Three examples of co - dependency from today !

http://jessescrossroadscafe.blogspot.com/2013/12/reich-jp-morgan-and-corruption-of.html

I thought this article below was a striking, insightful and important set of observations from Robert Reich.

Rather than merely link to it, I thought an extended excerpt was appropriate, since it strikes to the heart of a key theme of this Café, thecredibility trap that diminishes the reforms essential for a sustainable recovery by co-opting transparency and equal justice under the law, making the governing process both complicit and co-dependent with even the worst abuses and frauds of the monied interests.

Pam Martens has an interesting take on the Fed's role in this shifting of power to the unelected power brokers on Wall Street which you can read here.

I listen carefully to what Robert Reich has to say, and often find it to be well founded and thoughtful. But whenever I quote or link to something of his, it seems as though I get some comment about why I like that liberal. That comes, as so many others know, with the turf of managing a thought centered blog, but it helps to illustrate one of our key problems today. We cannot even speak to one another long enough to identify the problems, without resort to slogans, labels, and shouting.

It is too bad that so many are distracted, if not ensnared, in the well-crafted emotionalism and stage play of the left vs. right puppet showwhich is put forward in the headlines, while the looting of the nation by its ruling class proceeds virtually unimpeded and to almost everyone's detriment, except for an obscenely fortunate few. This is what the data shows, and the role of policy in this is almost unmistakable, except for those who are willfully blind.

Are there any remaining who would still, at this late date, consider Obama as a real progressive? By now he has been repeatedly shown as merely the less repugnant of two bad choices in which the 'liberal opposition' now resembles the corporate-friendly Republicans of only a couple decades ago. But as Richard Cobden is said to have observed, 'For every credibility gap there is a gullibility gap.'

You may read the entire, original piece here.

http://jessescrossroadscafe.blogspot.com/2013/12/reich-jp-morgan-and-corruption-of.html

Reich: JP Morgan, the Corruption of America, and the Age of Cynicism

“What is a cynic? A man who knows the price of everything and the value of nothing."

Oscar Wilde, Lady Windermere's Fan

I thought this article below was a striking, insightful and important set of observations from Robert Reich.

Rather than merely link to it, I thought an extended excerpt was appropriate, since it strikes to the heart of a key theme of this Café, thecredibility trap that diminishes the reforms essential for a sustainable recovery by co-opting transparency and equal justice under the law, making the governing process both complicit and co-dependent with even the worst abuses and frauds of the monied interests.

Pam Martens has an interesting take on the Fed's role in this shifting of power to the unelected power brokers on Wall Street which you can read here.

I listen carefully to what Robert Reich has to say, and often find it to be well founded and thoughtful. But whenever I quote or link to something of his, it seems as though I get some comment about why I like that liberal. That comes, as so many others know, with the turf of managing a thought centered blog, but it helps to illustrate one of our key problems today. We cannot even speak to one another long enough to identify the problems, without resort to slogans, labels, and shouting.

It is too bad that so many are distracted, if not ensnared, in the well-crafted emotionalism and stage play of the left vs. right puppet showwhich is put forward in the headlines, while the looting of the nation by its ruling class proceeds virtually unimpeded and to almost everyone's detriment, except for an obscenely fortunate few. This is what the data shows, and the role of policy in this is almost unmistakable, except for those who are willfully blind.

Are there any remaining who would still, at this late date, consider Obama as a real progressive? By now he has been repeatedly shown as merely the less repugnant of two bad choices in which the 'liberal opposition' now resembles the corporate-friendly Republicans of only a couple decades ago. But as Richard Cobden is said to have observed, 'For every credibility gap there is a gullibility gap.'

You may read the entire, original piece here.

JP Morgan Chase, the Foreign Corrupt Practice Act, and the Corruption of America

By Robert Reich

Sunday, December 8, 2013

The Justice Department has just obtained documents showing that JPMorgan Chase, Wall Street’s biggest bank, has been hiring the children of China’s ruling elite in order to secure “existing and potential business opportunities” from Chinese government-run companies.

“You all know I have always been a big believer of the Sons and Daughters program,” says one JP Morgan executive in an email, because “it almost has a linear relationship” to winning assignments to advise Chinese companies. The documents even include spreadsheets that list the bank’s “track record” for converting hires into business deals.

It’s a serious offense. But let’s get real. How different is bribing China’s “princelings,” as they’re called there, from Wall Street’s ongoing program of hiring departing U.S. Treasury officials, presumably in order to grease the wheels of official Washington? Timothy Geithner, Obama’s first Treasury Secretary, is now president of the private-equity firm Warburg Pincus; Obama’s budget director Peter Orszag is now a top executive at Citigroup.

