http://www.zerohedge.com/news/guest-post-abandoning-ship-eurozone-failing-accelerating-rate

and.....

http://globaleconomicanalysis.blogspot.com/2012/06/european-crisis-summit-score-0-18-with.html

http://www.zerohedge.com/news/lch-hikes-italian-bond-margins

http://www.zerohedge.com/news/italy-comes-begging-semi-bailout-germany-says-non-semi-nein-without-conditions

Guest Post: Abandoning Ship - The Eurozone Is Failing At An Accelerating Rate

Submitted by Tyler Durden on 06/20/2012 17:36 -0400

- Apple

- Belgium

- Central Banks

- European Central Bank

- Eurozone

- France

- George Soros

- Germany

- Greece

- Guest Post

- Ireland

- Italy

- Portugal

- President Obama

- ratings

- Reality

- Stop Trading

Submitted by Alasdair Macleod,PeakProsperity.com contributing editor

Abandoning Ship The Eurozone Is Failing At An Accelerating Rate

It will be no surprise to readers that the news coming out of the Eurozone just gets worse and worse. The reality is that Ireland, Portugal, Spain, Italy, Belgium, Greece, and France (in no particular order) are all in debt traps from which there is no escape. A debt trap is sprung when bankruptcy becomes the only outcome. With corporations, this usually becomes readily apparent and directors are forced by law to stop trading, but countries conceal this reality by printing money. Otherwise there is no difference in the two cases, despite what politicians and neoclassical economists would have us believe. This is why we are painfully aware that the Eurozone is in trouble, since nation states are unable to cover and conceal their obligations by printing money, having surrendered this role to the European Central Bank (ECB).

The ECB is meant to be independent of politics and political pressures. But the reality facing any central banker is that s/he cannot stand by and let politicians drown in their own mess. The politicians know this, and it's what is behind current attempts to move away from austerity towards Keynesian growth. The plea is exactly the same as that of the spendthrift who tells his bank manager that the only chance he has of getting his money back is to increase the overdraft to allow him to trade his way out of difficulty.

So the ECB knows, in its role as bank manager, that the argument is flawed. But unlike spendthrift individuals, politicians have real power, and the ECB has an ultimate responsibility not to upset the apple cart. And that is why the election of a new socialist French president is important. President Hollande is leading the charge away from austerity in Europe, and he has powerful allies, including President Obama in his own election year.

Unfortunately, the ECB and the politicians lack a proper understanding of their economic condition because they continue to operate within the neoclassical framework that has led them into this mess. The lack of understanding of the relationship between the elements of hard-to-predict future consumer preferences, as well as the entrepreneurial function and the role of time in their calculations, has led to a reliance on sterile economic models. These leave no room for the dynamic and unpredictable creativity of human nature that gives us real economic progress. It is the difference between a proper understanding of the role of free markets, and thinking they can be manipulated to achieve an outcome preferred by the state without adverse consequences. An important consequence has been the creation of credit-induced business cycles leading to escalating levels of debt in both private and public sectors, which is why so many countries have become ensnared in debt traps. This statement of the obvious is not recognised by Keynesians and monetarists who continue to argue that the solution is yet more debt, more stimuli, and the avoidance of deflation at all costs. And it is neoclassical Keynesians and monetarists that populate the central banks and advise politicians.

This brings us to an important consideration: Despite what her officials say publicly, austerity has limited support within the ECB itself, because it is run at the top by neoclassical economists. Instead, the real constraint is Germany, whose citizens’ savings are on the line and which faces the prospect of its third currency collapse in a century. So this is where the lines are drawn up: spendthrifts desperate for more money, a conflicted central bank, and Germany.

Angela Merkel has made considerable progress in pushing the German electorate in a direction that is completely against its instincts by playing the political card marked “there is no alternative.” With her considerable political skills, she may be able to push her people some more, but it is becoming increasingly difficult, because everyone in Germany can see that committing real savings to bailing out the spendthrifts only wipes out the savings. These are not euros simply conjured out of thin air, because the Bundesbank cannot print them and probably wouldn’t do so anyway. But the pressure is mounting on her, and she is being squeezed by governments such as the British and the Americans, who are now panicking over the consequences of failure.

