http://www.guardian.co.uk/business/2012/nov/16/eurozone-crisis-lagarde-greece-bailout-austerity

European stocks slide again

European stock markets posted another day of hefty falls.

Its the usual story of concerns over slow (or no) progress in the eurozone, and the US fiscal cliff.

David Madden, IG's market analyst, was in weary mood:

It feels like the Greek debt crisis is as old as the Acropolis. Stocks are sinking as we shut up shop for the weekend, as traders take their money off the table ahead of yet another Eurogroup meeting next week.We all know how it going to play out; the talks will go down to the wire, stocks will fall because of the 'what if' factor, but in the end Greece will be given the money and we might see a small bounce. Even when Greece is given the kiss of life next week, another indebted nation will be in the

cross hairs, and it may well be Spain.

And here's the damage:

FTSE 100: down 72 points at 5605, - 1.27%

German DAX: down 1.2%

French CAC: down 1%

Spanish IBEX: down 1.1%

Italian FTSE MIB: down 2%

Portugal's opposition demands a rethink

The head of Portugal's opposition has added his voice to those calling for an austerity rethink.

Antonio Jose Seguro told reporters in Lisbon today that neither the IMF nor the country's government understand the depth of the crisis in Portugal:

The country is in a more serious situation than the government and 'troika' realize...There is a consensus in Portuguese society that the austerity recipe has failed.

Yesterday's GDP data showed that Portugal shrank by 0.8% in the third quarter of 2012 -- adding to concerns that it is on the same path that Greece trod under its own bailout programme.

China's sovereign wealth fund official warning over European austerity

The man who runs China's huge sovereign wealth fund has warned that Europe's citizens are being pushed to the limit, and urged politicians in the region to heed the growing protests on the streets.

Jin Liqun, chair of China Investment Corporation's supervisory board, told a conference in Beijing that the anti-austerity protests show that the Europe's public are close to breaking point.

Our correspondent Tania Branigan was there, and reports that Jin said:

One commonality is that unions are now involved in organised protests; demonstrations and strikes. It smacks of the solidarity movement witnessed in the 1930s...The general public's tolerance of austerity has been stretched to breaking point.

Jin went on to warn that it was a mistake to attempt austerity at at time when economies really need growth, and suggested that a 'proper balance' was needed. Otherwise, he added, the austerity programmes may collapse completely....

Jin has previously argued that Europeans need to work harder to fight their way out of the crisis – today's comments suggest that protests (such as Wednesday's mass action) have had an effect around the globe.

Updated

Italians don't want more Monti

Over in Italy, an opinion poll has found that two-thirds of people do not want Mario Monti to continue as prime minister after next spring's elections.

The survey, conducted by state-owned TV network RAI, found that Monti's approval rating has halved to 36%, from 71% when he named his new technocratic government (a year ago today).

Roberto Weber, chairman of SWG, argued that Monti had done well to cling onto this much support, saying:

Given the measures taken and the extreme difficulty of the situation, his approval rating is high.

Monti has ruled out standing in next year's elections, and played down suggestions that he ought to stay on as unelected leader. But some in the financial markets would prefer an extended Monti premiership.

On France....

The Economist's Europe Editor has now defended the newspaper against the wrath of the French government (see 8.51am for the background).

John Peet insisted that they were simply trying to be helpful by using a bunch of baguettes as sticks of dynamite, and suggesting that Paris wasn't serious about making reforms.

Peet told the newspaper 20 Minutes that:

The point of this cover and the article is to encourage France...Other countries including Greece and Portugal have conducted many reforms. This is not yet the case in France.

Independent economist Shaun Richards has also warned that the situation in France is deteriorating, in this blogpost. He's particularly concerned about the cost of rescuing France's weaker banks, such as Dexia:

As she weakens more and more eyes will turn to her ability to support her weakened banking sector.....the bills are beginning to mount.But also she faces a bill from the bailout programmes she is committed too for her Euro area partners who are in trouble. As of the latest numbers up to the end of the second quarter such lending represents some 1.7% of her GDP to this we can add and rising.

Lower income and higher debt does not make a happy mix make as Mr. Micawber observed all those years ago.I suspect the Troika would take a dim view of Wilkins Micawber...

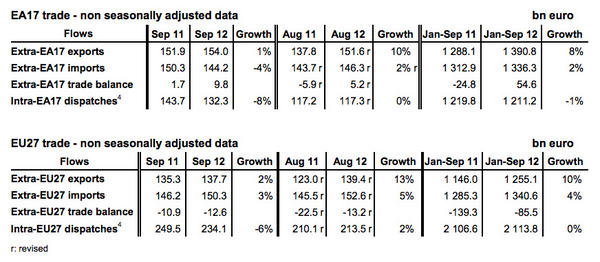

Encouraging eurozone trade data

A jump in exports from Greece and Portugal has helped to increase the eurozone's trade surplus.That's the encouraging (and perhaps surprising) news from today's eurozone trade data. Greece's exports are up by 11% over the first eight months of the year, while imports are down 13%.In Portugal, exports are up 10% and imports down 5%.And overall, the eurozone posted a trade surplus of €9.8bn in September, up from just €1.7bn a year ago. That was due to a 1% rise in exports, and a 4% drop in imports, as this table shows:

No comments:

Post a Comment