Markets.....

Estimated consensus (non-GAAP) S&P500 EPS growth for Q3 and is 0.8% and 7.3% Y/Y.

WTI futs settle up 66c (+1.4%) at $48.99 per barrel

Brent futs settle 64c higher (+1.3%) @ $50.35 per barrel

Baker Hughes US Rig Count 1-Jul: 431 (prev 421)

EXCLUSIVE: Millennium Hedge Fund Hires @Mercuria’s Top #Gas Trader Sutterby http://bloom.bg/298QyUU via @iamandyhoffman #commodities #oil

American Gasoline Demand Isn’t as Strong as Previously Thought http://bloom.bg/29733Aq via @laurablewitt

Weidmann: Much Will Depend On A Quick And Reasonable Negotiation Regarding UK/EU Relations

Bundesbank’s Weidmann: MonPol Already Very Accommodative, Doubtful Further Action Would Have Any Stimulatory Effect

Weidmann: The ECB And Other Important Central Banks Have Pledged More Liquidity If Needed

So the market is rallying on ECB easing which isn't happening in response to a Brexit which hasn't actually happened

NY Fed Q2 GDP Forecast At 2.1%, Q3 At 2.2% (Previously ‘Slightly Above 2%’) https://www.newyorkfed.org/research/policy/nowcast …

Fed’s Fischer: Preparing For July FOMC, Watching Markets Closely

-Will Have Better View Of Conditions By July - CNBC

Fed's Fischer: No Plans To Move Into Negative Territory - CNBC

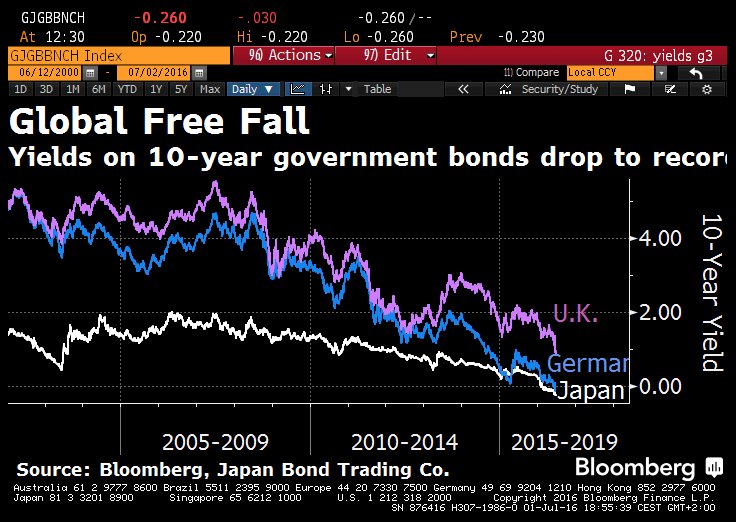

Global bond madness: Government bond yields fall to fresh record lows led by UK Gilts. http://on.ft.com/2957iuN

