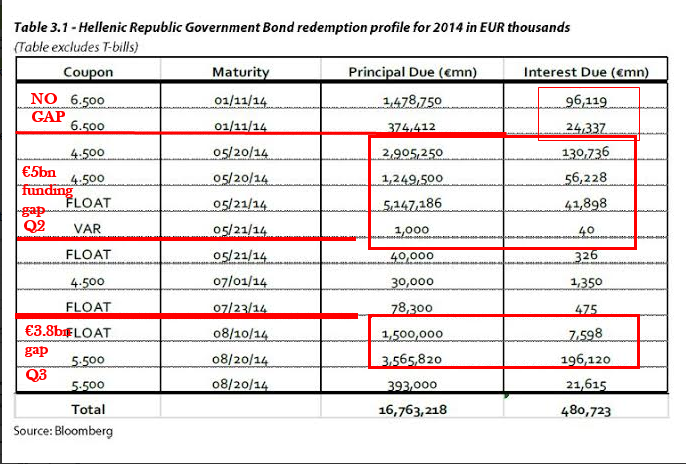

This second chart highlights when the inevitable shortage will become a default issue:

I’ve highlighted in red the ‘danger’ periods. For Q1 Jan-Mar 2014, there is no gap at all: the loan help exactly equals the redemption profile.

I’ve highlighted in red the ‘danger’ periods. For Q1 Jan-Mar 2014, there is no gap at all: the loan help exactly equals the redemption profile.

But in Q2 – specifically the third week in May – things fall apart. On 20th and 21st of the month, three whopping capital and interest payments become due. The largest of these – a €5.2bn sum – is also at a floating rate, and so could be bigger if confidence fails in the meantime. The funding gap to avoid default here is almost as big as that one sum due – at €4.7bn.

With that help available (and no yield rises) Athens could limp through to Q3. But then on 20th August things go badly pear-shaped again, when two further biggies hit the due date. The funding gap here is €5.6bn. Even if the Troika allowed Greece to bring the Q4 support forward, the gap would still be €3.8bn.

So in the very best, most optimistic scenario, Antonis Samaras needs €8.5bn in econo-fiscal surpluses….and he needs them over the next 16 weeks. The only way he can achieve that is via massive property confiscation, further taxes and growth. The 2013 surplus of €0.8bn all came from sales, cuts and taxes. There was no growth – in fact, the economy shrank by 4.6%….after Samaras predicted 3.8%. And the surplus took 12 months to accrue.

Let’s face it, Samaras lied. Talk of returning to the markets is pure fantasy. He knows it, we know it, Schäuble knows it, and Brussels knows it. The only folks who don’t are smug middle class and professional Greeks.

Let’s take a closer look at the timeline here.

Elections to the European Parliament will be held in all member states of the European Union between 22nd and 25th May 2014…..the day after Greek default is due. Spooky.

The elections have always previously taken place in June. But this time, the Council of the European Unionvoted unanimously to bring the date forward. Curiouser and curiouser.

And as I noted last year, Ollie Rehn confirmed that there would be no debt relief for Greece until after the Euro elections….at the earliest. In fact, Mr Reindeer’s final word on the subject used the noun ‘summer’.

Last year, I speculated that many signs suggested some big, smart movers felt all bets were off after Spring 2014. “I still see end Q4 2013, through to end Q1 2014, as the window in which we see a significant risk-on top before giving way, over the last three quarters of 2014 and through 2015, to what could be a 25% to 50% sell-off in global stock markets,” warned Nomura’s Bob Janjuah in a note to clients at the time.

In the piece, I outlined the specific oddities:

1. The UK Coalition has a number of issues and scandals in the air, both political, fiscal and economic. I have puzzled before about how the non-recovery, the fiscal fudge, the BBC DJ fitups and the Newscorp hacking trial all run out of road around about Easter 2014.

