Caveat Emptor......

State of Massachusetts Planning to Release ‘Consumer Advisory’ on Bitcoin

For the past several months, we’ve seen no lack of governments around the world issue warnings related to bitcoin and other digital currency. The movement is seemingly spreading to individual U.S. states.

For the past several months, we’ve seen no lack of governments around the world issue warnings related to bitcoin and other digital currency. The movement is seemingly spreading to individual U.S. states.

The State of Hawaii independently released their own bitcoin-related warning, noting that any organization transmitting bitcoin without proper money-transmitting licensing was doing so unlawfully.

Here in Massachusetts, the State’s Office of Consumer Affairs and Business Regulation said they will be releasing a consumer advisory on bitcoin, too. The information comes from Undersecretary Barbara Anthony, who said “We are going to be issuing an advisory indicating the disadvantages and advantages that accompany bitcoin,” in a phone interview with MarketWatch. “We need to impress upon consumers that you do take risk here.”

The office plans to touch on the digital currency’s volatility, lack of consumer rights (legally speaking) available when using bitcoin (as opposed to a credit card, for example), and the absence of insurance if bitcoins are stolen or lost due to bankruptcy (see FDIC).

The State of Massachusetts isn’t looking to threaten anyone who wishes to use bitcoin, however.

“If you’re willing to take the risk, then right now, there’s nothing that prohibits that,” Undersecretary Anthony said. “But my concern is that [your average] consumers aren’t really paying attention to the disadvantages that are associated.”

The news comes in the midst of outrage concerning bitcoin exchange Mt. Gox, whofiled for bankruptcy protection on Friday. It is speculated that all users of the exchange lost stored funds — an amount pegged at over 750,000 BTC, or over $400 million USD. [source: MarketWatch]

http://falkvinge.net/2014/02/28/the-gox-crater-crowd-detectives-reveal-billion-dollar-heist-as-inside-job/

The Gox Crater: Crowd Detectives Reveal Billion-Dollar Heist As Inside Job

54

CRYPTOCURRENCY

CRYPTOCURRENCY

Thousands of volunteering and self-organizing detectives have been meticulously laying a puzzle that reveals the Gox billion-dollar heist as an inside job. As smoke clears on the implosion of the Empty Goxbitcoin exchange, thousands of people in the community committed to revealing the truth behind the stonewalling exchange. What was claimed first to be a technical problem, then an outside theft, has been conclusively determined that the MtGox management knew too much, too long ago, to have this be an ordinary case of theft.

There are still many question marks remaining surrounding the missing 744,408 bitcoin at Empty Gox, valued at their peak to just under one billion US dollars, and which are well north of that in replacement value on the open market today. What’s becoming clear, though, is that this wasn’t a theft that properly shut down operations as soon as it was discovered. Instead, Empty Gox and its CEO Mark Karpeles appear to have attempted to benefit and profit from it. That would cross the line into criminal complicity, even if they were not part of the original loss – something that also remains an open question.

At this point, there are two outstanding principal questions:

- Who took the money?

- When was the money taken?

Let’s address the second question first and get the timeline in order, because it completes a lot of the puzzle. I have written before that it would be absolutely impossible to not notice the loss of one billion dollars from company assets, unless you were actively cooking the books to hide a gaping hole where a billion should have been. As it turns out, it seems such fraudulent cooking is exactly what has taken place.

An attempt at a timeline

Many different people have been working diligently to put together a timeline of events. Here’s an attempt to summarize the most important and credible ones.

June 2011 – the first possible time when the bitcoin in question might actually have disappeared (Jesse Powell). If true, Empty Gox has been operating with a lack of assets since, attempting to gradually cover the huge hole in its assets though operating profits. This would explain why there aren’t any books or balance sheets at all (Roger Ver), since making them would disclose the empty vault. Obviously, failing to disclose this would probably be at least criminal neglect toward shareholders, and quite possibly toward financial authorities as well.

