Evening Wrap...

Athens, Greece

Mish's Global Econ Trend Analysis: Greek Stock Market Reopens (sort of); Math Perspective on the "Bailout" http://po.st/GSXeRG via @po_st

Bundesbank VP Claudia Buch says debt relief impossible because of no-bailout clause. So IMF is out for good

IMF approves allocation of next tranche of $1.7 billion to Ukraine http://tass.ru/en/economy/811986 …

Greek FinMin @tsakalotos met troika chiefs, discussed fiscals, bank recap, privatization. 'Was convergence on some points, less on others.'

#Greece FinMin said inaugural discussion with institutions focused on fiscal issues, bank recap and privatization fund. #ec #ecb #imf #esm

GREEK STOCK MARKET AIMS TO REOPEN ON MONDAY, STILL NEEDS FINANCE MINISTRY DECREE DETAILING NEW TRADING RULES - REGULATOR

Morning Tweets.....

Broader Europe.....

Eurostat says French unemployment rate was 10.2% in June, unchanged from June 2014

Germany Q2 retail sales -0.3% vs. + 1.8% Q1 Q2 retail sales France -0.1% + 1.5% vs. Q1

French consumer spending fell 0.1% in Q2 - Stats Office

Handelsblatt: Sanctions on Russia are full of holes and hurting German business http://openeurope.org.uk/daily-shakeup/schaubles-proposals-to-restructure-commission-receive-mixed-response-in-germany/#section-8 …

Templeton group offers Ukraine 5% principal cut in first sign they are willing to take a haircut to the bonds --> http://bloom.bg/1DSHlb5

Which #Russian Regions are Most Affected by the Economic Crisis? (Infographic) http://tmt-go.ru/526483 #news

Italy's youth unemployment skyrockets to 44.2% (+1.9 percentage pts in a month) in June

What recovery? #Eurozone unemployment edged back up by 31k in June, mainly due to #Italy. Rate remains at 11.1%.

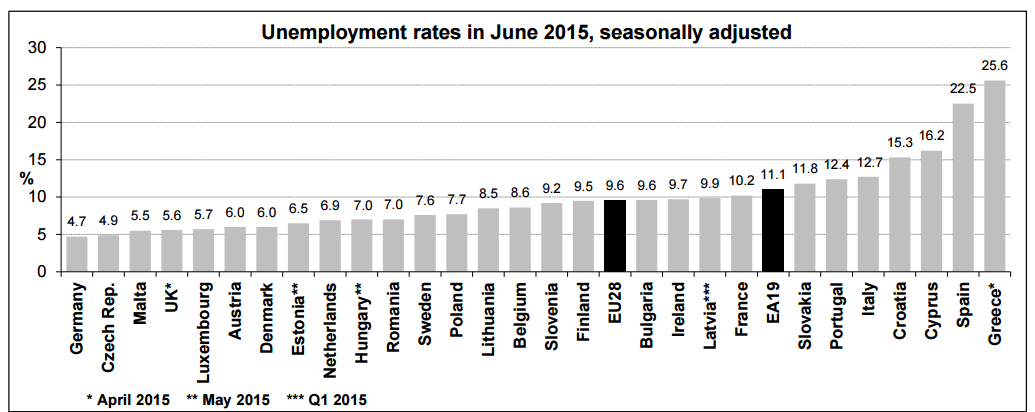

Unemployment in the eurozone. Greece: 25.6%. Germany 4.7%

#Eurozone inflation stays close but above Zero. July CPI YoY remains at 0.2%, matching estimates.

#Russia Ruble in free fall. Ruble weakens beyond 60 per Dollar, weakest since March as Brent oil continues to drop.

