http://economia.elpais.com/economia/2012/05/31/actualidad/1338455437_610619.html

http://www.reuters.com/article/2012/05/31/idUSWLB062520120531

and....

http://www.telegraph.co.uk/finance/debt-crisis-live/9301285/Debt-crisis-live.html

What we need first of all is for the Spanish government to tell us its restructuring plans for Bankia, what options it is considering.

What we need first of all is for the Spanish government to tell us its restructuring plans for Bankia, what options it is considering.

Voting has opened across Ireland in what will be the only popular vote on the fiskal pact. The Yes campaign is confident but needs a good turnout from the 3.1m voters to put wind in the sails of their vote.

Voting has opened across Ireland in what will be the only popular vote on the fiskal pact. The Yes campaign is confident but needs a good turnout from the 3.1m voters to put wind in the sails of their vote.

Yesterday saw a bit of a rout in the markets as the sellers came out in force to push indices lower as bad news after bad news hit the news wires. A terrible Italian bond auction, bad news from a Greek poll, spiking Spanish bond yields and economic sentiment data that would have shocked most pundits as it hit a two and a half year low was all a toxic set of ingredients that sent investors running for cover.

Yesterday saw a bit of a rout in the markets as the sellers came out in force to push indices lower as bad news after bad news hit the news wires. A terrible Italian bond auction, bad news from a Greek poll, spiking Spanish bond yields and economic sentiment data that would have shocked most pundits as it hit a two and a half year low was all a toxic set of ingredients that sent investors running for cover.

Overall it's very very tough and I don't see any respite for a year or so. The stories we get from our customers now - (they are) still buying biscuits but hiding them to a greater extent, recycling of clothes, passing clothes down, one in five mothers skipping meals. People are on really tight budgets, 43pc of our customers are now dipping into their savings to make their monthly bills.

Overall it's very very tough and I don't see any respite for a year or so. The stories we get from our customers now - (they are) still buying biscuits but hiding them to a greater extent, recycling of clothes, passing clothes down, one in five mothers skipping meals. People are on really tight budgets, 43pc of our customers are now dipping into their savings to make their monthly bills.

It is going to get a lot worse before it gets better and the market perversely acts as it is not particularly long at these levels.

It is going to get a lot worse before it gets better and the market perversely acts as it is not particularly long at these levels.

Unveiling detailed "report cards" on Europe's crisis-fighting efforts, the Commission also said that the European Stability Mechanism bail-out fund should lend directly to stricken banks. "Direct recapitalisation by the ESM might be envisaged," the report said.

Unveiling detailed "report cards" on Europe's crisis-fighting efforts, the Commission also said that the European Stability Mechanism bail-out fund should lend directly to stricken banks. "Direct recapitalisation by the ESM might be envisaged," the report said.

