Where is the German Gold?

Almost a year ago, the German government put in a formal request to reclaim (repatriate) a portion of their gold reserves held outside of Germany. Reports on the progress of this initiative have raised quite a few questions.

Here's the first report, from ZeroHedge and released on Christmas Eve: http://www.zerohedge.com/news/2013-12-24/year-later-bundesbank-has-repatriated-only-37-tons-gold-700-total

At the time the plan was announced, many in the gold community made note that it would take over8 years for Germany to reclaim this portion of its foreign reserves. Seven hundred metric tonnes...though a lot of gold...should simply be sitting in New York, London and Paris vaults, collecting dust. Why not just brush it off, certify that the bars numbers match up and then ship that shiny stuff back to Germany. No big deal and certainly not something that should take eight years to accomplish.

Now news comes that, in the first year of the plan, Germany only received back 37.5 metric tonnes of their gold. This is only 5% of the total repatriation amount. At this rate, it will take twenty years, not eight, to reclaim the gold.

Further muddying the waters are reports that this gold came exclusively from the vaults of the Federal Reserve Bank of New York (FRBNY). If that was the case, then the gold returned should have been a simple transfer. The Germans deposited the gold there decades ago. It is being shipped back to them now. Problem is, it wasn't a simple transfer!

Apparently, The Bundesbank took the unusual step of having "its" bars assayed, melted and recast into London Good Delivery form before taking delivery. Now, why would they do that? And why would they do this in the U.S. and not in Frankfurt? These bars should simply be the same bars that were deposited decades ago. Do they not trust the FRBNY? Are these not the same bars?

Perhaps, instead, there's another explanation. This idea was first spelled out on the GATA site earlier this week and I urge you to read through this post now: http://www.gata.org/node/13458

In summary, it goes like this:

- The original German gold held in the U.S. is gone. Leased, sold and rehypothecated many times over.

- Germany now wants its gold back. The U.S. balks and promises to only return roughly 40 mts/year for eight years. (By the way, why didn't France return any gold in 2013? Germany's looking for 374 metric tonnes from them and, in 2013, it got zilch, zero and nada.)

- Pressed to come up with gold to ship back to Germany, the U.S. scours it's vaults.

- The U.S. takes some of it's 1930s-confiscated "coin melt" gold, assayed at 90% purity, and recasts it into 99.5% purity London bars and ships them off to Frankfurt.

- The Bundesbank books in these new bars, apparently date-stamped "2013", as a "return of German gold" and now awaits the other 95% of their "order".

Hmmm. OK, then. First year done. Whew! Now, from which vault will the U.S. find gold for Germany in 2014? And how about the reserves allegedly held in Paris? When will those be returned? You'd think they could just drive that over in a convoy of guarded trucks. From Paris to Frankfurt is only about a 500km drive. You could do that in under a day. What's the big deal?

(Could it be that there is no German gold in Paris? Coincidentally, it's almost the exact same distance from Paris to Basel, Switzerland. Hmmmm. Maybe the Germans should look for their gold there, instead??)

Anyway, this entire farce just keeps getting sillier by the day. Today, there are reports from Germany that indicate the Bundesbank is quickly backtracking and attempting to retract the "U.S. remelting of bars" story. (http://www.gata.org/node/13472) OK, right. Whatever you say. And don't forget about this fun chart, created for us last year by our pal, Ned Naylor-Leyland:

2014 is going to a consequential year in gold and silver. This German gold story only adds intrigue and fuel for the fire.

http://www.ingoldwetrust.ch/gold-pricing-and-the-flows-of-gold-metal

Guest Post: Gold Pricing And The Flows Of Gold Metal

Written by 24 carat.

Up until now, the gold price did never caught up with 100 years of currency devaluations. This makes us believe the $ is better than gold, accomplished through the artificial fixing of the gold price. The international $ monetary system still dictates the entire world what the appropriate gold price is. The private gold markets haven’t yet been able to let gold’s value float freely. Private gold cannot yet determine whether a currency is worthy as a temporary store of value. So, there is still a general gold director out there who has the capacities of mispricing gold as to keep the private & official gold flows under relative control. And that can be none other than the BIS as the controlling coordinator of the world’s central banks and their gold reserves.

