http://www.zerohedge.com/news/2014-07-02/too-big-bnprosecute-how-yet-another-criminal-bank-got-away-just-slap-wrist

( Was The French Bank concerned about their banking license when they committed the crimes their guilty plea concedes ? )

Too Big To BNProsecute: How Yet Another Criminal Bank Got Away With Just A Slap On The Wrist

Submitted by Tyler Durden on 07/02/2014 18:01 -0400

Remember when the DOJ's banker lackey, assistant attorney general Lanny Breuer admitted to PBS that the US department of justice (sic) does not prosecute big banks because they are too systematically important and thus, above the law? Breuer waspromptly fired (only to rejoin Covington & Burling as vice chairman and head the firm's white collar defense practice) and with his departure the DOJ was said to have "fixed" its practice of giving banks, the more massive and insolvent the better, not only a "get out of jail" card but "do not even enter the courtroom" card. Ironically, all of the DOJ's subsequent wrath fell mostly on foreign banks (with domestic banks actually benefiting from the addback of "one-time, non-recurring" legal charges to their non-GAAP bottom line). It goes without saying, that not a single banker has still gone to jail since the infamous Too Big To Prosecute incident, suggesting it was all, once again, merely lip service to so-called justice.

But nowhere is it clearer thatnothing at all has changed when it comes to crony capitalist behind the scenes muppetry, than in the latest Reuters exclusive of the white glove treatment "evil" BNP got in order to make sure the full wrath of US justice doesn't damage the criminal money launderer too severely.

An official at the U.S. Securities and Exchange Commission (SEC) broke ranks with other commissioners, and voted against granting BNP Paribas a critical waiver to continue operating several investment advisory units in the United States.Kara Stein, a Democratic SEC commissioner who has recently demanded more accountability for big banks who break the law, was the sole dissenting vote on Monday on the temporary waiver, according to a document made public this week.BNP's application was granted the same day that BNP, France's largest bank, pleaded guilty to criminal charges it violated U.S. sanctions.The temporary waiver will become permanent, unless an "interested person" in the matter is granted a hearing. The deadline for requesting a hearing is July 25.The SEC rarely denies such waivers because such a move risks destabilizing financial firms.

Which all leads us to this:

The New York state banking regulator on Monday separately decided not to pull BNP's banking license in the state, despite a criminal guilty plea, because of the risk it could put BNP out of business.

And as is well known, we can't risk a bank going out of business because of its criminal actions, now can we. As for actually sending someone to jail? Don't make us laugh.

http://wallstreetonparade.com/2014/06/profiteering-on-banker-deaths-regulator-says-public-has-no-right-to-details/

Profiteering on Banker Deaths: Regulator Says Public Has No Right to Details

By Pam Martens and Russ Martens: June 30, 2014

Daniel Stipano, Deputy Chief Counsel of the OCC, Testifying Before the U.S. Senate on April 11, 2013

A man with a long history of keeping big bank secrets safe from the public’s prying eyes has denied the appeal filed by Wall Street On Parade to obtain specifics about the worker deaths upon which JPMorgan Chase pockets the life insurance money each year.

According to its financial filings, as of December 31, 2013, JPMorgan held $17.9 billion in Bank-Owned Life Insurance (BOLI) assets, a dark corner of the insurance market that allows banks to take out life insurance policies on their workers, secretly pocket the death benefits, and receive generous tax perks subsidized by the U.S. taxpayer. According to experts, JPMorgan could potentially hold upwards of $179 billion of life insurance in force on its current and former workers, based on the size of its BOLI assets.

The man who denied Wall Street On Parade’s appeal is Daniel P. Stipano, who told us by letter on June 20, 2014 that he had 450 pages of responsive material but it was not going to be released to us or the public. (See OCC Response to Appeal from Wall Street On Parade Re JPMorgan Banker Death Bets.)

Stipano is, by title, the Deputy Chief Counsel of the Office of the Comptroller of the Currency (OCC), the U.S. regulator of national banks, including those that were at the center of the 2008 financial collapse, mortgage and foreclosure frauds, and which continue to violate the nation’s laws with regularity. According to Stipano’s current bio, he also functions as the supervisor of the OCC’s Enforcement and Compliance, Litigation, Community and Consumer Law, and Administrative and Internal Law Divisions. That’s a lot of hats for one man to wear at a regulator of serially malfeasant mega banks.

Stipano also appears to be the decider-in-chief when it comes to Freedom of Information Act (FOIA) requests to the OCC. He also functions as a key decision maker when it comes to denying documents to U.S. Senators to allow them to perform their oversight duties. (One would certainly think that a Federal regulator would establish an independent office to handle FOIA and Congressional information requests.)

Stipano is the man who played an outsized hand in the scandalous structure of the “Independent Foreclosure Review,” where the major Wall Street banks who had illegally foreclosed on families were allowed to hire their favorite, deeply conflicted consultants to review the foreclosure files for wrongdoing, set the terms of the consulting contracts and pay out $2 billion to the consultants before homeowners had received a dime — and a year had been wasted on bogus reviews.

The end result of that hubris, as Senator Elizabeth Warren revealed last year, was that the actual banks engaged in the illegal foreclosure activities, not the so-called Independent Foreclosure Review consultants, were allowed by the OCC to tally up and classify their own wrongdoing.

One of the “independent” consultants that the OCC rubber-stamped for hire by the banks was Promontory Financial Group. As Wall Street On Parade reported in April of last year:

“In the engagement letter dated September 6, 2011 between Bank of America and Promontory Financial Group, the ‘independent’ consultant it hired to conduct its foreclosure investigation, Promontory attested to regulators that: ‘Promontory does not have an ongoing relationship with BAC [Bank of America], nor does it act in any advocacy capacity on its behalf.’

“The veracity of that statement is severely undercut by public records. While it was denying any ongoing relationship to regulators, Promontory actually had a large scale re-branding and turnaround contract with Bank of America that had been in place since May of 2011, four months prior to its engagement letter to conduct a government investigation into the bank’s foreclosure abuses.”

