Connecting some dots..... Updates since the Original post immediately below...

Must read pice from Brandon Smith may give insights as to part of the rush to axe Russia seemingly now ! IMF Spring Meeting set for 4/17 to 4/19 - 2015

Blacklisted News ....

“A full-blown currency and financial-crisis scenario seems to be unfolding in Russia in what was supposed to a quiet week as we head into the holiday season,” Slava Smolyaninov, deputy head of research, wrote in an e-mailed report today. “There is a risk that the economy will come to a sudden stop, along with the banks and the overall financial system. Hence, we may have underestimated the level of financial risk in the event of a full-fledged panic. A bank run could be in the cards.”

Links....

Rouble volatile as Russia begins selling currency reserves – business live

Russia Tries Emergency Steps for Second Day to Stem Ruble Rout

Anti War....

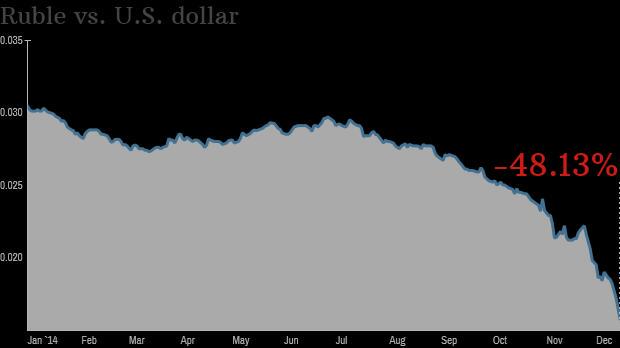

Russia’s current economic problems center around weakness in the ruble. Russia’s central bank raised interest rates yesterday to try to stave off further inflation, but the weakness continued in today’s trading.

Russia’s current economic problems center around weakness in the ruble. Russia’s central bank raised interest rates yesterday to try to stave off further inflation, but the weakness continued in today’s trading.

The bill gives President Obama the ability to waive the sanctions against individual companies if he thinks it is in national security interests, and officials said he was pleased with this “flexibility.”

The bill gives President Obama the ability to waive the sanctions against individual companies if he thinks it is in national security interests, and officials said he was pleased with this “flexibility.”

Ukraine - looking at not just the restive East Regions but the restive rest of Ukraine ... Illustrative items of note... Ukraine simply couldn't vanquish the Separatists and Putin and Russia became the villain of the set piece..

Must read pice from Brandon Smith may give insights as to part of the rush to axe Russia seemingly now ! IMF Spring Meeting set for 4/17 to 4/19 - 2015

IMF Now Ready To Slam The Door On The U.S. And The Dollar http://www.zerohedge.com/news/2014-12-17/imf-now-ready-slam-door-us-and-dollar …

Russian Food Suppliers Have Begun Halting Shipments http://www.zerohedge.com/news/2014-12-17/russian-food-suppliers-have-begun-halting-shipments

Blacklisted News ....

US TARGETING HUNDREDS OF MILLIONS OF RUSSIAN CIVILIANS

POWER MOVES: US-CUBA DEAL ISOLATES AND WEAKENS RUSSIA

RUSSIAN BANK RUN COULD BE ‘IN THE CARDS,’ URALSIB CAPITAL SAYS

AS RUBLE DIES, RUSSIA SELLS CROWN JEWELS TO STEM THE CHAOS

Links....

In the news

The Guardian - 4 hours ago

Bloomberg - 2 hours ago

Anti War....

White House Brags Sanctions Put Russia On ‘Brink of Collapse’

Crippling Russian Economy Could 'Force' Putin to Obey US

by Jason Ditz, December 16, 2014

Confirming that they intend to impose a new round of sanctions on Russia, White House officials are seeking to claim “credit” for Russia’s recent economic woes, bragging that they have put Russia on the brink of an economic collapse.

Russia’s current economic problems center around weakness in the ruble. Russia’s central bank raised interest rates yesterday to try to stave off further inflation, but the weakness continued in today’s trading.

Russia’s current economic problems center around weakness in the ruble. Russia’s central bank raised interest rates yesterday to try to stave off further inflation, but the weakness continued in today’s trading.