During the London Gold Pool, the central banks also managed to hold the pricing of gold and the private and official flows of gold firmly under their control. Volcker, Greenspan and Bernanke didn’t give the long awaited gold revaluation a single chance. More recently, the ECB was also unable to continue the permitted gradual revaluation of gold, starting from 1999/2001, whilst the Fed balance sheet grew explosively (+ 500%). However, the declining ECB balance sheet, since 2011 managed to hold to its 15 % gold reserve as the main active. The ECB and FED balance, including the 15 % gold reserve, began to diverge at the gold price top ( $ 1925/oz ) in 2011.

More than likely, this is formally / informally agreed on BIS level. Just as the ECB and Fed earlier agreed to construct the Washington Gold Agreement (WAG) in 1999 with the birth of the ECB and European Monetary Union (€-EMU). The emphasis of this gold agreement was originally on –Washington-, and later to be renamed as Central Bank Gold Agreement (CBGA) when the UK left WAG. This is another circumstantial indication that the € – $ agreements are being taken at the BIS level. EMU (€) would not have survived if the Fed hadn’t been willing to provide massive $ / € swaps with the ECB, to avoid the 2008/2009 -crisis total collapse in the EU/EMU. The € and $ were saved…

Then we can also imagine that the BIS has no objection to gold flows to China on condition that the Asians do not force the price of gold higher, without the approval of the $ forces in the BIS. We’ve seen the same dynamics in gold flows to the Middle East (Saudi Arabia) in exchange for preserving the petro -$ during the oil crisis of the seventies and beyond. Therefore the recent long staggered repatriation of German gold reserves do not have any effect on the BIS management of pricing gold.

The BIS central banks system decides when, and which, gold price is appropriate, best suitable for the smooth functioning of the international system of floating currencies.

The main question remains for how long China will accept this, so called, suitable BIS gold pricing. How long can China prosper and expand economically with ever rising Western deficits and subsidized stagnant economies!? That’s China’s pragmatic mercantilist condition for continuing to tolerate the $ supremacy and its firm grip on gold valuation. China is an empire on the globe but is left out of the Western international organizations (IMF-WB). The globe can never have two empires ruling the globe at the same time. The Western and Eastern attitudes about gold’s status are completely opposite, with the Europe floating in between. The days of the Western financial industry (stocks, bonds, etc.) as a store of wealth are being counted. Gold, the wealth reserve metal, is still the one and only an antithesis of unproductive debt. All Western credit has become unproductive debt, because the dysfunctional western economic system is now purely debt driven.

That’s why the West has to keep gold, de facto, fully integrated in its financial & monetary system by continued mispricing of gold’s objective value, electronically. The East wants to value gold, the metal, in a different way, out of the financial capitalism system, with absolutely no links to any currency, just like W. Duisenberg stated in his Aachen speech at the euro’s birth. China promotes gold for its citizens to take as wealth reserve OUT of the system. Whilst the West wants you to keep on holding stocks and bonds and many other manufactured financial products.

The entire globe longs for a new monetary order, which has already is postponed for quite some time now. But nobody has yet any idea how it will look like and function, as to rebalance the world’s systemic ever growing unbalances of Western deficits and Eastern surpluses. The West cannot even handle its systemic money bubbles and the evolving mania of cheap currency (zero interest rates). For the time being, the East plays along (conspires) with this absurd Western game, whilst accumulating gold from the West until the East has sufficient to enforce new rules. Remember that the ruling $-empire originally had 28,000 tons of gold reserves. What’s left of it, after decades of gold outflows, first to Europe (De Gaulle’s France) and the Middle East and now to the Far East?

On the geopolitical front, the US military order is crumbling. That’s why the East will not compromise on any of the US’ possible new monetary order dictates. The new monetary order will again be golden. The East is not only accumulating the yellow metal, but will soon let gold pull its value by introducing it as a possible settlement in trade as a value for value exchange (barter). The absurd promotion of crypto currencies will not alter this

evolving gold revaluation.

evolving gold revaluation.