There were two other interesting facts about Promontory: Stipano’s two former bosses were employed there: Eugene Ludwig, former head of the OCC and Julie Williams, former Chief Counsel at the OCC. Of the estimated $2 billion paid out to the “independent” consultants, Promontory received $928 million.

On April 11, 2013, Senator Elizabeth Warren had this to say to Stipano and a representative from the Federal Reserve at a Senate hearing on the Independent Foreclosure Review:

“Over the last few months, Congressman Elijah Cummings and I have requested documents from your agencies regarding the basic data and the processes of the Independent Foreclosure Review. We made 14 specific requests to you in January, and despite multiple letters back and forth and multiple meetings, you have provided only one full response, three partial or minimal responses, and no response to nine of our requests. You have provided little specific information on what the review actually found, such as the number of improper foreclosures, the amount and number of inflated fees, or the extent of abusive practices by each of the mortgage servicers.”

During the course of the hearing, Senator Warren became so frustrated with Stipano’s insistence that illegal activities of banks, if ferreted out by bank examiners, was subject to “privilege,” that she blurted out: “So unless someone throws a rock through the window with this information tied to it, you will not release it, is that what you are saying?”

Wall Street On Parade received the same fundamentally flawed logic in Stipano’s letter of June 20, 2014. Stipano writes:

“The OCC has no responsive records pertaining to the number of employees insured by JPMC under BOLI policies, the face amount of the policies, the rank of employees who are insured, or the number of deceased who have generated death benefits under the policies. The OCC does have documents provided by the bank to OCC examiners during examinations that are responsive to the aspects of your request dealing with revenues and peer data…As previously stated, all of this responsive information is properly exempt pursuant to FOIA exemptions 4 and 8.”

The absurdity of Stipano’s position rests in this paragraph:

“All of the information you requested was either provided by JPMC to the OCC or created by the OCC in the course of its examination of JPMC. Therefore, all of the responsive information is related to the OCC’s examination of JPMC and examination reports prepared by the OCC, and it is exempt from disclosure under the FOIA pursuant to Exemption 8. The application of Exemption 8 to the responsive materials promotes “frank cooperation” between JPMC and the OCC…”

Simple translation: JPMorgan Chase can be trusted to engage in “frank cooperation” with its regulators as long as the bank and the regulator keep the public in the dark about the details of corruption festering inside the bank.

Putting aside for the moment the public’s right to know if the same too-big-to-manage banks that ushered in the worst economic crash since the Great Depression in 2008 are gaming the system again, there is simply no basis at all to believe that JPMorgan Chase engages in “frank cooperation” with its U.S. regulators, regardless of how much is secreted away for them.

As Stipano well knows or should know, on October 28, 2008, JPMorgan turned in Bernie Madoff for potentially running a fraud, citing numerous alarm bells and calling his returns too good to be true. It filed its “Suspicious Activity Report” not with U.S. regulators but with the United Kingdom’s Serious Organized Crime Agency – leaving its U.S. regulators in the dark until Madoff confessed.

On March 15, 2013, when the Senate Permanent Subcommittee on Investigations released its report on how JPMorgan Chase had gambled and lost over $6 billion in depositor funds by making high-risk investments in exotic derivatives, the report specifically addressed how JPMorgan had kept the OCC in the dark and how the OCC had been blindsided:

“JPMorgan Chase dodged OCC oversight of its Synthetic Credit Portfolio [SCP] by not alerting the OCC to the nature and extent of the portfolio; failing to inform the OCC when the SCP grew tenfold in 2011 and tripled in 2012; omitting SCP specific data from routine reports sent to the OCC; omitting mention of the SCP’s growing size, complexity, risk profile, and losses; responding to OCC information requests with blanket assurances and unhelpful aggregate portfolio data; and initially denying portfolio valuation problems.

“The OCC failed to investigate CIO trading activity that triggered multiple, sustained risk limit breaches; tolerated bank reports that omitted portfolio-specific performance data from the CIO; failed to notice when some monthly CIO reports stopped arriving; failed to question a new VaR [Value at Risk] model that dramatically lowered the SCP’s risk profile; and initially accepted blanket assurances by the bank that concerns about the SCP were unfounded.”

Given this recent history between the OCC and JPMorgan Chase, the press has every right to demand and receive answers when we observe a vast, dark industry with ghoulish overtones going unregulated.

In our May 12, 2014 appeal to the OCC, we pointed out the following:

“Since December of 2013, JPMorgan Chase has experienced five unusual deaths among current workers in their 30s and one unusual death of a 28-year old former worker whose brother currently works for JPMorgan and was cited by name in the U.S. Senate’s Permanent Subcommittee on Investigations’ report of JPMorgan’s London Whale trading debacle…

“Three of the six JPMorgan-related deaths cited in the article referenced above were allegedly from leaps from buildings in London, Hong Kong and Manhattan, respectively. None of JPMorgan’s peer banks — such as Citigroup, Morgan Stanley or Goldman Sachs – have publicly reported any suicides in the past six months as far as I’m aware. A 12-month review of public death notices among Citigroup employees revealed no cluster of deaths of young men in their 30s. (JPMorgan is reported to have 260,000 employees versus Citigroup’s reported 251,000.)…

“Why young men in their 30s are dying at JPMorgan but not at its peer banks is a matter of critical public health and safety concern. It is against public policy to keep the records secret. As the Chief Medical Examiner of Connecticut (where one of the deaths occurred) states on its web site: ‘Medicolegal investigations also protect the public health: by diagnosing previously unsuspected contagious disease; by identifying hazardous environmental conditions in the workplace, in the home, and elsewhere; by identifying trends such as changes in numbers of homicides, traffic fatalities, and drug and alcohol related deaths; and by identifying new types and forms of drugs appearing in the state, or existing drugs/substances becoming new subjects of abuse.’

“Additionally, research into this matter has revealed that just four of Wall Street’s largest banks hold a total of $68.1 billion in Bank-Own Life Insurance assets. Using a legal expert’s estimate that there is frequently a 10-to-1 ratio between assets and life insurance in force, this could potentially translate into these four banks holding $681 billion in life insurance policies on their workers – policies which pay the corporation the death benefit income tax free.”