Wilson Center scholar Matthew Rojansky defended the sanctions, saying the logic behind them is to damage the Russian economy so much that it “starts hurting the Russian public’s ability to buy food or heat homes,” forcing Putin to act in the face of the crisis.

Russia’s economy is far from pushing the average citizen to the brink of starvation, however, though a new round of sanctions at this point makes it clear that is indeed the US goal.

Obama Will Sign New Russia Sanctions Bill

Kerry Says Sanctions Could Be Lifted If Putin Takes 'Steps'

by Jason Ditz, December 16, 2014

The White House has confirmed today that President Obama will sign a bill into law imposing a new round of economic sanctions on Russia and authorizing military aid to Ukraine. The bill was “passed” by “Congress” earlier this week, which is to say the three members of Congress present at the time unanimously agreed to it.

The bill gives President Obama the ability to waive the sanctions against individual companies if he thinks it is in national security interests, and officials said he was pleased with this “flexibility.”

The bill gives President Obama the ability to waive the sanctions against individual companies if he thinks it is in national security interests, and officials said he was pleased with this “flexibility.”

The sanctions are nominally punishment for supporting the rebellion in eastern Ukraine, even though Russia has brokered a ceasefire in the region that is holding.

Despite Russia being the primary driving force behind the ceasefire, and the US not being keen on the truce at all, Secretary of State John Kerry says that the US could lift all sanctions on Russia in a matter of days if they take the “right steps” toward resolving the crisis in eastern Ukraine. What exactly these steps are from the US perspective remain unclear.

Ukraine - looking at not just the restive East Regions but the restive rest of Ukraine ... Illustrative items of note... Ukraine simply couldn't vanquish the Separatists and Putin and Russia became the villain of the set piece..

Putin discusses Donbas situation with Merkel, Hollande, Poroshenko: Kremlin

http://sputniknews.com/politics/20141217/1015917810.html …

This says Ukraine had over 200,000(!) soldiers serving in the East http://news.yahoo.com/ukraine-defense-chief-wants-budget-doubled-fight-separatists-114749150--business.html …

Ukraine, Separatists Fail To Agree On New Round Of Peace Talks http://goo.gl/QwXm6u

Ukraine suspends social welfare in benefits in East after separatist election.Read @tanais_ua on elections & reforms http://fride.org/publication/1228/will-ukraine's-new-parliament-speed-up-reforms …?

#Elections in east #Ukraine 'unfortunate and counterproductive': #UN chief http://n.mynews.ly/!MB.B3eTw via @NewsRepublic @afp @KyivPost #Kyiv

Ukraine financial strains prevent victory over the Separatists and things seem likely to fall apart at the seams..... ...

http://www.capital.ua/en/publication/36426-biznes-neset-ubytki-iz-za-avariynogo-otklyucheniya-osvescheniya-po-vsey-strane

Tweets.....

Businesses sustaining losses due to emergency

power outages across the country

Many retailers and restaurateurs are forced to work without power for hours

Photo: Konstantin Melnitskiy

Over the last week, Sky Mall, which is one of the largest Ukrainian shopping malls, has been emptying out for a few hours every day. This is an unusual situation on the eve of the holiday season. “Electricity is being cut off for a few hours from Monday to Friday,” says representative of Sky Mall Olha Tkachenko. Power is cut off suddenly, at different times of the day, which immediately blocks operation of the mall. This means tenants cannot provide services to customers.

Kyivenergo is limiting the consumption of power and is cutting off power to industrial enterprises, the company’s official statement reads. In this way Kyivenergo is fulfilling the requirements of the Ukrenergo National Energy Company. It ensures that for consumers electricity will be cut off for no more than two hours. “Kyivenergo demanded that Sky Mall reduce power consumption by 20%, which means it is forced to turn off certain systems,” says Tkachenko.

Faulty operation

The tenants in Sky Mall are not the only ones facing power outages. CEO of the Ultra Group of Companies (Baldinini, Levi's, Pierre Cardin, Lagerfeld and Guess) Andriy Makarov says the power is cut off from time to time at the Promenada Shopping Mall.

