http://www.mybudget360.com/phd-food-stamps-rise-advanced-degrees-government-aid-benefits/

Ph.D. in food stamps – the rise of food stamp usage among those with advanced degrees. Record number of households on food stamps.

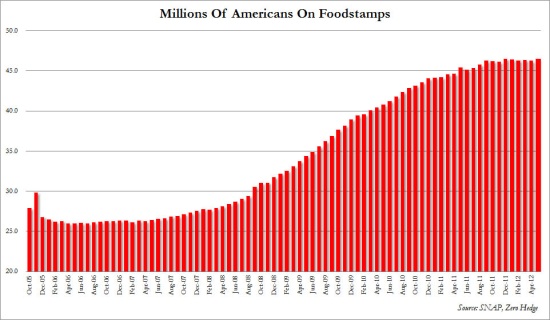

It is hard to declare a recovery when a record 22.3 million households are now on food assistance. The latest data shows that 46.5 million Americans are still relying on SNAP, the food assistance program, to get by each month. Since this data lags, we see that in May we added 77,000 jobs but added 222,000+ Americans to the food stamp program. This is not a positive economic calculus. The recent rallies were all spurred by the utterance of more bailouts with more debt. Will these promises be enough to give us a positive second half of the year? Central banks and the government are stepping up in historic fashion just to keep the system from coming apart. Think about the fact that over 46 million Americans rely on a small check each month just to get food into their household. Some companies have seized this trend to their advantage. Some with advanced degrees are turning to food assistance in larger numbers. Where do we go from here?

The structural changes of food stamps

Most states have a cap on how much in assets a household can have before giving out food assistance. This cap is usually at $2,000 or $3,000 in liquid assets (i.e., checking, savings, etc). Now think about the 22.3 million households that likely have less than one month of cash flow. These households are sustaining 46.5 million Americans:

The troubling item with the data above is the reality that we are at a peak in terms of households and we are supposed to be in a recovery. The recession technically ended in the summer of 2009. Yet for most Americans, the stock market is not a proxy for income growth and the slow decline of the middle class continues unabated.

To highlight even further the higher education bubble, there is an article that examines the jump in food stamp usage for those with a master’s degree or even Ph.D.s:

“(The Chronicle) During that three-year period, the number of people with master’s degrees who received food stamps and other aid climbed from 101,682 to 293,029, and the number of people with Ph.D.’s who received assistance rose from 9,776 to 33,655, according to tabulations of microdata done by Austin Nichols, a senior researcher with the Urban Institute. He drew on figures from the 2008 and 2011 Current Population Surveys done by the U.S. Census Bureau and the U.S. Bureau of Labor.”

This new dichotomy is demonstrating that many people that were once a shoe in for a middle class lifestyle continue to face the challenges of a tough economy. The article gives this following story:

“I am not a welfare queen,” says Melissa Bruninga-Matteau.That’s how she feels compelled to start a conversation about how she, a white woman with a Ph.D. in medieval history and an adjunct professor, came to rely on food stamps and Medicaid. Ms. Bruninga-Matteau, a 43-year-old single mother who teaches two humanities courses at Yavapai College, in Prescott, Ariz., says the stereotype of the people receiving such aid does not reflect reality. Recipients include growing numbers of people like her, the highly educated, whose advanced degrees have not insulated them from financial hardship.“I find it horrifying that someone who stands in front of college classes and teaches is on welfare,” she says.”

A college degree is no guarantee of a job yet the costs of going to college keep going up and up. At the same time, in the economy things are slowing down:

New orders are dropping as inventories are rising. This is not a good sign. Even with the European Central Bank poised to continue with unlimited bailouts, these figures are sobering. It is unsustainable to have 1 out of 6 Americans on food stamps. Yet projections show this trend holding tight for years to come. With over $1 trillion in student debt and growing, we are witnessing another major bubble that is destined to pop with additional ramifications to the economy.

How to spot a recovery when it arrives?

-Solid manufacturing growth that will appear in strong PMI figures-A housing market that is self-supporting without the need of major government intervention-A substantial decline in food stamp usage-Rising household wages

None of these items are part of our current economy. The second half of the year is going to bring major challenges ahead with little significant action thanks to the election season.

No comments:

Post a Comment