http://ftalphaville.ft.com/blog/2012/04/24/973191/sec-charges-egan-jones/

http://www.zerohedge.com/news/sec-emerges-carbonite-deep-freeze-sues-sec

and....

http://www.ritholtz.com/blog/2012/04/moodys-sp-remain-at-large/

>

Ratings Let Loose Subprime Scourge

SEC charges Egan-Jones

Washington, D.C., April 24, 2012 — The Securities and Exchange Commission today announced charges against Egan-Jones Ratings Company (EJR) and its owner and president Sean Egan for material misrepresentations and omissions in the company’s July 2008 application to register as a Nationally Recognized Statistical Rating Organization (NRSRO) for issuers of asset-backed securities (ABS) and government securities. EJR and Egan also are charged with material misrepresentations in other submissions furnished to the SEC and violations of record-keeping and conflict-of-interest provisions governing NRSROs.

Full SEC Order here. The regulator has alleged that Egan-Jones made a material misrepresentation in claiming to have rated government debt and ABS — and that it hadn’t — when making its NRSRO application, and that conflicts of interest were present:

and.....In addition, EJR falsely stated in submissions to the Commission that it was unaware whether its subscribers held long or short positions in particular securities. In fact, EJR’s salespeople were aware of certain clients’ holdings, and in some instances knew whether clients had long or short positions. In at least three instances, information about whether a client had a long or short position was conveyed to Egan, EJR’s primary analyst.Egan-Jones has often presented itself as a rating agency independent of issuers.Here is its earlier release on the SEC’s action. It said that “the SEC’s claims relate to a four year old application process. EJR intends to vigorouslydefend itself in this proceeding.”

http://www.zerohedge.com/news/sec-emerges-carbonite-deep-freeze-sues-sec

SEC Emerges From Carbonite Deep Freeze, Sues Egan-Jones

Submitted by Tyler Durden on 04/24/2012 14:46 -0400

Just in case one is wondering what is a greater crime in America: vaporizing $1.5 billion in client money or having the temerity to downgrade the US (twice), JP Morgan and Morgan Stanley, here is the SEC with the answer:

- SEC SUES EGAN-JONES, SEAN EGAN ON ALLEGED MISREPRESENTATIONS

Somewhere Jon Corzine is cackling like a mad cow.

More on Egan-Jones' inhuman crime (andPDF)

Egan-Jones Ratings Co. and Sean Egan Charged with Making Material Misrepresentations to SEC

Washington, D.C., April 24, 2012 — The Securities and Exchange Commission today announced charges against Egan-Jones Ratings Company (EJR) and its owner and president Sean Egan for material misrepresentations and omissions in the company’s July 2008 application to register as a Nationally Recognized Statistical Rating Organization (NRSRO) for issuers of asset-backed securities (ABS) and government securities. EJR and Egan also are charged with material misrepresentations in other submissions furnished to the SEC and violations of record-keeping and conflict-of-interest provisions governing NRSROs.

The Commission issued an order instituting proceedings in which the SEC’s Division of Enforcement alleges that EJR — a credit rating agency based in Haverford, Pa. — submitted an application to register as an NRSRO for issuers of asset-backed and government securities in July 2008. EJR had previously registered with the SEC in 2007 as an NRSRO for financial institutions, insurance companies, and corporate issuers.

The SEC’s Division of Enforcement alleges that in its 2008 application, EJR falsely stated that as of the date of the application it had 150 outstanding ABS issuer ratings and 50 outstanding government issuer ratings. EJR further falsely stated in its 2008 application that it had been issuing credit ratings in the ABS and government categories as a credit rating agency on a continuous basis since 1995. In fact, at the time of its July 2008 application, EJR had not issued — that is, made available on the Internet or through another readily accessible means — any ABS or government issuer ratings, and therefore did not meet the requirements for registration as an NRSRO in these categories. EJR continued to make material misrepresentations regarding its experience rating asset-backed and government securities in subsequent annual certifications furnished to the SEC.

The SEC’s Division of Enforcement also alleges that EJR made other misstatements and omissions in submissions to the SEC by providing inaccurate certifications from clients, failing to disclose that two employees had signed a code of ethics different than the one EJR disclosed, and inaccurately stating that EJR did not know if subscribers were long or short a particular security.

The SEC’s Division of Enforcement further alleges that EJR violated other provisions of Commission rules governing NRSROs. EJR failed to enforce its policies to address conflicts of interest arising from employee ownership of securities, and allowed two analysts to participate in determining credit ratings for issuers whose securities they owned. EJR also failed to make and retain certain required records, including a detailed record of its procedures and methodologies to determine credit ratings and e-mails regarding its determination of credit ratings.

The SEC’s Division of Enforcement alleges that Egan provided inaccurate information that was included in EJR’s applications and annual certifications. He signed the submissions and certified that the information provided in them was “accurate in all significant respects,” when he knew that it was not. Egan also failed to ensure EJR’s compliance with the recordkeeping requirements and conflict-of-interest provisions.

The SEC’s Division of Enforcement alleges that, by the conduct described above, EJR willfully violated Exchange Act Sections 15E(a)(1), 15E(b)(2), 15E(h)(1) and 17(a), and Rules 17g-1(a), 17g-1(b), 17g-1(f), 17g-1(a)(2), 17g-2(a)(6), 17g-2(b)(2), 17g-2(b)(7), and 17g-5(c)(2). The Division of Enforcement further alleges that by the conduct described above, Egan willfully made, or caused EJR to make, material misstatements in its Form NRSRO, and caused or willfully aided, abetted, counseled, commanded, induced or procured EJR’s violations of Sections 15E and 17(a) of the Exchange Act and Rules 17g-1, 17g-2, and 17g-5.