June 23, 2011 – Under pressure to prove solvency, Karpeles moves a very specific huge amount of money (424,242 bitcoin) from one wallet to another. Thus, we know that he was in control of the target wallet of this transaction at this time, and can trace the funds forward from that point in time.

May 2, 2013 – Empty Gox was sued by CoinLab for 75 million USD for breach of contract. For unknown reasons, Gox failed to fulfill obligations to provide server access, resulting in a startup-crushing financial liability for failing to deliver. (Rob Banagale)

(Interestingly, there’s a massive selloff of 750,000 coins at an average price of about 100, totalling $75M, just following this event, suggesting customer coins were fraudulently sold to cover Gox liabilities. However, such a move wouldn’t make sense from a funding perspective, as it doesn’t change the amount customers have deposited in the exchange – if there was $75M deposited already, that could be used directly without a selloff; if there wasn’t, it would not magically appear because Gox sold customers’ coins on their own exchange.)

Summer 2013 – First Gox competitors get a significant foothold in the exchange market. Trading volume at Empty Gox, and therefore income from commissions, drops to one-third of pre-April levels.

August 2013 – First rumors that everything isn’t financially well with Empty Gox. Trouble with US Dollar withdrawals due to August 13 seizure of funds by US government. Nothing solid at this point, but in hindsight, this is when the game of musical chairs started (Weiner). The fractional reserve that was initiated some time 2011 has been holding up until this point.

September 10, 2013 – Empty Gox countersues CoinLab for five million US dollars in cash, which appears to have been withheld by CoinLab for some reason in a way Gox didn’t agree with. That would indicate Gox is now very short on cash. (Banagale)

October 20, 2013 – First report of a withdrawal from Empty Gox that didn’t go through, like an ATM executing a withdrawal but not dispensing any money. The stuck withdrawals are technically diagnosed by the community to be caused by an attempt at Empty Gox of spending the same money twice, which suggests that the Gox software believes it has money that it actually doesn’t. This is the date when Empty Gox management, at the latest point possible, must have been acutely aware that it was unable to serve withdrawals due to lack of funds. (Bryce Weiner)

November 26, 2013 – Last known transaction of the chain directly descending from the proof-of-solvency in June 2011 (easily manually traceable). On this date, Gox was able to access the cold storage that was used earlier, at least partially negating a “lost keys” theory.

December 2013 – People’s Bank of China announces an end to Chinese bitcoin trading by February 1, 2014. This causes Chinese to withdraw from Empty Gox in large numbers, depleting the reserves.

January 2014 – I try to empty my account at Gox. Bitcoin withdrawals are not coming through. It’s like emptying your account at an ATM but only getting dispensed a fraction of the money out of what was listed as withdrawn. Still not a large issue in the forums; you have to dig deep to find some technical discussion threads analyzing the withdrawal problems. Complaints to Gox get answered well after a week, at which point the balance is restored, and new withdrawals fail the same way. Rinse and repeat.

February 1, 2014 – Following the People’s Bank of China edict that times out on February 1, the amount of stuck withdrawals at Gox goes stratospheric enough for independent people to start tracking them on charts for debugging purposes.

February 4, 2014 – I publish my “38 million dollars missing at Gox” article, which is the first article to convert the question from a technical to a financial one, as far as I know. Several people would contact me after that article and hint that the situation was much worse than I could imagine.

February 7, 2014 – Gox shuts down bitcoin withdrawals entirely, blaming problems with the bitcoin protocol as such, so-called “transaction malleability attacks”. This is immediately identitied as technical bullshit by a number of heavy names, plus myself. Gox promises an update on February 10.

February 9, 2014 – First recorded event of an actual transaction malleability attack against the blockchain, two days after Gox had been blaming such attacks for all problems up until now. This contrasts with the fact that failed withdrawals occurred as early as October 20, 2013. (Weiner)

February 10, 2014 – Empty Gox issues a non-update to the situation, not giving a date for when its next update will follow. A few hours prior, there had been a massive selloff of coins on Gox, sending the price from $300 to $150, strongly suggesting insider trade (read: obviously showing).

