Tweets.....

Greece......

Broader Europe....

Greece......

#Greece govt contemplating imposing a 1/1000 tax on bank withdrawals; hopes measure will bring in €180mil. http://news.in.gr/economy/article/?aid=1231405039 … via @in_gr

The Greek Analyst retweeted

Germany's Schaeuble says 'skeptical' whether Greek debt deal reachable by Monday @AFP @MathildeRichter

Imminent Greek payments to the IMF:

- €200MM tomorrow;

- €780MM May 12

#Greece willing to move ahead on key asset sales to appease lenders - Senior Privatizations Official http://reut.rs/1Kce92e via @Reuters

Eleni Varvitsiotis retweeted

In forecasts, @EU_Commission says #Greece tax collection at end-2014 was so low that 2014 primary surplus only 0.4%, down from 1.7% estimate

HRADF said it does not negotiate w/ any party change in the terms of the tender 4 the sale of a 67% stake in Piraeus Port (OLP). #Greece.

#Greece MoF collected revenues of €110 mln from the settlement (in up to 100 instalments) of €2.2 bln tax arrears in 13 days (by end-Apr).

Manos Giakoumis retweeted

Manos Giakoumis retweeted

EC expects Greek GDP growth at 0.5% in 2015 (from 2.5% before) and 2.9% in 2016 (from 3.6% previously). #Greece #EC #economy

Perhaps a more useful measure of mood than usual, vague "do you want to stay in #euro at any cost" question. #Greece

Amid reports of IMF upping pressure in Greek debt talks, Tsipras 'discussed matters relating to negotiations' with Lagarde, his office said.

Broader Europe....

Holger Zschaepitz retweeted

German FinMin Schäuble says @FT's report on IMF's #Greece position misleading. IMF “did not say” Greek debt cut needed for more aid.

RBC says Bund sell-off has quite some way to go. Expects 10yr yields to rise to 0.75% by Q3. 10yr yields now at 0.46%

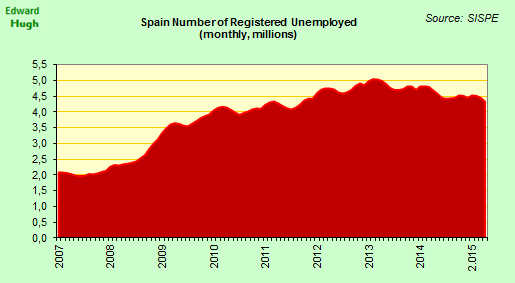

Spain unemployment has now fallen to *only* 4.33 million (23% of economically active).

Spain's labour market had another good month in April, unemployment down sa 50k, and 7.5% (351k) y-o-y.

Italian & Spanish yields now steadily ticking up in lockstep. Only relapse in inflation expectations can change this.

Some tried to argue this was only short term technical blip. Not sure what they're arguing now.

As the housing bubble is popping another bubble is forming: #China's households rotate out of real estate into stocks

China Stocks Tumble Most In 4 Months; Australia Cuts Rates To Record Low http://www.zerohedge.com/news/2015-05-05/china-stocks-tumble-most-4-months-australia-cuts-rates-record-low …

No comments:

Post a Comment