The SEC’s investigation was conducted by Stacy Bogert, Pamela Nolan, Alec Koch, and Yuri Zelinsky. The SEC’s litigation will be led by James Kidney.

and....

http://www.ritholtz.com/blog/2012/04/moodys-sp-remain-at-large/

SEC Pursues Egan Jones; Moody’s, S&P Remain At Large

I have to admit to being stymied by this:

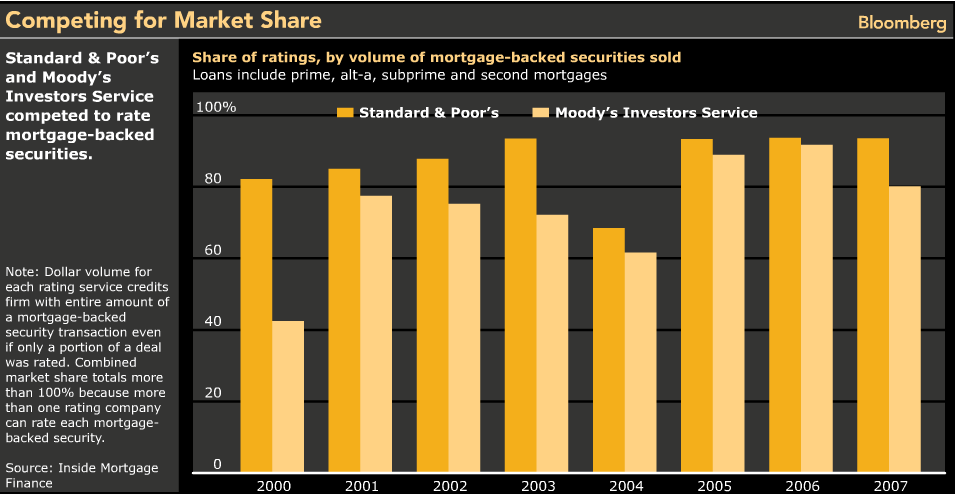

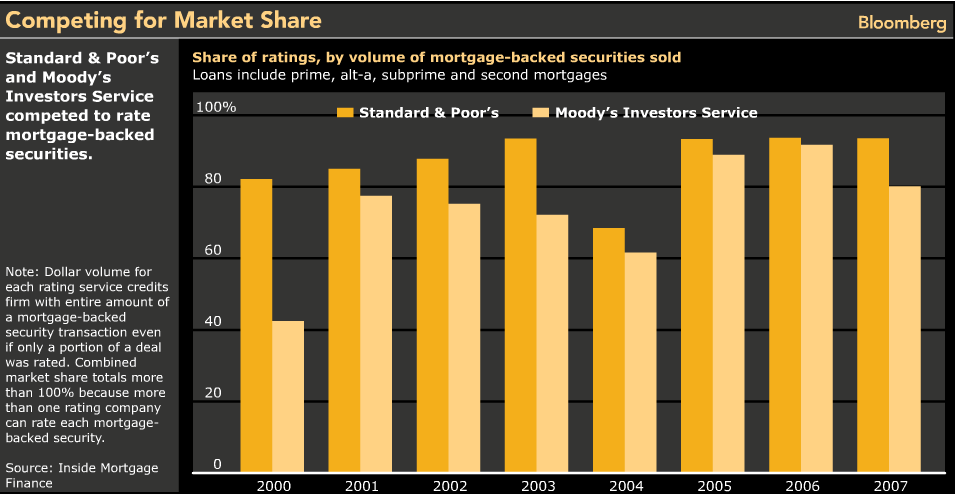

At the same time, we have a broad set of systemic errors made by the two much larger competitors, Moody’sand Standard & Poors. These two firms, by design, gave triple AAA ratings to piles of junk paper. They did so because that was what they were paid to do by the underwriters.

These were not good faith errors. They were instead a reflection of a wholly corrupted industry, designed to mislead investors and legitimize junk paper. Consider what Nobel prize winning economist Joseph Stiglitz observed:

Somehow, these two whales of corruption get a pass. I don’t get it . . .“The Securities and Exchange Commission voted Thursday in favor of bringing an administrative action against Egan-Jones, the firm said. In what would be an unprecedented move, the SEC could seek to punish the firm by stripping it of its ability to issue officially recognized ratings on securities tied to government debt and asset-backed deals. An SEC spokesman declined to comment.Here we have an allegation of a specific error, made in good faith by Egan Jones, over the course of doing business.

The move stems from alleged “material misstatements” Egan-Jones made when it applied to regulators in 2008 to rate bonds issued by countries, U.S. states and local governments, and asset-backed securities, according to documents reviewed by The Wall Street Journal and people familiar with the matter.” (WSJ)

At the same time, we have a broad set of systemic errors made by the two much larger competitors, Moody’sand Standard & Poors. These two firms, by design, gave triple AAA ratings to piles of junk paper. They did so because that was what they were paid to do by the underwriters.

These were not good faith errors. They were instead a reflection of a wholly corrupted industry, designed to mislead investors and legitimize junk paper. Consider what Nobel prize winning economist Joseph Stiglitz observed:

“I view the ratings agencies as one of the key culprits. They were the party that performed that alchemy that converted the securities from F-rated to A-rated. The banks could not have done what they did without the complicity of the ratings agencies.” (Bloomberg)

>

Ratings Let Loose Subprime Scourge

No comments:

Post a Comment