Through February – People observing Gox actions remain hopeful at the slightest activity that things will sort out well in the end; some technical developments do take place. Meanwhile, the exchange rate of bitcoin tanks, especially on Empty Gox which is now isolated from the rest of the bitcoin economy. The exchange rate plummets from $1,000 per coin to sub-$100 per coin on Gox, and to about $600 on other exchanges. Allegedly, Karpeles is acting to profit personally from this difference in price, which is directly caused by his own mismanagement and shareholder deception, through active arbitrage (Selkis).

…Karpeles knew about the pervasive damage of the transaction malleability attacks for several weeks and was engaging in an arbitrage scheme that leveraged the depressed Mt. Gox price to reap gains on other exchanges. This was allegedly happening well before [February 25].

February 24, 2014 – A crisis strategy draft leaks, courtesy of Ryan Selkis, that indicates there has been a leak from Gox’ cold storage, leaving a hole of 744,408 bitcoin. As Andreas Antonopoulos points out, a “leak” from “cold storage” is a contradiction in terms: that means it either wasn’t a leak or it wasn’t cold storage. This document makes it clear that Empty Gox management knew that the problem wasn’t technical, and that they knew well what was going on:

For several weeks, MtGox customers have been affected by bitcoin withdrawal issues that compounded on themselves. Publicly, MtGox declared [...technical problems with the bitcoin protocol...]. [...] The truth is that the damage had already been done. At this point 744,408 bitcoin are missing…

February 25, 2014 – Empty Gox website goes completely blank. The music stops. This is consistent with the timeline presented in the “Crisis Strategy Draft” leaked the day before. The bitcoin exchange rate plummets to $400 per coin.

February 26, 2014 – The exchange rate of bitcoin has recovered completely from the shock of Empty Gox closing, back up to $600 per coin. Erik Voorhees notes that the bitcoin price fell less after the Gox implosion than the US equities fell after the Lehman implosion, which puts things in perspective. (Voorhees)

