3/15/15 Tweets...

Biggest #Ukraine bond holders (incl Franklin Templeton & @PIMCO) form group, hire Blackstone for restructuring talks http://on.ft.com/1HTTorB

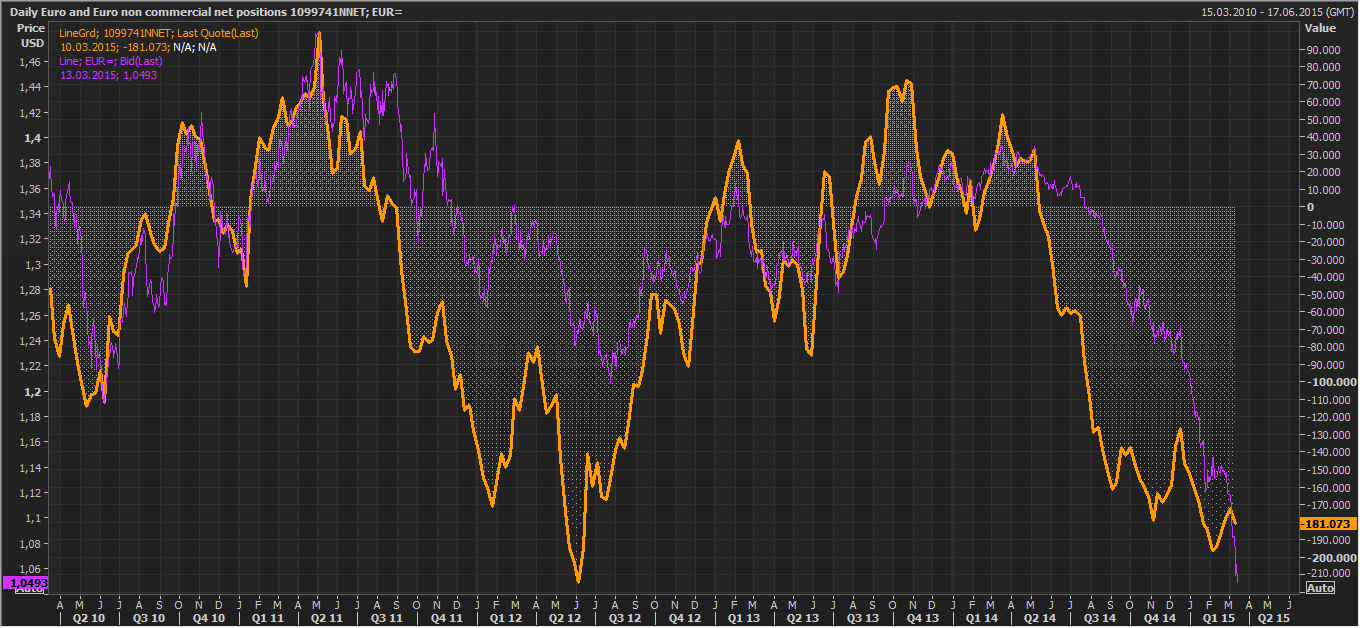

#ECB’s Visco says #Euro decline ’stronger than we had expected’ since QE. http://news.forexlive.com/!/bank-of-italys-visco-says-the-euro-is-weakening-faster-than-expected-since-qe-20150314 …

EU extends sanctions over #Ukraine for another 6 months http://on.rt.com/98j8s9

EU executive warns of Grexit 'catastrophe', urges euro solidarity - http://www.reuters.com/article/idUSKBN0M90PH20150314 …

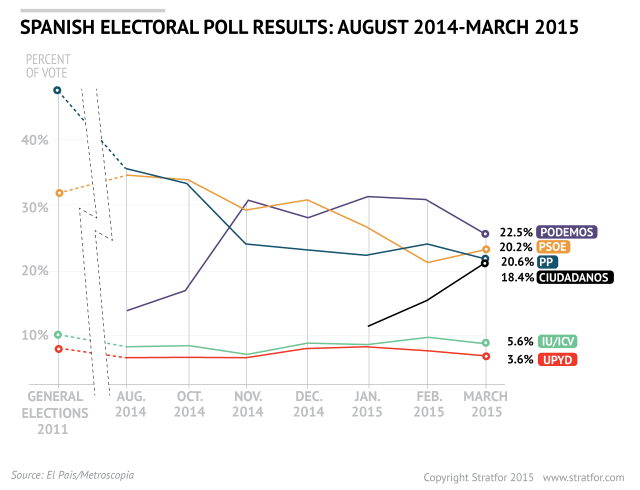

A shift in Spain's political landscape - RT @Stratfor Spain's Podemos Party Faces a Challenger http://social.stratfor.com/wB6

3/14/15 - Tweets.....

