http://www.zerohedge.com/news/2012-12-17/greece-not-japan

http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_17/12/2012_474788

http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_17/12/2012_474806

and....

http://www.guardian.co.uk/business/2012/dec/17/eurozone-crisis-china-mario-draghi-berlusconi

It appears that the full text of the latest official review of Greece's

economy has been released to the public.

Photograph: JUAN MEDINA/REUTERS

Photograph: JUAN MEDINA/REUTERS Protesters march with banners reading 'No financial cuts'. Photograph: Andres Kudacki/AP

Protesters march with banners reading 'No financial cuts'. Photograph: Andres Kudacki/AP The banner reads, 'We have no flags or politicians, we have patients.' Photograph: JUAN MEDINA/REUTERS

The banner reads, 'We have no flags or politicians, we have patients.' Photograph: JUAN MEDINA/REUTERS

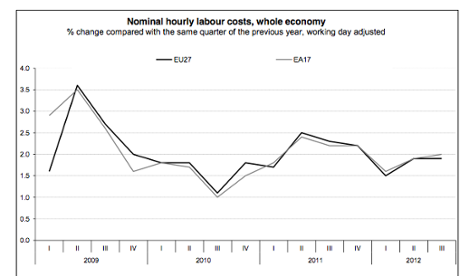

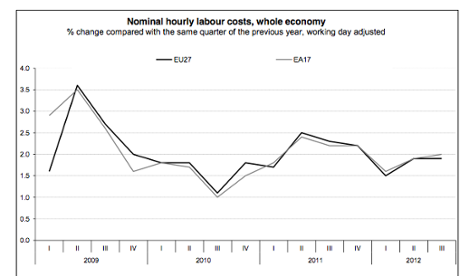

More European economic news – labour costs continued to lag behind inflation, rising by an annual rate of just 2% in the eurozone during the third quarter of 2012, and 1.9% across the EU (that's also via Eurostat).

Photograph: Eurostat

Photograph: Eurostat

"Greece Is Not Japan"

Submitted by Tyler Durden on 12/17/2012 07:55 -0500

"Greece is not Japan" - at least that is the forecast reality when comparing official IMF projections for the two depression-torn countries. Yet one needs to see the projected GDP/debt chart side by side to truly appreciate the humor and lunacy of Greek economic expectations. We give Greece 3-4 years before its ongoing socio-economic collapse, and its relentless plunge in GDP, brings it on par with Japan's basket case economy. End result: both countries will proudly sport debt/GDP in the 250% ballpark by the middle of the decade. But for now, let's pretend that Greece is not Japan.

http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_17/12/2012_474788

Stournaras waits for court's tax verdict, eyes growth plan

Stournaras told Naftemporiki newspaper that he would ask the think-tank he ran, the Foundation for Economic and Industrial Research (IOBE), and the Center for Planning and Economic Research (KEPE) to develop a blueprint for generating growth in Greece. The finance minister added that part of the plan would focus on the use of EU structural funds. However, Stournaras’s immediate concern is likely to be whether the Supreme Court will continue to allow the emergency property tax introduced late last year to be levied via electricity bills. A judge heard on Monday the Finance Ministry's argument but a verdict is not due to be issued until a full hearing has been held on Tuesday. Last week, Stournaras wrote to the Public Power Corporation to ask the company to keep collecting the tax despite a first instance court ruling that electricity bills should not be used for this purpose. Stournaras said it was in the national interest that PPC continue to collect the tax, which is vital for the government to meet its revenue targets. In a statement on Sunday, Greece’s prosecutors’ union said that based on the press reports of the finance minister’s communication with PPC, Stournaras could be accused of inciting others not to abide by the law. The prosecutors suggested that this could prompt legal action against the government. |

http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_17/12/2012_474806

Amount Greeks owe their state rises to 54 billion euros

There was an increase of more than 5 billion euros in the amount of money Greeks owe the state last year and stands at over 50 billion euros this year, according to figures provided to Parliament by the Court of Audit.

The court informed MPs that while debts to the state stood at 38.7 billion euros at the end of 2010, they rose by 21.1 percent last year to reach 44 billion euros by the end of 2011. This was the equivalent of 21.1 percent of Greece’s GDP.

Auditors said that the figure at the end of October this year had increased to 54 billion euros, or 27.7 percent of GDP.

Meanwhile, the number of bounced checks in November stood at 72.5 million euros, which was down 8.2 percent on the previous month and 56.3 percent less than a year earlier.

The total number of dud checks for the year came to 1.25 billion euros by the end of November, which was down 35.7 percent on the same period in 2011.

http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_16/12/2012_474724

|

and....

http://www.guardian.co.uk/business/2012/dec/17/eurozone-crisis-china-mario-draghi-berlusconi

Another Greek development -- the EU's task force dispatched to Greece has warned today that Athens has fallen behind its target of recovering €2bn of outstanding tax receipts during 2012.

By the end of October, the taskforce said, Greece had only recovered €1bn. Just 88 audits of large taxpayers had been conducted, against a target of 300, and just 467 of "high-wealth individuals"had been probed, versus a target of 1,300.

Despite the slippage, commissioner Olli Rehn declared that Greece was making progress, saying:

Greece is tackling deep-rooted structural problems with determination and resolve, as has been recognised by the Eurogroup.The Task Force is working hard to help Greece implement essential reforms to boost its competitiveness, create a fairer and more effective tax system, and generate sustainable growth and employment.