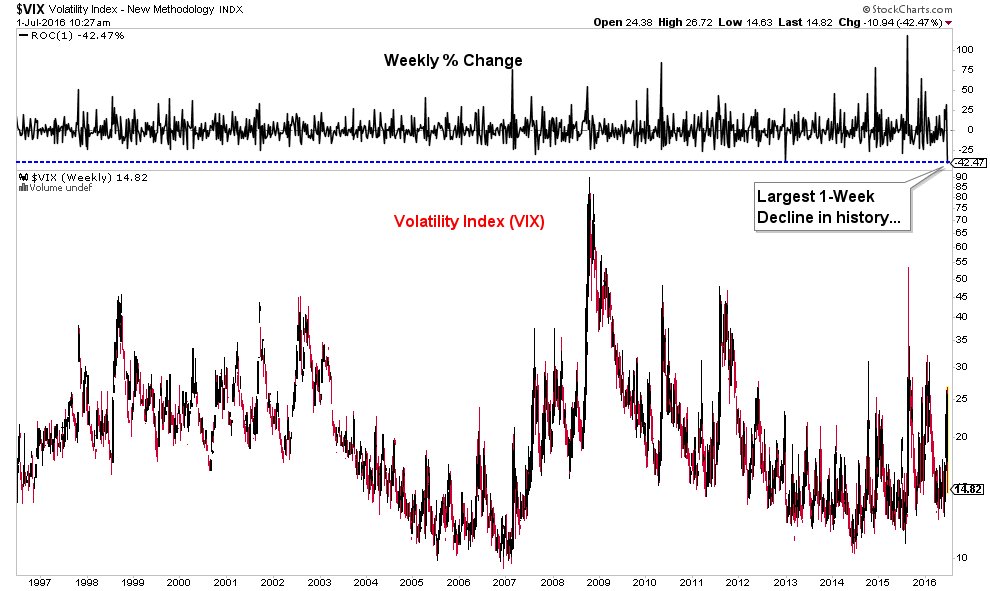

The Volatility Index is down 42.5% this week, on pace for the largest weekly decline in ... history. $VIX

fred walton @fredwalton216 8hr

Expect more panic buying episodes....

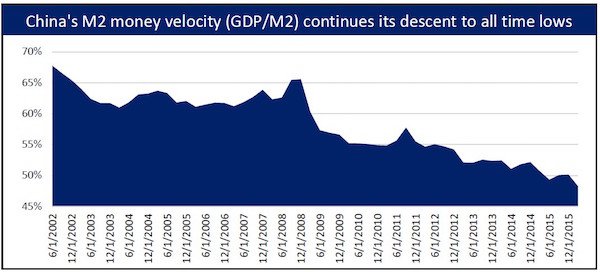

China , Japan & Europe "Post Brexit " - in focus...