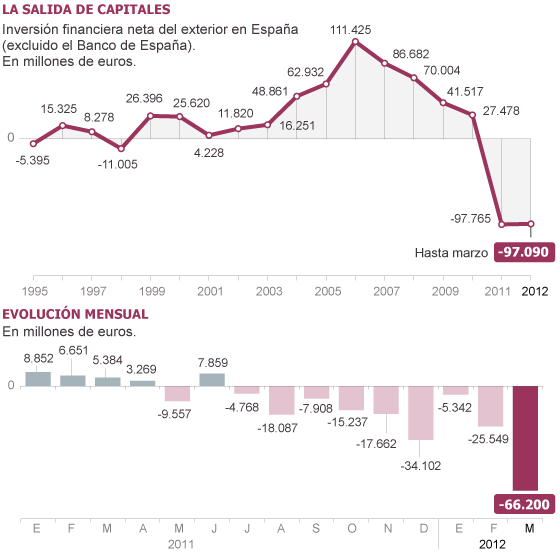

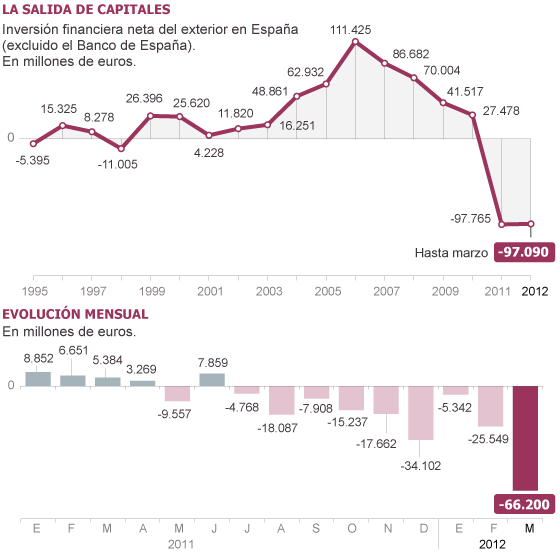

The outflow of capital of the Spanish economy surpasses all records

The withdrawal came in March to 66,200 million, nearly double the previous maximum

Almost a third of the balance is due to liquidity put Spanish banks abroad

In nine months, have left 200,000 million in financial resources of the Spanish economy

The money came from Spanish stock and bond data ten times a year ago

Source: Bank of Spain and Treasury. / THE COUNTRY

http://www.reuters.com/article/2012/05/31/idUSWLB062520120531

(The following statement was released by the rating agency)

May 31 - Fitch Ratings has downgraded eight Spanish autonomous communities. The agency has also affirmed one autonomous community. The Outlooks are all Negative. In addition, the agency has downgraded three credit-linked public sector entities (PSE) and assigned Negative Outlooks. The respective bond issues/senior unsecured ratings have also been downgraded. A full list of rating actions is below.

Fitch placed eight Autonomous Communities on Rating Watch Negative (RWN) on 9 March 2012, and indicated that it would resolve the RWN by end May. Following the downgrades, the Long-term ratings of all the Autonomous Communities under the common regime that were on RWN are now in the 'BBB' category, while the Basque Country is rated 'A+' and the Autonomous Community of Madrid, which was not been placed on RWN, is rated 'A-'.

The rating actions reflect the negative economic and market environment in Spain, which has resulted in depressed fiscal revenues, and the structural fiscal deficits of the regional administrations, which will require considerable additional efforts to be reduced, and also the difficulties in accessing long-term funding.

In resolving the RWN, Fitch specifically assessed four elements:

- The autonomous communities suffered from some under-funding by the state in 2011, which worsened the overall results. Large extraordinary expenditure that should have been recorded in previous years also contributed to the significant deterioration.

- The recent introduction of the Budgetary Stability and Financial Sustainability (BSL) law is a positive step by the central government to instil budgetary discipline in the regions. It establishes severe penalties for non-compliance and allows central government to intervene directly in the regions' finances if they fail to meet budget deficit targets. The ratings also factor in the significant efforts that autonomous communities have made to meet budgetary goals.

- The central government approved the economic and financial plans (EFP) of 16 autonomous communities on 17 May. Only Asturias' plan was not approved but this is not yet a cause for concern. Most of the plans show a projected decline in current revenue for 2012 and a strong recovery in 2013. However, despite reducing operating expenditure, most of the autonomous communities expect to report a negative operating balance in 2012. Many austerity measures have been introduced but to date only limited structural reforms have been implemented that address the sustainability of basic services funded by autonomous communities (notably healthcare and education).

- Regions still face significant financing pressure in 2012 as a large proportion of debt falls due in the second half of the year. Fitch understands that central government is actively seeking ways of easing liquidity for the regions and also looking at setting up instruments to facilitate long-term funding at more affordable rates.

The downgrade of the Autonomous Community of Madrid is in part due to the significant increase in debt incurred in the 2010-12 period, which Fitch considers very unlikely to be reduced, as well as the negative economic environment in Spain.

Fitch notes that the intrinsic rating of the weakest regions could be lower than their actual rating but the control and monitoring measures introduced by the central government and the fact that debt servicing is a priority expenditure item help to support at least an investment grade rating. The central government has indicated that some mechanisms to support liquidity and more particularly to allow regions to pay their debt coming due in 2012 will soon be designed. Nevertheless, Fitch will continue to monitor the ability and continued willingness of central government to support and control regional finances. Any weakening of this support would result in further negative rating actions. The more severe downgrades of the regions of Andalusia, Murcia and the Canary Islands reflect their large refinancing pressures in 2012 and their weaker than national average economic environment, which Fitch believes will delay their financial recovery.