This is why both countries went public last week, with David Cameron even visiting Merkel in person. It is a sure indication that major governments outside the Eurozone are beginning to expect the worst, and that unless Germany gives way, it will happen quickly.

Eurozone bank lending

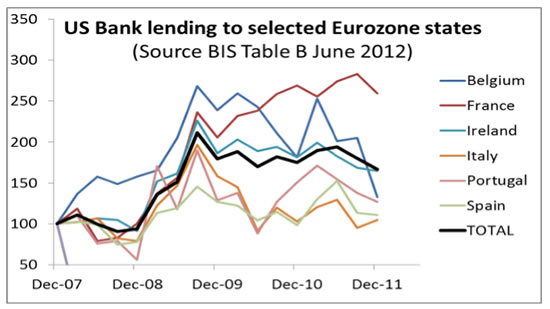

While there is a stalemate at government and central bank level, this is far from the case in commercial banking. The period of expanding bank credit, which gave rise to unsustainable levels of debt, ended with the banking crisis in 2008, and since then, central banks have been dealing with the aftermath. The Eurozone countries facing problems today were beneficiaries of bank credit expansion, and thus are badly hit by the subsequent contraction.

The chart below illustrates how Eurozone bank lending is collapsing, and represents European cross-border bank lending between European countries, rebased to 100 at 31 December 2007. The total is shown by the heavy black line, along with lending to selected Eurozone countries.

It becomes clear from this chart why the ECB offered its long-term refinancing operation last February, when it injected €530bn in raw cash into the banks. The contraction of cross-border lending was accelerating, having completely absorbed the November injection of €489bn. And it tells us that more LTRO injections will be needed very soon.

The underlying picture is more complex than shown by one chart. The lending shown is to both private and public sectors, and the drop in cross-border lending to governments was partially replaced by increased lending from domestic sources on the back of the ECB’s LTRO, and also by US banks (see below). But given that the Eurozone’s banks are already highly exposed to their individual governments, this increase in loan concentration has undermined their creditworthiness; hence the continuing ratings agency downgrading of the banks involved.

A further concern is that government borrowing is crowding out the private sector. Private sector borrowers are being badly squeezed, not only for capital investment funding but also for their working capital requirements. The consequence is that governments with large budget deficits are not going to get the future tax revenues assumed in economic forecasts.

This is why the only solution to the Eurozone’s problems is a round of massive and immediate cuts in public spending. Without these cuts, the destruction of real savings, vital to the economic wellbeing of society itself, continues. In the past, this destruction was a relatively slow process, but the speed at which it is now happening has accelerated exponentially. The importance of cutting public spending has become more urgent; unfortunately, the election of President Hollande in France has delayed this process.

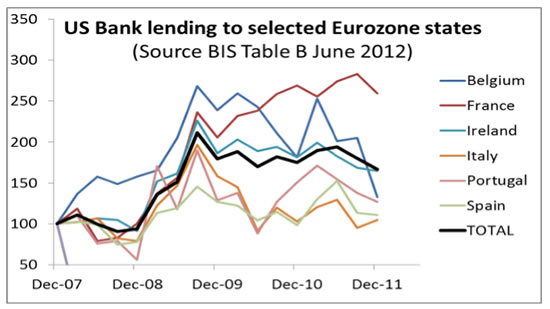

Help from outsiders only delays the inevitable and increases their exposure to the Eurozone’s problems. Lending to Eurozone countries by US banks has expanded in all the cases shown in the chart below, though lending totals have fluctuated widely. But total lending (the heavy black line) is still up 67% from December 2007. A cynic might say that the Fed has encouraged US banks to increase their lending to the Eurozone, on the basis that no banker in his right mind would have otherwise done so. But if this is true, the Fed has little flexibility to continue with this support, given that commercial bankers will be increasingly reluctant to commit further funds. It explains President Obama’s interest in the current state of the Eurozone, because if it goes down, there will have to be a major capital injection into US banks to keep them solvent. We get used to trillions being thrown around, but that is government spending and money-printing; in the context of the Wall Street banks, the quantities are not small, with the lending total at end-December 2011 being $347bn.