Wall Street On Parade previously filed a Freedom of Information Law (FOIL) request with the New York State Insurance Department. Amazingly, it responded that it “does not have any of the records” for JPMorgan’s BOLI policies, a company headquartered in its state with tens of billions of life insurance policies on its workers. (See NYS Department of Financial Services/NYS Insurance Dept Response to Freedom of Information Law Request by Wall Street On Parade Seeking Information on Life Insurance Held by JPMorgan on Employees Lives.)

Perhaps New York State regulators do not even know this type of bank life insurance exists. In New York, nothing is really “official” until it appears in the Old Gray Lady. The New York Times made BOLI official just recently, on June 23, 2014, with an article by David Gelles.

Two days after Gelles’ article, Teresa Tritch continued the topic on the New York Times editorial page editor’s blog, writing: “It’s not illegal, but it’s dubious in the extreme.” Tritch goes on to state that “At the very least, there needs to be better disclosure” since it is the public that is subsidizing the generous tax breaks on the policies. (Both the death benefit as well as the cash buildup in the policies are received tax free to the corporation. If the policy were to be cashed in prior to the death of the insured, back taxes on the gains would have to be paid.)

If the OCC has no records pertaining to the number of employees insured by JPMorgan under BOLI policies; has no idea as to the face amount of the policies or the rank of employees who are insured, then it cannot possibly know if JPMorgan is complying with the 2006 law that limits this insurance to just the highest-paid 35 percent of employees. If the OCC does not know “the number of deceased who have generated death benefits under the policies,” it could not possibly spot a pattern of suspicious deaths. (Given its obfuscation with the Senate during the Independent Foreclosure Review matter, is there any reason to believe it would bring troublesome findings to the attention of Congress under any circumstances?)

If the OCC is in the dark about much of this insurance and the key insurance regulator in New York State is as well, who exactly is regulating this vast dark area of tax-subsidized death profiteering?

We suspect Wall Street’s powerful lobbyists have imposed this dark curtain because BOLI is exempt from the Volcker Rule – these insurance assets can, and are, remaining under bank control and invested in high-risk instruments as proprietary bets for the house – essentially repealing the Volcker Rule and potentially laying the foundation for the next Wall Street blow up.

The OCC says that it does have documents provided by JPMorgan “that are responsive” to the revenues JPMorgan receives from BOLI policies,” but it says those are privileged as well. This is akin to telling the public, whose pensions and 401(k) mutual funds are holding millions of shares of JPMorgan Chase stock, that it’s none of your business how JPMorgan Chase generates its revenues. According to OCC thinking, shareholders are not entitled to know to what extent the business model of this mega global behemoth is built around providing prudent consumer and business loans or is built around tax dodges and longevity bets on the lives of its workers.

Given the financial crash of 2008, the Bernie Madoff decades long Ponzi scheme, the decidedly not “independent” Independent Foreclosure Review, and the London Whale debacle, regulators have not earned the right to tell the public “just trust us.”

Related articles:

| John Donne |

| 72. "Death be not proud, though some have called thee" |

| DEATH be not proud, though some have called thee | |

| Mighty and dreadfull, for, thou art not so, | |

| For, those, whom thou think'st, thou dost overthrow, | |

| Die not, poore death, nor yet canst thou kill me. | |

| From rest and sleepe, which but thy pictures bee, | 5 |

| Much pleasure, then from thee, much more must flow, | |

| And soonest our best men with thee doe goe, | |

| Rest of their bones, and soules deliverie. | |

| Thou art slave to Fate, Chance, kings, and desperate men, | |

| And dost with poyson, warre, and sicknesse dwell, | 10 |

| And poppie, or charmes can make us sleepe as well, | |

| And better then thy stroake; why swell'st thou then; | |

| One short sleepe past, wee wake eternally, | |

| And death shall be no more; death, thou shalt die. | |

http://wallstreetonparade.com/2014/06/boes-carney-inflated-central-bank-balance-sheet-the-new-normal-expect-to-hear-the-same-conclusion-from-the-u-s-fed/

BOE’s Carney: Inflated Central Bank Balance Sheet the New Normal; Expect to Hear the Same Conclusion from the U.S. Fed

By Pam Martens and Russ Martens: June 25, 2014

The tabloids in London are having a field day today with headlines calling Bank of England Governor, Mark Carney, an “unreliable boyfriend” – a remark made yesterday by MP Pat McFadden during a hearing of the Treasury Select Committee of Parliament over the mixed signals Carney is sending the market about the timing of interest rate hikes by the BOE. (Carney, a Canadian and former head of the Bank of Canada, where he masterfully steered the Canadian economy through the financial crisis, might be forgiven for alternately thinking he’s on a bad blind date in his current assignment.)

Carney suffered a withering grilling yesterday over a speech he delivered on June 12 in which he said “There’s already great speculation about the exact timing of the first rate hike and this decision is becoming more balanced. It could happen sooner than markets currently expect.” (See full text of speech linked below.)

The real stunner of yesterday’s hearing, however, and the import of its underlying message, came at almost the end of the session in response to questions from MPs John Thurso and Stewart Hosie. Carney, who is also Chairman of the G20 Financial Stability Board, raised the very real possibility that the big asset purchases that have inflated both the BOE’s balance sheet as well as created a $4 trillion balance sheet at the U.S. Fed, are not going to be fully unwound – they are the new normal.

Thurso started off with this line of questioning:

Thurso: “It seems that there is a general view that we have to get out of QE at some point and this is important. Yet, Professor Miles [a member of the BOE’s Monetary Policy Committee] in a speech he made recently observed that when markets are functioning properly, the purchase or sale of assets does not have a great deal of impact…The question, really, is this: would it be true to say that it is the movement in the stock of assets that actually is the important thing rather than the quantum of assets held? And, therefore, is there an argument to say that having done a great movement to achieve where we are, actually we don’t need to do another movement, i.e. an exit; and we could keep that as a weapon when we need to go in the opposite direction at a future stage. In other words, exiting itself may be a danger rather than holding on.”

Carney responded that the BOE has been actively studying this issue and will continue to do so.

