Update - Tsipras speech of 2/8/15 Very important !

Tsipras' speech in English via @tsipras_eu #Greece

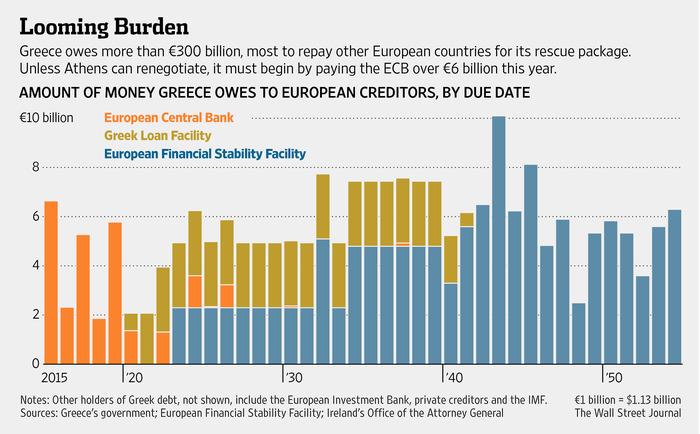

In response to the negative feedback from EuroGroup and Germany against the Greek Government reform efforts and agenda largely directed toward resolving an agreed unsustainable and ultimately unpayable debt owed to the officials creditors ( ESFS / IMF and ECB )

Paul Mason retweeted

Greece's looming debt payment deadlines http://www.wsj.com/articles/greek-government-plays-down-european-central-bank-decision-1423135592?mod=WSJ_hp_LEFTWhatsNewsCollection …

Yves Smith retweeted

Key dates in the Greek calendar

we saw protests in Greece on Thursday.

"We don't yield, we have no fear"! Anti-austerity protest & Support for #Syriza government #Greece #ECB #EU

And Greece played the Russia card..........

#Putin and #Tsipras agreed on phone to boost cooperation in economy & energy, tourism, culture & transport sectors reports @ekathimerini

#Putin yesterday invited #Tsipras to event in Moscow in May to mark the victory over Nazism: @ekathimerini http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_05/02/2015_546951 … #Sryiza

The Troika response came Friday......

First salvo came from S&P.....

Later Moody's chimes in.......

Moody's places Greece's Caa1 government bond rating on review for downgrade https://www.moodys.com/research/Moodys-places-Greeces-Caa1-government-bond-rating-on-review-for--PR_317662?WT.mc_id=AM~UmV1dGVyc05ld3NfU0JfUmF0aW5nIE5ld3NfQWxs~20150206_PR_317662 …

But the Cat's paw move came from EuroGroup itself - announcing the ten day deadline !

http://ekathimerini.com | A kick in the teeth from the ECB http://www.ekathimerini.com/4dcgi/_w_articles_wsite3_1_06/02/2015_546972 … via @ekathimerini An interesting item to consider !

GREECE MUST APPLY FOR BAILOUT EXTENSION ON FEB 16 AT THE LATEST TO KEEP EURO ZONE FINANCIAL BACKING -DIJSSELBLOEM

Eurogroup Gives Greece A 10 Day Ultimatum http://www.zerohedge.com/news/2015-02-06/eurogroup-gives-greece-10-day-ultimatum …

This followed ECB denial of Greece Government request to issue more T Bills.....

#ECB's GC rejects #Greece govt's request for extra €4.5bn T-bills issuance. /via @euro2day_gr #Grisis | Fait accompli...

Which followed the ECB decision to cutoff Greek Banks ......

#ECB's Liikanen defends decision to cut off funding to Greek banks http://reut.rs/16PqJr4 #Grisis #euro

Greece present financial , political and strategic situation ..... news and views

2/8/15 Tweets....

#Greece gov't not seeking a 'bridge loan' from the Eurozone, to ask for removal of €15bn ceiling on T-bills issuance ~reports | #Grisis

#Greece govt's 'moratorium' proposal to the Eurogroup: Both parties will refrain from unilateral actions, Greek gov't receives a bridge loan

#Greece PM Tsipras to give 1st policy speech in parliament 1700 GMT. Acc to govt sources he'll announce 'moratorium' in reversal of reforms.

#Greece fin needs over next 5 yrs may amount to €30~35bn. W primary surpls @ 1~1.5% &no privatisations fin needs wd rise to €60bn ~Unicredit

'

Can #Greece Make a Deal with Europe? Part 1: Why and When a Deal Must Be Struck' ~Jacob Funk Kirkegaard http://ift.tt/1zg9Xax ~@PIIE_com

Greek govt refusing to take anymore IMF tranches is illogical. How r they going to repay IMF's €8.7b loan &interst for 2015? Markets r closd

Open Europe retweeted

Belgian Fin Min:"#Grexit would cause chaos in Greece but we can control the conseq for the rest of the #eurozone" http://deredactie.be/cm/vrtnieuws/politiek/1.2231851?google_editors_picks=true …

Greek banks can borrow max €33B from cenbank, banking system could withstand another deposit outflow wave "but not a very big one"-JP Morgan

#Greece poll: 72% support the Greek gov't in a confrontation with the Eurozone & the IMF, 22.5% say its wrong. #Grisis /via @skaigr

[In Eurogroup's Working Group mtng] "it was #Greece against all others, basically one versus 18" ~Eurogroup official to Reuters

Greece Still Defiant After ECB Mugging: Some brief updates, with more on Monday. http://bit.ly/1xzaXpJ

"If the ECB triggers a bank run in Greece, government would likely resort to capital controls, seek bilateral funding outside euro system."

Nonsense... "The #ECB move I confidently predict, will precipitate not just a run on Greek banks..." http://www.socialeurope.eu/2015/02/ecb-2/ @socialeurope

The 4th February late-night decision by the European Central Bank to reject Greek bank collateral for monetary policy operations will, I confidently predict, precipitate not just a run on Greek banks; not just greater price instability across the Eurozone – but ultimately, the collapse of the fantastic machinery that is the ‘self-regulating’ economy of the Eurozone.

Please Share! My latest 4 the @guardian "Stop squeezing #Syriza. We can’t afford another wrong turn in #Europe" http://gu.com/p/45t9m/stw

george mastropavlos

george mastropavlos

No comments:

Post a Comment