Tweets - 1/24/15...

Poland , Romania and Croatia dealing with fallout from Swiss Franc move by SNB.....

Banking crisis coming to Poland http://buswk.co/1JoNZrT

Polish Finance Minister Mateusz Szczurek is prodding banks to abide by a pain-sharing agreement to help borrowers with $35 billion in Swiss-franc home loans or face pressure for more sweeping measures that may inflict losses.

***

Retweeted 124 times

WOW. Croatia votes to peg currency against Swiss franc over mortgage mess. http://on.ft.com/1Jtc00W

RT @RRAEnglish: Implications of the soaring Swiss Franc http://owl.li/HRIGa

Tweets.....1/23/15...

1/12/15 missive ...

Man Asked To Speak To Chinese Officials Warns Of Cascading Series Of Global Defaults http://kingworldnews.com/man-asked-speak-chinese-officials-warns-disastrous-series-defaults/ …

If Ing is correct , watch CitiB

1/22/15 missive ....

kingworldnews.com/man-predicted-collapse-euro-swiss-franc-issues-second-terrifying-prediction/ … This is definitely something that you won't hear on CNBC and certainly not drifting out of Davos.

1/23/15 missive ...

Man Asked To Speak To Chinese Officials Warns World To Plunge Into Total Chaos And Panic In 2015 http://kingworldnews.com/man-asked-speak-chinese-officials-warns-world-plunge-total-chaos-panic-2015/ … You are on notice

http://www.zerohedge.com/news/2014-12-07/total-derivatives-decline-3-q2-only-691-trillion

Who says macroprudential regulation doesn't work: according to the BIS, notional amounts of outstanding OTC derivatives contracts fell by 3% to "only"

$691 trillion at end-June 2014. This is also roughly equal to the total derivative notional outstanding just before the Lehman collapse, when global central banks volunteered taxpayers to pump a few trillion in capital to meet global variation margin calls. Clearly the system, in the immortal words of Jim Cramer, is "fine."

$691 trillion at end-June 2014. This is also roughly equal to the total derivative notional outstanding just before the Lehman collapse, when global central banks volunteered taxpayers to pump a few trillion in capital to meet global variation margin calls. Clearly the system, in the immortal words of Jim Cramer, is "fine."

*****

http://www.zerohedge.com/news/2014-12-12/presenting-303-trillion-derivatives-us-taxpayers-are-now-hook

****

Exhibit A: US banks are the proud owners of $303 trillion in derivatives (and spare us the whole "but.. but... net exposure" cluelessness - read here why that is absolutely irrelevant when even one counterparty fails):

Exhibit B: Here are the four banks that are in complete control of the US "republic."

****

http://www.zerohedge.com/news/2014-09-25/5-us-banks-each-have-more-40-trillion-dollars-exposure-derivatives

****

What I am about to share with you is very troubling information.

I have shared similar numbers in the past, but for this article I went and got the very latest numbers from the OCC's most recent quarterly report. As I mentioned above, there are now five "too big to fail" banks that each have more than 40 trillion dollars in exposure to derivatives...

JPMorgan Chase

Total Assets: $2,476,986,000,000 (about 2.5 trillion dollars)

Total Exposure To Derivatives: $67,951,190,000,000 (more than 67 trillion dollars)

Citibank

Total Assets: $1,894,736,000,000 (almost 1.9 trillion dollars)

Total Exposure To Derivatives: $59,944,502,000,000 (nearly 60 trillion dollars)

Goldman Sachs

Total Assets: $915,705,000,000 (less than a trillion dollars)

Total Exposure To Derivatives: $54,564,516,000,000 (more than 54 trillion dollars)

Bank Of America

Total Assets: $2,152,533,000,000 (a bit more than 2.1 trillion dollars)

Total Exposure To Derivatives: $54,457,605,000,000 (more than 54 trillion dollars)

Morgan Stanley

Total Assets: $831,381,000,000 (less than a trillion dollars)

Total Exposure To Derivatives: $44,946,153,000,000 (more than 44 trillion dollars)

And it isn't just U.S. banks that are engaged in this type of behavior.

As Zero Hedge recently detailed, German banking giant Deutsche Bank has more exposure to derivatives than any of the American banks listed above...

Deutsche has a total derivative exposure that amounts to €55 trillion or just about $75 trillion. That’s a trillion with a T, and is about 100 times greater than the €522 billion in deposits the bank has. It is also 5x greater than the GDP of Europe and more or less the same as the GDP of… the world.

****

http://www.zerohedge.com/news/five-banks-account-96-250-trillion-outstanding-derivative-exposure-morgan-stanley-sitting-fx-de

Lastly, and tangentially on a topic that recently has gotten much prominent attention in the media, we present the exposure by product for the biggest commercial banks. Of particular note is that while virtually every single bank has a preponderance of its derivative exposure in the form of plain vanilla IR swaps (on average accounting for more than 80% of total), Morgan Stanley, and specifically its Utah-based commercial bank Morgan Stanley Bank NA, has almost exclusively all of its exposure tied in with the far riskier FX contracts, or 98.3% of the total $1.793 trillion. For a bank with no deposit buffer, and which has massive exposure to European banks regardless of how hard management and various other banks scramble to defend Morgan Stanley, the fact that it has such an abnormal amount of exposure (but, but, it is "bilaterally netted" we can just hear Dick Bove screaming on Monday) to the ridiculously volatile FX space should perhaps raise some further eyebrows...