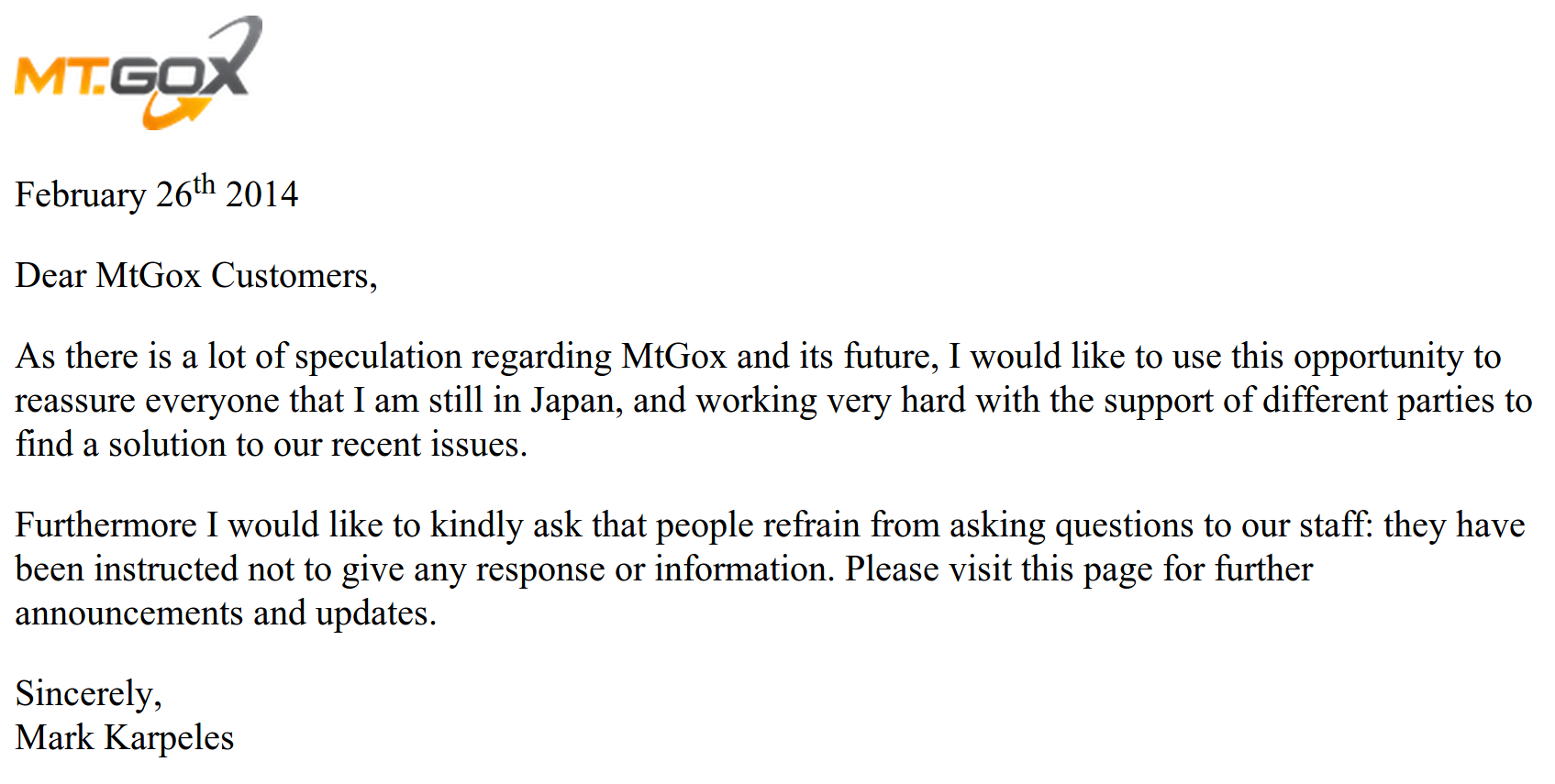

February 26, 2014 – Mark Karpeles posts a statement on the Gox website stating he is still in Japan and working to resolve the “recent issues” (see screenshot).

February 27, 2014 – Mark Karpeles’ neighbors say he moved out of his apartment in Tokyo a month ago (Kolin Burges).

February 27, 2014 – The 2014-2017 business plan of Gox leaks, courtesy of Ryan Selkis. It confirms the leaked document from February 24, and notably lacks any balance sheet. It reads very much like a prospectus aimed at courting buyers.

February 28, 2014 – Empty Gox files for bankruptcy protection, according to the Wall Street Journal (breaking at the time of writing).

This timeline, when seen from a zoomed-out perspective like this, paints a clear picture of a company – or at least a management – that was well aware of an insolvency, trying to actively deceive the community and shareholders, and profit personally from doing so.

Who took the money?

So, the trillion-dollar question: who took the money? Strictly speaking, we don’t know that yet. We’re talking about a sum of money so large that “humongous” and “enormous” aren’t sufficient to describe it – it’s 6% of all bitcoin in existence, and assuming bitcoin keeps growing to its potential, that means one individual is sitting on 6% of the world’s future trade and retail currency supply. In today’s USD value, such an amount would be on the order of 20 trillion US dollars, or roughly 250 times the fortune of today’s richest billionaire. It’s not exactly hard to see a motive here.