Professor Miles weighed in with this:

Miles: “On the eve of the financial mess, the commercial banks that held reserves at the Bank of England were holding very small levels of reserves relative to their balance sheets – miniscule in many ways, 25-30 billion pounds. They’re now holding close to 300 billion. It may well be that the commercial banks decide it’s prudent for them to hold many more reserves at the Bank of England. If that’s what they decide, the overall balance sheet at the Bank of England will stay much larger than it was before the financial mess.”

Stewart Hosie asked Carney:

Hosie: “Governor, when you were first before us, in answer to the question from David Ruffley, what does unwinding QE mean, you said, returning the bank’s balance sheet to its pre-crisis position. All of the indications now are that that will not be the case. So can I just now ask a simple question? Is this a policy change or is it simply a pragmatic tweaking in relation to the banks’ need to hold reserves in relation to new liquidity rules?”

Carney: “…I would define – picking up on what my colleagues have said – pre-crisis position as a position that’s consistent with the normal course of liquidity requirements of the banking system…What has changed, to the good, in terms of the banking system here is that through regulation and supervision we have put much more responsibility on the banks themselves to hold liquidity to manage liquidity shocks. And, as a consequence of that, their demand for reserves can be expected to be higher. The further consequence of that is that the balance sheet of the Bank of England will be larger…”

If this is the new reality in the U.K., which competes with the U.S. as a global banking center, one can certainly expect it to become the new reality in the U.S. where the global behemoth banks that sacked the U.S. economy in 2008 are now demonstratively more bloated than pre-crisis.

On March 31, 2009, the FDIC reported that there were 8,246 FDIC insured institutions in the U.S. with total domestic deposits of $7.5 trillion. Just four of those institutions, Bank of America, JPMorgan Chase, Wells Fargo & Co. and Citigroup, controlled 35 percent of all the insured domestic deposits in 2009.

By the second quarter of last year, according to FDIC data, the 8,246 banks and savings institutions in the U.S. had shrunk to 6,940 institutions. Bank of America, JPMorgan Chase, Wells Fargo & Co. and Citigroup, controlled a combined $3.511 trillion in domestic deposits, a stunning 58.8 percent of all domestic bank deposits.

The market share of these four U.S. mega banks has increased by 24 percent in just 4 years and the U.S. Fed has effectively become their permanent sugar daddy.

There is a very real suspicion that Carney was simply laying the groundwork for Fed Chair Janet Yellen to begin to slip the same hints into her forthcoming speeches.

————-

http://wallstreetonparade.com/2014/06/dark-pools-barclays-and-the-%E2%80%98tone-at-the-top%E2%80%99/

Dark Pools, Barclays and the ‘Tone at the Top’

By Pam Martens and Russ Martens: June 26, 2014

New York State Attorney General, Eric Schneiderman, (Right) Announcing Fraud Lawsuit Against Barclays Over Its Dark Pool

Yesterday, New York State Attorney General Eric Schneiderman filed a civil fraud complaint against the global bank, Barclays, for what can best be summed up as fostering an internal culture that rewards serial lying to customers and enforces the culture of lies by firing or intimidating employees who refuse to go along.

The lawsuit was framed around well documented allegations that Barclays is running a dark pool that allows, encourages, and facilitates high frequency traders to front run the orders of slower market participants like pensions and mutual funds; but the critical takeaway from the complaint goes to the very heart of global banking. The complaint is the clearest proof yet that the insidiously corrupt culture of global banking has not been reformed but has instead metastasized throughout each operating unit of the unmanageable behemoths.

To fully grasp this reality, it is helpful to reflect on what was happening at Barclays in the summer of 2012. Barclays was fined $451 million for fostering a culture which resulted in its traders colluding with other employees of the bank and outside banks to rig the interest rate benchmark known as Libor. Embarrassing emails showing the casual attitude the employees demonstrated toward breaking the law resulted in hearings by Parliament’s Treasury Select Committee in 2012 to examine Barclays’ leadership.

Marcus Agius, Former Chairman of Barclays, Testifying About LIBOR Before the UK's Treasury Select Committee

On July 10, 2012, the Treasury Select Committee called Barclays Chairman, Marcus Agius to testify. It also released an April 10, 2012 letter to Agius from the U.K.’s Financial Services Authority, the main U.K. regulator of global banks at the time, which outlined a laundry list of serious concerns about Barclays and noted the following: “…I wished to bring to your attention our concerns about the cumulative impression created by a pattern of behavior over the last few years, in which Barclays often seems to be seeking to gain advantage through the use of complex structures, or through arguing for regulatory approaches which are at the aggressive end of interpretation of the relevant rules and regulations.”

The letter, signed by Adair Turner, Chairman of the FSA at the time, went on to say that “These concerns are sufficiently great that I felt it was appropriate to communicate them directly to you, and to urge you and the Board to encourage a tone of full co-operation and transparency between all levels of your Executive and the FSA.” (See FSA Letter to Barclays’ Chairman, Marcus Agius, Dated April 10, 2012.)

This and other letters were read to Barclays Chairman Agius during the hearing by the Treasury Select Committee on July 10 as proof that Barclays CEO, Bob Diamond, had repeatedly lied before the same Parliamentary panel during his recent appearance, by disclaiming any knowledge that regulators were warning about the “tone at the top” at Barclays.

There was a house cleaning of Barclays in the summer of 2012 with the resignations of Chairman Marcus Agius; CEO, Bob Diamond; and COO, Jerry del Missier – ostensibly to provide an ethical “tone at the top” going forward.

And yet here we are today in the ongoing endless summer of our discontent with global banks continuing to fleece us blind and prosecutors failing to put any bank CEOs in jail.

The rigging of the dark pool at Barclays did not happen years ago under the old “tone at the top.” According to Schneiderman’s complaint, one of the most shocking and ethically unconscionable activities occurred just eight months ago. (See Barclays Lawsuit Filed by New York State Attorney General Eric Schneiderman Re Dark Pool and High Frequency Trading on June 25, 2014.)

From the complaint:

“In October, 2013, Barclays prepared a trading analysis for a major institutional investor that services millions of individual accounts both inside the United States and abroad (‘Institutional Investor’). The analysis determined that:

“Approximately 88% of this Institutional Investor’s sampled trades in dark venues were executing in Barclays’ dark pool;

“Approximately 60% of the trading counterparties for the Institutional Investor’s sampled orders were high frequency trading firms; and

“Approximately 75% of all orders routed by Barclays to dark venues were executing in Barclays’ own dark pool.