Or, for that matter, how different is what JP Morgan did in China from Wall Street’s habit of hiring the children of powerful American politicians? (I don’t mean to suggest Chelsea Clinton got her hedge-fund job at Avenue Capital LLC, where she worked from 2006 to 2009, on the basis of anything other than her financial talents.)

And how much worse is JP Morgan’s putative offense in China than the torrent of money JP Morgan and every other major Wall Street bank is pouring into the campaign coffers of American politicians — making the Street one of the major backers of Democrats as well as Republicans?

The Foreign Corrupt Practices Act, under which JP Morgan could be indicted for the favors it has bestowed in China, is quite strict. It prohibits American companies from paying money or offering anything of value to foreign officials for the purpose of “securing any improper advantage.” Hiring one of their children can certainly qualify as a gift, even without any direct benefit to the official.

JP Morgan couldn’t even defend itself by arguing it didn’t make any particular deal or get any specific advantage as a result of the hires. Under the Act, the gift doesn’t have to be linked to any particular benefit to the American firm as long as it’s intended to generate an advantage its competitors don’t enjoy.

Compared to this, corruption of American officials is a breeze. Consider, for example, Countrywide Financial’s generous “Friends of Angelo” lending program, named after its chief executive, Angelo R. Mozilo, that gave discounted mortgages to influential members of Congress and their staffs before the housing bubble burst. No criminal or civil charges have ever been filed related to these loans...

The Foreign Corrupt Practices Act is important, and JP Morgan should be nailed for bribing Chinese officials. But, if you’ll pardon me for asking, why isn’t there a Domestic Corrupt Practices Act?

Never before has so much U.S. corporate and Wall-Street money poured into our nation’s capital, as well as into our state capitals.Never before have so many Washington officials taken jobs in corporations, lobbying firms, trade associations, and on the Street immediately after leaving office. Our democracy is drowning in big money.

Corruption is corruption, and bribery is bribery, in whatever country or language it’s transacted in.

http://www.zerohedge.com/news/2013-12-09/david-stockman-rages-market-valuation-has-lost-any-anchor-real-world

Submitted by Tyler Durden on 12/09/2013 21:16 -0500

http://jessescrossroadscafe.blogspot.com/2013/12/why-fed-and-us-government-confiscated.html

I believe that this example of how the Fed and the US government 'directed' gold to preferred parties prior to a major revaluation is even more relevant now than I did when I first wrote about this in 2009.

As you know, I think that a new 'Bretton Woods' will be reconstituted at some point, and what we are seeing right now is a vigorous 'negotiation of terms' between the Anglo-American banking cartel and the developing countries, or at least those that cannot be cowed by force. The wild card is why China has been included so graciously and so deeply in the scheme, and what role they are expected to play.

This has been referred to here and other places for some time now as the 'currency war.'

There is plenty of propaganda, also known as semi-official 'advice,' being put forward in support of the various intentions of the worldly powers. China is clearly urging its people to buy gold for themselves, and the West is encouraging its people to turn their gold over to the Banks. To expect China to act in the interest of the Western peoples is a bit too altruistic to be credible.

And while I do not expect a 'hard confiscation' of gold and silver, given the likelihood of credible resistance at least in the States, I do think that expecting a 'bail-in' to occur, even from so-called allocated assets in storage in a few countries in the Banks' sphere of influence, from the US and the UK to their former colonies and client states, to be increasingly possible.

If this is correct, then the public of America and the UK, not to mention Europe and Japan, may be in for what is colloquially referred to as 'a royal screwing.' That is so dark that it seems to be almost impossible, inhuman. It would be taking money from innocent people, especially the poor and the weak, to bailout the Banks and the thoroughly corrupt monied interests. But based on what we have seen, it is certainly not out of the question.

Let's see how all this plays out.

And from Naked Capital today - December 10 , 2013....

The current malaise of news, data, and spin is "meaningless," David Stockman tells Bloomberg's Tom Keene, adding that markets are exhibiting "the kind of speculative froth you get at the top of a cycle where valuation loses any anchor in the real world; from earnings or the prospects of the economy." Ashe argued before, "owning stocks here is very dangerous," and despite Keene's best efforts to denigrate Stockman's "of course it's a bubble," perspective; the former inside-man exposes the hard mathematical truths of valuations, performance, and reality in this brief clip. Who is to blame - The Fed or Wall Street? "It is a question of who has taken whom hostage," Stockman concludes ominously, "it's a co-dependency... it's very dangerous."

