Europe ......

Broadly.....

EUR continues its downward trend after EUR/CHF broke its 200DMA at 1.0802...No Tier 1 data out of Europe for the rest of today #fx #Euro

French Economy Minister Macron: "Treaty change is just a matter of timing": http://openeurope.org.uk/daily-shakeup/french-economy-minister-treaty-change-just-a-matter-of-timing/ …

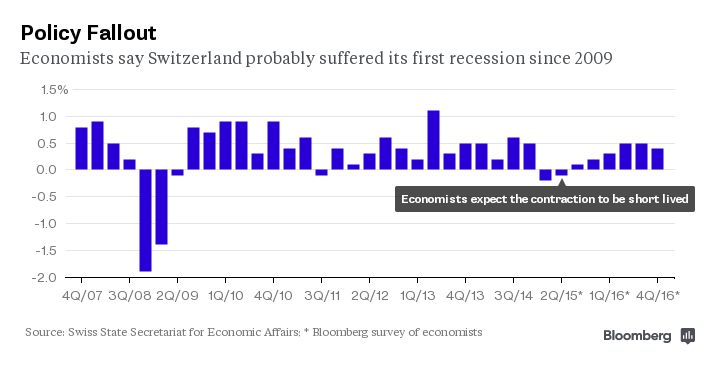

Franc Fallout: First Swiss Recession in Six Years http://bloom.bg/1MS9N5F

You don't say!?

Merkel's approval rating 'falls' to 53%, possibly because of 3rd Greek bailout. Angela still as popular as Hollande and Renzi combined.

#ECB getting aggressive on buying ABS on concerns that ECB finds it difficult to complete QE. http://bloom.bg/1U5HWmJ

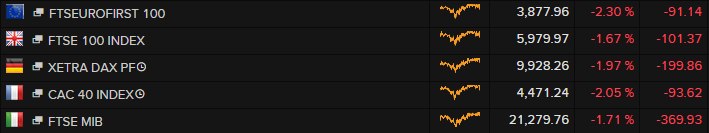

Down go Europe's stock markets again.....