The Negative Outlooks reflect the general market environment in Spain and the still weak economic and fiscal context for the autonomous communities, which heightens the execution risk of implementing the austerity measures. Non-compliance with the EFP, as well as increasing liquidity pressure could lead to further negative rating action.

The central government has presented its 2012 budget, and the reduction in funding for the autonomous communities means that current revenues were revised downwards, equal to an average 1.3% decline compared with 2011. Despite reductions in operating expenditure, most of the autonomous communities expect to report negative operating balances in 2012, which would represent about 6.2% of their combined operating revenues. Fitch believes that negative operating balances may persist over the medium term. The agency takes some comfort from the recent legislation which makes debt servicing a priority spending over commercial obligations.

The individual regional deficit as a proportion of GDP for 2011 was larger than planned. The compliance with the 2012 deficit target of 1.5% is still challenging. However, it may still be possible to reach it, thanks to a reduction in capital investment rather than as a result of successfully implementing structural reforms. It will also depend on the willingness of central government to implement the BSL.

The rating actions are as follows:

Autonomous Community of Andalusia

Long-term foreign and local currency ratings downgraded to 'BBB' from 'A'; off RWN; Negative Outlook

Short-term rating downgraded to 'F3' from 'F1' ; off RWN

and....

http://www.telegraph.co.uk/finance/debt-crisis-live/9301285/Debt-crisis-live.html

11.28 Bruno Waterfield (who's in Dublin today covering the referendum) said earlier this morning that the Yes camp will start to get jittery if turnout drops below 50pc. Well, poor weather seems to be keeping voters indoors...

09.45 Spain has said it intends to rescue troubled lender Bankia with a €23.5bn package. What it hasn't said is where it hopes to find the money. Now the EC says it needs to reveal the plan, and that a domestic solution would be preferable to one that involves the rest of Europe. Spokesman Amadeu Altafaj said:

09.26 Bruno Waterfield is in Dublin today to cover the referendum. He brings us this update:

Voting has opened across Ireland in what will be the only popular vote on the fiskal pact. The Yes campaign is confident but needs a good turnout from the 3.1m voters to put wind in the sails of their vote.

Voting has opened across Ireland in what will be the only popular vote on the fiskal pact. The Yes campaign is confident but needs a good turnout from the 3.1m voters to put wind in the sails of their vote.

Polling stations opened at 7am and will close at 10pm. Voting started slowly here in central Dublin, it's raining, grey and chilly after a week of sunshine. It's low turnout weather - so far anyway - and the Yes camp will start to get jittery if participation drops to below 50pc.

When the Irish rejected the Nice Treaty in June 2001, just 35pc of voters turned out. It was passed after a rerun referendum in October 2002 with a bigger turnout of 50pc. The pattern was repeated in 2008 when Lisbon Treaty was also rejected, on a turnout of 53pc of eligible voters.

Again there was another rerun referendum and a Yes with 59pc turnout. I spoke to a senior Yes campaigner this morning who was worried. "The hard core of No voters will turn out whatever the weather, some of them are frankly nutters. Yes voters might be put off by the rain because that's what normal people are like," said the senior official.

09.01 The markets are up this morning, despite tension over the situation in Spain. Simon Denham, chief executive of Capital Spreads, explains (and the chart below also puts today's rise into context):

Clients were buying yesterday as the markets sold off, trying to find the bottom in the hope of a bounce and so far we’re seeing that boldness pay off to some extent. Market sentiment towards the eurozone is getting worse as indicated by the rising yields in the Spanish and Italian bonds. The threat of contagion is in the limelight with many wondering if the genie is not out of the bottle again.

08.23 Morrisons chief Dalton Philips says consumers are finding the downturn so hard that they're having to use savings to pay monthly bills, skip meals and hide treats from their children.