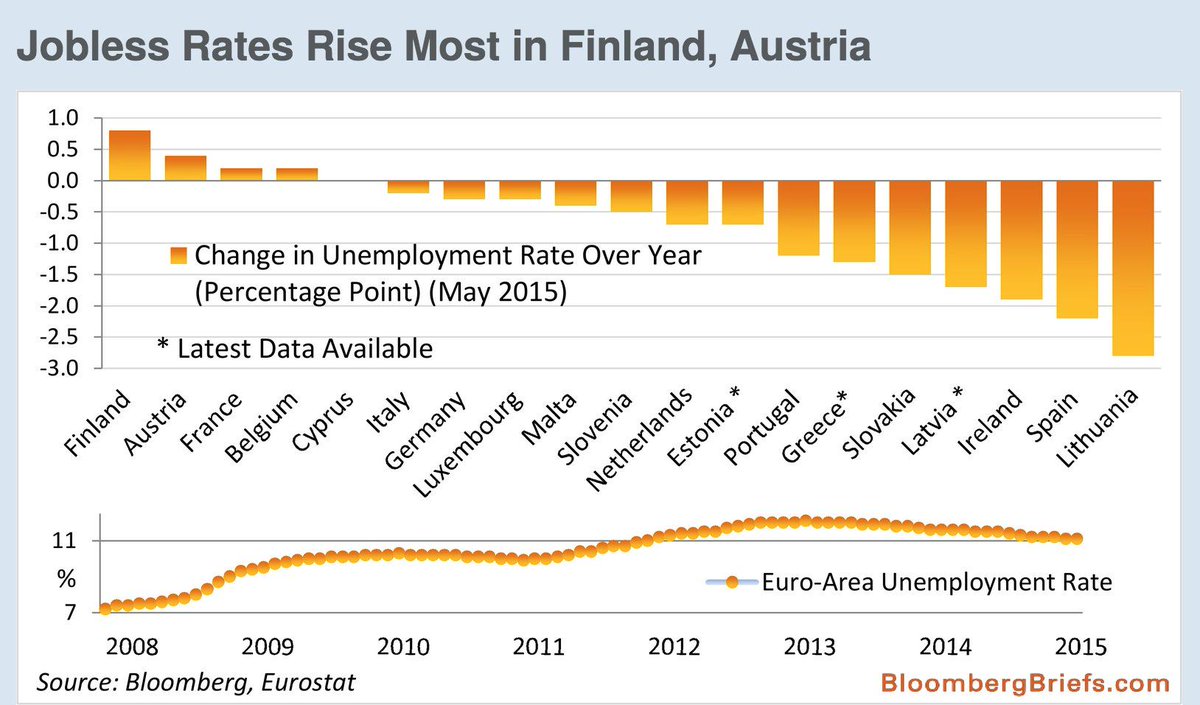

#Finland is poster child for why #Euro doesn’t work. Unemployment in Finland increased by most in May YoY. (via BBG)

SNB posts 1H loss of CHF50.1bn, 1H results driven by currency, #Gold price developments. 1H Loss on Gold at CHF3.2bn.

German pwr in Commission: Holds 10.2% of posts (more than any other EU country) and 9 of the 28 Commissioner's Cabinet Heads are German.

Greece.....

