Evening wrap....

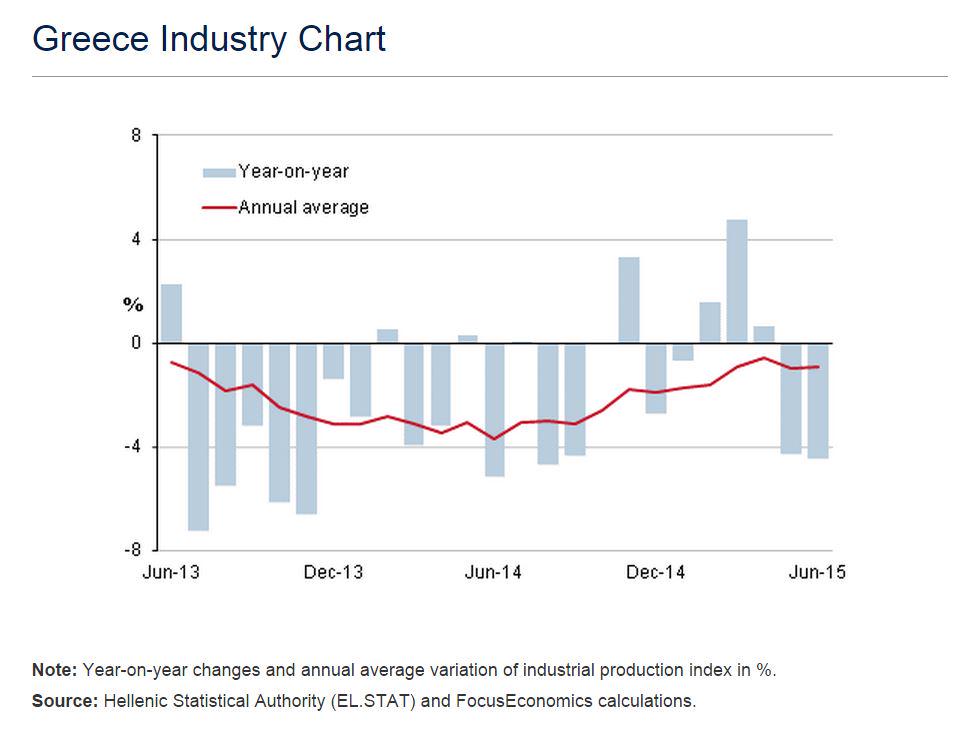

Greece.....

#EU's Financial Committee officials were informed on #Greece agrmnt @ conf call; reacted 'positively': EU officials. New conf call tomorrow.

Ukraine....

Morning Tweets....

Greece...

China .......

Greece.....

HFE: 3yr €86bn deal lends #Greece more money than it has to roll over during its term. Indebtedness will rise as a result of this program.

#Greece PM Tsipras and #Germany Chancellor Merkel hold telephone call; Tsipras reportedly told Merkel he rejects bridge loan.

#Greece Parliament speaker Constantopoùlou refuses to hold parl committees sessions tomorrow, plans to meet w Parl dep spkrs tomorrow night.

#Tsipras requests in letter to House Speaker Konstantopoulou 'immediate convening' of parliament plenum to vote on 3rd bailout

Migrants Riot on Greek Island of Kos, ‘Situation out of Control’ Says Mayor http://dlvr.it/Bps2Hr #Greece

Now The Bad News: This Is How Much More Downside Is Left For China's Currency http://www.zerohedge.com/news/2015-08-11/now-bad-news-how-much-more-downside-left-chinas-currency …

DB: Our estimate is that a 1 pct yuan depreciation agains tthe dollar would trigger about $40 billion in capital flight.

Markets demanding response/clarity from ECB/BOJ on how they will react to China's currency warfare

#Greek agreement discussed by deputies all 28 EU-countries now → bridge loan still considered. Germany: quality more important than speed.

Finland's Stubb says more work remains with Greek deal http://www.reuters.com/article/idUSKCN0QG16A20150811 …

#greece and troika seal technical bailout deal, but politically could be tricky. 'no deal done yet' - eu dips

Ukraine....