It is hard to conclude anything other than that all of the avenues for resolution have been explored and substantial sums of money thrown at the problem, much of it without the public’s knowledge. The ECB has expanded its balance sheet to offset cross-border lending contraction, and other central banks, particularly the Fed, have done their bit. Germany has committed enough of her own citizens’ savings to fill what is obviously a bottomless pit. New investors, except wild speculators, are non-existent. And without more outside help, Eurozone institutions do not have the resources to avoid a financial collapse.

That outside help is not there. The result is that the Eurozone is failing at an accelerating rate. George Soros is on record as giving Euroland three months. It will be lucky to last that long.

Points arising

While it's impossible to foresee the precise order of events in this accelerating collapse, in Part II: The Most Predictable Next Events, we detail the inevitable developments that will almost certainly arise over the course of Europe's struggle.

Remember that most commentators have little understanding of the true position, or are trained in neoclassical economics (if at all), and are generally recycling someone else’s take on things. Also bear in mind that the Eurozone’s politicians are desperate to allow no steps backwards in their cherished project, because they suspect that any regression will kill not only the euro, but the whole EU project. Everything will be done to prevent countries from leaving the Eurozone, including ignoring problems in the hope they will go away. And the bigger the country, the more resolute everyone will be to stop them from leaving.

Click here to access Part II of this report(free executive summary; paid enrollmentrequired for full access).

and.....

http://globaleconomicanalysis.blogspot.com/2012/06/european-crisis-summit-score-0-18-with.html

European Crisis Summit Score 0-18 With Another Coming Up June 28; Is Merkel Misinterpreted? Will the FOMC Move Decisively?

Steen Jakobsen, chief economist of Saxo Bank in Denmark, asks via email: "Is Merkel Misinterpreted? Will the FOMC Move Decisively?"

The misunderstood Chancellor.and......

The market clearly believes Ms. Merkel will, ultimately, not withstand the pressure - and she will end up collateralizing rising debt. I remain extremely skeptical. I even dusted off my school German to read Der Spiegel and Focus, two major German weeklies, which give you a very different perspective.

As a generalization, the Anglo-Saxon driven investment banks and media tend to rely on poorly translated English versions of domestic financial papers, hence they lose the subtle difference on what Merkel is REALLY saying. This is what I believe Ms. Merkel, and Germany, think.

- When countries join the euro, they also directly and indirectly accept the Stability-and-Growth Pact, hence anything that moves Germany and Europe closer to Stability-and-Growth will be supported by Germany.

- Germany knows it will take time - more time than the market wants it to take. But Germany also realizes it will probably mean more crisis before the whole of Europe moves in the same direction.

- The big loser if Germany "caves in" is Germany. Bund yields will rise and all of Europe will have to finance itself at higher rates - the exact same reason the Alexander Hamilton sinking fund will not work - why should Germans pay more for issuing debt and the high debtors pay less?

- Germany has a game-theory upside in Greece failing to comply - only through more crisis will Club Med (Italy, France and Spain) move to more Europe. (The only thing Club Med wants for now is more German money, not more Europe...)

- Merkel needs to reach across to SPD, the opposition, to get her 2/3 majority for the Fiscal Compact. Watch closely what "concessions" she is willing to give SPD. That will give us clear indication on where she stands vis-a-vis the Club Med call for the easy solution of Euro-bonds and Banking Union.

- Merkel and Germany are pro-European. They want the EU to succeed and they will never leave the euro. But they are also aware that collateralizing debt without the Stability-and-Growth pact will end in tears as it will be extend-and-pretend squared. Throwing liquidity at a solvency issue avoids any real reforms and will be the fastest way to Japanisation.

From this old cynical trader's point of view, the more likely Merkel and Germany give up and bow to the pressure, the sooner will we face a full-blown crisis and collapse of Europe.European Crisis Summit Score 0-19

Rhetoric and non-plans cannot continue to dominate the agenda at the EU Summits. The meeting on the 28/29 June is, by my count, meeting number 19 without a real result. Zero from nineteen games - talk about a team going towards relegation!

