Morning Tweets...

Greece ....

Feels like only MPs & journos covering tonight's vote are in Athens these days

#greece #GreekCrisis

Greek MPs start debating third bailout, vote due late Thursday or early Friday http://dlvr.it/BqsBw6

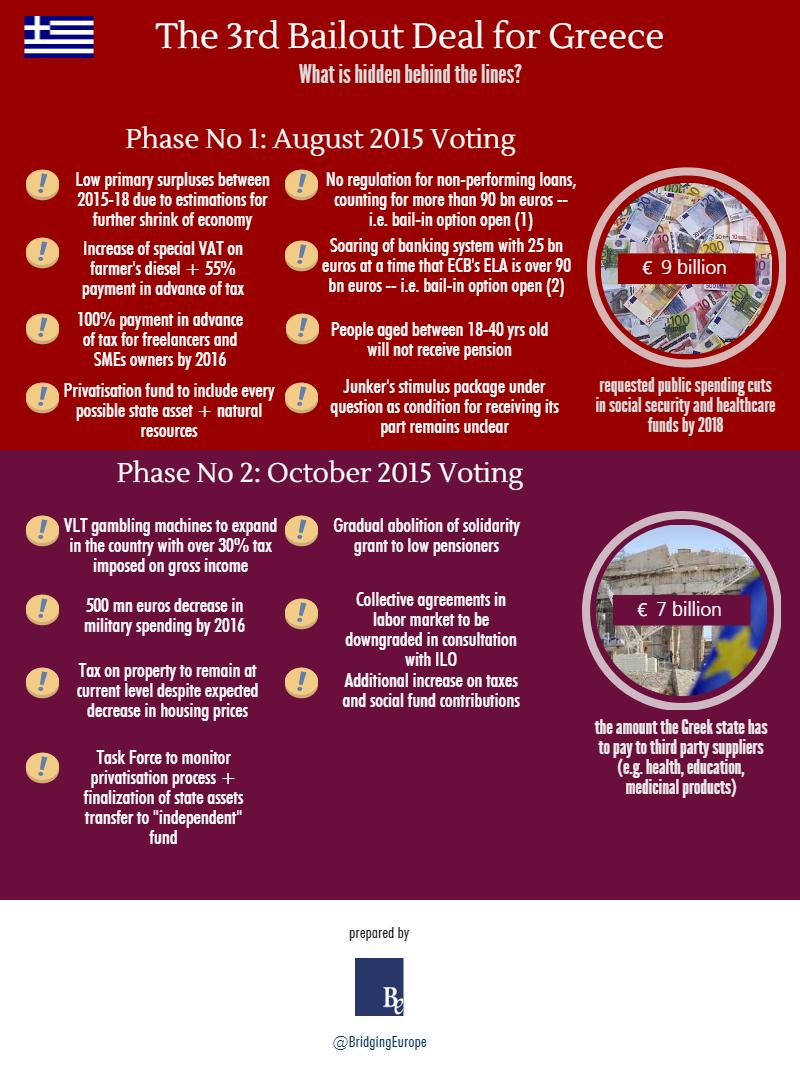

State arrears mount up, revenues fall short, budget figures show http://dlvr.it/Br77JN

Mish's Global Economic Trend Analysis: 29 Page Memo Proves Greek Parliament is Puppet Government Run by Ge http://po.st/Qpyx5E via @po_st

Germany, France want details on Greek debt plan: Berlin http://bit.ly/1J1GuX0

This is going to be fun. #vouli

EC: Ready For Both ESM Program And Bridge Loan, Bridge Loan Prepared Only As A Contingency.

#Greece's 2y yields rise as #Germany Says It Can’t Back Greek Bailout Plan Yet. http://bloom.bg/1IYUtN4

German Deputy Finance Minister: We’re open to debt relief for Greece, but write-down is out of the question http://openeurope.org.uk/daily-shakeup/boris-johnson-in-the-event-of-brexit-much-of-uk-eu-relationship-would-be-rebuilt-on-an-intergovernmental-level/#section-1 …