The drying up of the globe’s physical gold market is an illusion. Scarce gold will always flow between strong and weak hands. From deficit zones to producers surplus reserves. Gold flows don’t have any immediate impact on the gold price and the dynamics of gold pricing, gold’s value is not directly affected by the laws of whatever offer/demand, through the pricing in the paper markets. Gold is never functioning as an industrial commodity.

All holders of all kinds of $ debt will crescendo face various forms of depreciation. Those who realize the constant and rising dangers of economic attacks from the dictatorial $-regime, go for protection with the gold. The ECB was the first central bank to mark its gold reserves to the market. This dynamic is exactly what makes gold increasingly more valuable above all manipulated gold derivatives. The increasingly deficit driven Anglo Saxon $-regime is now

rapidly losing the loyalty of many of its former ardent supporters. The global balance of power goes from the ruling West to the East. We’ll have to face this harsh reality rather sooner than later.

rapidly losing the loyalty of many of its former ardent supporters. The global balance of power goes from the ruling West to the East. We’ll have to face this harsh reality rather sooner than later.

Conclusion

The days of Western Rothschild financial capitalism are numbered. The Eastern rising of economic capitalism has still a very long way to go. The rising physical gold flows from West to East over the past decades are now more than obvious. The new gold valuations, out of the $ system, will automatically follow. The $ will be returned back to sender.

Today, when the globe still accepts the dollar’s reserve status, the correct gold price should be 15% gold reserve of world central banks total balance sheet: $ 3,125/oz. As soon as the dollar is no longer accepted as a central bank reserve, gold’s value will be a multiple of $ 3,125/oz in currency terms.

Keep in mind that the $-gold price so far has been rising double as much as the $-Dowindex since 1973.

http://www.zerohedge.com/news/2014-01-08/proof-golds-latest-slam-was-not-fat-goldfinger

Proof Gold's Latest Slam Was Not A "Fat Goldfinger"

Submitted by Tyler Durden on 01/08/2014 15:50 -0500

Compare the next 4 charts which all zoom in on the first 1/10th of a second of activity (10:14:12.880 to 10:14:13) in Gold and Silver ETFs and futures. The futures trade in Chicago, while the ETFs trade in NY. It takes information about 4 to 5 milliseconds to travel between these two locations.

With December's "fat finger" in US Treasury Futures proved as nothing but an HFT algo gone wild, Nanex has turned its deep-thought to the recent halt in gold futures markets. Their conclusion, this was not the result of a fat finger, but rather the work of a high frequency trading algorithm that would pause, and (probably) test the market before continuing. A fat finger would not have had such distinguishing features.

December's bond melt-up was not a fat finger but an HFT algo gone wild..

Video replay of trading action in T-Bond Futures casts doubt that this was a "fat-finger" event

A fat-finger trade would send prices straight up, but video replay clearly shows pauses and ample back-and-forth trading.

A fat-finger trade would send prices straight up, but video replay clearly shows pauses and ample back-and-forth trading.

And so was the recent gold smack down...

On January 6, 2014 at 10:14:13, Gold futures plummeted $30 on heavy volume. About 4,200 contracts send gold futures prices tumbling $30 and trigger a 10 second trading halt.