FOMC - more of the same The US data is still getting weaker, but not weak enough to warrant a panic from the FOMC tomorrow. Bernanke failed to provide the juice in his speech last week, so now the consensus is it will have to happen tomorrow. Otherwise... you know the rest of the sentence. The Fed will lower growth; it will probably also extend Operation Twist, but I doubt it will go all in considering the banking system issues and the overall need for having reserves.

On the other hand, however, the Fed also realizes that "promising" has a real impact on the market. So, overall, expect some small adjustment from FOMC/FED, but not enough.

Strategy

We would be almost square into this meeting, but looking to be heavily bearish on equities post the FOMC and EU Summit.

We still see a summer of discontent as the misinterpretation of Germany and FOMC will lead the market to realize that, for once, central banks and the politicians can't buy more time.It is time to reflect not act, as their five-year experiment of doing the same thing expecting different results is leading them nowhere. Probably naive thinking by me... But I think we will all lose if I'm wrong, as extend-and-pretend squared is the road to the poor house.Market Won't Wait

Safe travels,

Steen Jakobsen

I believe Steen has this essentially correct and that Germany giving in would ultimately just make matters worse in spite of all the "mother hen calls" from nearly every other economist.

Yet, the market cannot and will not wait long enough for Merkel to be proven correct. Interest rates in Italy and Spain are at disaster levels and will likely get worse.

My position is summed up in these three posts.

http://www.zerohedge.com/news/lch-hikes-italian-bond-margins

LCH Hikes Italian Bond Margins

Submitted by Tyler Durden on 06/20/2012 13:38 -0400

And just like yesterday, when LCH hiked Spanish bond margins in the whole Guardian disinformation fiasco, so LCH tries to sneak one in today again, this time hiking margins on Italian bonds with a 2-15 year maturity.

From LCH:

LCH.Clearnet SA has revised the parameters applied to transactions on Debt Securities executed on Trading and Matching Platforms.

These changes shall come into effect from the close of business on 21st June 2012 and will be reflected in the margin calls on 22nd June 2012.

The parameters changed appear in bold in the following tables.

http://www.zerohedge.com/news/italy-comes-begging-semi-bailout-germany-says-non-semi-nein-without-conditions

As Italy Comes Begging For A Semi-Bailout, Germany Says Non-Semi Nein (Without Conditions)

Submitted by Tyler Durden on 06/20/2012 07:01 -0400

- Bond

- Borrowing Costs

- default

- European Central Bank

- Eurozone

- fixed

- Germany

- Greece

- International Monetary Fund

- Italy

- Mexico

- Newspaper

- Reuters

- Sovereign Debt

- United Kingdom

Two days ago, when noting that Italy is on collision course with technical insolvency should its bonds remain at current levels for even one more week, we wrote that "As Italy Hints Of Subordination, Did Rome Just Request A "Semi" Bailout?" Of course, yesterday's big market moving rumor was just this - namely that "supposedly" Germany had agreed to provide the underfunded EFSF and non-existent ESM as ECB SMP replacement vehicles, and implicitly to launch the bailout of not only Spain but also Italy. This turned out to be patently untrue, as we expected, despite speculation having been accepted as fact by various UK newspaper and having taken Europe by a storm of false hope, leading peripheral spreads modestly tighter (and Germany naturally wider). Of course, even if Merkel were to allow the ESM/EFSF to effectively replace the ECB secondary market bond buying, which is what this is all about, nothing will be fixed, and in fact it would lead to even more subordination and more bond selling off of positions which are not held by the ECB or ESM. But that is for the market to digest in 4-6 weeks as it appears nobody still understands how the mechanics of the flawed European rescue mechanism works. In the meantime, now that Italy has tipped its hand, it has only one option: to push full bore demanding that someone, anyone out there buy its bonds. Sadly, Germany just said nein. Again.

From Reuters:

Italy put forward a proposal at a G20 summit in Mexico on Tuesday for the euro zone's rescue funds to start buying the debt of distressed European countries, and the idea is expected to be discussed at a meeting of leaders in Rome on Friday.The Italian proposal foresees using the EU's rescue funds, known as the EFSF and the ESM, to buy bonds of countries such as Spain and Italy in the secondary market to help bring down bond yields and lower refinancing costs.Both facilities have the power to buy sovereign debt, but so far only the European Central Bank (ECB) has been active in purchasing the bonds of stricken euro zone countries, snapping up over 210 billion euros worth of debt since launching the programme in May 2010.