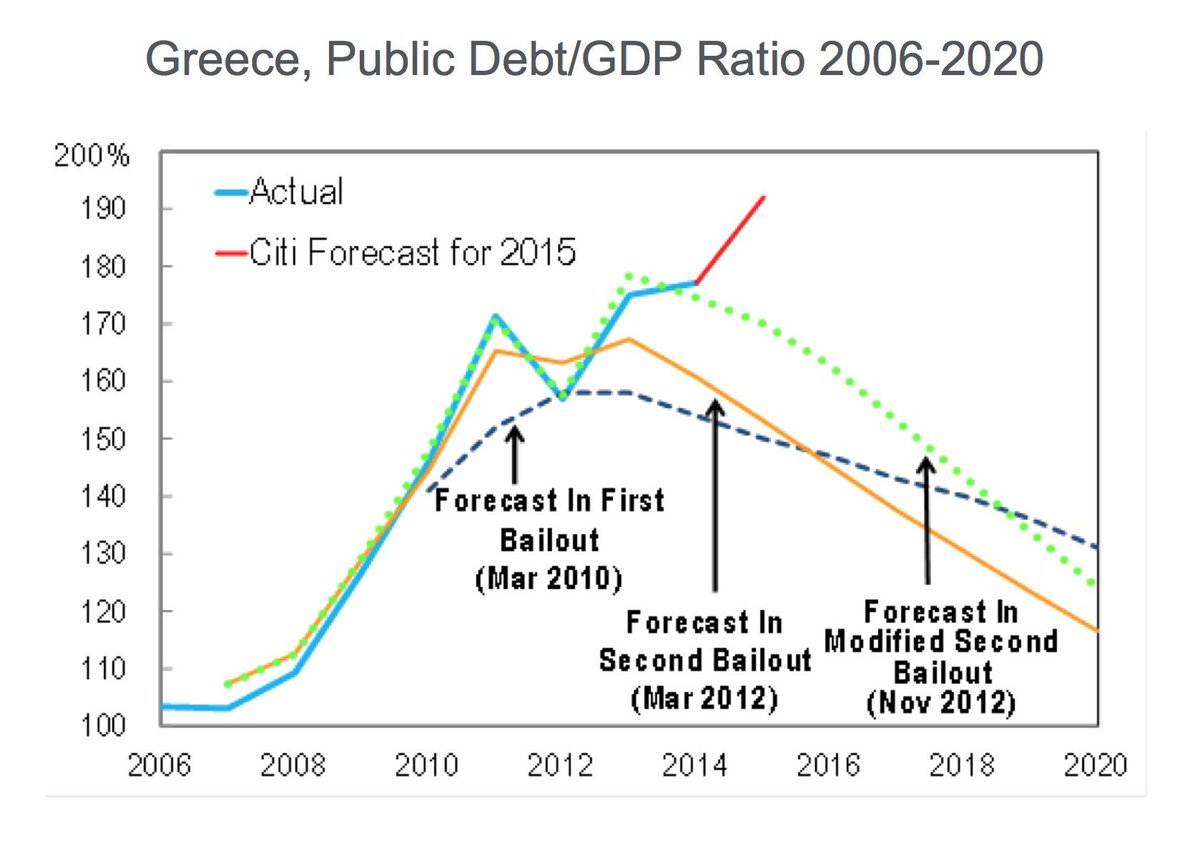

EU sees 'nothing new' in #IMF stance on Greek debt, next package, EU spokesperson says. (BBG)

The big conflict of interest the ECB is facing in 1 paragraph, by the great @Frances_Coppola: http://coppolacomment.blogspot.co.uk/2015/07/in-defence-of-conflicted-ecb.html …

And, quite right too… RT @YanniKouts: Tsipras gives full cover to Varoufakis

#Greece PM Tsipras defends Varoufakis' Plan B, says country had to prepare a contingency plan.

Barter is booming in Greece for the first time since the Nazi occupation http://ind.pn/1Dd21zw