Update - 8-Jan-2014

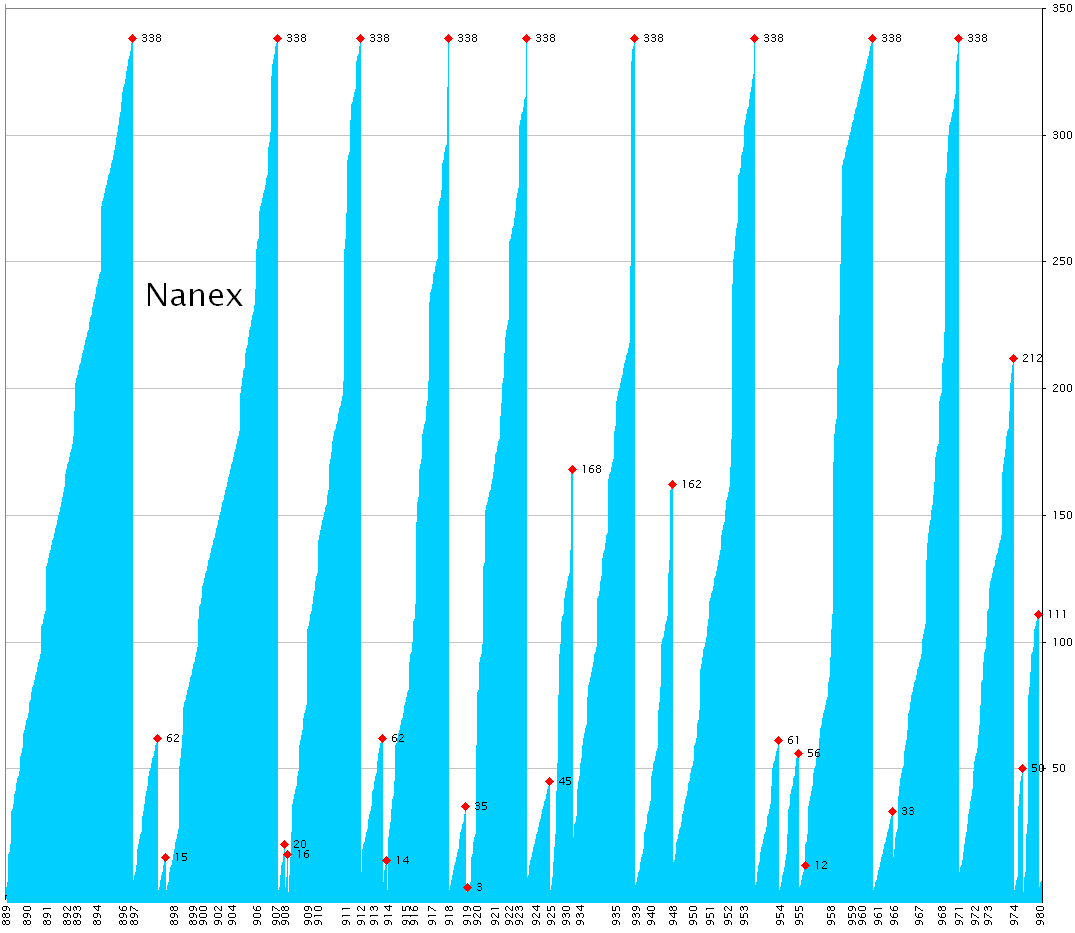

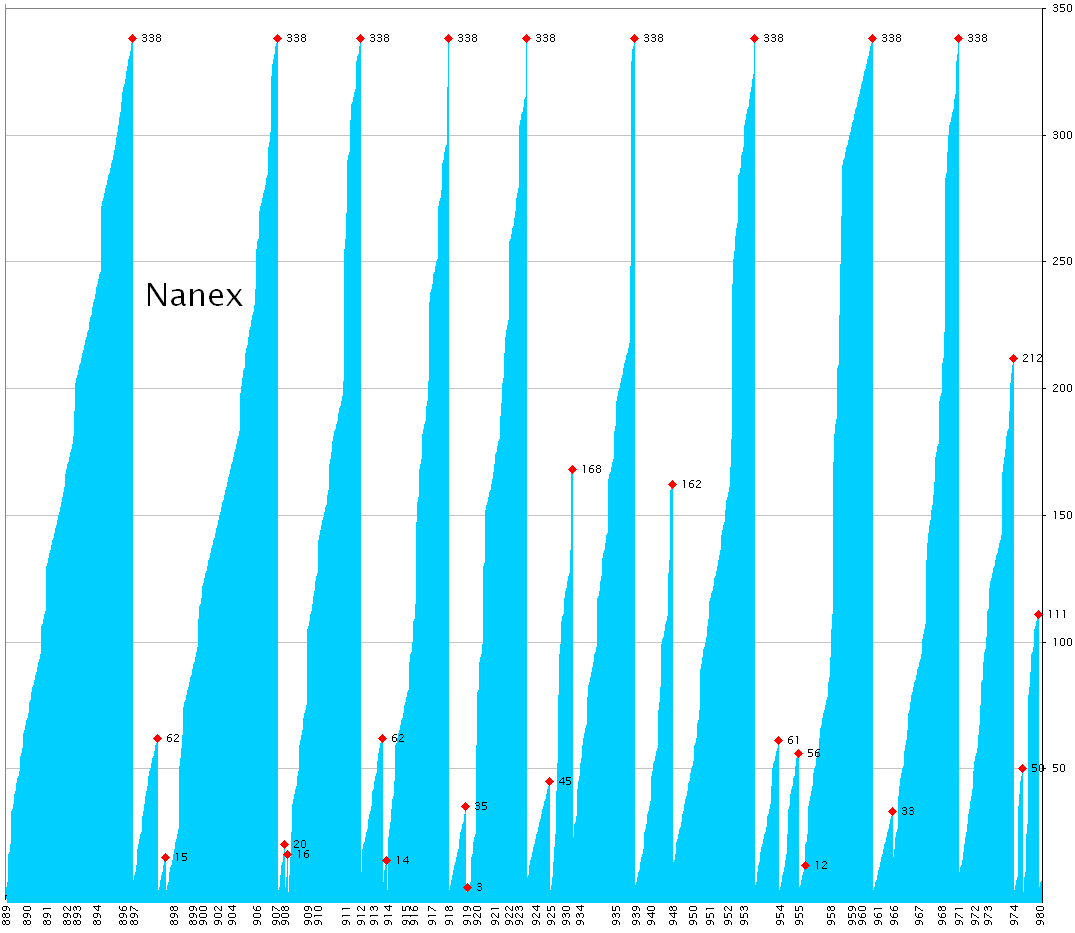

The chart below shows the entire $30 drop in the price of Gold futures that occurred in just under 100 milliseconds (1/10th of a second). When we separated groups of trades by a jump in the exchange sequence number (a technique to determine the size of a larger order) we discovered there were 9 groups where the sum of the trade sizes was exactly 338 contracts! Each group is composed of widely different number of trades (211, 186, 120, 193, 97, 193, 137, 112 and 109 to be precise), yet the sum of the sizes of each group totals exactly 338. We show these 9 groups in the chart below. What's more, there are other trades occurring between these groups of 338 contracts.

What this tells us is that this was not the result of a fat finger, but rather the work of a high frequency trading algorithm that would pause, and (probably) test the market before continuing. A fat finger would not have had such distinguishing features.

The next chart shows the cumulative sum of trade sizes for each group of trades where a group is distinguished by a jump in the exchange sequence number. Since exchanges use one sequence number for multiple products, you can usually tell if a group of trades is the result of a larger order by the lack of gaps in the sequence number. That means no other contracts traded during that time.

The time axis is the millisecond time component of the second 10:14:12, so that the value 889 corresponds to 10:14:12.889. The value axis is the cumulative number of contracts. The red diamond indicates the total size of a group when a sequence jump is detected.

Notice there are 9 groups that total exactly 338 contracts. Also note that each of these groups are separated by smaller groups of trades, and 3 of these smaller groups total 61 or 62.

1. February 2014 Gold (GC) Futures

2. February 2014 Gold (GC) Futures

3. February 2014 Gold (GC) Futures

5. March 2014 Silver (SI) Futures

6. SLV ETF trades

7. GLD ETF trades

Compare the next 4 charts which all zoom in on the first 1/10th of a second of activity (10:14:12.880 to 10:14:13) in Gold and Silver ETFs and futures. The futures trade in Chicago, while the ETFs trade in NY. It takes information about 4 to 5 milliseconds to travel between these two locations.