what to watch...... Swiss franc naturally

Swiss franc jumped 40% in 13 min, gold could do the same - Goldcore Ltd exec dir @MarkTOByrne

https://soundcloud.com/rttv/goldcore

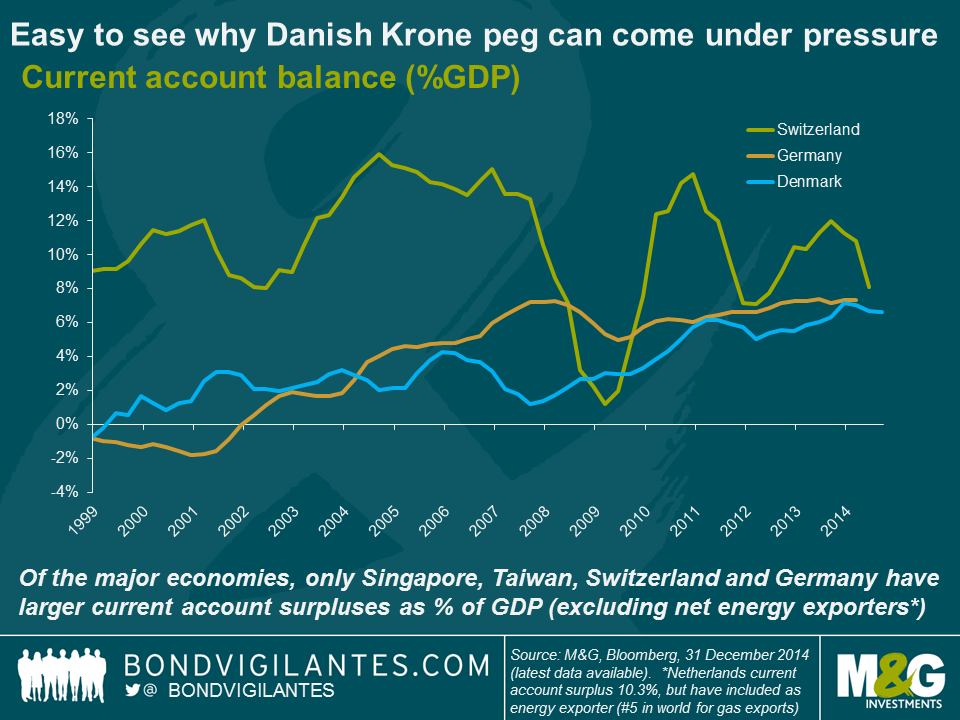

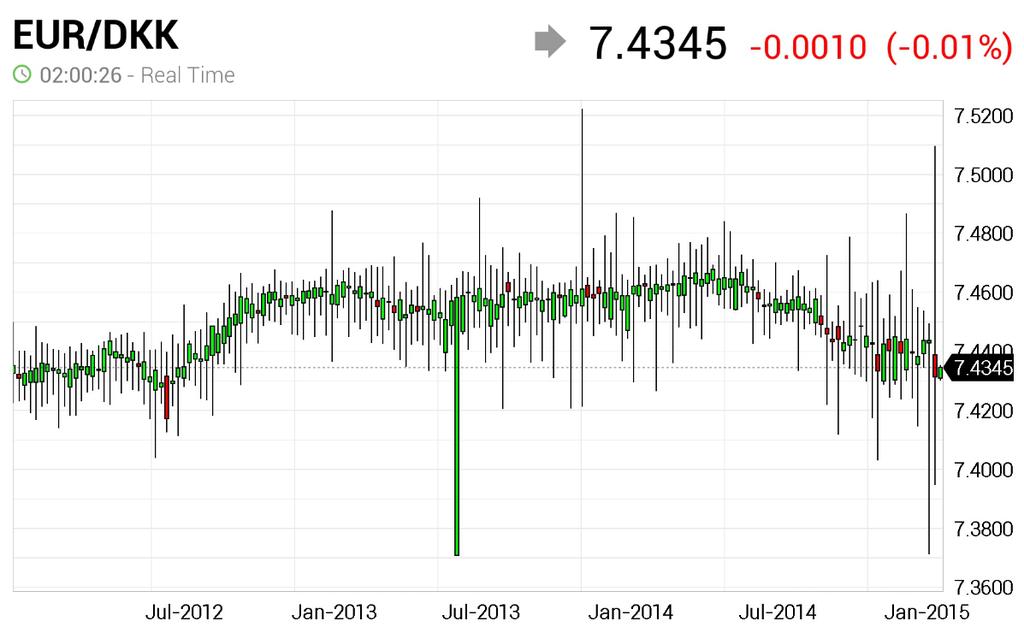

Denmark cut its main interest rate for the 2nd time this week as it sought to dampen investor interest in the krone http://trib.al/pfaJhNQ

It’s easy to see why the Danish krone/euro peg can come under pressure

Russian Market

Russian Market  Robin Wigglesworth

Robin Wigglesworth  Romania Actualitati

Romania Actualitati

Quartz

Quartz

Susan

Susan  MarketWatch

MarketWatch

No comments:

Post a Comment