07.35 10-year German Bund yield remained around lows of 1.27pc on Thursday, as rapidly rising Spanish borrowing costs intensified expectations that Madrid may need outside help to save its banks and stave off contagion from the Greek crisis.

While the European Commission may be ready to offer Spain an extra year to reduce its budget deficit and direct aid to recapitalise its weak banks from the EU rescue fund, it can do nothing without the agreement of Germany. One trader said:

07.28 Retail sales in Germany rose for the second month in a row in April, beating analysts' expectations. Sales were up 0.6pc in April compared with March, according to provisional figures by the federal statistics office Destatis. On a 12-month basis, however, retail sales slumped by 3.8pc in April, the statisticians calculated.

Also, Volkswagen, Europe's largest carmaker, said it struck a pay deal with Germany's engineering union IG Metall for the bulk of its German workers, without disclosing the outcome.

07.22 British house prices rose slightly more than expected this month to leave prices broadly unchanged on a year ago against a backdrop of generally subdued demand, according to mortgage lender Nationwide.

However, a new report out by Fathom Consulting warns that London house prices could tumble 50pc if the euro breaks up. The report says foreign money seeking a refuge from the economic turmoil in the eurozone accounted for 60pc of acquisitions of prime central London property between 2007 and 2011.

It believes that while a euro collapse would initially boost luxury house prices in the short term, once the break-up had taken place, demand for these assets as an insurance against this event would start to ebb.

07.20 Europe's escalating debt crisis continued to weigh on global stock markets, with pressure growing on Spain and Italy as borrowing costs in the two countries soar.

Shares in Asia fell with Japan's Nikkei 225 sliding 1.35pc, Hong Kong's Hang Seng dropping 0.7pc, South Korea's Kospi down 0.7pc and Australia's S&P/ASX 200 shedding 0.6pc.

07.10 Meanwhile, the Brussels machine continues to whirr. Louise Armitstead describes how the European Commission has put itself on a collision course with Berlin by calling for a eurozone "bank union", including collective bail-outs, and a relaxation of the Fiscal Pact rules:

Unveiling detailed "report cards" on Europe's crisis-fighting efforts, the Commission also said that the European Stability Mechanism bail-out fund should lend directly to stricken banks. "Direct recapitalisation by the ESM might be envisaged," the report said.

Unveiling detailed "report cards" on Europe's crisis-fighting efforts, the Commission also said that the European Stability Mechanism bail-out fund should lend directly to stricken banks. "Direct recapitalisation by the ESM might be envisaged," the report said.

The recommendations, which will be discussed by leaders in June, advocate a radical shift in policy to address fears that Spain and other sinner states will be engulfed by their banks' debts.

Jose Manuel Barroso, president of the EC, said: "The Commission will advocate an ambitious approach. The building blocks could include a banking union with integrated financial supervision and a single deposit guarantee scheme. And our ideas on euro bonds are already on the table."

He added: "We have to establish a road map with a calendar ... early confirmation of steps to be taken will underscore the irreversibility and solidility of Europe."

07.00 The red lights are flashing over Spain. Yesterday, Felipe Gonzalez, the country's former premier, said Spain was "in a situation of total emergency

, the worst crisis we have ever lived through”.

and....

http://www.guardian.co.uk/business/2012/may/31/eurozone-crisis-ireland-referendum

Spain is having a relatively calm day, with bond yields falling back from danger levels. The Spanish 10-year bond yield has dropped back to 6.47%, reversing yesterday's alarming rise as concern over its banks escalated.

Good. But there is also worrying news from the Bank of Spain about the amount of capital leaving the country.

Giles Tremlett reports from Madrid:

People and companies have been taking their money out of Spain at an unprecedented rate. Some €66.2bn left the country in March, according to figures published today by the Bank of Spain.That is the largest monthly amount since the statistical series started in 1990, according to El País, and raised the spectre of capital flight as people worry about the country staying with the euro.It was more than twice the previous month and means some €193bn have left Spain over the past nine months.

