Evening Wrap.......

Get the low down this evening ! Some music provided for while you read or scan !

Overview.........

BREAKING: Kerry: Diplomats agree to implement "cessation of hostilities" in Syria, aim to start in a week's time.

#StateSec Kerry says a UN task force co-chaired by Russia & US will be set up to thrash out the modalities of long term ceasefire. #Syria

ASO: WANT TO CONSIDER POLICY COORDINATION LOOKING AT MARKETS AT G20 MEETING IN SHANGHAI; So China's grand devaluation is coming?

After hitting a cycle low of 94 bps, Yield Curve actually steepened today. Want to see more of this on a mkt bounce.

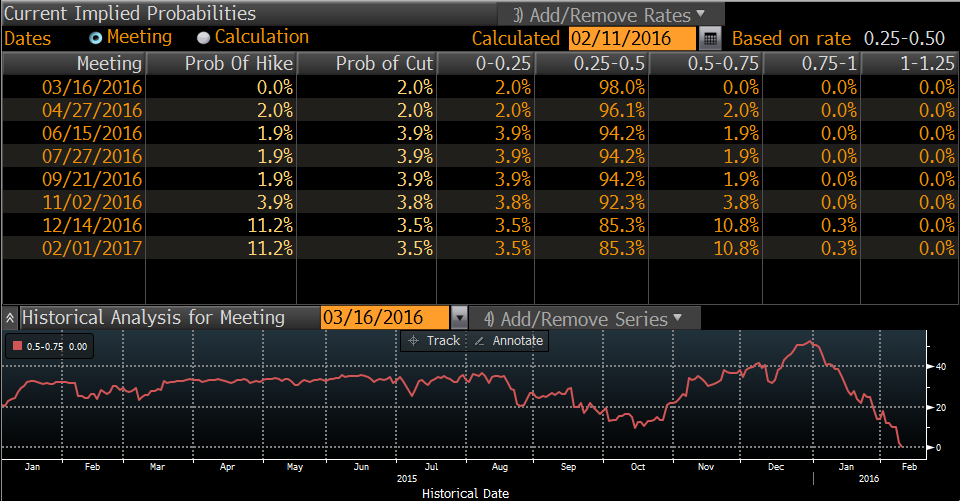

Dec '15: Fed projects 4 hikes in '16.

Market Today: 1) Cut odds > hike odds in Mar-Sep. 2) No hike until mid 2018.

Senate Banking Committee Chair Richard Shelby has doubts about the Fed’s legal authority to impose negative rates http://www.bloomberg.com/news/articles/2016-02-11/shelby-expresses-doubt-fed-has-authority-to-use-negative-rates …

48.8 million shares traded today in the Gold ETF, highest volume on an up day since August 2011. $GLD

Gary Shilling: " Oil prices are headed for the $10 to $20 per barrel range we first forecast in January 2015 when WTI was $62"

Responses from # of traders on UAE energy min report re output cut: pfff..uh, Iran?, meh, already said, back to shorting, yeah right, no way

..and no matter that it's 23:51 in UAE. The Energy Minister always waits for @WSJ at this hour..

WTI CRUDE FALLS TO 12-YEAR LOW AT $26.14/BBL. What's the sublease on Astenbeck's office

OPEC Will Not Blink First http://www.zerohedge.com/news/2016-02-11/opec-will-not-blink-first …

"The cure for low prices is ... low prices."

With Oil down 76% US Crude supply finally coming down...

Lots of WTI puts trading this AM. More than 19,500 lots of March $25 puts...and some sizeable volumes in March $26 and March $21 too

Let's check across Europe......

Greece says will have to spend over 1 bln this year to deal with refugee crisis; NATO on… http://dlvr.it/KTd76t

Pension cuts are coming

#IMF's Thomsen to #Greece: Without pension cuts numbers don't add up http://bit.ly/1Skd0O0 /via @IMFNews

#pensionsreformGR

TAIPED frustrated with AIA board for preventing sell-off from taking off http://dlvr.it/KTcb6t

IMF: First reforms, then debt cut http://dlvr.it/KTcZlM

Measures deal blow to Greek black market http://dlvr.it/KTcbDj

No reconsideration of tough rules for failing Banks.

"it is only the ECB that is holding Europe together. If it steps back you would have a massive sovereign debt crisis"http://www.telegraph.co.uk/finance/economics/12152451/Is-the-sovereign-debt-crisis-coming-back-to-haunt-Europe.html …

#Yatsenyuk #televises Cabinet #meeting for first time amid widespread criticism http://bit.ly/1o77eD4

Further argument here for completing reload of Ukraine's reformer-led government and zero tolerance for corruption

Sweden goes more negative, cutting rates to -0.5%.

US Fed: only developed central bank whose last move was a hike.

France : former PM #Ayrault appointed Foreign Minister, replacing Fabius (Presidency) http://f24.my/YTliveEN

France rejects special treatment for UK banks in EU package http://j.mp/1XkGk6o

Former EU Commission President admits PM's EU deal won't bring down migrant numbers. Dave's disastrous deal unravels http://www.bbc.co.uk/news/uk-politics-35538074?ns_mchannel=social&ns_campaign=daily_politics&ns_source=twitter&ns_linkname=news_central …

Even EU officials surprised by weakness of @David_Cameron's negotiation. What a rotten deal! http://www.telegraph.co.uk/news/worldnews/europe/eu/12149313/David-Cameron-asked-for-too-little-on-Brexit.html …

Oops! Deutsche Bank credit risk passes #Italy's largest lender. http://bloom.bg/1ougcu1

Deutsche Bank Is Back: 5Y Sub CDS Soar To Record High http://www.zerohedge.com/news/2016-02-11/deutsche-bank-back-5-year-cds-soar-record-high …

Eurogroup Chairman Dijsselbloem sends warning to #Portugal: Gov't needs to stand ready, if necessary, to do more to comply with € rules.

Meanwhile EU tells Greece to improve refugee conditions so EU states can send more back,but chides states for not taking more from Greece

Migrant crisis latest - NATO sends warships at Turkish request to curb flow, while Erdogan threatens to, er, send more migrants to EU

Former PSOE Prime Minister Felipe González said in rambling TV interview he thought new elections "probable".

https://www.thespainreport.com/articles/629-160211133844-daily-spain-briefing-february-11-2016 …

Rajoy admits Spain has not met its 2015 deficit target, coming in at 4.5%, instead of 4.2%.

#Portugal - Interest rate on 10-year bonds today rose to 4.5% for the first time since March 2014. http://www.jornaldenegocios.pt/mercados/taxas_de_juro/detalhe/juro_a_dez_anos_ultrapassa_a_fasquia_de_4.html …

Last time Spanish yield spread was above 170 was on May 20, 2014:

http://www.datosmacro.com/prima-riesgo/espana …

No comments:

Post a Comment