#Italy, #Spain to follow if #Greece exits eurozone, says Greek Defense Minister. http://dw.de/p/1Eqql #Grexit

#Greece's FinMin Varoufakis says QE to fuel unsustainable equity rally & are unlikely to boost euro zone investments. http://www.reuters.com/article/2015/03/14/ecb-qe-varoufakis-idUSL6N0WG09B20150314 …

Liquidity crisis also exist when there are no signs of queues or panic at ATMs MT @ArisMessinis Homeless ATM #Greeece

Albert Broomhead retweeted

Ongoing protest in Thessaloniki. for stopping #skouries citizens prosecutions for anti-gold protests TRMT @stenikito

Edward Hugh retweeted

Has anyone seen Putin?

#Ukraine says creditors face losses on Dollar bonds. Investors already priced in a default. http://bloom.bg/1NSVwnV

#Ukraine has lethal aid deals with 11 EU countries – Poroshenko http://on.rt.com/p0gw3m

US threatens to cut Russia off from SWIFT; SWIFT puts Russia on the board. Major diss for an overweening USG. http://bit.ly/1BFvzD2

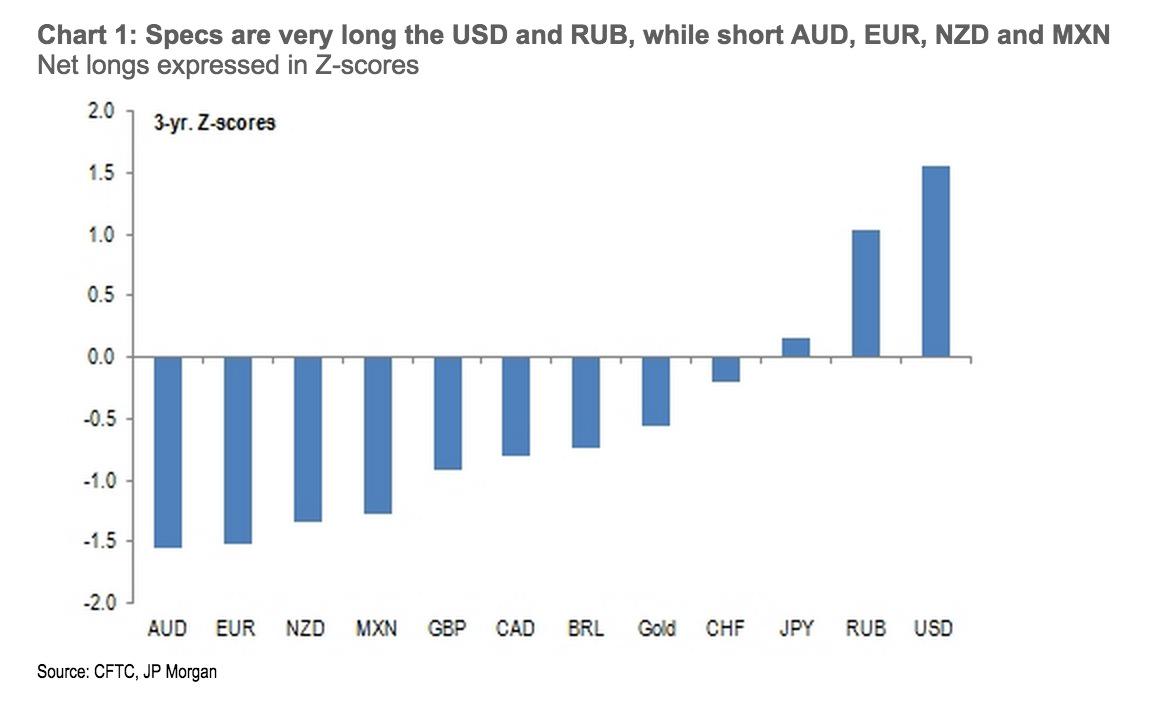

Specs are very long USD & RUB, while extremely short AUD, EUR. #Gold positioning has declined dramatically. (via JPM)

#Euro ended at a fresh 12yr low as specs extended short positions. Acc to JPM risk-reward in chasing the Euro is poor