Spanish banks lost two percent of their deposits in the same month. That is by no means a run, but it is also one of the largest figures for the past 15 years.El Pais has a great graph showing monthly capital levels here.

Irish public broadcaster RTE has tweeted that by 9.30am there was only a 3.8% turn out of voters in Dublin South while the turn out in neighbouring Dun Laoghaire was a mere 3%.

Henry McDonald explains:

It's very early days of course but it is worth nothing these two constituencies south of the river Liffey have produced some of the largest pro European votes in all the referenda on the EU preceding today's one.

An update from Brussels – Mario Monti is telling the Germans that they need to think again on the euro.

Ian Traynor reports:

Also addressing a Brussels audience this morning, the Italian prime minister positioned himself halfway between Chancellor Angela Merkel (Frau Austerity) and President François Hollande (Monsieur Growth).He supported the Germans in resisting French calls for the European Central Bank to expand its mandate to promote growth in the eurozone, but backed the French campaign pressing Berlin for greater growth-oriented flexibility. The popular backlash in Greece and elsewhere against austerity meant that the German government had to "reflect quickly and deeply" over how to respond.

The comments come after the other Mario, Sig. Draghi, added his weightto calls for closer banking union across Europe.As flagged up earlier (see 8.57am), public anger over Ireland's debt ridden and generally loathed banks is one factor in today's referendum.The news in the last 24 hours that the Irish banking sector needs another €4bn cash injection could influence voters, one way or the other. (details here)From Dublin, Henry McDonald reports:Where the money will come from is anybody's guess. Some suspect the billions could come from a second international bail out, others fear the state may have to raise the cash elsewhere to keep the Irish banking system functioning.Either way the prospect of Irish High Street banks getting more largesse from the taxpayer, whether they be Irish, German or whoever, will enrage most people in the state. The question is: willl this focus minds further on the necessity to stay in the eurozone because of the need for a potential second loan from Ireland's EU partners and thus boost the Yes camp or will it only compound the growing resentment against the entire financial system and provide more late ammunition for the No side?

A new opinion poll was published in Greece today, putting New Democracy ahead of Syriza in the run-up to the June 17 parliamentary election.Mario Draghi has made an important intervention on the eurozone crisis this morning, telling the European Parliament that national governments must show proper leadership now to stem the crisis.The head of the European Central Bank told the Parliament's economic affairs committee that there was no time to waste in fixing Spain and moving more radically towards a proper eurozone fiscal union.As Ian Traynor explains from Brussels, after yesterday's rather impotent calls from the European Commission, Draghi is a formidable voice:Draghi added his views to the growing clamour for a eurozone banking union, with common guarantees for depositors.Europe's political leaders need to show "vision", he said, and can't expect the ECB to act as a surrogate eurozone government. A eurozone banking union would need to be supervised centrally, include eurozone guarantees for depositors and a resolution fund, he said.The requirement was "further centralization of banking supervision." Draghi bluntly showered scorn on the "worst possible" attempts of national authorities to deal with imploding banks, notably in Spain and Belgium."What Dexia shows and Bankia shows as well is that whenever we are confronted with the dramatic need to recapitalize, if you look back, the reaction of the national supervisors... is to underestimate the problem, then come out with a first assessment, a second, a third, fourth...That is the worst possible way of doing things, because everybody ends up doing the right thing but at the highest possible cost and price."As Ian puts it, Draghi appears to be "cautiously enlisting in the cause of a eurozone banking union", which would open up a new front in the euro wars. He explains:Top people in Brussels predict a looming and bruising battle between Frankfurt and Berlin which will centre around the uses and abuses of the European Stability Mechanism, the eurozone €500bn permanent bailout fund which is to be up and running in July.One of the biggest and most protracted conflicts over Greece in the past couple of years was between Angela Merkel and Jean-Claude Trichet, Draghi's French predecessor, revolving around the terms of the second Greek bailout, specifically on German demands that it include haircuts for Greece's private creditors. Merkel won, but now concedes she was wrong and that this chastening experience won't be repeated.Trichet consistently argued that Berlin's "moral hazard" argument on private lenders taking a hit and sharing the losses was misplaced and would prove disastrous, setting a precedent and deterring investors across the eurozone. He lost on Greece, but may feel vindicated by events.Draghi's remarks this morning presumably mean that the ESM firewall would need to be deployed for a banking union, perhaps for the direct recapitalisation of Spanish banks. This is not possible under the treaty setting up the ESM. The money can only go to governments which can then funnel it to the banks. For that to happen, though, a government has to request a bailout with all that that implies - humiliation, very tight strings attached.