If this happened in the 2011 hack, then frankly, we have no idea. There are rumors floating around that Karpeles just lost the keys to the vault, that Gox has money stashed away, that the billion dollars are “temporarily unavailable”, and while an admirable theory to get hopes up that those keys may be found again, the zoomed-out picture says very clearly no such thing has happened. Somebody managing a company like this and treating it like his personal toy would have a personality that could well hint at all the money being just around the corner if you would only make a few more trades, acting just like any Prince of Nigeria. There is also unconfirmed research suggesting that Karpeles is in personal control of a very large amount of bitcoin (424,000) once used in the operations of Empty Gox; this research can be expected to be peer reviewed over the coming days. But no matter whether Karpeles personally robbed Gox blind, or profited personally on continuous deception from somebody else doing so in 2011 while deceiving clients and shareholders, it is clearly over the line into criminal territory and definition of an inside job.

In order to further boost hope in returning the money, there have been rumors of a buyout, apparently planted by Karpeles himself. Such rumors, getting hopes up that the client funds would be restored, turned out to be nothing but delusional bailout dreams from CEO Karpeles, as I predicted in my last article – while I understand the hopes of a competent management buying Gox, as I wrote, that’s a contradiction in terms. No competent management is going to go anywhere near this toxic crater. Instead, as revealed by bitcoin entrepreneur Ryan “Two-Bit Idiot” Selkis, once the businesses thus approached understood the magnitude of fraudulent mismanagement, they immediately notified authorities.

The silence from MtGox in general and its CEO Mark Karpeles in particular is stunning – and concerning – in this situation. A billion US dollars of clients’ money is missing, and the only public statement amounts to “stop asking us questions”.

In what must surely rewrite the handbooks for the entire field of Public Relations, MtGox’ trailblazing handling of public concerns over the missing billion dollars at this point amounts to “stop asking us questions”.

(Screenshot of mtgox.com, taken early morning on February 28, 2014.)

(Screenshot of mtgox.com, taken early morning on February 28, 2014.)

In the first and only interview so far after the still-officially-unexplained shutdown, which has already led to multiple tragic suicides over the loss of fortunes, CEO Mark Karpelesresponded to questions with a picture of his cat. This means that the communications skills from MtGox and Karpeles are either so carefully orchestrated here that only an experienced genius would understand them, or so incompetent that it falls below any description. Take a guess which is more probable.

According to research by Bryce Weiner, Karpeles himself is the person who took the funds, and this happened in 2011, which would be consistent with the observation by Jesse Powell (Weiner): “There’s nothing to indicate that Empty Gox was ever solvent.” While the timeline doesn’t conclusively show that Karpeles himself is behind the original disappearance of funds, it does show clear complicity in profiting from the heist.

As this article is almost finished, the Wall Street Journal reports that Empty Gox has just filed for bankruptcy.

Copycat Scam?

According to an anonymous high-profile source, the first and original bitcoin scam was the online coin wallet Mybitcoin.com. People would deposit hundreds of thousands of coins there, as the currency was new and hundreds of thousands of coins weren’t yet worth a lot.

Then, on July 29, 2011, the site went blank, just like the Gox website did. People panicked and gradually accepted a catastrophic loss of funds.

On August 11, 14 days later, the site came back online and declared – just like Gox – that they “had been hacked”, had filed for bankruptcy protection, just like Gox, but “had managed to recover” 49% of the funds. People could fill out claim forms to recover these funds. As this was enough time for most people to internalize the loss, they were happy again at the sudden windfall; things suddenly weren’t as bad as they had seemed. In the meantime, the anonymous person who ran mybitcoin.com disappeared with a huge amount of money, according to the source.

In other words, the scam cynically exploited people’s loss and grief to actually make them happy when they got something back. Most “hacks” of bitcoin sites since then have actually been copycat scams of mybitcoin.com, again according to this source. If – repeat, if Empty Gox is executing a copycat scam, we should expect the site to offer their clients a portion of the holdings back, a portion probably lower than 50% (just to drive the point home), and that offer should appear on or about March 11, 2014. Time will tell.

The one key difference between mybitcoin.com and MtGox would be that Mark Karpeles is not anonymous, which would make for a very poor execution of a copycat scam.

Live Updates Below

Mar 01 02:11 - Added the CoinLab lawsuits and the 2011 proof-of-solvency to the timeline. They are both relevant in context.