"The idea is to stabilize borrowing costs, especially for countries who are complying with their reform goals, and this should be clearly separated from the idea of a bailout," Italian Prime Minister Mario Monti told a news conference in Los Cabos at the end of a G20 meeting.

Well, actually the idea is to bailout Italy in absence of real bond buyers, no? Because last we checked the bond market (forget idiot stocks) is still quite capable of judging for itself who is actually "complying" with non-existant targets and goals. In fact, by pushing spreads wide, the market is doing precisely that: forcing Italy to be honest about fixing its fiscal mess. Sadly Italy refuses to see logic in the eye. Actually, it spits in it.French President Francois Hollande said no decisions had been taken on using the funds to buy debt, but that the idea was worth exploring and would be discussed at a meeting between him, Monti, German Chancellor Angela Merkel and Spanish Prime Minister Mariano Rajoy on Friday.

"Italy has launched an idea which is worth looking at,"Hollande told reporters in response to a Reuters question."We are looking for ways to use the ESM for this," Hollande said. "At the moment it is just an idea, not a decision. It is part of the discussion."Merkel has signaled in the past that the funds could be used to buy bonds, but that is unpopular in Germany and would require the agreement of other euro-zone member states.The idea was set out by Italy's Europe minister, Enzo Moavero, in Brussels on Monday.Moavero said the plans would also be discussed at a meeting of finance ministers in Luxembourg on June 21-22.

Note the "no discussions" had taken place to replace the SMP with ESM. But even if that did happen, and the ESM is perfectly in its right to buy Spanish debt, the only thing it would achieve is subordinate existing debtholders even more.

At least one person gets this: Credit Suisse’s Andrew Garthwaite said in a note that the reported proposal by Italian PM Monti does "little to resolve" the 3 main problems - growth, PIIGS solvency, and need for a banking union.

- Isn’t clear if ESM / EFSF “has enough firepower to make a sustainable difference;” cites maximum lending volume of €500 billion

- Any crisis resolution will have to have the ECB at its core

Finally, Germany has spoken, and has dashed all hopes once and for all that it is not the ultimate paymaster in Europe, superseding even the ECB. From Market News:

The German government on Wednesday reaffirmed that the European bailout funds EFSF and ESM won't be able to buy bonds of EMU member states on the secondary markets without these countries applying formally for such aid and accepting the conditions tied to it.

"Such secondary market purchases are foreseen as one of several instruments in the EFSF as well as in the future ESM," government spokesman Georg Streiter said at a regular press conference here. "They are naturally tied to conditions and there won't ever be any purchases without conditions."

Commenting on Greece, Streiter said Germany expected that the new government there will abide by the fiscal consolidation and reform program agreed with the EU, the ECB and the IMF.

Yet, finance ministry spokeswoman Marianne Kothe said at the same press conference that regarding the timetable of the consolidation and reform program "small adaptations can be made, as has been already the case before."

German Finance Minister Wolfgang Schaeuble told German weekly Die Zeit in an interview to be published Thursday that "we did not ask too much of Greece and we won't ask too much of Greece."

ECB Executive Board member Joerg Asmussen, a German national, said Monday it was too early to tell if Greece should be allowed more time to meet its goals. One must first see how the new government judges the state of the economy and the progress on reforms, he explained. Asmussen also warned that giving Greece more time meant automatically that "there will be an additional external financial need."

A senior EU official said Tuesday that Eurozone finance ministers are expected to open talks on modifying the details of Greece's second bailout program because months of political paralysis in the country have caused reforms to stall.

Well that about kills the existing rumor mill.

Now let's see what rumor that Germany has completely changed its policy of pushing the Eurozone to the brink of default, keeping the EUR lower (and its export sector humming), keeping its mercantilist trading partners on the edge of disaster and thus demanding a bailout at any condition that Germany sets (the last being most critical), can give us today...

No comments:

Post a Comment