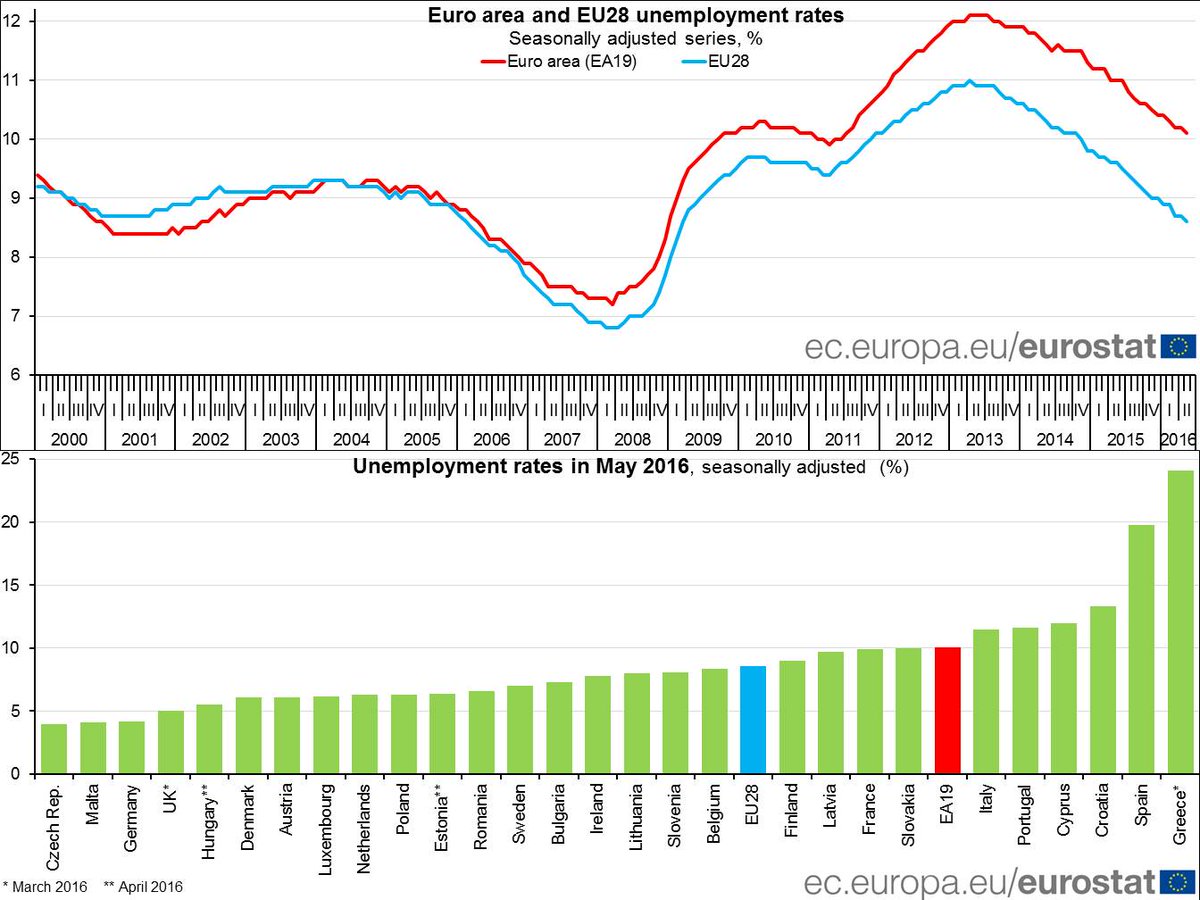

May 2016: euro area unemployment rate 10.1% (Apr 10.2%), EU 8.6% (Apr 8.7%) #Eurostat http://ec.europa.eu/eurostat/documents/2995521/7545626/3-01072016-AP-EN.pdf/ …

#CHINA JUN CAIXIN PMI MANUFACTURING: 48.6 V 49.2E (16th straight contraction; 4-month low) - http://bit.ly/297f10n

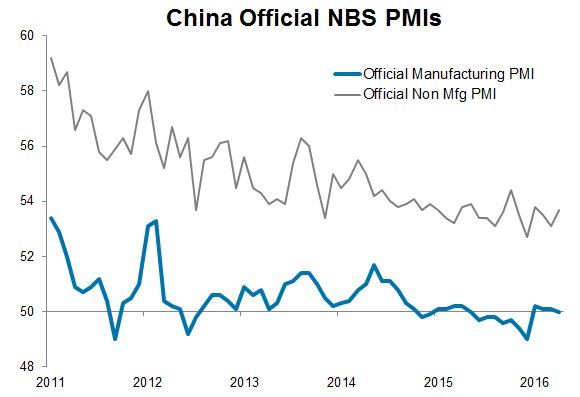

#China June NBS PMIs

-Manufacturing 50.0 (50.1)

-Non-manufacturing 53.7 (53.1)

JPN pension fund GPIF poised for $50 bln FY loss, biggest since 2008. Official results delayed until after elections

Brexit Aftermath & UK Politics ....

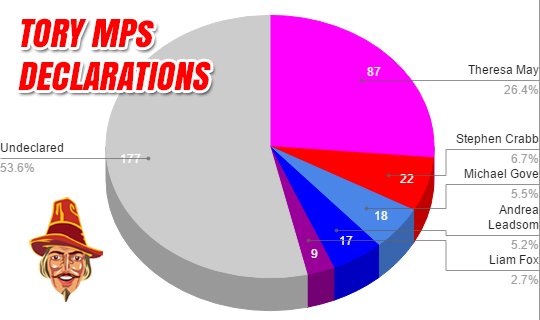

#ToryLeadership Latest Numbers:

Let's see if the referendum petition gets 50,000 signatures...

Noting any referendum , if one occurs , might not be supported by voters...

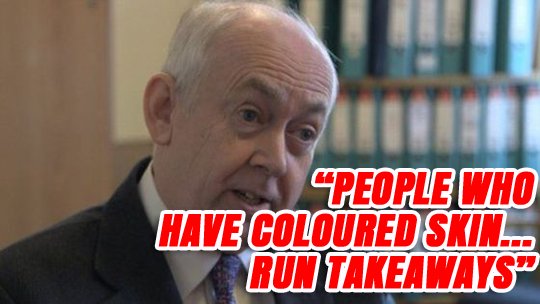

Labour's Anti-Semitism Inquiry condemned "incendiary" Hitler mentions. Meanwhile...

http://order-order.com/?p=239902

AUDIO Labour MP: "The Only People Who Have Coloured Skin Are People Who Run Takeaways" http://order-order.com/2016/07/01/labour-mp-people-coloured-skin-people-run-takeaways/ …