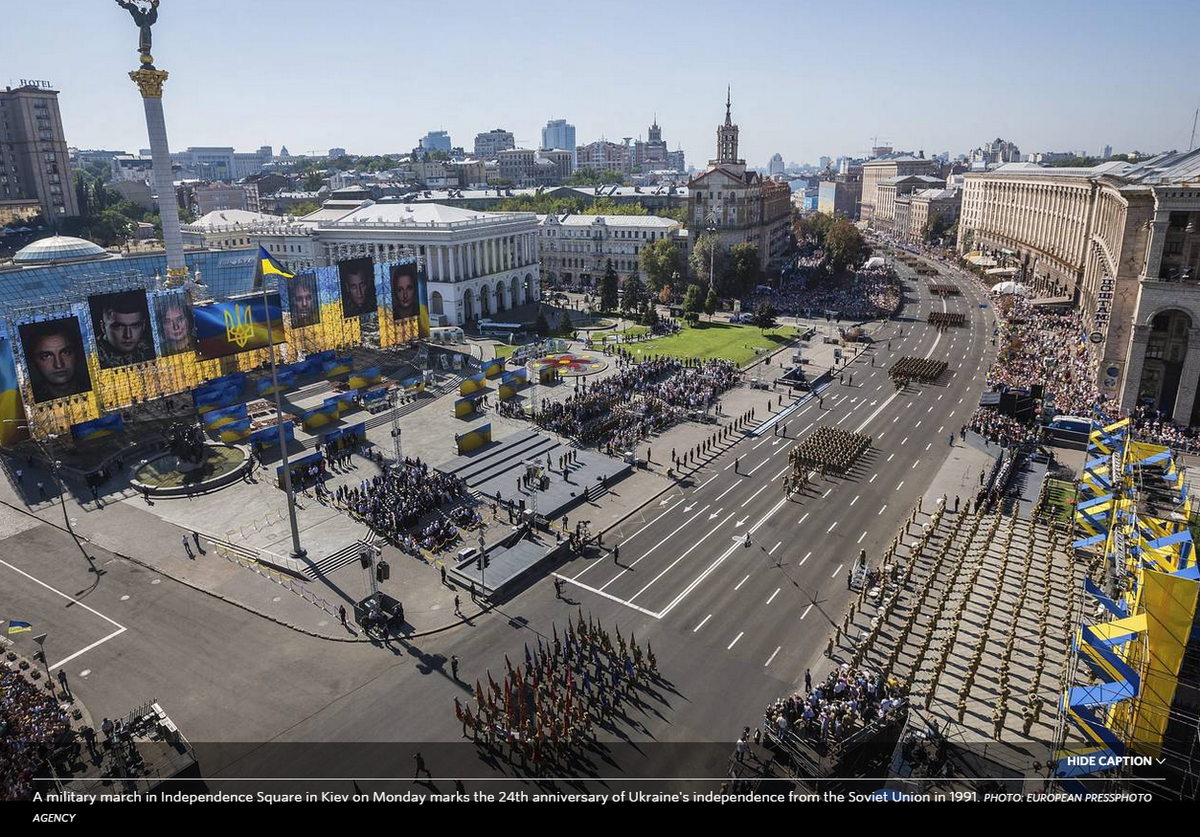

Ukraine.....

Lviv Is Ukraine’s Happiest Sad City http://thebea.st/1KJge4I

Ukraine’s Motor Sich loses $200 million per year due to ban on exports to Russia http://tass.ru/en/economy/816572 …

Ukraine is still too corrupt for a debt deal to help much, says @bershidsky http://bv.ms/1hEaP8p via @BV

Greece....

Monthly evolution of #Greece primary surplus, revenues & prim expenditure vs targets in the course of 2015. #economy

You see, @SMerler ?

zoe konstantopoulou is launching her own party, discussing collaboration with popular unity. #ekloges2015_round2

Greek Parties Accuse Tsipras of Unduly Expediting Election Date http://dlvr.it/Byr6Dp #Greece

How many more senior & mid-level ppl need to leave Syriza for the "Tsipras will win on his personal popularity" fairytale to end? #Greece

FinMin Tsakalotos & ex-gov't spox Sakellaridis haven't decided yet if they'll stand as SYRIZA candidates at elex, reports Skai TV #Greece

EU's @VDombrovskis expects #Greece progress regardless of government http://www.ekathimerini.com/200903 #ekloges2015_round2

Around 13,000 Greek companies have abandoned #Greece and re-established in #Bulgaria since end 2013 to avoid unprecedented taxation.

More and more #Syriza members leave the party. Not necessarily to join #PopularUnity, but turning against adoption of bailout. #Greece

Refugee Situation....

Serb PM: “Germany should cut allowance [for refugees] to €200. Then there'll be 80% less asylum seekers from Balkans” http://openeurope.org.uk/daily-shakeup/french-economy-minister-treaty-change-just-a-matter-of-timing/ …

Italian Foreign Minister: Logic of Dublin regulations does not apply anymore. Phenomenon has changed radically: http://openeurope.org.uk/daily-shakeup/french-economy-minister-treaty-change-just-a-matter-of-timing/#section-1 …

Action plan *yet* to be completed by the Greek govt on the #refugeesGR / migration problem. /via @ekathimerini

While EU shoulders big part of blame for the (no) response towards the #refugees / migration crisis, GR govt has been slacking much as well.

BREAKING: Hungarian police use tear gas against migrants in city of Roszke http://on.rt.com/6puq

I welcome Germany's decision to suspend Dublin returns for Syrian refugees.This is the right thing to do.I hope more Governments follow suit

Excellent graphic on refugee crisis slamming Europe !

Merkel grapples w/ possible arrival of 800,000 refugees, equivalent to 1% of population and biggest influx since WWII http://bloom.bg/1If8XIa

Asia.......

Wow! Hong Kong media declare China is already in economic crisis and its impact will be like "nuclear explosion"...

