Evening Wrap....

#Greece My Big Fat Greek Funeral: SYRIZA, 3. bailout and capital controls http://www.keeptalkinggreece.com/2015/08/03/my-big-fat-greek-funeral-syriza-3-bailout-and-capital-controls/#.Vb_gYd7WU48.twitter …

S&P revises EU outlook from stable to neg on EU's repeated use of its balance sheet to provide higher-risk financing to EU states (Greece).

HFSF participation in #Greece banks tumbles by €2.25 billion today to €5.25 bln as the banking index plummets ~30%. #economy #markets

From incr health contributions for main pensions to 6% (from 4%) & for suppl'ry to 6% (from zero), #Greece aims to raise €854 mln annually.

Morning Tweets.....

China.....

Shanghai Stock Exchange statement: to closely monitor accounts esp for short-time profit-taking operations; will be determined to crack down

With new actions taken by stock exchange today, a total of 38 accounts (incl. US hedge fund Citadel) have been so far restricted for trading

BREAKING: Shanghai Stock Exchange suspend 4 more securities accounts; issue warnings to 5 accounts due to "unusual stock trading activities"

BREAKING: Chinese securities regulator warned investors NOT to use "program-oriented trading" to unstable stock market for own quick profits

BREAKING: China's state agency for margin finance to pour 200 bln RMB or more via new mutual funds into stock market August - official media

MORE: Some investors found to buy a lot of large-caps like Sinopec, PetroChina intraday and sell before market close for profits - regulator

MORE: Some investors try to cause market panic, put market in disorder by making quick profits for their own amid market recovery -regulator

MORE: To stabilize market regulator has ordered stock bourses to so far restrict 34 trading accounts incl one owned by US hedge fund Citadel

MORE: No.1 working priority for CSRC now is to stabilize market and "stabilize people's mind 穩定人心" and put market in order by law -regulator

Note: all above are from CSRC interview with state newspapers (all same comments) for 1st time especially to warn "program-oriented trading"

China Regulator once again speaks out on HFT ....

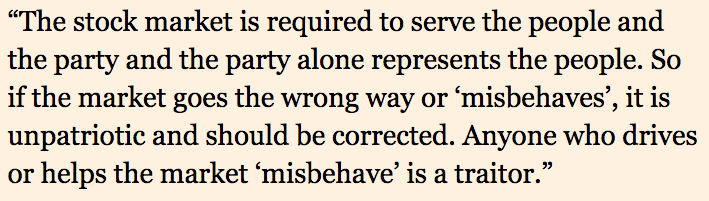

This is a superb quote from the China Securities Regulatory Commission http://www.ft.com/cms/s/0/5142f160-3675-11e5-bdbb-35e55cbae175.html …

Greece.....

2nd #Greece bridge loan looks increasingly likely, €zone may find it useful to force immediate reform b4 cash release http://openeurope.org.uk/blog/a-second-bridge-loan-for-greece-on-the-horizon/ …

Greek manufacturing slumps at record pace as crisis takes toll http://dlvr.it/BkNQBx

Greek business confidence falls 5th straight month to worst level since Oct. 2012