Conservative Leadership Race: Party MP backers

May: 77

Crabb: 21

Gove: 18

Leadsom: 17

Fox: 9

Undeclared: 188

Arron Banks Keen to Bankroll Leadsom Campaign: http://order-order.com/2016/07/01/arron-banks-offering-bankroll-leadsom-campaign/ …

Gove: I will honour pledges made during referendum campaign, I will end free movement, I will use budget contribution on NHS

BOE easing:

- At least 1 rate cut during summer

- Easing banks capital requirements

- Restarting QE probably the next shoe to drop

they will use all levers to help growth. not bearish GBP with US rates catching a safe haven bid gbp may bottom here

Now both monetary and fiscal easing as expected

The FTSE 100 is 6.3% higher on the week, on course for its best performance since 2011: A Brecovery

Tory leader election is basically:

"Soft Brexit landing by staying in single market" versus

"Hard Brexit landing by leaving single market"

Once referendum ball gets in motion , might be hard for politicians to control how voters react..

Italy.....

Regarding possibly using pension funds to bailout -need we ask , what could go wrong ?

Keep your eyes on wobbling Italy...

Italy forced to rescue Vento Banca...keep your eyes on the Italian Banks..

Winds of change blowing for Italy too ?

First intervention by a EU or EZ Gov't into its banking system since the U.K. vote to leave the EU.

France.....

#France Christine #Lagarde should face court over #Tapie affair says proescutor http://dw.com/p/1JHX9

Very difficult to find current news , in english language regarding French labor protests and overall situation.

Odds & Ends.....

Austria takes steps to control migration on Balkan route http://bit.ly/29eFKH6

Greek gov't looking for support of 200/300 MPs for proposed changes to apply immediately, rather than after next general election #Greece

#Greece govt publishes election law draft. No bonus seats for biggest party -> proportional representation. 3% threshold, 17-yr olds to vote

Libya's 'unity government' suffers blow as four ministers resign http://ow.ly/Zp9v301Pjtq

Oddest part of Puerto Rico default: PR is paying weaker Public Building Authority debt & defaulting on GOs #muniland

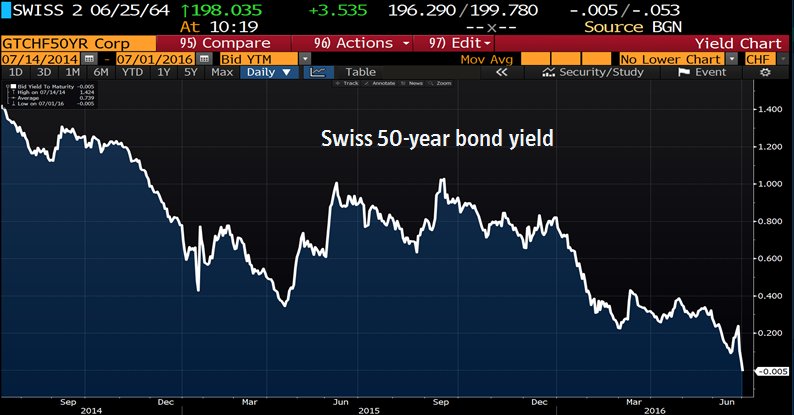

ICYMI! The Swiss 50-year bond #yield is now NEGATIVE!

BRAZILIAN MAY INDUSTRIAL PRODUCTION -7.8% VS YEAR AGO

Europol data show changing trends in migrant smuggling

http://www.ekathimerini.com/210039

#migration

AUSTRIA ELECTION

- May presidential election void

- Vote count irregularities

- Far-right candidate Hofer lost narrowly

- Re-run Sept/Oct

Bitcoin set to come under siege in France ?

Where is Pedro Sánchez? Five days after the elections, the PSOE leader is keeping very quiet indeed. That is being noticed.

Puerto Rico’s default would be the first from a state-level borrower on G.O debt since Arkansas in 1933.

Fico-"We have to focus on mechanisms that function, not on those that don't function," as per relocation mechanisms.

#Correction - 4 GNA cabinet ministers have resigned not 5 as mentioned in my previous tweet - all from Eastern #Libya. #PT

#Libya Three months after arriving, UN-backed government remains in Tripoli naval base. Eastern (Tobruk) govt. not accepting its authority.

No comments:

Post a Comment