"Wall street demands that the Fed keeps dishing out the liquidity, keeps dishing out the monetary heroin...They have a hissy fit if the chairman of the Fed even suggested they might begin to taper four years into a recovery.So - it's a codependency.It's a very dangerous thing. "

http://www.nakedcapitalism.com/2013/12/whistleblower-reports-rampant-violation-of-broker-dealer-laws-by-private-equity-firms.html

MONDAY, DECEMBER 9, 2013

Whistleblower Describes How Private Equity Firms Flagrantly Violate SEC Broker-Dealer Requirements

Last week, Crain’s Business Daily and Fortune reported that whistleblower has provided the SEC with evidence of massive, ongoing violations of securities laws, specifically, the Securities Exchange Act of 1934, by several unnamed private equity firms.

The violations result from the long-established practice of PE firms charging “transaction fees” to investors in their funds when the PE firms, as managers of various funds, buy and sell of portfolio companies. They also levy transaction fees when portfolio companies issue debt or equity securities. Bear in mind that these fees are not in lieu of fees paid to investment bankers and brokers; they are additional charges, on top of both those third party fees and the private equity firm’s management fee, the famed “2 and 20″ (2% annual management fee, 20% of the gains, although the management fee is lower for the very large funds). And these transaction fees are typically comparable in size to the fees paid to investment bankers.

This controversial practice has been going on for decades, and it is no secret. The PE firms collectively have reaped billions of dollars through this ruse. Dozens, if not hundreds, of articles have been written about it. Typically, these stories depict these transaction fees as an abuse of both the portfolio companies and the private equity fund investors, since portfolio company revenues are diverted into the pockets of private equity managers. For instance, a account about the whistleblower published last week by the usually pro-industry CNBC, where the headline itself described transaction fees as “private equity’s ‘crack cocaine.’”

But as scandalous as this ongoing looting ought to be, the whistleblower focuses on another glaring problem with the private equity firm transaction fees: the private equity firms are not registered broker-dealers.

Anyone who has been in the securities industry will know how big a deal being a broker-dealer is. Even as a small firm consultant, I’d take care with how my engagements were defined so that there was no way they’d be considered to be securities dealing and hence oblige me to register my firm as a broker-dealer. Being a broker-dealer involves not just registering with the SEC but complying with a long list of requirements to make sure you are dealing with customers fairly, including:

Becoming a member of a self-regulatory organization (usually FINRA)Training and licensing principals and staffObeying state securities lawsBeing subject to SEC inspections and disciplinary actionsComplying with customer protection and commission disclosure rules, recordkeeping, financial reporting requirements, and Treasury anti-money laundering requirements

See this Davis Polk discussion for more detail.

So what is surprising isn’t that the whistleblower is making these charges, but that are about twenty years overdue. These filings are simply pointing out what should have been obvious to everyone all along: most of the PE industry stands flagrantly non-compliant with fundamental law regulating the duties of investment managers when they take “transaction-based compensation” in connection with the purchase or sale of securities on behalf of their clients.

The reaction of the PE industry flacks to these allegations has been all too familiar indignation resulting from an overweening sense of entitlement: how can anyone dare to question their fee skimming prerogatives? Legally, they have nothing to stand on. In a courtroom, even the best lawyers money can buy would find it well nigh impossible to defeat the clear language of the statue and decades of supporting decisions. However, the SEC is a very different forum than a court. The PE industry has a strong political hand there, as their lawyers marshal the only arguments they have, which are self-serving palaver dressed up as public policy claims for why the SEC should treat private equity differently than all other investment asset classes.

At their core, the industry arguments are an attempt to dismiss the issue as a mere “technical violation.” This is hard to stomach from firms that fetishize the clever use of contracts, financial engineering, and arcane tax and legal structures to rip out more profits and while insulating themselves from liability when things go awry. For example, when Bain Capital bought Gymboree, it did so through an intermediary called “Giraffe Holdings, Inc.,” and when it bought Dunkin Donuts, it was through “BCT Coffee Acquisition, Inc”. Bain would scream bloody murder if a court didn’t respect the separate legal existence of these purely shell entities.