Feb 28 18:22 - According to the bankruptcy filings, the situation is even worse than previously imagined: 64 million US dollars and 850,000 bitcoin are missing.

Feb 28 14:47 - Unconfirmed just now (via Joanne Heidi): It seems Karpeles is seeking a reconstruction of Empty Gox though bankruptcy proceedings and to pay back account holders partially with a reconstructed company. If true, it continues the blueprint copycat scam.

Feb 28 13:08 - It’s possible to watch Mark Karpeles in the Japanese press conference declaring the bankruptcy. His body language is interesting to observe.

Feb 28 11:27 - A class action lawsuit has been filed that sues Mark Karpeles, MtGox Inc (US), MtGox KK (JP), and Tibanne KK (JP) for pretty much all of the above.

Feb 28 11:20 - Live updates, additions, and/or corrections will be posted here as the story keeps unfolding. All timestamps are European.

Butterfly Labs mystery ......

http://dorktech.com/where-did-butterflylabs-go/

Where did ButterflyLabs go?

3/1/14 – Popular Bitcoin ASIC hardware/software company ButterflyLabs has mysteriously disappeared Friday evening. The company was just getting ready to roll-out their 600/GH and 300/GH cards that many individuals and companies have pre-ordered as early as 8 months ago. Their website currently just shows an empty blank white page at the moment. Although upon deeper digging, some of their directories still exist on the server. Also, the ButterflyLabs Twitter page is also not showing any new signs of activity. Does this mean that ButterflyLabs is also going to leave us as well?

3/1/14 – Popular Bitcoin ASIC hardware/software company ButterflyLabs has mysteriously disappeared Friday evening. The company was just getting ready to roll-out their 600/GH and 300/GH cards that many individuals and companies have pre-ordered as early as 8 months ago. Their website currently just shows an empty blank white page at the moment. Although upon deeper digging, some of their directories still exist on the server. Also, the ButterflyLabs Twitter page is also not showing any new signs of activity. Does this mean that ButterflyLabs is also going to leave us as well?

This comes just a few days after MtGox, an extremely highly used Bitcoin/USD trading platform went down due to mistakes made in the security of the platform.

What is next for Bitcoin? All I can say is that we are in for a bumpy ride – so strap on your seat-belts and hold on.

And from Coin Desk earlier this month.....

http://www.coindesk.com/butterfly-labs-faces-5m-lawsuit-unfulfilled-order/

Butterfly Labs Faces $5m Lawsuit Over Unfulfilled Order

Published on February 6, 2014 at 17:29 GMT | Butterfly Labs, Mining

Butterfly Labs is facing a lawsuit for over $5 million that alleges that it was negligent in its business dealings, and even accuses the company ofdownright fraud.

The suit was brought by Martin Meissner, who placed a $62,000 order for BFL miners back in March 2013. Meissner claims he did not received the units or a refund for his payment, according to a report in Ars Technica.

The suit was filed in December, and it accuses Butterfly Labs of fraud, negligent representation and breach of contract.

Motion to dismiss

Butterfly Labs and its attorneys refused to comment on the matter, but Meissner’s attorney, Robert Flynn, was keen to share his views, saying to Ars Technica that he has been contracted by multiple people with similar complaints, but this is the first one to result in a lawsuit.

Although Butterfly Labs isn’t talking, it is making some legal moves. Earlier this week, the company filed a motion to dismiss Meissner’s claims, arguing that it does not state a claim that can be compensated.

The plaintiff “is not entitled to consequential damages as a matter of law because they are too speculative,” the company said.

Delays and disputes

On March 25, 2013, Meissner ordered two 1,500 GH/s bitcoin miners (product code MRG015T) and transferred $62,598 to Butterfly Labs. The contract stated that initial shipments were expected in April, but, since products are shipped according to the order queue, Meissner would get them “two months or more after order.”