Tenants of premises and facilities outside the shopping malls face the same problem. “Last Monday, power was cut off at 11:00 am and turned back on around 4:00 pm. The refrigerators in the kitchen, the cooling system in the bar, the coffee machines and the electric heating system were left without power,” says co-owner of the ProRock Pub Denys Novikov. He said the managers had no choice but to close the establishment because working in the kitchen with candles is a violation of fire safety regulations. Power is being switched off even in the downtown area of Kyiv, adds co-owner of the Fanera Project Company (fan-bar Banka, Zheltok) Anton Beletskiy.

“But the greatest difficulties are in the regions, particularly in Dnipropetrovsk,” says co-owner of Zeebra (Butlers, Six, I am, Glossip, Peacocks) Dmytro Yermolenko. Makarov says that Ultra was forced to close its stores in Odesa and Zaporizhzhia for some time.

“According to our observations, this week power outages were non-systemic and affected some districts in the cities in the Dnipropetrovsk, Zaporizhzhia, Poltava, Odesa and Sumy oblasts,” said Chief Operating Officer at Rush (EVA chain of stores) Oleksiy Zozulya. Power outages were also observed in Kharkiv.

Given the force majeure circumstances, business owners are not daring to count their losses. Managing Partner at the Retainet Consulting Company Oleksandr Lanetskiy believes that 2–3 hour power cuts in grocery supermarkets lead to losses of several thousands of dollars per day. The most important thing is that the equipment does not fail. Indeed, the press service of the Varus grocery store chain said that power is often cut off without fair warning.

For restaurateurs the average revenue drops by 50% when electricity is cut off at night and the restaurants cannot prepare hot meals, CEO of the Restaurant Consulting Company Olha Nasonova estimated.

Seeking a solution

Such a situation may affect retail sales during the holiday season, which is considered to be the most profitable time of the year. Yermolenko says that traditionally chains of stores sell 100–150% more goods in December compared to other months of the year. But now stores in shopping malls are not only facing power cutoffs, but also calls from “bombers”. “Ocean Plaza alone was checked for explosives more than ten times,” said the expert, adding that in such cases the stores and markets have to close their doors for half a day or even a full day. The situation is aggravated by the fact that since the beginning of the year the sales of chain stores have declined by nearly 50%.

Business owners have not yet devised a unified strategy for minimizing potential losses. During power cutoffs many non-grocery retailers use “soft checks”, which they issue to buyers. The situation is much more complex for grocery retail chains and restaurateurs, which use all kinds of equipment for proper operation, for example, refrigerators. “In extreme cases we use a generator and light candles on the tables,” says Beletskiy. However, in most cases buying a generator is not always justified.

For full-time operation the pub needs a generator with a capacity of no less than 50 kW, which costs approximately UAH 95,000, according to Novikov’s estimates. For its maintenance the establishment will have to spend UAH 4,800–5,000 per day and the current cost of electricity is UAH 600 a day. “This is hardly a rational solution to the problem,” he says. Co-owner of the Furshet chain of supermarkets Ihor Balenko is also not ready to buy generators for all the stores. “Each one costs US $30,000–40,000, so it is virtually impossible to buy such equipment for 100 stores,” he said.

Many tenants are trying to persuade their landlords to lower rents until the situation stabilizes. For example, Makarov is writing letters to all landlords with a request to lower the rent due to the problems with the power supply. Tkachenko says a decision on discounts has not yet been made – Sky Mall is examining the situation. Nonetheless, Makarov says managers of shopping malls are willing to hold talks assuming that they will achieve some concessions.

Tweets.....