“Those extraordinarily high internalization rates suggest that Barclays’ representations to investors that it did not route orders in favor of any particular trading venue were false or misleading.

“In preparation for a meeting with the Institutional Investor to explain these findings, two senior Directors prepared a PowerPoint presentation that included the results of the trading analysis. Two days before the scheduled meeting, one of those Directors was called into a meeting with senior leadership in the Equities Electronic Trading division, who instructed him not to disclose the findings to the client. According to this Director, ‘[t]here was no suggestion at that meeting, or at any other point, that the analysis was wrong,’ merely that it should not be shared with the client because it reflected poorly on Barclays. Despite the pressure from senior leadership, this Director declined to withhold the findings from Institutional Investor. The next day, and prior to the scheduled meeting with the Institutional Investor, this Director was fired.

“Another Director was then instructed to change crucial figures in the PowerPoint presentation, in order to make them more favorable to Barclays.”

There is another critical takeaway from this latest Barclays’ complaint. The two hundred year old theory of how efficient markets operate when all market information is visible and transparent to all market participants at precisely the same time through the enforcement of public stock exchanges operating in the public good has been delivered a death blow by these dark pools.

The dark pools are effectively functioning as the antithesis of public stock exchanges. The dark pool is not registered as a stock exchange, is not supervised by the SEC as a stock exchange, does not display millions of bids and offers on stocks to the public marketplace, and yet the Attorney General’s complaint tells us that it is estimated today that “over forty percent of all U.S. equities trades are executed in dark pools.”

Investing in corporations on the basis of their fundamentals, which in the past has guided price discovery for all market participants, has no role in the formula for investing by high frequency traders operating inside dark pools.

According to Schneiderman’s complaint, Barclays allowed the high frequency traders to “cross-connect” to its computer servers, giving them a “speed advantage over those slower-moving counterparties.”

A former Barclays’ insider explained what happened next:

“ ‘[T]he way the deal would work is [Barclays] would invite the high frequency firms in. They would trade with the buy side. The buy side would pay the commissions. The high frequency firms would pay basically nothing. They would make their money off of manipulating the price. Barclays would make their money off the buy side. And the buy side would totally be taken advantage of because they got stuck with the bad trade.’ ”

To a large degree, U.S. markets are now based on a cartel of pirates who have no interest in the fundamentals of the companies or the fundamentals of the economy. Their goal is simply to skim each trade and go home flat on the day.

This is not an efficient market; it is not a sane market; it is not an ethical market; and it may well explain why the stock market rose yesterday on a shocking first quarter decline in U.S. GDP. Fundamentals don’t matter to pirates.

http://wallstreetonparade.com/2014/06/citigroup%E2%80%99s-dark-pools-here%E2%80%99s-why-the-public-doesn%E2%80%99t-trust-wall-street/

Citigroup’s Dark Pools: Here’s Why the Public Doesn’t Trust Wall Street

By Pam Martens and Russ Martens: June 18, 2014

Citigroup, the Bank the U.S. Taxpayer Saved From Insolvency in 2008, Is Operating a Dizzying Array of Dark Trading Pools Today

In 2008, the sprawling global bank, Citigroup, created under the controversial repeal of the Glass-Steagall Act, blew itself up with toxic debt hidden in the dark in the Cayman Islands in an exotic framework called Structured Investment Vehicles or SIVs. The unwilling taxpayer was forced into servitude to bail out this hubris that had occurred at the hands of captured regulators, infusing $45 billion in equity, over $300 billion in asset guarantees, and $2.5 trillion in below-market loans.

At the time of its implosion, Citigroup had over 2,000 subsidiaries, affiliates or joint ventures, many of which operated in the dark in foreign locales.

Flash forward to today: in March, the Federal Reserve said Citigroup had flunked its stress test and the Fed prevented it from boosting its dividend. (The so-called stress test is how the Fed measures a mega bank’s ability to withstand a major economic upheaval.) In rejecting Citigroup’s capital plan for 2014, the Fed said that Citigroup “reflected a number of deficiencies in its capital planning practices, including in some areas that had been previously identified by supervisors as requiring attention, but for which there was not sufficient improvement. Practices with specific deficiencies included Citigroup’s ability to project revenue and losses under a stressful scenario for material parts of the firm’s global operations.”

Most Americans, and, sadly, members of Congress, believe that Citigroup is the parent of all those branch banks holding FDIC-insured deposits across America and bearing that angelic red halo over the word “Citi.” But Citigroup is far more than that.

A recent record search by Wall Street On Parade suggests that Citigroup may be operating one of Wall Street’s largest collections of dark pools, trading stocks 24/7 around the globe in de facto unregulated stock exchanges which it operates under a dizzying array of different names.

For the first time ever, the Financial Industry Regulatory Authority has started releasing partial trading data for dark pools. For the week of May 26, 2014, FINRA data shows that Liquifi, a dark pool owned by a unit of Citigroup, traded 5,865,427 shares of stock; another dark pool owned by a unit of Citigroup, LavaFlow, traded 98,604,159 shares of stock; and Citi Cross, also owned by a unit of Citigroup, traded 37,547,262 shares of stock.

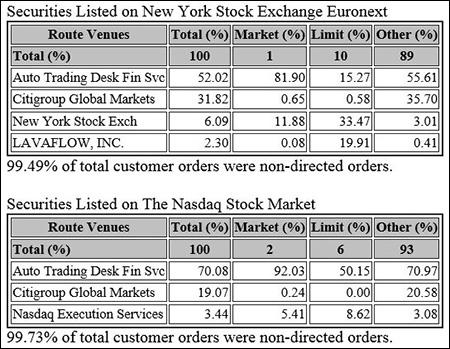

But there seems to be something wrong in the above report. At the end of the first quarter of this year, Citigroup filed a required SEC Rule 606 report which said it was identifying “the significant market centers” to which it routed its customers’ orders and was also identifying “the material aspects of Citigroup Global Markets’ relationship with those top market centers.”