Things quickly went downhill from there. In May, Butterfly Labs told Meissner that they received his payment, but they were unable to match it to any order until they got an email from him. Butterfly Labs invoiced him the same day. However, Meissner’s miners were not shipped. Instead Butterfly Labs offered to ship him six 500GH/s miners but it is unclear whether Meissner accepted or refused the offer.

This is where it gets a bit blurry, but, in any case, Meissner did not receive the 500 GH/s miners, either.

In mid-October, Meissner’s lawyer sent the company a letter, saying that any shipment at such a late date would be refused. Butterfly Labs refused his request for a refund, saying that all sales are final. However, Meissner argues that no sale was ever made, since he never got the product.

‘Speculative claim’

The most obvious question is why Butterfly Labs allowed the dispute to escalate and get them in the news. After all, it could have refunded Meissner and sold the miners to someone else, when they become available.

There is a bit of a problem, though. Meissner is not just asking for his $62,000 back – he also wants compensation for lost revenue. The complaint states that Meissner missed out on an opportunity to mine between $5- and $7.5-million worth of bitcoins.

This is probably why Butterfly Labs insists his damage claims are “speculative” and dismisses them outright.

Call in the jury

Butterfly Labs blames Meissner for the mess, insisting that his order was not finalised. Although it received the payment in March, it could not tie it to any existing order, as it did not include an order number. The company then waited for Meissner to get in touch, which he did in May.

A Butterfly Labs document sheds more light on the matter: “In the case of the product generation (65nm) that the Plaintiff pre-ordered, BF Labs experienced technical delays in its development that held up manufacturing the new technology at commercial scale”. It continues:

In addition, the company points out that it increased its prices in April 2013, following a rise in the price of bitcoin. Since Meissner’s order was not finalized, Butterfly Labs assumed it was abandoned when he did not reply to the email notice.

This is not the first legal dispute involving a mining hardware company and it probably won’t be the last. There are always risks involved with pre-ordering untested and unproven silicon, regardless of legal fine print. In this particular case, it may be that both parties share at least part of the blame, but that’s ultimately for a jury to decide.

http://www.cryptocoinsnews.com/2014/02/28/buttercoin-promises-launch-soon/

Buttercoin Promises To Launch *Very* Soon…

But Where And What?

Buttercoin has just emailed everyone that signed up for their early access list!

If you are interesting in pushing me further up the queue to get more information on Buttercoin to the masses faster, please follow this link and register for early access.

Who Is Buttercoin?

Buttercoin was founded by Cedric Dahl and Bennet Hoffman, formerly of CoinHarvest, back in 2013 and received roughly $1.6 million in funding from various sources including Google Ventures and Y Combinator.

Dahl and Hoffman are targeting the International Remittance market, a $550 billion USD market that is currently run by “cartels” such as Western Union which charge up to 10% for a transfer. Buttercoin seeks to rebuild this crucial international infrastructure using Bitcoin as the centerpiece instead of the current hodgepodge mesh of bank transfer systems riddled with middlemen and governments which is currently used.

As I mentioned back in 2013, both domestic and international remittances highlight Bitcoin’s superiority to the USD as a medium of exchange. I posited that we may soon find ourselves in a world where Bitcoin and other cryptocoins are the best “bank account” that someone in a third world country could conceivably own or have steady access to. A Bitcoin wallet in a fiat denominated world is useless without trusted exchanges though, and that’s where Buttercoin comes in.

How is Buttercoin Launching?

Buttercoin’s plan, as revealed to TechCrunch in an interview last August, is to partner with existing local money transfer businesses in order to guarantee regulatory compliance within the country. However, they plan to keep these local partners’ hands out of the pot, so to say, by only giving them 50% of generated fees. Buttercoin is merely using these existing local money transfer businesses, or third party payment processors as China likes to call them, for regulatory compliance. The hands off partnership offers the established fiat businesses a way to legally tap into the growing Bitcoin economy and in turn allows Buttercoin to bring Bitcoin to that specific country.