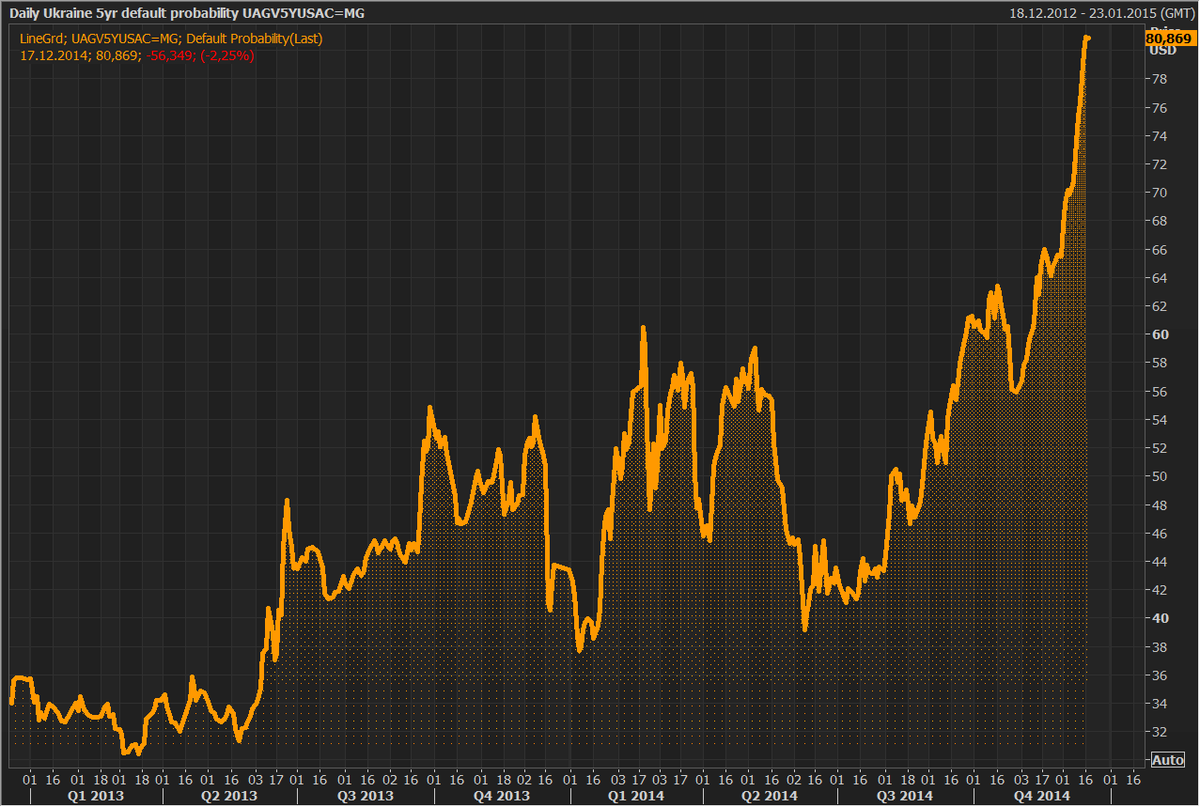

#EU's Juncker says #Ukraine will need $15bn more in financial aid as 5yr default probability seen by markets at 81%.

Today is the day when we may find out if Ukraine is default or not (officially). Ukrainian govt bonds 2023 traded around 58 already.

'

Credit Maidan' protest under Rada : Ppl took loans in foreign currency, now devastated bc of hryvnia devaluation

#EU denies Ukraine immediate financial aid. Popular unrest across EU sets limits to geopolitical ambition. http://reut.rs/1uPnJjc @reuters

Ukrainian PM appeals to EU for immediate financial aid http://reut.rs/1suv9I1

Bloomberg: Biden pledges aid as #Ukraine seeks $10 billion to avert default threat http://www.kyivpost.com/content/ukraine-abroad/bloomberg-biden-pledges-aid-as-ukraine-seeks-10-billion-to-avert-default-threat-375272.html …

****

U.S. Vice President Joe Biden has pledged help to Ukrainian President Petro Poroshenko as the former Soviet republic seeks billions of dollars to avert a default. The U.S. is committed to working with partners, including the International Monetary Fund, "to ensure that Ukraine will have the macroeconomic support it needs," Biden told Poroshenko in a phone call, according to an e-mail statement issued by the White House.