That has been the German precondition so far. The outcome of this gathering dispute will show whether Berlin is undertaking a serious shift in its approach to the euro crisis.

New Greek retail sales have just been released, and they're dire.

Retail sales in March were 16.2% lower than a year ago on a volume basis, accelerating the decline in consumer spending (February's data showed a 12.9% tumble).

The bad data is hardly a surprise - and simply reinforces the point that the Greek economy, now in its 5th year of recession, is spiralling downwards.This graph by Reuters' Scott Barber shows how Greek retail sales and consumer confidence began to slide as soon as the financial crisis began, and have worsened again in recent months.Just in - inflation across the eurozone has fallen to an annual rate to 2.4% in May, from 2.6% in April. Economists had expected a smaller fall, to 2.5%.This easing in the rising cost of living may give the European Central Bank more leeway on monetary policy, perhaps to lower interest rates again soon (the ECB's governing council meets next week)In the bond markets, the yields* on French and Austrian 10-year bonds have both fallen to their lowest level since the euro was created.In the latest sign that investors are stashing their funds in safe European debt, the price of debt issued by France and Austra rallied this morning. This pushed the yield on France's 10-year bond down to just 2.379%, and the Austrian equivalent to 2.13%.

and in greek news , insurers cut export coverage and not just Euler Hermes.....

Greece risks trade constraints as insurers cut export coverage

|

Euler Hermes SA (ELE), the world’s biggest credit insurer, said it will no longer cover new shipments of goods to Greece because of the risks of the nation leaving the euro currency and customers defaulting on payments.

The insurer, a unit of Allianz SE (ALV), took the decision because exporting to Greece has become “significantly more risky,” Paris-based Euler Hermes said in an e-mailed statement on Wednesday. The insurer is still working under the assumption Greece will remain in the eurozone, it said.

“We will still cover those shipments under way and internal commercial transactions,” spokeswoman Bettina Sattler said by telephone on Thursday. Future shipments to the country won’t be covered, she said.

The lack of export insurance, which pays companies if a client defaults, raises the prospect that certain goods will no longer reach Greek companies and stores. Austria’s OeKB Versicherung AG said on May 29 it will also drop coverage of new shipments to Greece and Coface SA of France said it’s only doing business with “the healthiest Greek companies.”

Greeks vote again June 17 after elections on May 6 failed to produce a workable majority in parliament, as parties opposed to sticking to Greece’s part of an aid agreement with the European Union won most of the votes. Euler Hermes said on May 26 it was reviewing its coverage of exports to Greece because of the risk of the country exiting the euro.

Atradius NV, the trade-credit insurer owned by Grupo Catalana Occidente SA, and Sace SpA, Italy’s trade-credit insurer, said earlier this week they continue to cover reasonable risks on new supplies to Greece, while closely monitoring developments in the country.

Euler Hermes had gross premiums last year of 2.28 billion euros, up 5.9 percent from the year earlier.

and also consider....

| |||

|

and the EU continue to ignore Germany and Buba regarding eurobonds

http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_31/05/2012_444679

Juncker says euro bonds still an option for growth

"The solution of euro bonds to relaunch growth in Europe is still on the stable,» Juncker told a news conference with French Finance Minister Pierre Moscovici. While eurozone paymaster Germany is strongly opposed to mutualising sovereign debt in the 17-nation block without substantial progress on economic and political integration, France's new Socialist government has argued that joint bonds should come first. [Reuters] |

Greek bank losses swell.....

| Three banks post losses | ||||||||||||||||

| ||||||||||||||||

The country's biggest lender National Bank (NBG) made a heavy loss in the first quarter and rival Piraeus Bank also lost money as the recession sapped clients' ability to pay back loans and hit new business, the banks said on Wednesday.