The SEC Rule 606 report (as shown in part below) indicates that 52.02 percent of Citigroup’s customers’ orders in New York Stock Exchange Euronext listed stocks were routed to a company called Automated Trading Desk Financial Services. According to Citigroup’s disclosure, it owns that company and “potentially stands to profit by trading as principal with its customers’ orders.” Citigroup Global Markets (or ostensibly its dark pools) accounted for another 31.82 percent with LavaFlow receiving 2.30 percent. In short, Citigroup routed 92.23 percent of its customers’ orders in New York Stock Exchange Euronext traded stocks – to itself.

Automated Trading Desk’s web site says that it trades on average, “200 million shares a day.” If you add that 1 billion a week to the 142 million shares Citigroup reported to FINRA for its dark pools, it looks like Citigroup is eclipsing Credit Suisse and Goldman Sachs as a trading juggernaut.

But why isn’t Automated Trading Desk included in FINRA’s data. Citigroup, in its own report, refers to the company as “a significant market center.” And, surely if it’s trading 1 billion shares of stock a week it is indeed “a significant market center,” but unburdened with the pesky regulations of a stock exchange and excused from burdens like trotting up to the Hill yesterday to explain cozy dealings to Senator Carl Levin’s Permanent Subcommittee on Investigations.

We reached out to the SEC, asking if Automated Trading Desk is not a regulated stock exchange and it’s not an ATS (Alternative Trading System a/k/a “dark pool”), what is it. The SEC promptly advised that Automated Trading Desk is, simply, a broker.

According to FINRA’s files on the firm, various incarnations of the company have been repeatedly sanctioned for bad practices: like trading for its own account ahead of its customers’ limit orders.

FINRA documents show four lines of businesses for Automated Trading Desk Financial Services: “broker or dealer making inter-dealer markets in corporation securities over-the-counter; put and call broker or dealer or option writer; non-exchange member arranging for transactions in listed securities by exchange member; and [wait for it] trading securities for own account.”

Wasn’t the Volcker Rule under the 2010 Dodd-Frank financial reform legislation supposed to prevent systemically risky financial institutions from trading for their own account? After stalling the implementation of the Volcker Rule for years, when the SEC finally did get around to implementing a weakened version of it, the new pushed-out effective date became the summer of 2015.

Automated Trading Desk gets multiple mentions in Wall Street Journal reporter Scott Patterson’s seminal book on the subject of unregulated stock exchanges running amok in the U.S. In the book, Dark Pools, Patterson tells us that “by the mid 2000s, just four firms – Automated Trading Desk, Renaissance, Tradebot, and Getco – accounted for roughly 25 to 30 percent of all stock trading in the United States.”

Patterson also shares the following about the history of Automated Trading Desk:

“In the 1980s, a finance professor named David Whitcomb and James Hawkes, a computer engineer who taught at the College of Charleston in South Carolina, had devised algorithms to predict the outcomes of horse races. They eventually applied those same algos to the stock market and launched ATD from Hawkes’s Mount Pleasant home.”

Patterson says that ATD “designed an artificial intelligence program” that could predict “where prices would go during a period of roughly thirty seconds to two minutes.” It named its pricing engine “BORG,” “a nod to the race of evil cyborgs from the popular TV show Star Trek: The Next Generation.”

ATD admits on its web site that it’s using artificial intelligence to trade “in milliseconds,” noting that “In the 1980s, when no one on Wall Street believed it could be done, we taught computers how to trade like humans – except, of course, our systems were much, much faster.”

Citigroup bought the company in 2007 for $680 million in cash and stock. Unfortunately, the cash portion was only approximately $102.6 million. As 2008 unfolded, Citigroup’s shares would lose the bulk of their value as its dark toxic debt came into the sunshine. Key ATD shareholders, including Whitcomb, filed a class action lawsuit against Citigroup. Citigroup settled the case for $590 million in 2012.

Automated Trading Desk says on its web site that “From our ever-expanding retail execution to the institutional markets to creating the first-ever automated pinks and bullies execution system, ATD is leveraging our technology to become a single source destination for all U.S. equity order flow.” That certainly sounds like a stock exchange to us – why isn’t it regulated like the New York Stock Exchange?

Automated Trading Desk, LavaFlow, Liquifi and Citi Cross are not the only big trading platforms owned by Citigroup where there is a lack of trading data transparency. According to SEC records, Citigroup also owns Citi Credit Cross. Citigroup also says on its web site that Citi Match is a “leading internal crossing network, available globally” and “consistently ranked in the top two dark pools in Europe. It offers anonymous access to premium liquidity and price improvement.” Where’s the trading data for that one?

FINRA records also show that Citigroup is operating 48 foreign firms trading securities. A sampling of those names shows: Monex Group, Inc. in Tokyo; ZAO Citigroup Global Markets in Moscow; Citivalores S.A. in Panama City.

In addition to all of this darkness, records show that discount brokers are being paid by trading units of Citigroup to send their “dumb money” (a phrase used by New York State Attorney General Eric Schneiderman to correctly describe retail customers’ order flow) to Citigroup’s trading platforms. The payments are known as PFOF – payment for order flow — a tactic used by Ponzi-schemer Bernie Madoff in his securities trading division — that actually did trade stocks.

While discount brokers argue that they only use trade execution firms that provide fair customer prices, Senator Carl Levin showed yesterday in a Senate hearing that TD Ameritrade was directing its order flow to the firms that paid it the highest rebate per share.

Also discussed at yesterday’s Senate hearing is the fact that while stock markets are setting new highs, stock ownership among U.S. adults is at a 16-year low, trending down from 65 percent participation in 2007 to a reading of 52 percent today, according to aGallup poll released in May.

The ability to rig markets is always so much easier in the dark. And until Congress brings sunshine into the nether world of Wall Street’s dark pools, public confidence is not coming back any time soon.

