Tweets....

Updates also at blog tweet feed !

#Kremlin denies reports of multibillion dollar loan agreement with #Greece http://sptnkne.ws/en2 #Putin #Tsipras

Key " Russia didn’t offer financial help because it was not asked,” Peskov told the Russian radio station Bus FM.

There is no agreement with #Greece for a €3~€5bn advance payment over Turkish Stream ~Kremlin spox Peskov http://bit.ly/1b7BqqH /via @riaru

Denials Mount as Greece Robs Peter to Pay Paul; Shell Games and Check Kiting - http://stateofglobe.com/2015/04/18/denials-mount-as-greece-robs-peter-to-pay-paul-shell-games-and-check-kiting/ …

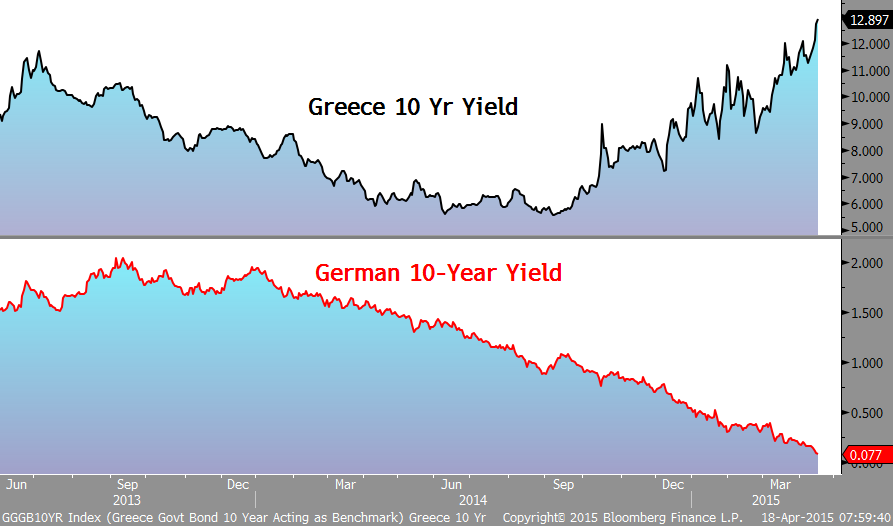

Charts/Themes of the Week: 2) Greece is back in the news, 10-yr close to 13% while German yields hit all-time lows

IMF urges EU to slim down its demands on Greece http://trib.al/3TooERi

Exclusive: Greek PM Tsipras tells @Reuters he's "firmly optimistic" deal will be reached with EU despite friction http://www.reuters.com/article/idUSKBN0N71I320150416 …

€5bn - what #Greece may get over 10 years from the Russian gas pipeline deal

€165bn - the 2nd EU aid package to Greece from 2012 to 2014

Russia to loan Greece ‘up to $5bn’ to join Turkish pipeline http://wp.me/pfwuX-6oj

Greece to sign €5bn gas pipeline deal with Russia on Tuesday http://www.telegraph.co.uk/finance/economics/11546965/Russian-gas-deal-will-net-Greece-5bn-and-turn-the-tide.html …

State of Globe

State of Globe  Charlie Bilello, CMT

Charlie Bilello, CMT

Jamie McGeever

Jamie McGeever

Gergely Polner

Gergely Polner

Stratfor

Stratfor

No comments:

Post a Comment