U.S. authorities expose the 1st major case of insider trading to cross into the cyber realm http://bloom.bg/1WeqdIa

Ukraine Bonds Rally on Bets of Compromise at California Meeting http://bloom.bg/1Tknv4X via @business

Morning Tweets....

Greece...

Agreement "in principle " has to be translated to deal in reality ! Not there yet....

*EUROGROUP SET TO MEET FRIDAY ON GREECE ACCORD, RAJOY SAYS

*EU SAYS GREEK TECHNICAL AGREEMENT FORESEES 3-YEAR PROGRAM

Tech agreement on Greek bailout included involvement of IMF officials - @EU_Commission

Theodoros Mihopoulos: “negotiations have been completed. There are some details left.” http://on.wsj.com/1DEY2fP #Greece

#Greece forced to vote through privatisations and deregulation this week BEFORE bailout proceeds https://euobserver.com/economic/129867 #thisisacoup #oxi

Officials - "some minor issues remain" in 3rd programme for #Greece, but suggest it's more or less done: http://openeurope.org.uk/daily-shakeup/greece-said-to-have-reached-deal-with-creditors-on-third-bailout/ …

Greece close to clinching €86bn bailout deal – live: The debt mountain: With government debt heading for 200% ... http://bit.ly/1DFmSfs

Germany Isolated as Greece Near €86 Billion Deal With Creditors; Ambitious Yes, Feasible No: In reaching a dea... http://binged.it/1ToDc5K

Slovakian PM Fico says he believes temporary #Grexit is a good idea: http://openeurope.org.uk/daily-shakeup/greece-said-to-have-reached-deal-with-creditors-on-third-bailout/ …

Slovakian PM Fico tells @derstandard_at he will never agree "to write off a single cent" of #Greece's bailout debt: http://openeurope.org.uk/daily-shakeup/greece-said-to-have-reached-deal-with-creditors-on-third-bailout/ …

Greece Says It Reached a Deal for a Third Bailout http://www.nytimes.com/2015/08/12/business/international/greece-third-bailout-deal.html …

So #Greece agrees to bailout in record time, accepts all creditors' demands, but Germany puts up resistance? We've entered parallel universe

Greece, the ultimate irony. 6 months of shameful Grexit threats, followed by a swift deal focused on reforms rather than austerity.