Citigroup's SEC Rule 606 Report for First Quarter of 2014 Shows It's Executing the Vast Majority of Its Customers' Orders Itself, Rather Than Routing Them To a Stock Exchange

Fitting piece from George Benson.....

http://ragingbullshit.com/2014/06/28/mini-tax-havens-how-spains-one-percent-pays-only-percent/

Mini Tax Havens: How Europe’s 1% Gets to Pay Only 1%

2

28/06/2014 by Don Quijones

Something completely out of the ordinary happened in Spain this week: a politician resigned. His name is Willy Meyer and he was, until Wednesday morning at least, a Member of the European Parliament (MEP) and European Parliamentary leader for Spain’s ostensibly far-left party “Izquierda Union.”

The reason for Meyer’s resignation is that he was caught funneling his parliamentary pension contributions into an EU-sponsored investment fund commonly referred to as a SICAV (standing for Société d’Investissement à Capital Variable) – an investment vehicle that Meyer’s own party has long pledged to ban.

A SICAV is an open-ended collective investment scheme that is common throughout Western Europe, especially in Luxembourg, Switzerland, Italy, Spain, Belgium, Malta, France and the Czech Republic. In all of those countries SICAVs receive preferential tax treatment. In Spain, for example, investors must pool together a minimum of 2.4 million euros and pay only 1 percent tax on annual returns. Meanwhile, in banker-friendly Luxembourg – where the EU-sponsored SICAV just happens to be based – the funds are taxed at a measly 0.05 percent rate.

Meyer is not the only Spanish politician to have invested in the SICAV. According to the financial daily El Confidencial, a total of 39 Members of the Spanish Parliament, MEPs, and government ministers signed up to the SICAV. They include Spain’s current finance minister, Cristobal Montoro, the man who over the past two years has hiked direct and indirect taxes on both workers and small businesses to confiscatory levels.

Lax Legislation and Limp Enforcement

Thanks to lax legislation and limp enforcement, SICAVs have effectively become mini-tax havens allowing many of the country’s best-heeled individuals and families to avoid paying almost any tax on their investment earnings. One way they do that is by not cashing in their dividends or selling their shares in the funds, since that would accrue taxes of 19 percent and 21 percent respectively. Instead, what they do is execute regular draw-downs on their capital investment. By withdrawing just part – rather than all – of their initial investment, they pay just 1 percent tax on their earnings.

What’s more, by law each SICAV must have a minimum of 100 stockholders. Most funds avoid this rule, however, by naming a series of straw-man investors, commonly known as “mariachis,” so that each SICAV is effectively controlled by only one person or one family.

Six Bourbons and Hundreds of Mariachis

A perfect case in point is the SICAV owned by the sister of Spain’s recently abdicated King, Juan Carlos II. As Lo Que Somos reported in an initially censored article from 2012:

Pilar of Spain, Duchess of Badajoz, Grandee of Spain, Dowager Viscountess de la Torre (…) has five children (…). Those five are the only shareholders that appear registered on the SICAV. (…) The rest of the stockholders don’t even appear. In order for the SICAV to be legal, a minimum of 100 is necessary, and the Labiérnago 2000, as the fund is called, has plenty: 237, according to the National Securities Market Commission (CNMV), but it is not known who 231 of them are (…)

(…) At the end of the 2001 fiscal year, the SICAV assets had already surpassed 4.3 million euros (…) Labiérnago 2000 earned [in 2009] 392,970 euros, on which 930 euros were paid in taxes, according to the financial statements that feature in the records. No zero is missing. To put this in perspective, if an ordinary company earned this profit, it would have to pay some 100,000 euros in corporate taxes. If a person received that from working, more than half of the earnings, some 200,000 euros, would go to the Ministry of Economy and Finance. (Translation courtesy of Global Voices Online)

It’s not just royalty that’s in on the act. So too is the Catholic Church and prominent members of the business community, including Amancio Ortega, Europe’s richest man and owner of global fashion giant Inditex. Also at it are politicians, members of the nobility, bankers, TV and film personalities, footballers, singers, tennis players and bullfighters (this is Spain, after all).

Indeed, so serious and widespread are the abuses of the financial vehicles that in 2004 it prompted a full-scale investigation by Spain’s tax office. What it found was that of the 3,100 SICAVs in operation in Spain, 58 were plainly illegal. The vast majority of them (2,650) were, in the words of the tax inspectors, “highly dubious” since more than 90 percent of the shares were controlled by just one individual or family.

But before the tax office could take legal action and claw back some of the tax owed, Zapatero’s government of caviar-socialists stepped in, granting legal immunity to the owners of SICAVs and handing over exclusive regulatory authority to the Commisión Nacional de Mercados de Valores – a Spanish version of the Security and Exchange Commission (which should more or less tell you all you need to know about where this story’s heading).

Just to give an idea of how thorough the Commission’s regulatory oversight has been, one of the people responsible for overseeing the SICAV industry is the CNMV’s vice-president, Carlos Arernillas – a man who until recently spent much of his spare time running a 9-million euro SICAV of his own, of which he owns 99.25 percent of shares.

The Eternal Global Race to the Bottom

Indeed, rather than tackling the abuses of the SICAVs, the Commission seems far more inclined to kowtow even lower to the demands of industry representatives, who argue that even less – indeed, preferably zero – tax should be paid by SICAV investors while the rules demanding at least 100 participants should be scrapped altogether.

The logic is simple: if Spain doesn’t offer the best possible conditions for investors, they will simply up sticks and take their money elsewhere, including to pseudo tax havens such as Luxembourg. In other words, in order not to lose the financial patronage of Spain’s wealthiest individuals and families, the government and financial regulator need to replicate the favourable conditions and opacity offered by tax havens.

And it’s not just Spain that’s playing this game. SICAVs are everywhere in Western Europe. As Nicholas Shaxson reports in his book Treasure Islands, the world’s biggest tax haven has long been the sovereign City of London. Thanks to the creation of the Euro-Dollar market in the post-war years, it became the favourite place for foreigners to park their money, no matter who they were or where it came from [Click here to see two fascinating Democracy Now interviews on tax havens with Shaxson and John Le Carre].

The main beneficiaries of this global race to the bottom have not been the top 1 percent, but the top 0.1 percent of the population, who in the U.S. alone have seen their share of national wealth surge from 2.7 percent in 1974 to 13 percent today – and thanks in no small part to the luxury of tax-free living.