BREAKING: Chinese media describe Beijing's rate cut as "failure" to boost stocks, ending -1.2% in M-shape bumpy trade

More short-term liquidity moves from the PBoC- an additional 140B yuan today (around $21.8B) after yesterday's RMB150B 7-day reverse repos.

These PBoC loans have 6-day maturity, interest rate 2.3%, to provide credit lines to cash-strapped commercial lenders (after 50bps RRR cut!)

Chinese stock market hits new eight-month low as sell-off continues - live http://www.theguardian.com/business/live/2015/aug/26/asian-markets-open-with-investors-on-edge-after-dow-extends-losses-live …

Just another discombobulating day on the Chinese stock market.

$SSEC -1.3%

$SZCOMP -3.05%

CSI300 -0.6%

ChiNext -5.1%

Asian markets still with frayed nerves http://www.theguardian.com/business/live/2015/aug/26/asian-markets-open-with-investors-on-edge-after-dow-extends-losses-live … #AsianStockMarkets #ChinaStocks #Yuan

Get this -> Shanghai Composite has changed direction 43 times (at least a 0.4% move each)... 30 minutes to the close #ChinaStocks

My latest piece: How a Chinese slowdown will hit global growth http://theconversation.com/how-a-chinese-slowdown-will-hit-global-growth-46655 … via @ConversationUK #China #markets

Gov funds are said to be buying large financial stocks, esp state-owned banks, to support index, clear signs of gov intevension - once again

BREAKING: China stock market in V-shape rebounding suddenly after midday break, up 4% jumping from below 2900 points to now near 3100 points

Post-midday V-shape rebounding comes at "good news" incl police arrest of top bankers, financial journalist, following central bank rate cut

Chinese Margin Debts Shrink by 1 Trillion Yuan ($156 Billion) Amid Rout http://bloom.bg/1NTn4rq

BREAKING: China's well-respected Caijing magazine confirmed 1 of its reporters was arrested by police for a stock market story denied by Gov

Caijing reported on July 20 about Chinese Gov possible plans to exit from stock market interventions, which securities regulator CSRC denied

China Devalues Yuan To Fresh 4-Year Lows, Arrests Top Securities Firm Exec As Stocks Slide Despite Rate Cuts http://www.zerohedge.com/news/2015-08-25/china-devalues-yuan-fresh-4-year-lows-probes-securities-firms-restricts-futures-trad …

Before police arrest, top Citic banker Xu Gang was responsible for entire brokerage and research business; Chinese police gave no reason yet

Now the stock market is NOT just panic about losses but about police arrests! Many believe this may be just beginning - chain effect soon!

Citic in China is like Goldman on Wall St. Can u imagine if NYPD arrested a top banker from Goldman's NY office? Chinese Police just did so!

Malaysian PM Najib to Hold Press Conference on the Economy at 1230PM Local Time, PM's Office Spokesman Says

Asian markets in volatile mood as China rate cuts fail to calm nerves – live http://gu.com/p/4bzg2/stw

Nice chart showing lack of correlation between China's economic fundamentals & Shangai Comp performance @CapEconomics

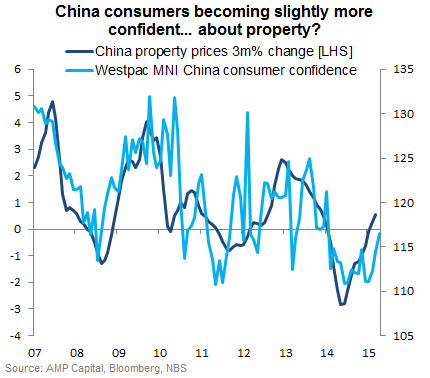

China Westpac/MNI Consumer Confidence Index up +2pts to 116.5 - consumers focused on their main assets; property.

Chinese Stocks Tumble Despite Rate Cut; PBOC Devalues Yuan To Fresh 4-Year Lows, Restricts Futures Trading http://www.zerohedge.com/news/2015-08-25/china-devalues-yuan-fresh-4-year-lows-probes-securities-firms-restricts-futures-trad …

MacroPolis

MacroPolis

No comments:

Post a Comment