8. February 2014 Gold (GC) Futures - Zooming in on about 1/10th of a second.

9. GLD ETF trades - Zooming in on about 1/10th of a second.

Compare to Chart 8 above - note how the futures activity starts about 5 milliseconds earlier, indicating the move started in Chicago (futures) and not in NY (GLD).

Compare to Chart 8 above - note how the futures activity starts about 5 milliseconds earlier, indicating the move started in Chicago (futures) and not in NY (GLD).

10. March 2014 Silver (SI) Futures - Zooming in on about 1/10th of a second.

Trading didn't start in silver futures until a good 30 milliseconds after gold, which indicates silver was reacting and not part of the same strategy affecting gold.

Trading didn't start in silver futures until a good 30 milliseconds after gold, which indicates silver was reacting and not part of the same strategy affecting gold.

11. SLV ETF trades - Zooming in on about 1/10th of a second.

Activity in SLV appears 5 milliseconds after activity in GLD. The silver ETF reacts faster to the the gold ETF (both in NY), than the silver futures reacts to gold futures in Chicago.

Activity in SLV appears 5 milliseconds after activity in GLD. The silver ETF reacts faster to the the gold ETF (both in NY), than the silver futures reacts to gold futures in Chicago.

12. GLD ETF trades - Zooming in on about 1/2 second of time.

Note how trades from EDGX (blue diamonds), Dark Pools (squares) and BOST (light green circles) are reported significantly late.

Note how trades from EDGX (blue diamonds), Dark Pools (squares) and BOST (light green circles) are reported significantly late.

13. GLD ETF - Direct Edge-X trades and NBBO

It's easier to notice the significant delay in trades reported from Direct Edge-X

It's easier to notice the significant delay in trades reported from Direct Edge-X

http://www.silverdoctors.com/the-fed-is-waging-a-nuclear-currency-war-on-the-physical-gold-market/#more-37079

By PM Fund Manager Dave Kranzler, Truth in Gold:

Anyone who calls what is happening a “flash crash” or hedges on their assertion of “possible” direct intervention is either completely ignorant of the facts or they write their commentary in fear of public ridicule and doubt from other intellectual hedgers. It is what it is: a nuclear currency war rooted in the historical intervention of the gold market by the Federal Reserve and the U.S. Treasury.

Forget the “flash crash” story being widely promoted. The “flash crash” story says that technical and algo trading caused the plunge. Really? In the absence of a big dose of intervention, the flash crash never happens. Therefore, the only attributable cause by anyone who is being intellectually honest – not just with their readers but with themselves – is that INTERVENTION was culprit

In the last two days, 26+ tonnes was delivered on the Shanghai Gold Exchange. The enormous physical off-take in China is a freight train w/out brakes. From Standard Bank:

“In the physical market we are witnessing strong demand. Since the start of 2014, the SGE premium has jumped higher, reaching $18/oz this morning. The buying frenzy in especially China comes on the back of the seasonal demand pick-up ahead of the country’s New Year, which starts on 31 January…More broadly we have also noted an improvement in Asia demand for gold since mid-December. This is evident in the pickup of our Standard Bank Gold Physical Flow Index”

The manipulation in the gold market is getting worse by the day as the demand for physical gold from the eastern hemisphere begins to accelerate. It looks like the western Central Banks and their bullion bank market agents are going to work on silver with more focus. SLV is starting to see physical drawdowns, as is the Comex. The capping in silver is beyond blatant. Turkey imported a record amount of silver last year, as did India.. India’s demand for silver is the substitution of the gold that was cut off by the U.S. Government-induced Indian import controls.

Make no mistake about it. In the face of China’s moves to move away from the U.S. dollar and bolster their own currency with an historically epochal program of systemic physical gold accumulation, the U.S Government and the Fed are waging a nuclear currency war with a war on the physical gold market at its nexus. Anyone who asserts that it is any less than that is a complete coward.

http://www.silverdoctors.com/alasdair-macleod-govt-has-lost-control-complete-collapse-of-the-dollar-coming/

No comments:

Post a Comment