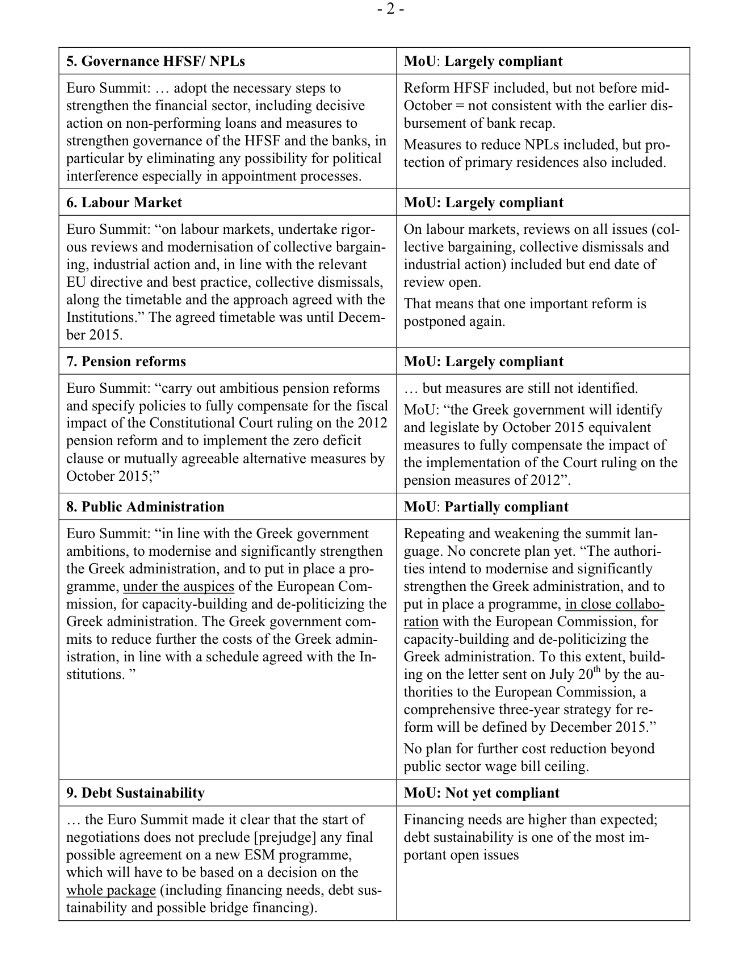

What #Greece MPs aren't going to discuss in Parliament in fear of social unrest. Not at least in front of cameras.

#Greek GDP grows in 2015Q2: +0.8% q-on-q, +1.4% y-on-y. I'd say that was widely unexpected..

@MMQWalker No plunge in tax collection says Finance Ministry. Fall in revenue due to delayed tax declaration. Check statement today.

Lesson from #Greece: There is no simple way to explain correlation btwn government spending, private consumption and GDP growth

Government shutdown triggers rebound in Greek economy. Talk to me @JosephEStiglitz

149 minus lafazanis's 11, assuming they're all MPs...

tsakalotos says there will be new measures for 2017, 2018 but these to be brought to parliament for discussion in october

In written statement, ex-Energy Minister Lafazanis announces intention to form anti-memorandum movement t #Greece

China......

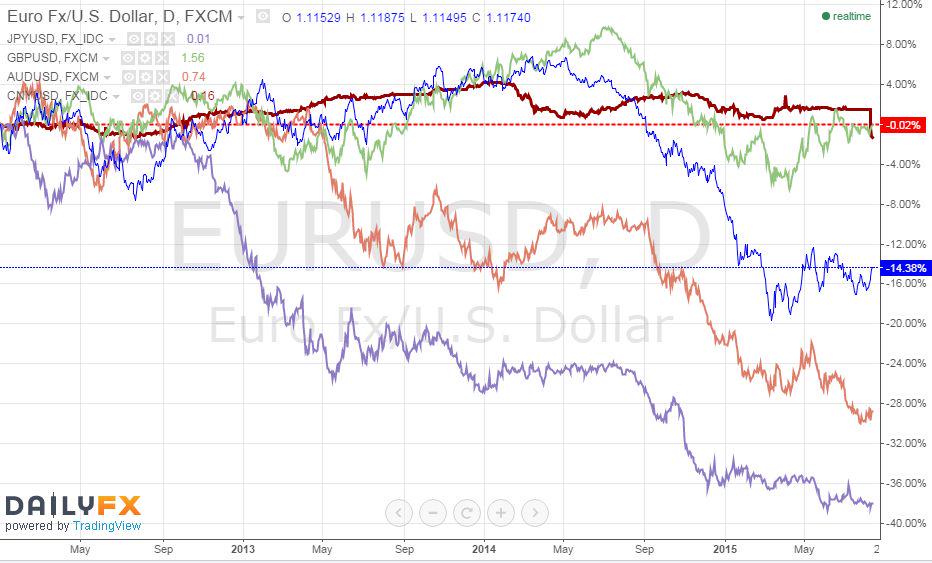

Chinese Yuan finally down against the USD benchmarked to Jan 1, 2012 prices. Euro is down 14%, AUD 28%, JPY 38%