UN slams gov for Donbass pension cuts: Kievs embargo of eastern #Ukraine exacerbating misery http://www.dpa-international.com/news/international/un-kiev-embargo-of-eastern-ukraine-exacerbating-misery-a-43624927.html …

Blackouts continue for several hours pr day: 25 power plants out, 20 are disabled because of low coal reserves #Ukraine

Tore retweeted

#Chevron pulls out of gas extraction deal, delivering blow to #Ukraine

http://www.kyivpost.com/content/business/chevron-pulls-out-of-gas-extraction-in-western-ukraine-375176.html …

Talks with IMF have started in #Kiev : Focus on public sector cuts, which acc to Yatsenuk, will be around 10 percent. #Ukrane

Country on brink of disaster: Yatsenuk just said he wants to spend 5% (!) of GDP for defence, build #Ukraine army acc to NATO standards

Poroshenko expected to announce Fourth wave of mobilization next week. #Ukraine prepares for more war | 112.ua

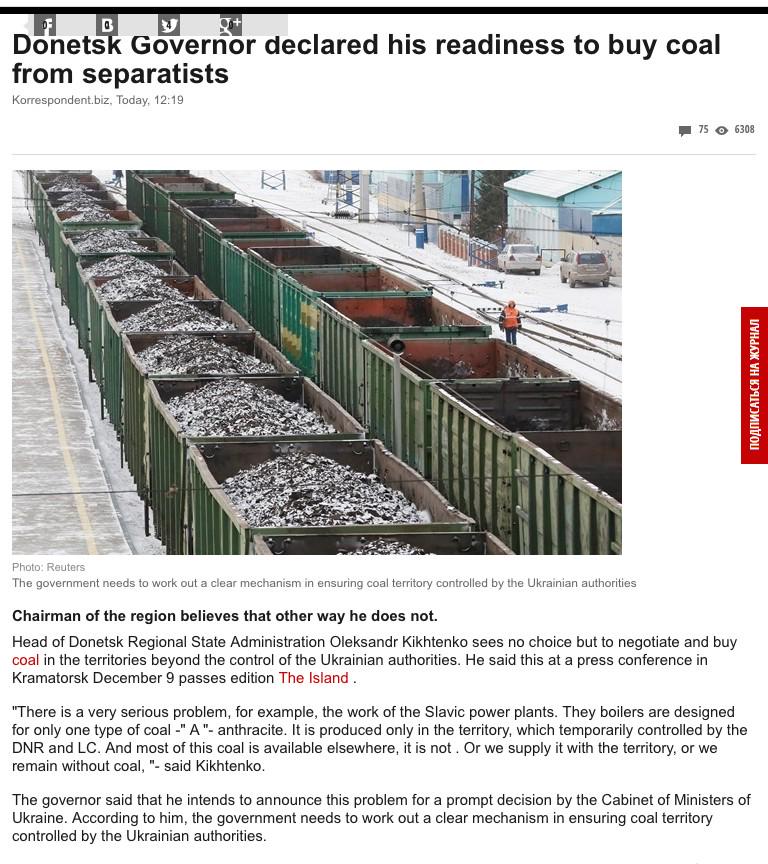

Donetsk governor: We cannot leave ppl without light and heat . We have no choice,we have to buy coal from separatists

MORE: Risks in gas transit via Ukraine remain 'extremely high' in winter - Gazprom Chief http://bit.ly/12msIAv

Ukraine War with Separatists going nowhere fast , Ukraine financial straits getting worse , time to turn the heat up on Russia ! Note how Russia's currency problems really began in the Fall . Shortly after the East Ukraine Separatists announced and then held their own elections in Lugansk and Donetsk !

Updated $USDRUB chart. Russian ruble continues to collapse relative to the dollar. This probably won't end well.

Wednesday the decline slowed down a bit ...

Russian rouble suffers new fall but the collapse slows: The dramatic fall in Russia's r... http://yhoo.it/1J1B5Td http://www.dcd-ag.com

'People are bringing piles, huge piles of cash. It is madness' plunging Ruble poses new test for Putin. http://on.wsj.com/1yXfMtU

Of course , Tuesday was just nuts !