It appears that the full text of the latest official review of Greece's

economy has been released to the public.

Called "The Second Economic Adjustment Programme for Greece – First Review", it is available for download from the EC's website.

It starts by explaining how the Greek economy performed worse than expected, due to political instability (the two general elections) and the weakness of the global economy. It warns that Greece's tax collection system is failing to meet its targets, and that privatisations have been disappointing. It pays tribute to Antonis Samaras's government, before warning that there are very large 'implementation risks' to the programme.

Here's a flavour, as another reminder that the crisis is not over yet:

The key risks concern the overall policy implementation, given that the coalition supporting the government appears fragile and some components of the programme face political resistance, despite the determination of the government. Moreover, the impact on the weakened economy of the pronounced fiscal consolidation in

2013 may be stronger than currently foreseen, even though it could also be mitigated by the liquidity injection from clearance of government arrears.Important budgetary measures are likely to be challenged

in courts, which could lead to the need to fill a fiscal gap emerging as a consequence. Should product and services market reforms not accelerate as foreseen under the programme, positive economic growth could not return in 2014 as foreseen.A return to sustained growth can only be achieved when the structural reform agenda is fully and swiftly implemented.

It was released by the EC's Directorate General for Economic and Financial Affairs:

More protests due in Spain tonight

A new round of anti-austerity protests have been called for this evening in Spain.

AP has the details:

Hundreds of thousands of people are expected to pack the streets of Spanish cities in evening protests against the conservative government's anti-crisis austerity measures.The demonstrations Monday have been called by the main labor unions and dozens of social groups. They are to take place in 55 cities. Union leaders are to head what is expected to be the largest march in Madrid.

This follows yesterday's demonstrations against changes to the country's healthcare system (see 11.18am for photos)

Spanish cities were at the forefront of last month's co-ordinated general strike against austerity, and there is deep anger against the government's austerity plans.

Photos: Sunday's austerity protests

Yesterday, public anger against Spain's austerity programme hit the streets again.

Thousands of Spanish health workers, patients and supporters protested against plans to partially privatise the country's health sector, by selling off the management of six of 20 public hospitals and 27 of 268 health centres.

Here are some photos from Madrid:

Photograph: JUAN MEDINA/REUTERS

Photograph: JUAN MEDINA/REUTERS Protesters march with banners reading 'No financial cuts'. Photograph: Andres Kudacki/AP

Protesters march with banners reading 'No financial cuts'. Photograph: Andres Kudacki/AP The banner reads, 'We have no flags or politicians, we have patients.' Photograph: JUAN MEDINA/REUTERS

The banner reads, 'We have no flags or politicians, we have patients.' Photograph: JUAN MEDINA/REUTERSMore European economic news – labour costs continued to lag behind inflation, rising by an annual rate of just 2% in the eurozone during the third quarter of 2012, and 1.9% across the EU (that's also via Eurostat).

Photograph: Eurostat

Photograph: Eurostat

The survey (which doesn't include data from Greece), showed that the highest annual increases in hourly labour costs were recorded in Estonia (+7.6%) and Romania (+7.2%), while they actually fell by 0.8% in Slovenia (where several anti-austerity rallies have taken place in recent weeks).

Overall, European employees' wages are being pegged back by the weak labour market and record unemployment across the region.

Howard Archer of IHS Global Insight warns that workers have little power at present:

There is a need for companies to hold down their wage and total labour costs in a very challenging and uncertain environment, while appreciable and rising labour market slack in most Eurozone countries means that workers have little, if any, bargaining power.

Mario Monti will outline his future plans on Friday, it appears, in his end of the year address.

As Alberto Nardelli flags up, the technocratic PM could present a list of candidates who support him, giving Monti a powerbase for a post-election coalition.

Or he could simply present a reform manifesto which parties could support -- giving legitimacy to Monti continuing as leader after the election....

Chinese sovereign wealth fund 'not optimistic' about eurozone

Good morning, and welcome to our rolling coverage of the eurozone crisis, and other key events in the world economy.

First up: China's powerful sovereign wealth fund has warned European leaders that the outlook for the eurozone remains very tough.

Jesse Wang Jianxi, executive vice-president at China Investment Corp, diluted the pre-Christmas spirit in Europe by telling a conference that CIC was wary of investing more in the region.

Speaking on the island of Hainan, Wang said:

I think the outlook for the European debt crisis is not optimistic yet.We have been investing actively in European countries and if the heavily indebted countries and European Union can provide a more friendly investment environment, I think we can invest more actively in the future.

European leaders have been actively lobbying China to help them out of the crisis – Angela Merkel visited the country twice in 2012 in an effort to drum up trade and investment (in February and August).

Wang's comments, though, show that Beijing remains sceptical about the eurozone, despite optimism in Brussels that the worst of the crisis is over.

With resources of around $480bn (£300bn), CIC's concerns should carry weight. And as Reuters points out, China has resisted buying into Europe's bailout fund – and is keen to see Europe's richer nations contribute more.

For CIC, a "more friendly investment environment" means one with a greater focus on growth, rather than self-defeating fiscal consolidation.

Last month, the chair of its board warned that European austerity has now pushed the public close to "breaking point". He also argued that the European Central Bank should engage in more "unorthodox" measures to turn the region's slump around.

So, a reminder that the crisis has not abated.

As usual we'll be tracking all the latest developments though the day, as the end of the year approaches....

Updated

No comments:

Post a Comment