SLJ: EM currencies will likely face extremely hostile conditions in months ahead. USDBRL has moved from 1.50 to 3.20, w/o any Fed tightening

Is This The Catalyst For The Next Big Leg Down In Oil Prices & Energy Stocks? http://www.zerohedge.com/news/2015-03-13/catalyst-next-big-leg-down-oil-prices-energy-stocks …

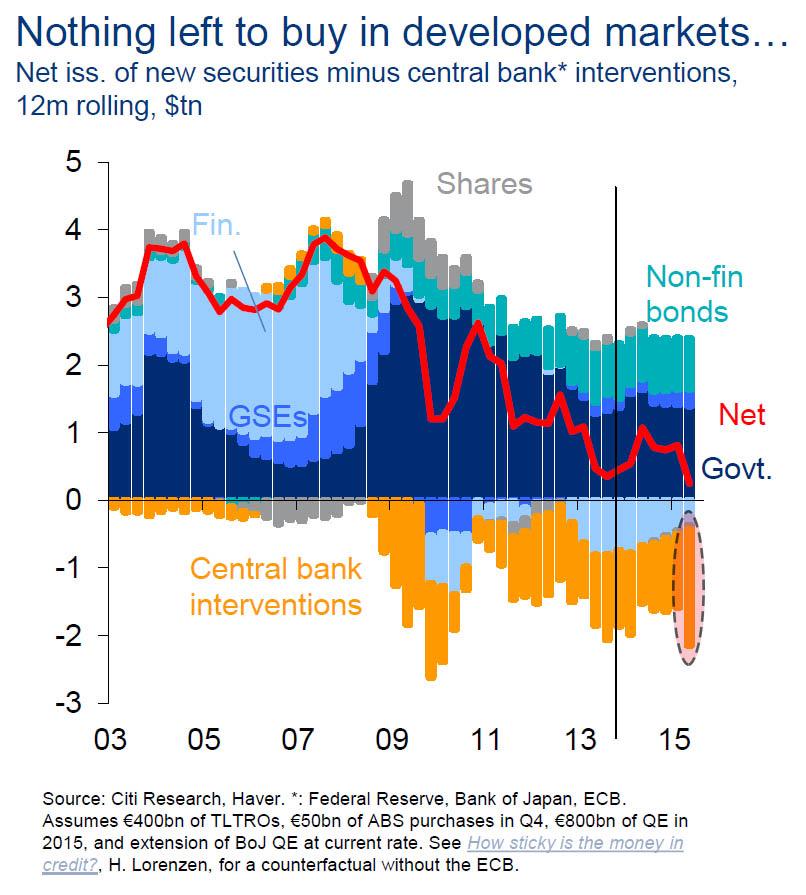

2015 will be a record year for central bank intervention because things have never been better

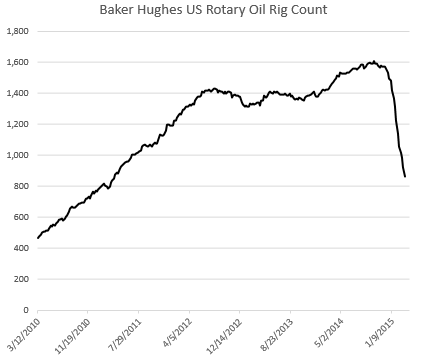

It's impressive that US rig count is now at 2011 levels, yet production continues to climb. Is OPEC going to blink?

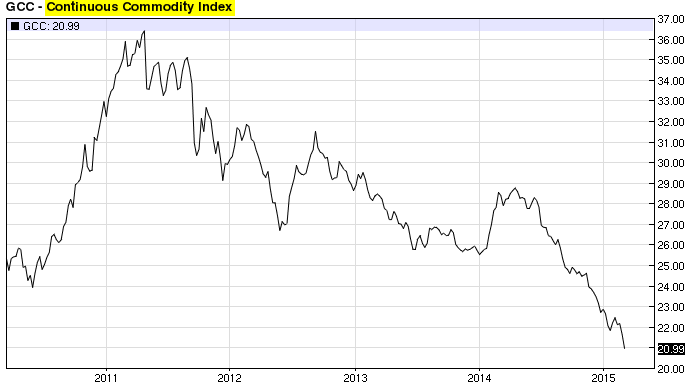

Chart: Continuous Commodity Index -

At zero interest rates, it is very difficult for the German insurance industry to remain solvent http://ow.ly/3xvxTT

No comments:

Post a Comment