National Bank said it lost 537m euros as provisions for non-performing loans surged by 47 percent year-on-year to 539m euros.

Piraeus Bank, the country's fourth largest lender, said it lost 80m euros before tax. But using an outstanding deferred tax asset related to a bond swap allowed it to post a profit of 298m euros.

Provisions for non-performing loans at Piraeus were also steeply higher – up by 78 percent compared to the same period a year earlier.

Another lender, Geniki Bank, which is majority-owned by France's Societe Generale, reported a smaller first quarter loss compared to a year earlier as it booked lower provisions for bad debt.

The bank, taken over by SocGen in 2004, lost 66.3m euros in the first three months of the year versus a loss of 98.6m euros in the first quarter of 2011.

The recession has continued to take a toll on its loan book, but the bank's provisions for non-performing loans declined by 54 percent year-on-year to 45.6m euros.

"The market remains focused on the sector's recapitalisation which will help renew direct access to ECB funding. First-quarter results take the back seat," said Takis Zamanis, head of research at Athens-based Beta Securities.

Both banks were recapitalised earlier this week by a state bank support fund - the Hellenic Financial Stability Fund (HFSF) - as huge losses from a mammoth sovereign bond swap to cut the state debt depleted their capital base.

"The capital injection secures us uninterrupted access to Eurosystem liquidity, it allows us to disengage from liquidity drawn on the Bank of Greece's emergency liquidity assistance facility," National Bank's CEO Apostolos Tamvakakis said in a statement.

On Tuesday, the HFSF fund injected 18bn euros into the country's four largest banks to restore their capital adequacy and enable them to borrow from the European Central Bank at a lower cost than from the Bank of Greece, the country's central bank.

The HFSF fund advanced 7.4bn euros to NBG and 4.7 billion euros to Piraeus in the form of European rescue mechanism bonds the banks can repo at the ECB.

"We strengthened the banks' capital adequacy to 8 percent which gives them access to ECB funding," the fund's president Panayotis Thomopoulos told reporters on Wednesday. "Depositors should not worry."

On a more positive note, NBG said its operations in Turkey and other Balkan countries contributed 450m euros to core earnings, a rise of 7 percent year-on-year.

Deposit flight

With unemployed at record levels and the economy in a fifth straight year of recession, people are struggling to meet their debt repayments, forcing banks to set aside more money to cover potential losses.

At the same time, banks are having to eat into their own profit margins by paying depositors higher interest rates to discourage them from withdrawing their funds, a tactic that squeezes the net interest income they earn.

The banking sector has been haemorrhaging deposits since the debt crisis erupted in late 2009 when worried depositors began sending money abroad or tapped savings in order to get by, burning up their cash reserves without any near-term hope of replenishing them.

Between December 2009 and March 2012, the banking sector's deposit base collapsed by 72bn euros to 165bn, based on central bank statistics, forcing banks to turn to the lenders of last resort to plug their funding gaps.

Both banks lost deposits in the first quarter. Piraeus said its deposit base shrank by 24 percent year-on-year to 20.9 billion euros. At NBG, deposits fell by 2.3 billion euros, with its loans-to-deposits ratio at 111 percent.

Banks pledged various collateral to borrow a total of 127bn euros from the ECB as well as from the Bank of Greece's emergency liquidity assistance facility up to January this year, a sum that translates to about 77 percent of their total deposits.

With the 215bn euro economy contracting at a 6.2 per cent annual pace in the first quarter as austerity measures to cut debt squeeze disposable incomes, asset quality is deteriorating.

Piraeus Bank said loans in arrears of more than 90 days reached 16 percent of its loan book at the end of the first quarter, up from 13.5 percent in December 2011. It blamed the deep recession and political uncertainty for the rise.

At NBG, the ratio of non-performing loans in Greece rose to 15.5 percent from 13 percent in December. (Reuters)

and news at 10am from Greece......

| ||||||||||||||||

No comments:

Post a Comment