Tweets...

Broader Europe...

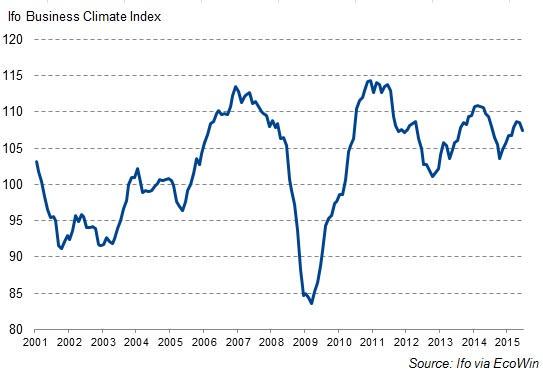

Ifo Business Climate Index for #Germany falls from 108.5 in May to 107.4 (4-month low) http://ow.ly/i/bsU0J

Vodafone reveals losses of €642m after cleaning up balance sheet of Spanish cable company Ono http://elpais.com/elpais/2015/06/23/inenglish/1435069628_593829.html …

New Sigma Dos poll for Mediaset:

PP 27%

PSOE 26.1%

Podemos 20.2%

Ciudadanos 10.3%

For First Time Since 2005, Russia Overtakes Saudi Arabia To Become China's Top Crude Dealer http://emergingequity.org/2015/06/24/for-first-time-since-2005-russia-overtakes-saudi-arabia-to-become-chinas-top-crude-dealer/ …

"Europe must have a strategy" to tackle Mediterranean refugee crisis, Italian PM Renzi writes in the @guardian. Without suggesting any.

ANSA on immediate strike until Thursday: 'Company plan of 65 redundancies unacceptable, assembly June 25' http://bit.ly/1Lzr6nM

Greece....

Holger Zschaepitz retweeted

#Eu source, dispute about aide mémoire, issues DSA and financing, #Greece insist on debt relief, unacceptable for #Germany @Schuldensuehner

* Greece's creditors have presented new counter-proposals to athens to bridge remaining differences - sources close to talks - RTRS

"TOTALLY UNACCEPTABLE" #Greece

Buba exec board member Nagel says debt relief for Greece would be "wrong incentive" - MNI

At midday presser, @EU_Commission no comments on dispute w/@atsipras

.@jeuasommenulle At presser, @KGeorgievaEU was asked, but wouldn't respond other than to say talks ongoing.

JohannesBorgen retweeted

#Greece officials say new @atsipras statement aimed at #IMF. Schäuble told Monday's #eurogroup to "stop blaming" IMF. Rock, meet hard place.

Low expectations for final deal today. Creditors going back to "Juncker proposal" http://www.kathimerini.gr/820683

Doesn't seem we are going to have a Staff Level Agreement tonight #Eurogroup

Greek crisis: deal unravels as Tsipras says measures have been rejected http://www.telegraph.co.uk/finance/economics/11695232/Greek-crisis-deal-unravels-as-Tsipras-says-measures-have-been-rejected-before-crunch-finance-ministers-meeting.html …

JohannesBorgen retweeted

Told #Greece "prior actions" list submitted y'day walked back previous commitments, angering creditors. Story soon: http://www.ft.com/intl/cms/s/0/e75eb2cc-1a48-11e5-8201-cbdb03d71480.html#axzz3ds9Lqj5P …

#Euro briefly drops below $1.12 on news that creditors don't accept Greek proposals.

The repeated rejection of equivalent measures by certain institutions never occurred before-neither in Ireland nor Portugal. #Greece (1/2)

This odd stance seems to indicate that either there is no interest in an agreement or that special interests are being backed. #Greece (2/2)

*DIJSSELBLOEM SAYS `STILL A LOT OF WORK' TO DO ON GREECE

Mehreen retweeted

PM on IMF "technical staff" (Thomsen) rejection of Greek equivalent measures: They either do not want a deal or serve specific interests”

Gov source:@tsipras_eu said lenders' refusal of equivalent measures 'unprecedented,either they don't want deal or serve interests in Greece

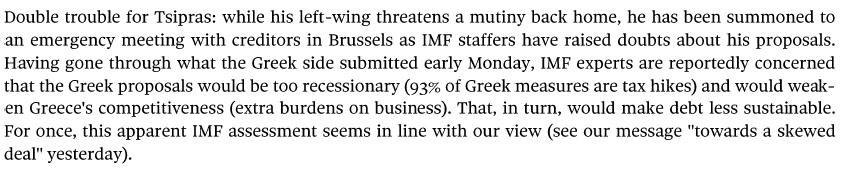

#IMF concerned Greek proposals too recessionary (93% are tax hikes) & wld weaken #Greece's competitiveness ~Berenberg

#Greece's 5y default probability (derived from CDS) on the rise again as some creditors reject Greek debt proposal.

FTSE Athex Banking index drops >7% on debt talk angst. Acc to Greek official, #IMF has rejected Greek tax proposals.

S&P: We continue to think that #Greece will remain Euro member. But limited progress in talks w/ creditors suggests that #Grexit is possible

Spanish and Italian 10yr bond yields jump as #Greece's Tsipras says proposals not accepted.

Jan Dams

Jan Dams  Peter Spiegel

Peter Spiegel

Dimitris Yannopoulos

Dimitris Yannopoulos

No comments:

Post a Comment