Wondering what the Fed will do in response to China's weakening of the yuan? You're watching the wrong central bank. http://uk.businessinsider.com/bank-of-japan

Dong falls for a third day, longest run of losses since 2011

Fires Blazing, Untold Number Trapped Under Massive China Blast Wreckage http://thebea.st/1IMFHdk via @thedailybeast

214 soldiers form a nat'l nuclear biochemical emergency rescue team, leave Beijing for rescue work in #Tianjin Thu

2 blasts equivalent to 24 tons of 'TNT' leave 'apocalyptic' scenes in #Tianjin #China http://sc.mp/pltle

US-CHINA TIES: Chinese telecoms company ZTE refuses to bring executive to US over arrest fears http://www.scmp.com/news/china/policies-politics/article/1848834/chinas-zte-refuses-bring-executive-us-because-arrest …

China shuts down space supercomputer damaged by shockwaves of #Tianjin blast http://www.scmp.com/news/china/society/article/1849200/china-shuts-down-space-supercomputer-damaged-shockwaves-deadly … via @SCMP_News

Apple shares fall amid concerns weaker #RMB makes iPhone more expensive in China http://www.scmp.com/tech/enterprises/article/1848862/apple-shares-fall-amid-concerns-weaker-yuan-will-make-iphone-more … #CurrencyWars

Very good (and short) story to recap every major event that happened in regional markets today! Well done, @fastFT!

Chinese Devaluation Extends To 3rd Day - Yuan Hits 4 Year Low, Japan Escalates Currency Race-To-The-Bottom http://www.zerohedge.com/news/2015-08-12/china-devalues-yuan-3rd-day-4-year-lows-argentina-suffers-losses-japan-escalates-cur …

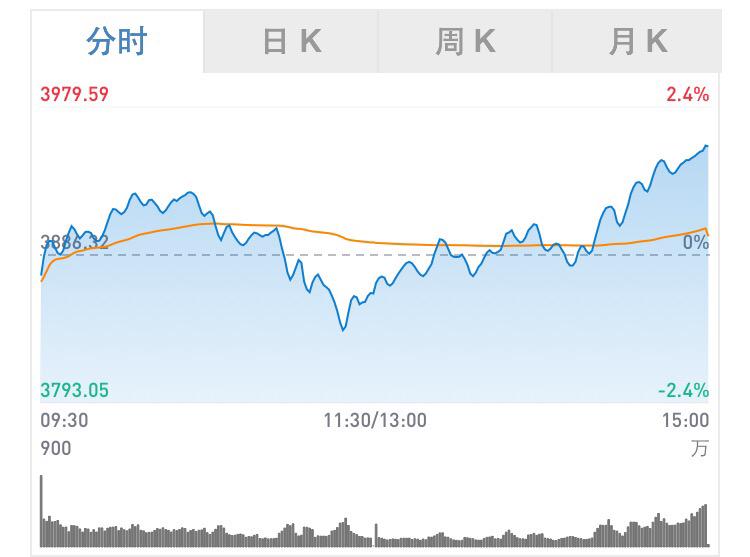

Shanghai benchmark index ended 1.76% higher, led by SOE stocks in last 30 mins of trading, after market worries earlier about cheaper #RMB

BREAKING: Chinese stock market in V-shape rebounding in last 30 mins of trading as PBOC clarified on #RMB devaluation

BREAKING: China's tech giant @lenovo to cut 3,200 jobs amid net profit sinking 50%, slow sales http://www.scmp.com/tech/enterprises/article/1849158/chinas-lenovo-cut-3200-jobs-amid-profit-decline-slow-sales …

PBOC Vice Governor Yi Gang: No need for Chinese Gov to use #RMB adjustment to boost our exports, China still has significant trade surplus

PBOC Vice Governor Yi Gang: Current capital outflow is normal; good to see Chinese enterprises and residents hold FX too, not just Gov alone

Nick Malkoutzis

Nick Malkoutzis

Manos Giakoumis

Manos Giakoumis

George Chen

George Chen

No comments:

Post a Comment