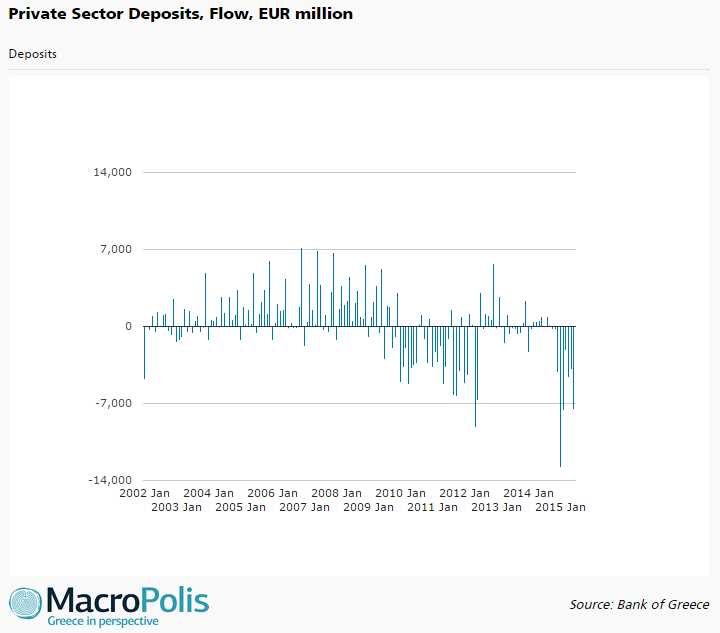

Dec 14 - Jun 15, in 7 mths #Greece banks lost almost half of the volume of deposits gone in 33 mths Oct 09 - June 12

Bailout talks to shift gear http: // dlvr.it/BhsLds

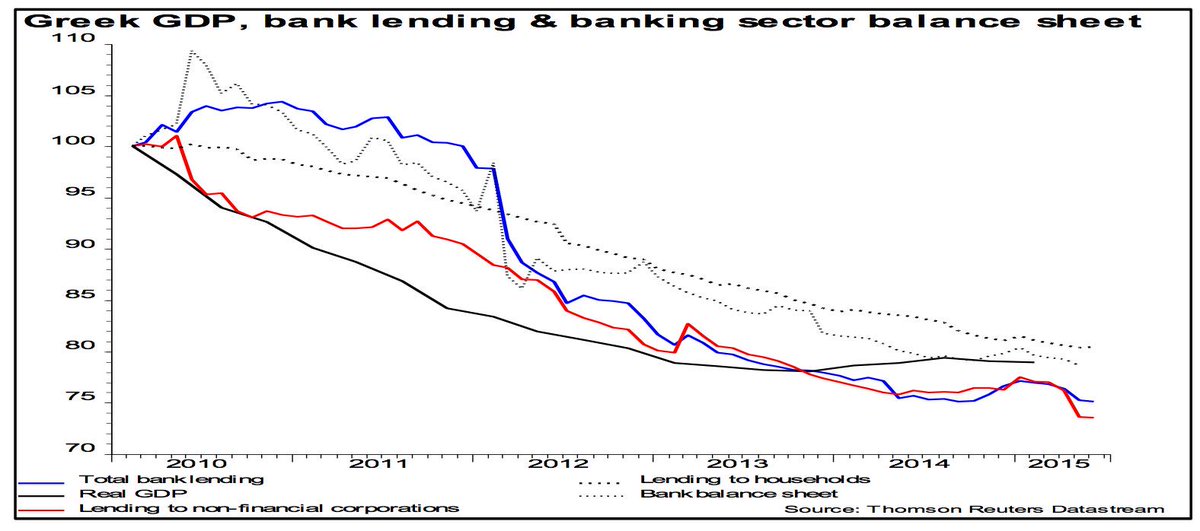

#Greece GDP collapse not just a story about fiscal austerity. Greek banking sector’s balance sheet contracted by 20%.

Greece crisis escalates as IMF withholds support for new bail-out deal http://www.telegraph.co.uk/finance/economics/11773977/Greece-crisis-escalates-as-IMF-witholds-support-for-a-new-bail-out-deal.html …

Why did #Varoufakis keep #Greece ‘Plan B’ in secret? - prof. James Galbraith @UTAustin explains @AmeeraDavid

China......

BREAKING: China announces new rules on stock index futures trading to curb speculation and tighten supervision following recent market crash

From Aug 3, China Financial Futures Exchange will closely monitor any "abnormal trading behavior" and report to gov

BREAKING: To suspend new IPOs is necessary amid market crash but such IPO suspensions will be just temporary - Chinese securities regulator

Chinese securities regulator: China will continue to push "market-oriented" stock market & IPO reform forward after recent market correction

BREAKING: Key Shanghai stock index lost 14.3% in total July; down 1.13% today amid CSRC investigation into brokers in Hong Kong & Singapore

No comments:

Post a Comment