What And Where Exactly Is Buttercoin Launching?

It isn’t yet clear what exactly Buttercoin has lined up for the launch. Back in August they informed the press that they planned to open in India by the end of 2014; however, it is likely that the regulatory haze within the Indian government that delayed Unocoin for awhile may have also delayed Buttercoin’s plans in the region.

Astute Bitcoiners may recall that Sunny Ray is involved with both Unocoin and Buttercoin. The connection is simple, Sunny Ray works with BitPay in India and likely knows all the channels (read: existing local money transfer businesses) that will settle Bitcoin with Indian Rupee. Whether or not Buttercoin’s new launch effects Unocoin in any way, remains to be seen.

Buttercoin’s announcement hints that they will be launching their Bitcoin trading platform globally; however, I still sincerely hope that they also have a fully established Bitcoin exchange to announce in a new country.

The human toll .......

http://www.cryptocoinsnews.com/2014/02/28/crypto-community-mourns-loss-autumn-radtke-still-remembers-mikhail-sindeyev/

Crypto Community Mourns The Loss Of Autumn

Radtke, Still Remembers Mikhail Sindeyev

Singaporean police reported the death of Autumn Radtke, CEO of First Meta Exchange, late on February 26th. The news traveled fast on the wings of tweets and First Meta Exchange’s blogconfirmed the death the next day and offered these consoling words:

“The First Meta team is shocked and saddened by the tragic loss of our friend and CEO Autumn Radtke. Our deepest condolences go out to her family, friends and loved ones. Autumn was an inspiration to all of us and she will be sorely missed.”

As of now, the cause of death has not yet been completely confirmed by police, though some sources claim that the death was a suicide.

First Meta Exchange first caught the attention of the Crypto community when Jon Matonis publicized First Meta’s receiving of nearly $500,000 in venture capital from Silicon Valley’s Plug and Play Tech and Singapore’ National Research Foundation. First Meta Exchange was not a Bitcoin exchange in the way that Mt. Gox was. First Meta would accept all different types of virtual currencies both centralized and decentralized. Bitcoin was but one of the many options that First Meta offered to its customers.

First Meta plans to continue operations.

Mikhail Sindeyev

A few weeks ago, the Crypto community at large, was also shocked with the all too sudden death of Mikhail Sindeyev aka ‘thecoder’. Mikhail Sindeyev was just one year younger than Autumn Radtke at the tender age of 27. He passed away due to a stroke, as relayed by his department at MSU in Russia:

“Mikhail Sindeyev, researcher of our lab, has died February 14, 2014 from stroke at 27. He was one of the most talented graduates of our laboratory and active participant of many research projects. In May 2013 he successfully defended his PhD thesis “Research and developement of video matting algorithms”. Our sincere condolenses to his parents. We will deeply miss him.”

Beyond the Sindeyev’s PhD work in Academia, his C++ work on Huntercoin and Namecoin is being utilized at the bleeding edge of technology.

Sindeyev was a Namecoin and Huntercoin developer and continually redefined what we thought was possible with a blockchain. Namecoin and Huntercoin are two examples of altcoins that are leading true innovation in altcoins. The then nascent Huntercoin community, led by Huntercoin developer snailbrain, gathered in the days after his untimely death to mourn the passing of a Crypto great.

Here at CCN, we’d like you to join us in a moment of silence for our fallen colleagues: Autumn Radtke and Mikhail Sindeyev.

The Bitcoin ATM Card will, in practice, function just like any other debit card: swipe, type your pin and get a receipt. Bitcoin ATM Card will then be automatically transferred from your Bitcoin ATM Card wallet to the vendor's.

ReplyDeleteIt is a one of the handy article which is very essential for me as well. I must follow the content and must follow the article. I will come o you t know the great article. keep it up.Bitcoin atm card

ReplyDeleteBitcoin atm card. I am always check your blog and get always informative content, Keep up the good wor

ReplyDelete