Evening Tweets....

The ECB Just Changed the Ball Game for Other Central Banks http://ow.ly/HNlHI #currencywars #Switzerland #Sweden #Denmark

Here Are The Negatives In Today's ECB QE Announcement http://www.zerohedge.com/news/2015-01-22/here-are-negatives-todays-ecb-qe-announcement …

"A €1000bn QE programme would only boost price levels by 0.2-0.8 after two years" - SocGen

UKRAINE ’URGENTLY NEEDS FINANCIAL ASSISTANCE,’ SOROS SAYS. can the ECB please monetize Ukraine bonds?

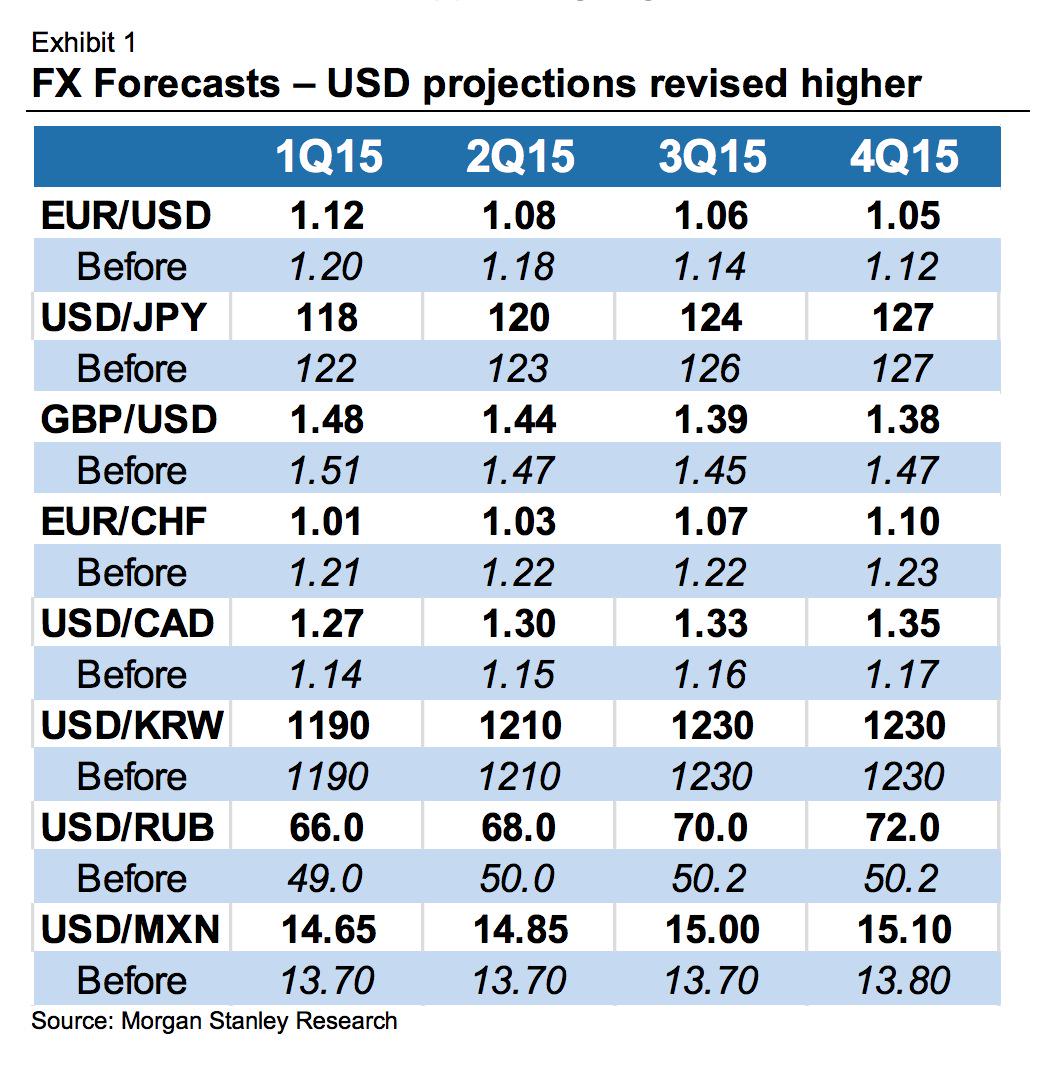

Morgan Stanley cuts #Euro forecasts after #ECB's historic QE move. Sees now $1.05 for end-2015 vs $1.12.

