Tweets....

FYI- More tweets intraday at tweet feed ....

Broader Europe...

Ukraine offers coupon cuts, 10-year extension.

- Oops

I think Ruble is reacting to yesterday's Poroshenko debt moratorium announcement. #USDRUB 53.21 Ukraine bonds -2.11%

Morning Note: 1. BoJ inflation gauge back at zero. 2. Swiss 1Q GDP -0.2%. 3. How many terms does Sepp want?

These Swiss Banks were allegedly involved in FIFA corruption:

- UBS

- Julius Bäer

- Hapoalim (Zurich)

http://blick.ch/3806826 (via @Blickch)

Jonathan Ferro retweeted

Strong support among officials at G7 in Dresden for my call for EU to offer Greece take it or leave it deal http://www.wsj.com/articles/time-politicians-handed-greece-an-ultimatum-1432759411?mod=e2tw …

The Greek Analyst retweeted

Literally no one at G7 in Dresden thinks this is true this. Everyone agrees two sides still miles apart.

#Greece to top agenda on last day of #G7 talks. Greek 2yr yields have dropped on deal hopes. http://www.dpa-international.com/news/international/45403301 …

"We have a serious final assembly quality problem," admits Airbus after #Seville #A400M crash http://bit.ly/1KsNWgk

Trade union CC OO says this is an image showing the "massive document destruction" taking place at Madrid City Hall.

Spanish trade union CC OO denounces "massive document destruction" at Madrid City Hall: http://cadenaser.com/emisora/2015/05/28/radio_madrid/1432829843_868908.html …

More photos of the drought at the Amadorio resevoir, via Spain Report reader @Frererabit. https://geogblogcostablanca.wordpress.com/geography-costa-blanca/regional-local-hydrology/amadorio-reservoir-orxeta-28th-may-2015/ …