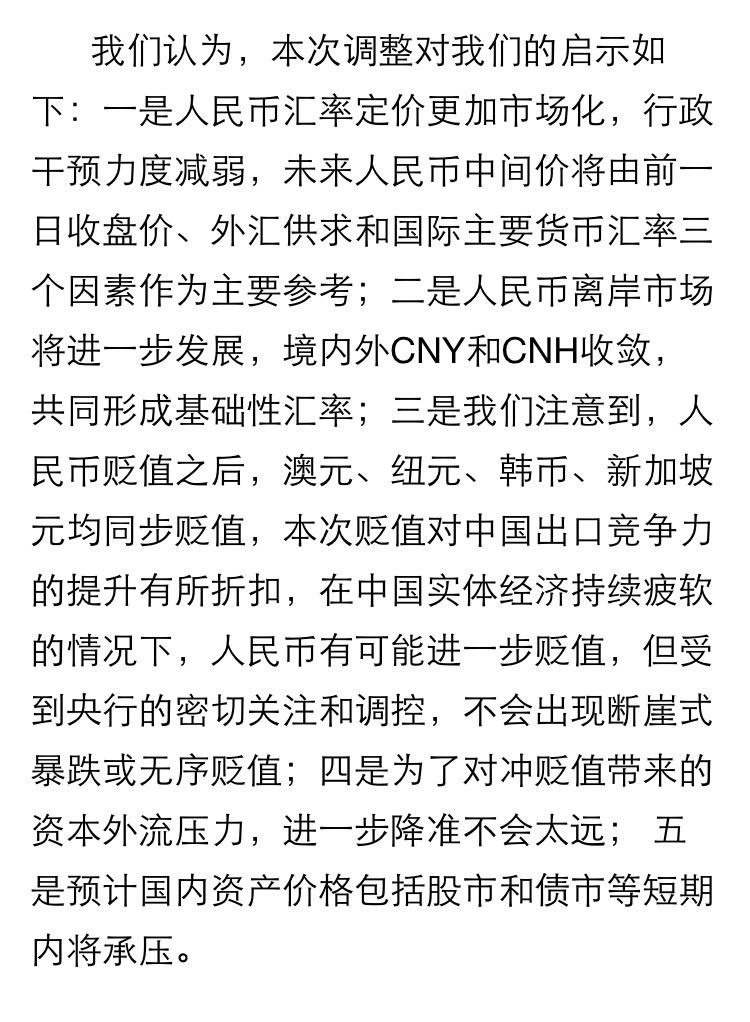

China .......

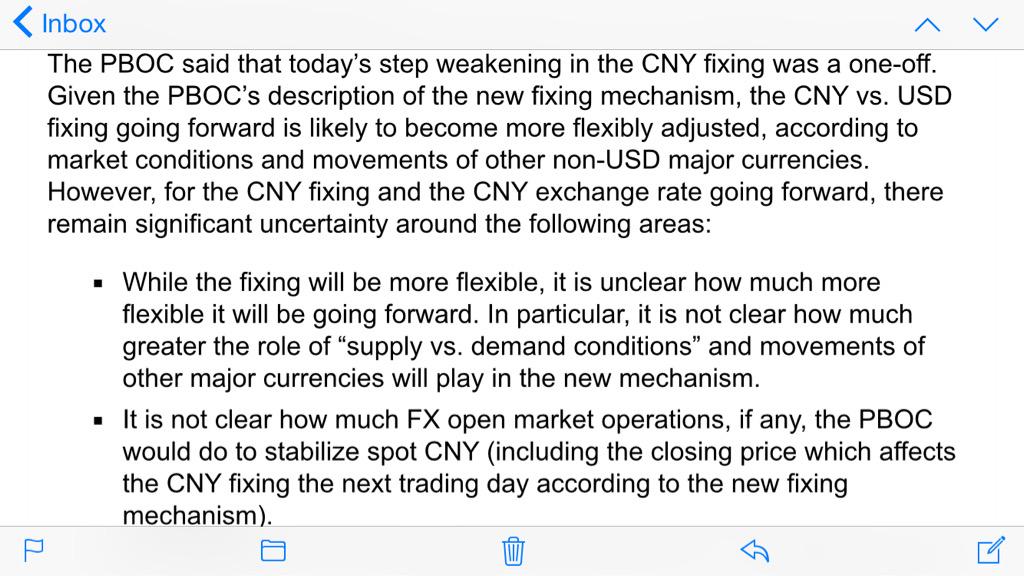

Goldman Sachs: China's central bank's surprising move to devalue RMB makes the foreign exchange system more "unclear"

My Forbes post on China's devaluation of the yen. It didn't have much choice, and there's more to come. http://www.forbes.com/sites/francescoppola/2015/08/11/china-joins-the-global-devaluation-party/ …

China Merchants Bank: 1) RMB may devalue further 2) likely more bank reserve ratio cuts 3) stock market uber pressure

This chart shows the magnitude of China's shock currency devaluation.

Some fastFT coverage: http://on.ft.com/1To9o9s

My view: like Euro QE, it will boost export earnings but will also drive capital outflows.

MORE: Shanghai benchmark index ended just flat today. The biggest winner today? All gold related stocks after PBOC surprisingly devalued RMB

BREAKING: China stock market struggled in W-shape trading Tuesday; investors divided on outlook after RMB devaluation

Yannis Koutsomitis

Yannis Koutsomitis

María Tejero Martín

María Tejero Martín

NYT Anonymous

NYT Anonymous

George Chen

George Chen

No comments:

Post a Comment