Survey: http://goo.gl/Y30ufp

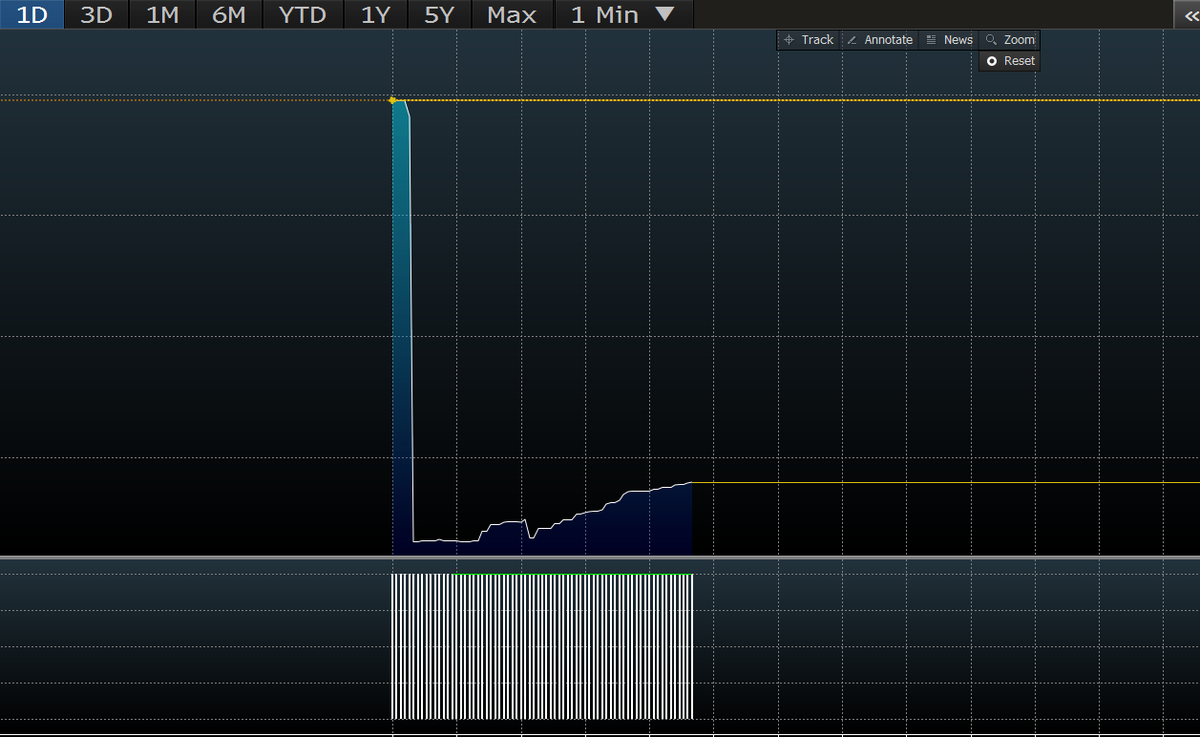

#Greek stocks plunge 22 percent as bourse reopens http://bit.ly/1SzRw0c

Athens market now at -17.8%. Financials still at -30% limit down but some blue chips & mid-caps find buyers at these levels. #ASE #Greece

French finance minister Sapin (one of Yanis' few friends) says his capability for "fantasy is truly unlimited" http://www.handelsblatt.com/my/politik/international/interview-michel-sapin-ich-glaube-dass-wolfgang-schaeuble-sich-irrt/12136472.html?ticket=ST-4368808-r3Nyxm7S4jRkcGXCEJBO-s02lcgiacc02.vhb.de …

Wowzers. Greece is a cash only economy

Weird world. Greece's worst PMI numbers in history has seen Athens markets *stabilise. We're only down 19.8%

*EU SAYS GREEK ECONOMY HAS 'DETERIORATED MARKEDLY' IN 2015 - WEAKER GREEK GDP A FACTOR IN SETTING NEW FISCAL TARGETS

*ATHENS BOURSE CEO LAZARIDIS: RESTRICTIONS WILL APPLY FOR AROUND ONE MONTH

@keeptalkingGR key level: main support 168 (low 06/12) - safe area above main resistances 214 $ASE in the middle

Greek Hotels in Thessaloniki Filled With Syrian Refugees http://dlvr.it/BkMbhn #Greece

"The sheer magnitude of manufacturing downturn sends a worrying signal for the health of #Greece economy as a whole"

Greek manufacturing PMI falls to record low in July, new business sees biggest drop https://shar.es/1tXC3P #Greece

#Greece Alpha Bank, Piraeus, NBG, Eurobank, all -30%, warrants -82%

Broader Europe.....

Migrant flow to Europe is result of US, EU military ops in Middle East – Czech president http://on.rt.com/6oa7

European shares unaffected by Greek crash

#Greece HT @Investingcom

Breaking a Taboo: Plans for Euro-Zone Tax Take Shape http://spon.de/aeye0 via @SPIEGELONLINE

Crap.

FOCUS reports that German govt thinks Greek bailout schedule is overly ambitious and may not be met: http://openeurope.org.uk/daily-shakeup/uk-and-france-seek-eu-and-international-help-to-deal-with-global-migration-crisis/#section-2 … #Greece

FOCUS reports special session of Bundestag to vote on 3rd Greek package in mid-August may have to be moved:http://openeurope.org.uk/daily-shakeup/uk-and-france-seek-eu-and-international-help-to-deal-with-global-migration-crisis/#section-2 …

Latest Emnid/Bild poll: CDU/CSU would have absolute majority in parliament - polling on 43%: http://openeurope.org.uk/daily-shakeup/uk-and-france-seek-eu-and-international-help-to-deal-with-global-migration-crisis/#section-1 …

Credit markets getting more nervous by the day as Ruble rout deepens. #Russia's 5y default probability jumps to >21%.

UK and France seek EU and international help to deal with “global migration crisis”: http://openeurope.org.uk/daily-shakeup/uk-and-france-seek-eu-and-international-help-to-deal-with-global-migration-crisis/ …

Calais migrants step up bids to get into Channel Tunnel http://bit.ly/1fZmtsV

Manufacturing PMIs print better than Exp from Eurozone & UK with ASE down 20% after reopening for 1st time in 5 wks - http://bit.ly/1N3MIJK

Fiscal transfers & monet unions fail:"Between 2000 and 2013, Southern Italy's economy grew 13%, half of Greece's 24%" http://www.ansamed.info/ansamed/en/news/nations/italy/2015/07/30/southern-italys-2000-2012-growth-half-of-greeces_42c9c3e7-3fef-48e6-b87d-10c95482b46a.html …

Commodities.....

Ruble rout deepens: #Russia Ruble weakens vs Dollar as Brent oil continues to drop.

Copper poised to enter a bear market. Now -20.35% from May 5 peak.

Brent 50 handle

US Crude falls below $46.50

Commodity rout spurs worst resource currency meltdown in 7years. http://bloom.bg/1IF2pax

Why #gold has lost its shine for investors & a growing number of hedge funds bet against asset http://on.ft.com/1eMGz8U

In #China’s broken markets, PetroChina’s volatility surges to highest among world’s Top 100. http://bloom.bg/1IE0kvB

Copper drops to lowest since 2009

No comments:

Post a Comment