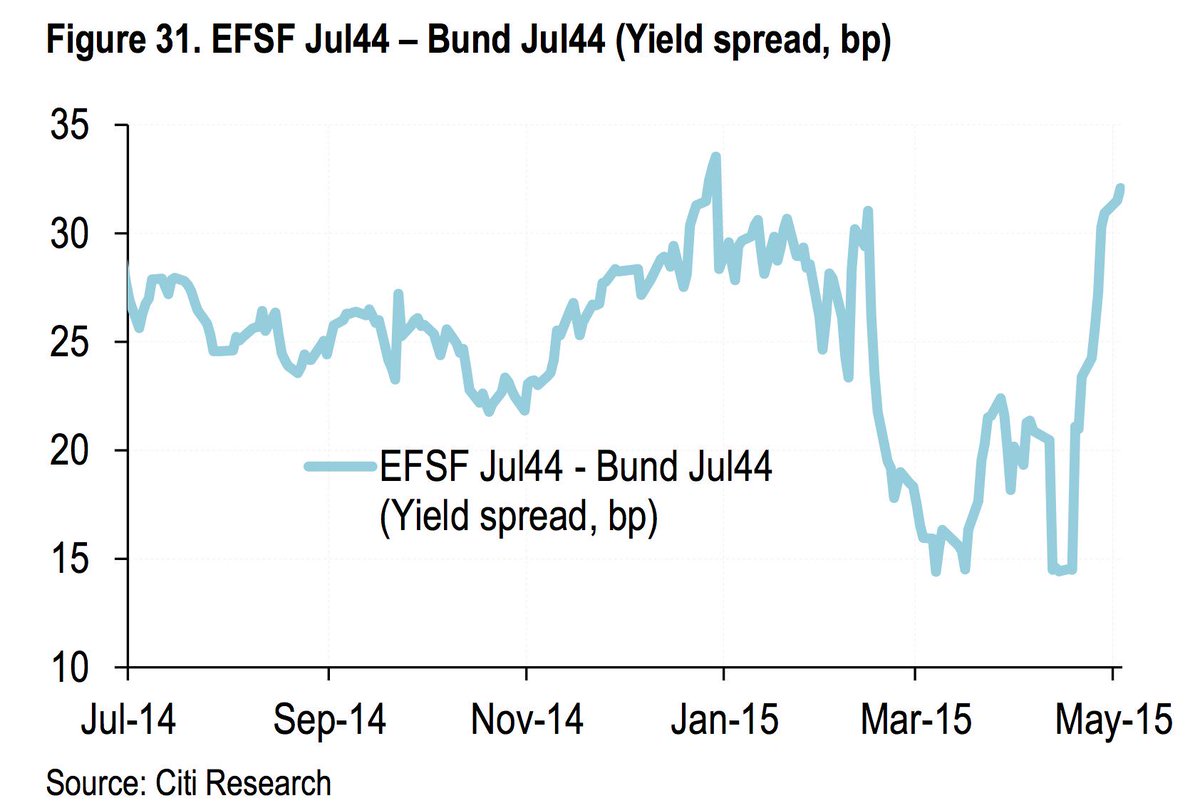

EFSF 30yr spreads to #Germany have exploded as loans to #Greece are 77% of the assets of #EFSF. #Grexit

Strong rebound in German retail sales. Upside surprises to inflation, Spanish version. What else?

Contributions to Q/Q Italy GDP growth in Q1

Private Consumption -0.1%

Investment +0.3%

Government +0%

Inventories +0.5%

Net Exports -0.4%

Greece.....

Frederik Ducrozet retweeted

Greek authorities have till the end of next week to reach a deal with creditors for a disbursement to take place in June. #Euroworkinggroup

Fabrizio Goria retweeted

*VAROUFAKIS SAYS THERE WILL BE NO LEVY ON BANK TRANSACTIONS - blah, blah, blah

The Greek Analyst retweeted

"Bullshit",the reaction of an unnamed repr of the Inst to the question :Is a conclusion of the negotiat.imminent via

http://www.sueddeutsche.de/wirtschaft/g-treffen-warten-auf-taten-1.2498473 …

#Greece MinFin Varoufakis says the institutions still want permanent recessionary measures (such as on VAT tax); GR opposes those. @vimafm

The Greek Analyst retweeted

Open Europe retweeted

Varoufakis says Greece, creditors have agreed on most issues.

- Let's wait for Schäuble's denial

Varoufakis says Greek talks have new developments every day - VIMA Radio

- are you taping all the talks again, DJ Varoufakis?

Next Greek aid program isn’t on table yet, says Moscovici http://dlvr.it/B1JJT2

Greece creditors say no deal near as G-7 frustration vented http://dlvr.it/B1JFDG

Only Greece can end its miserable 'Groundhog Day' http://dlvr.it/B1JHZB

Varoufakis says Greece will not accept recessionary measures.

Minutes earlier he sad:

Greece & creditors agreed on most issues.

Who lies?

Greek, Iranian diplomats eye closer ties, energy cooperation http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_28/05/2015_550501 … #greece

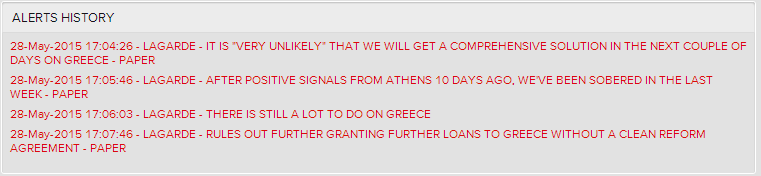

Christine Lagarde: After positive signals from Athens 10 days ago, we've been sobered since (via Reuters)

#Greece: Alpha Bank deposits dropped 16.1% in Q1, NPL ratio rises to 33.8% from 33.0% at end 2014.

As of 15th May, National Bank of Greece's deposit base in Greece had shrunk 15% from end 2014

Won't be much left in #Greece's banks by the time #ECB gets the keys. Deposits down another €5.6 billion in April.

Top news story

Dispatches: The Ugly Truth Behind British Tourists’ Ruined Holidays in Greece http://trib.al/Kwk8EKd

Forward Guidance

Forward Guidance

Simon Nixon

Simon Nixon

Eleni Varvitsiotis

Eleni Varvitsiotis  Michael Hewson

Michael Hewson  Anastasios Telloglou

Anastasios Telloglou  Dealingroom

Dealingroom  Vincenzo Scarpetta

Vincenzo Scarpetta  Graeme Wearden

Graeme Wearden

Yannis Koutsomitis

Yannis Koutsomitis

HRW Dispatches

HRW Dispatches

No comments:

Post a Comment