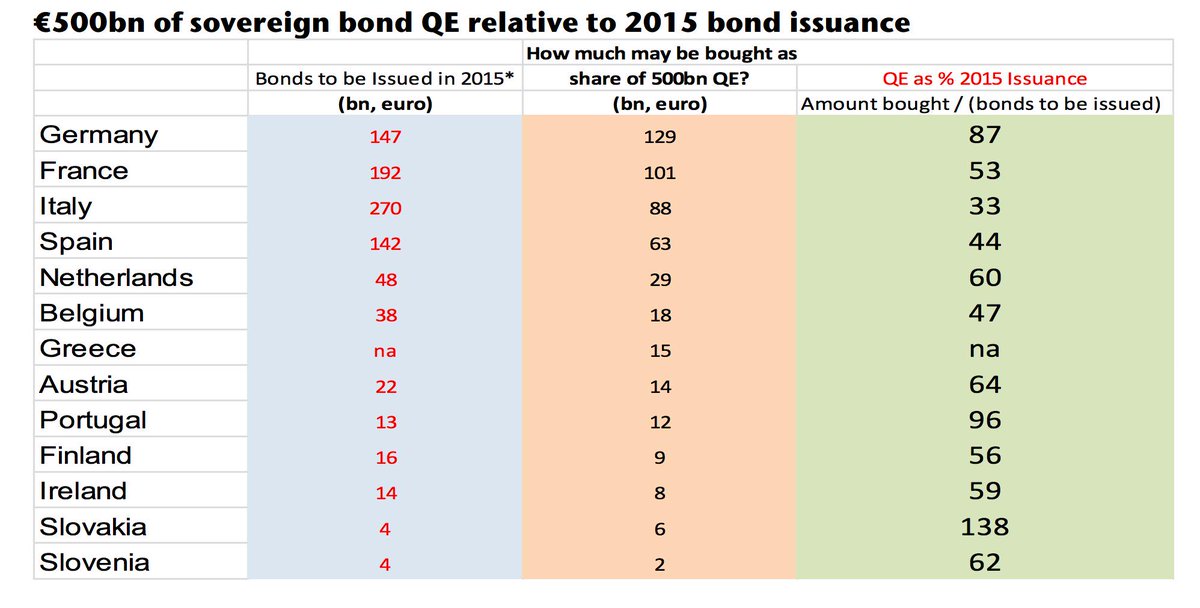

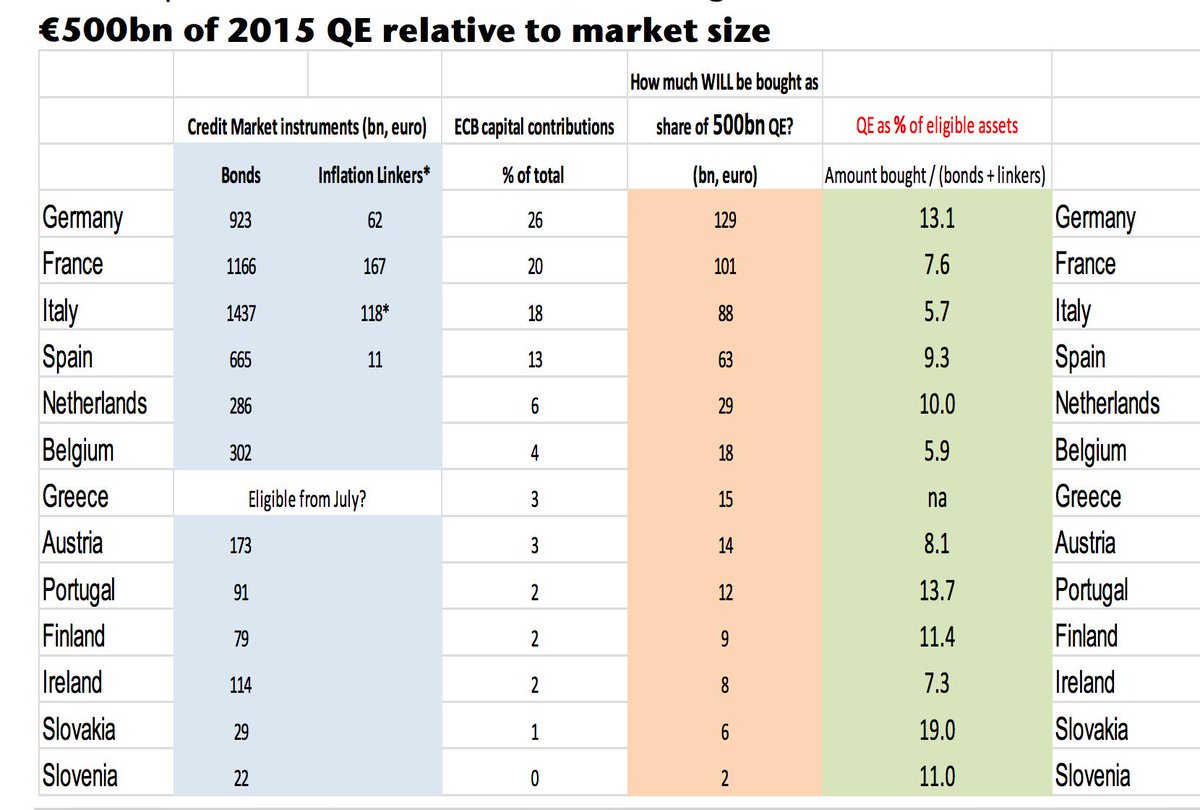

Why #Germany, #Portugal and #Slovakia stand out as being particularly affected by #ECB #QE. (tables by Jefferies)