2. The same is true of the eurozone. Greece’s debt relief has been blithely cut off, and there won’t be any help until May at the earliest. Further, it’s very likely that Draghi’s narrowing options – and the growing recovery of German power by going around the ECB – mean push will come to shove on fiscal union at about that time. Yet any sense of urgency in Brussels about this seems to me entirely absent – while Berlin is worryingly silent.

3. You may have noticed that Hillary Clinton has been giving more smiles and encouragement when asked about running in 2016. Also hubby’s profile has been rising again. If she is to succeed a two-term Democrat President, then campaigning in a fairly overt way will start for her mid 2014….because she will have to give herself maximum time for clear water to be visible between her and the Black Dude. But equally if not more important, a sound American well-connected source said to me ten days ago, “Hillary wants to associate Obama with Republican economics, and go hard against neoliberalism after things go belly up. She reckons this’ll be around summer 2014.”

4. Eurozone banks expected to improve liquidity to capital/lending ratios in the run-up to the ECB’s projected stress tests by taking more provisions have underperformed, surprise surprise: ratios rose a mere 3% on average in Qs 1-3 this year, but they have yet to take extra provisions against doubtful loans to show they have put the financial crisis behind them in time for a critical review by regulators.

Next year’s Asset Quality Review (AQR) stress test by the European Central Bank will judge whether the banks have done enough, but the latest feedback I have (via Madrid) is that the test will now be over two stages….the first of which will be “very light touch”. Then a more strict round is to begin…..after May next year.

5. There are plenty of negative (but heavyweight opinions) around suggesting that the preceding points fit well with their soothsaying. Dutch Rabobank’s forecast observes, ‘…both the political impasse in the US and the ‘tapering’ of the Fed’s extremely accommodative monetary policy would appear to involve greater uncertainties than the situation at the time of President Bush senior and the then Fed Chairman Alan Greenspan. As regards European integration, the situation today features scepticism about the European project and uncertainty regarding the progress of the still ongoing crisis…’

You could also in turn add the seven deadly signs from yesterday…if you agree with them, which not everyone does. And the stress test referred to has, of course, been made a doddle by Draghi’s support for keeping bank cap/liquidity ratios at a ludicrous 3%.

I think there is growing evidence that key figures around the world in central banking, investment, politics and business have more or less decided that after the Spring, Crash 2 will, in one form or another (possibly several at once) happen….and be a game changer. I doubt very much if it’s a conspiracy: rather, it’s the usual same group of utterly self-interested clowns figuring out how best to survive individually.

To revisit a previous hobby-horse in this context, what else could explain the bizarre behaviour of Greek finance minister Yiannis Stournaras? Whereas Samaras tries to be crafty but is actually thick (as evidenced by his kack-handed attempt to frame Golden Dawn) Mr Stournaras is a very bright man. Yet he admits now that he turned down Christine Lagarde’s offer to campaign jointly in favour of debt relief for Athens. Why?

None of us know for certain as yet. There are signposts, but all they say is ‘To the Cliffs’. The EC, of course, insists that they say ‘To the Beach’ and yes, to be fair, falling over the cliff is the quickest way to get to the beach. Either way, the Samaras confidence >> Stournaras arrogance >> Olli Rehn timetable >> euro elections >>Greek funding gap >> May redemption dates are a vicious circle that cannot be squared. Greece is going to need help, or it will default.

Perhaps this time, the reality might get slightly more coverage in the mainstream media.

News items from Greece.......

Venizelos in Washington for talks with US Secretary of State Kerry

Venizelos is scheduled to meet with Kerry at 6.30 p.m. Greek time for talks that are expected to touch on Greece's priorities while holding the rotating presidency of the European Union, the Cyprus problem, Greece's dispute with the Former Yugoslav Republic of Macedonia (FYROM) over the latter's official name and about fears of domestic terrorism in Greece after convicted November 17 terrorist Christodoulos Xeros absconded while on a prison furlough. Before meeting Kerry, Venizelos is to meet with US Treasury Secretary Jacob J. Lew who last week visited France, Germany and Portugal for talks that focused on developing a strategy to boost the European economy. Lew visited Athens last July. |

No comments:

Post a Comment