Chart: Russian 5yr gov. bond yield. At these rates any lending or private sector bond activity grinds to a halt -

Russian government works out measures to stabilize currency market — minister http://tass.ru/en/economy/767350 …

Western Banks Cut Off Liquidity To Russian Entities http://www.zerohedge.com/news/2014-12-16/western-banks-cut-liquidity-russian-entities …

Outspooking The Lehman Apocalypse: Could A Russian Default Be In The Cards? http://www.zerohedge.com/news/2014-12-16/outspooking-lehman-apocalypse-could-russian-default-be-cards …

Kuwait oil minister: OPEC meeting will not take place before June. Time to refresh Venezuela CDS

Obama To Sign Off On Lethal US Aid To Ukraine By End Of Week, Russian Response To Follow http://www.zerohedge.com/news/2014-12-16/obama-sign-lethal-us-aid-ukraine-end-week-russian-response-follow …

"The USDRUB Pair Will Be Discontinued Due To Recent Instability Of The Russian Ruble" http://www.zerohedge.com/news/2014-12-16/usdrub-pair-will-be-discontinued-due-recent-instability-russian-ruble …

Turmoil Spreads: Ruble Replunges, Crude Craters, Yen Surges, Emerging Markets Tumbling http://www.zerohedge.com/news/2014-12-16/turmoil-spreads-ruble-replunges-crude-craters-yen-surges-emerging-markets-tumbling …

USDRUB back to 72

Rouble hits 80 to the dollar and 100 against the euro !

While everyone is talking about Ruble, #Norwegian Krone is down vs. US dollar. Dramatically. #oilcrisis #Norway

Oil sinks, Russian moves fail to quell nerves: LONDON (Reuters) - A plunge in oil below $60 and the failure of... http://news24h.allnews24h.com/RFZH

Russian Stocks Plunge on Rate Rise, Resumed Ruble Falls: Russian stocks plummeted on Tuesday after the Central... http://bit.ly/1uSvIvU

( from 58 after interest rate hike last night back to 66 today ! )

Rouble hits new all-time low despite rate hike http://gu.com/p/4485c/tw

Rouble just hit 66 to the dollar, bad day ahead

FULL STORY: #Oil tumbles under $60 for first time since 2009 http://english.alarabiya.net/en/business/energy/2014/12/16/Oil-s-renewed-weakness-may-pressure-Gulf-markets.html …

Graeme Wearden retweeted

GOOD GRIEF! Rouble slides to new record low despite massive overnight rate hike http://on.ft.com/1zkpbzv

Rouble is tumbling again after briefly holding up, and signs of elite battle breaking out. Kudrin criticising Sechin, Rosneft criticing CB.

Russian Market -5.6%

Gazprom -9.7%

Lukoil -8.6%

Vtb -6.3%

Sberbank -9.7%

Rosneft -9.6%

Surgut -10.6%

Sistema -18%

Turkish Lira vs $: 2.3389

Canadian Dollar vs $: 1.1656

Indian Rupee vs. $: 63.43

Brazilian Real vs. $: 2.6958

Ruble vs $: 62

- Ouch

Whoosh! Ruble is strong after the last night affair.

- Elvira, don't be shy next time. See you on January 30.

All the interest in the ruble appears to have crashed the Moscow Exchange website, http://moex.com , this morning.

Russian #ruble crashes to world's worst-performing currency http://www.themoscowtimes.com/business/article/russian-ruble-hits-60-to-the-u-s-dollar-as-currency-collapse-continues/513309.html … via @MoscowTimes

IMF official: no need for GCC to cut spending much as oil falls http://english.alarabiya.net/en/business/energy/2014/12/16/IMF-official-no-need-for-GCC-to-cut-spending-much-as-oil-falls.html …

english.alarabiya.net/en/views/business/economy/2014/12/16/Declining-oil-prices-OPEC-vs-future-Shale-.html … #oil

Dubai shares plunge on oil sell-off http://news.ae/1yXhWys

Central Bank's decision to raise key rates to 17% in current conditions necessary, correct - Kudrin

No comments on sharp rise in key rates by Central Bank, Central Bank is independent - Kremlin

Mark Adomanis

Mark Adomanis

Blogs of War

Blogs of War

Press TV

Press TV

Scrabby doo

Scrabby doo

Holger Zschaepitz

Holger Zschaepitz

Reuters Top News

Reuters Top News

Alex Sell

Alex Sell

Neal Mann

Neal Mann

zerohedge

zerohedge

Chris Adams

Chris Adams  Steve Collins

Steve Collins

News 24h Canada

News 24h Canada

Robin Wigglesworth

Robin Wigglesworth

Shaun Walker

Shaun Walker

Al Arabiya English

Al Arabiya English  The National

The National

No comments:

Post a Comment