Next technical level to watch in EUR/USD would be the 61.8% retracement level at 1.1213. Now 1.1475. (via Pierpont)

Danish CB cut rates, again: DANISH CENTRAL BANK CD RATE -0.35% from -0.20%

#Draghi stressed #ECB is the "sole decision maker" on #QE, suggests NCBs cannot stop purchases even if they wanted to http://openeurope.org.uk/blog/ecb-qe-larger-expected-unlikely-enough-solve-eurozone-woes/ …

Hard for #Greece to get #ECB #QE - needs review done, prog confirmed & ECB owns 30% its debt already http://openeurope.org.uk/blog/ecb-qe-larger-expected-unlikely-enough-solve-eurozone-woes/ …

Morning Tweets....

#ECB is about to make history.

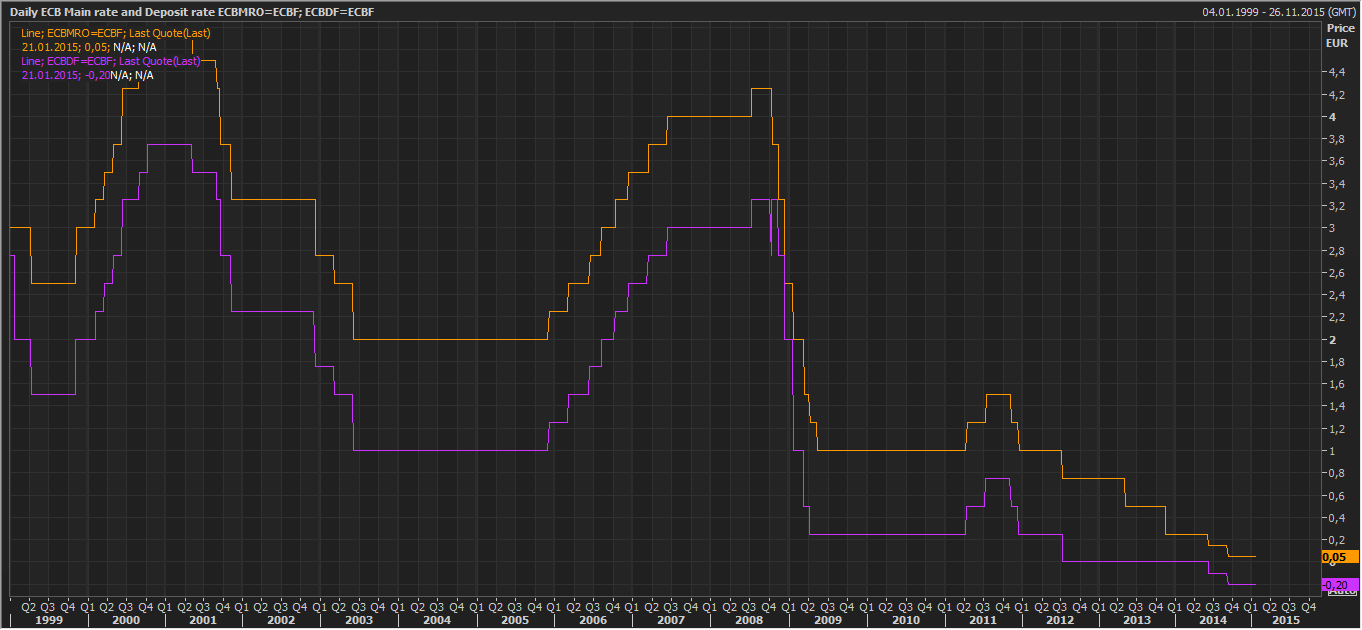

ECB leaves interest rates unchanged - the big news comes at 8:30 EST on the Conference call !