None of this has happened by accident. As Jacob Hacker and Paul Pierson document inWinner-Take-All Politics, it happened because law-makers and public officials allowed it to happen – not because international markets or globalisation made it inevitable. It was a choice, driven by the pressure of lobbyists and other organisations to create an environment much more hospitable to the needs of the very rich.

Fiscal Suicide

The problem today is that the very rich are now rich beyond their wildest imagination, while most of the rest of us struggle with declining real wages. At issue is not just the question of justice or fairness. Nor is it, as defenders of the current system claim, about envy. What’s at stake is fiscal sustainability.

The super-rich are not only the primary beneficiaries of offshore havens and vehicles such as SICAVs; they are also the primary – if not exclusive – beneficiaries of today’s deeply-flawed model of money creation, whereby new money is injected into the economy at strategic points, creating a few winners and countless losers along the way. Those with access to the new money (namely those already endowed with vast financial wealth and power) gain immeasurably while vast majority, far from the free-money spigot, continue to lose purchasing power and end up having to pay more in taxes to boot.

As this process escalates, all talk (whether from governments, economists, central bankers or the IMF) of the need to rebalance government fiscal accounts is cruelly disingenuous.

European governments can (and no doubt will) continue to privatise what remains of their national industry, infrastructure and natural resources; they can (and no doubt will) ramp up taxes on the incomes of what little remains of the middle classes; they can even – as the Spanish government has just decided to do – begin taxing bank deposits. But as long as the individuals and companies that possess the lion’s share of the financial and resource wealth can get away with contributing next to nothing to public coffers, the fiscal health of our governments is doomed to continue its terminal decline.

Money does talk...

Curiously, no one goes to prison for money laundering, falsifying business records, or conspiracy charges.

But New York Times Deal Book reports Prosecutors Ask at Least 8 Years for Martoma in Insider Trading Case.

Rajartnam was sentenced to prison for 11 years based on illicit profits of $63 million.

Here's the question of the day: Did BNP Paribas make more than $63 million in money laundering and other conspiracies?

Bonus question: Is insider trading worse than falsifying records?

Answer: Apparently, insider trading is worse than money laundering, falsifying business records, and various other conspiracies. Martha Stewart knows this as well, via obstruction of justice charges related to insider trading.

Addendum:

The CATO institute has the absurd details in Martha Stewart in Prison?

Meanwhile, insider trading by Congress is perfectly legal, even when Congressmen know who a big defense contract will be awarded to (and act on it in advance).

Mike "Mish" Shedlock

Money does talk...

Monday, June 30, 2014 7:30 PM

French Bank BNP Paribas Pleads Guilty Criminal Conspiracy Charges, Fined Record $9 Billion; Anyone Headed to Prison?

Today, French bank BNP Paribas plead guilty Monday to criminal money-laundering laws by helping clients dodge sanctions on Iran, Sudan and other countries.

As part of the settlement, BNP will pay a record penalty of close to $9 billion.

Former ECB president Jean-Claude Trichet said the fine was neither fair, just, nor proportionate and carries risks for the global financial system.

CCN Money has the synopsis in BNP Paribas to Pay Nearly $9 Billion Penalty.

As part of the settlement, BNP will pay a record penalty of close to $9 billion.

Former ECB president Jean-Claude Trichet said the fine was neither fair, just, nor proportionate and carries risks for the global financial system.

CCN Money has the synopsis in BNP Paribas to Pay Nearly $9 Billion Penalty.

On Monday in an agreement with the Manhattan District Attorney Cyrus Vance the bank pleaded guilty to falsifying business records and conspiracy in Manhattan Supreme Court. On Tuesday it is expected to plead guilty for violating money laundering laws in federal court with U.S. Attorney Preet Bharara.Curious Thing

The bank also agreed to a sanction by the New York department of financial services. It will suspend certain U.S. dollar clearing transaction services through its New York branch for one year.

About 30 employees will leave BNP Paribas as a result of the investigation, including several who have gone already, according to the U.S. official.

The fine dwarfs HSBC (HSBC)'s $1.9 billion penalty in 2012 for similar offenses, and the $2.6 billion Credit Suisse (CS) paid in May to settle tax evasion claims.

The Wall Street Journal said BNP Paribas would have to slash its dividend and raise billions of euros by issuing bonds.

Standard and Poor's has warned it could cut the bank's long term credit rating once it reviewed the size of the fine and the nature of any additional penalties.

Curiously, no one goes to prison for money laundering, falsifying business records, or conspiracy charges.

But New York Times Deal Book reports Prosecutors Ask at Least 8 Years for Martoma in Insider Trading Case.

Federal prosecutors are recommending that Mathew Martoma, a former trader who worked for the billionaire investor Steven A. Cohen, be sentenced next month to at least eight years in prison for insider trading, if not significantly more.Questions of the Day

That would be at the upper end of prison sentences for hedge fund traders convicted of insider trading in recent years, but by no means the stiffest punishment handed down during the long-running investigation.

In February, a federal jury in Manhattan convicted the former SAC portfolio manager of helping the hedge fund generate profits and avoid losses totaling $275 million in 2008.

To date, the 11 years given to Raj Rajaratnam, the co-founder of the Galleon Group hedge fund, is the longest sentence anyone in the investigation has received. Mr. Rajaratnam was convicted by a jury in May 2011 on 14 counts of insider trading — more than Mr. Martoma’s three criminal charges. But the illicit trading by Mr. Rajartnam generated about $63 million, compared with the $275 million in illegal profits and avoided losses for Mr. Martoma.

Rajartnam was sentenced to prison for 11 years based on illicit profits of $63 million.

Here's the question of the day: Did BNP Paribas make more than $63 million in money laundering and other conspiracies?

Bonus question: Is insider trading worse than falsifying records?

Answer: Apparently, insider trading is worse than money laundering, falsifying business records, and various other conspiracies. Martha Stewart knows this as well, via obstruction of justice charges related to insider trading.

Addendum:

The CATO institute has the absurd details in Martha Stewart in Prison?

Meanwhile, insider trading by Congress is perfectly legal, even when Congressmen know who a big defense contract will be awarded to (and act on it in advance).

Mike "Mish" Shedlock

No comments:

Post a Comment