UNCHANGED

ECB SAYS FURTHER MEASURES TO BE ANNOUNCED LATER

As we head into #ECB, there is talk of a more substantial program. Bunds sold off. 10yr ylds jump to 0.57% (via Citi)

Market Wrap: Futures Unchanged As Algos Patiently Await The ECB's "Monumental Decision" http://www.zerohedge.com/news/2015-01-22/market-wrap-futures-unchanged-algos-patiently-await-ecbs-monumental-decision …

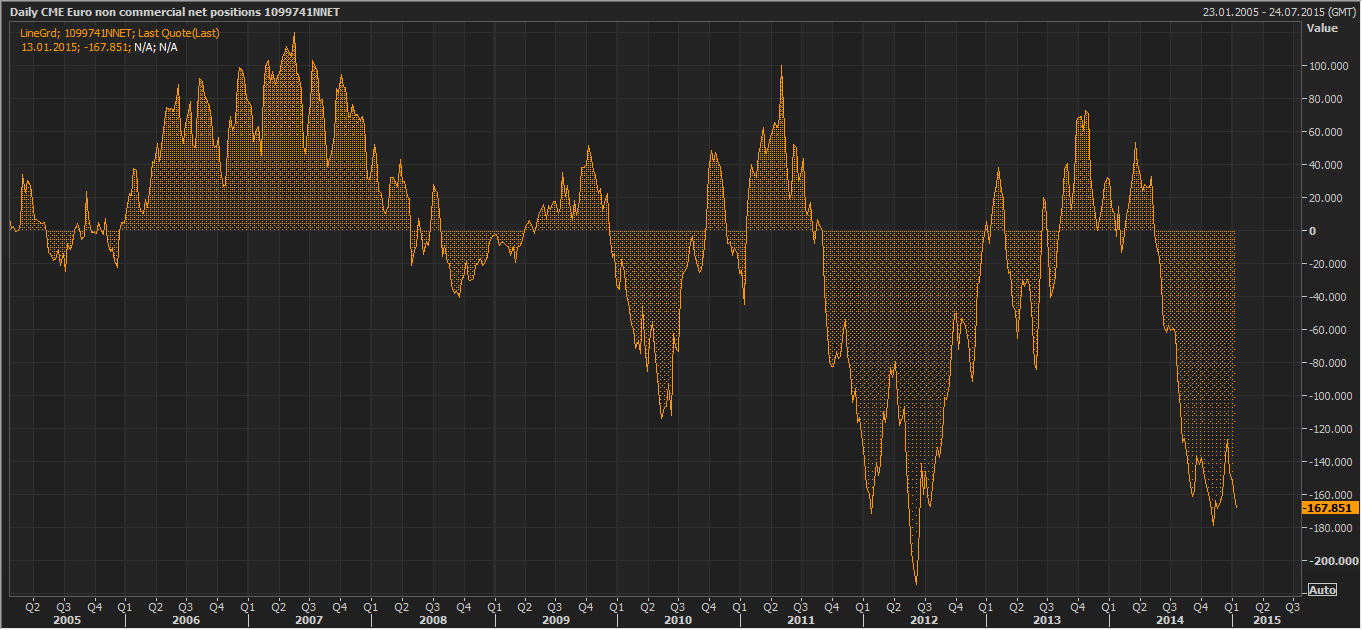

How #Euro short is the market going into ECB? A lot. Leveraged community bets w/ net 167,851 positions on lower Euro.

Elections 2015 | Facts & Figures http://www.ekathimerini.com/4dcgi/_w_articles_wsite3_1_21/01/2015_546422 … #Greece #ekloges2015

.@OpenEurope's need-to-know ahead of today’s crucial #ECB meeting http://openeurope.org.uk/daily-shakeup/ecb-considers-e50bn-sovereign-debt-purchases-per-month/#flexi-box … #QE

Open Europe retweeted

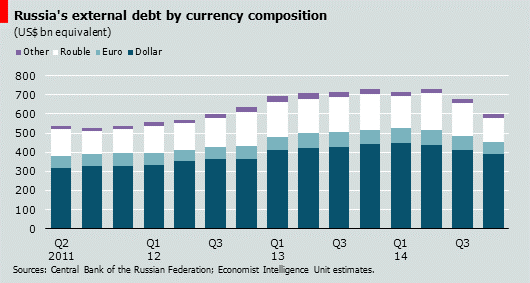

Russian extnl debt fell $130bn in H22014, but $50-$60bn due to $ impact of depreciation on rouble-denominated debt.

Chart: Swiss 1-year government yield. Significant deflation being priced in -

Greek success story continues at all odds to defy g̶r̶a̶v̶i̶t̶y̶ #NDexit RT@teacherdude Greek public debt reaches 176% of GDP. @EU_Eurostat

Tsipras' Financial Times column -> MT @ThierryBeysson End Austerity Before Fear Kills Greek Democracy http://www.socialeurope.eu/2015/01/end-austerity-fear-kills-greek-democracy/ … #ekloges2015

No comments:

Post a Comment