The PR industry’s pious claims that “technicalities don’t matter when complying with them is inconvenient and costly” is a repeat of the posture of the mortgage securitization professionals, where the entire industry was founded on meticulous compliance with complex contractual provisions so as to satisfy multiple legal requirements. But when deal sponsors and servicers decided it would be cheaper to blow off these carefully crafted provisions that were fundamental to achieving highly desired legal outcomes, suddenly mortgage and foreclosure frauds were rebranded as “paperwork problems”. You can easily substitute “private equity” in this discussionby Georgetown law professor Adam Levitin of the securitization industry’s efforts to trivialize its abject disregard for the law:

To raise the “it’s just paperwork” argument in the context of securitization, however, is unreal. Securitization is all about legal fictions and paperwork. Why on earth would anyone every bother with the complex legal structures of securitization (typically involving two shell entities) other than to take advantage of legal fictions?As I’ve noted in other venues, securitization is the legal apotheosis of form over substance, and the basis on which this is legally tolerated is the punctilious observance of formalities. Failure to do so can result in a securitization failing to be bankruptcy remote or to lose its off-balance sheet accounting status or lose its pass-thru tax status, any of which are disasterous. Securitization deals were so heavily lawyered precisely because the paperwork matters. They aren’t like a sale of a used sofa over Craigslist.

Whether private equity fund investors have been cheated out of brokerage fees is a difficult question. By not registering, PE firms have evaded the requirement of registered broker-dealers to provide investors with brokerage commission reports. Investors can’t tell whether they have been cheated out of portions of transaction fees that were supposed to be rebated to them because they never got the information they would need in order to know. It’s much like the NSA before Snowden arguing that nobody could prove illegal spying because the fact of the spying was itself a secret.

How has the SEC missed this flagrant violation of the 1934 Exchange Act for so long? The answer is very simple, and has a surreal Catch-22 quality. Basically, the SEC limits its surveillance for security law violations almost exclusively to those who volunteer to be examined, either as “investment advisers” or “broker-dealers”. Other than shutting down flagrant Ponzi schemes run by two bit hustlers, the SEC does very little even to look for securities law violations among investment firms that don’t comply with requirements to self-register as broker-dealers or investment advisers. Almost all PE firms chose to keep the SEC entirely out of their houses by ignoring the requirement to register as broker-dealers. To the SEC, the private equity industry, and its illegal broker-dealer practices, simply didn’t exist. And Dodd Frank’s registration requirements don’t address this issue. Private equity firms are now required to register as investment advisors, but that regime covers different activities than that of broker dealers, and thus is not relevant to the transaction fee abuse. But, natch, the SEC firms are arguing otherwise: the SEC is already supervising [part of] what they do, so that should be more than enough.

In fact, the SEC’s failure to supervise all relevant securities-related activities was the heart of the Madoff fraud. Madoff had two businesses: a basically legitimate broker-dealer unit that was registered with the SEC and therefore regularly audited by it, and an unregistered investment adviser that was running the massive Ponzi fund. The SEC dutifully oversaw the broker dealer while essentially pretending that Madoff’s investment adviser unit didn’t exist. So the PE funds are arguing we should just trust them with the mirror image of Madoff’s supervision.

We’re going to continue to probe this topic. There’s lot’s of interesting evidence available in the public domain showing how PE firms have carried on their shenanigans, and we are going to examine it. We are also going to look at the political efforts of the industry to influence the SEC, and also ask some questions about how such a nakedly illegal securities practice has managed to hide in plain sight for so long.

And from two days ago , along the same lines......

07 DECEMBER 2013

Why the Fed and the US Government Confiscated Gold in 1933, And What They May Be Doing Now

"He who does not punish evil commands that it be done."

Leonardo da Vinci

I believe that this example of how the Fed and the US government 'directed' gold to preferred parties prior to a major revaluation is even more relevant now than I did when I first wrote about this in 2009.

As you know, I think that a new 'Bretton Woods' will be reconstituted at some point, and what we are seeing right now is a vigorous 'negotiation of terms' between the Anglo-American banking cartel and the developing countries, or at least those that cannot be cowed by force. The wild card is why China has been included so graciously and so deeply in the scheme, and what role they are expected to play.

This has been referred to here and other places for some time now as the 'currency war.'

There is plenty of propaganda, also known as semi-official 'advice,' being put forward in support of the various intentions of the worldly powers. China is clearly urging its people to buy gold for themselves, and the West is encouraging its people to turn their gold over to the Banks. To expect China to act in the interest of the Western peoples is a bit too altruistic to be credible.

And while I do not expect a 'hard confiscation' of gold and silver, given the likelihood of credible resistance at least in the States, I do think that expecting a 'bail-in' to occur, even from so-called allocated assets in storage in a few countries in the Banks' sphere of influence, from the US and the UK to their former colonies and client states, to be increasingly possible.

If this is correct, then the public of America and the UK, not to mention Europe and Japan, may be in for what is colloquially referred to as 'a royal screwing.' That is so dark that it seems to be almost impossible, inhuman. It would be taking money from innocent people, especially the poor and the weak, to bailout the Banks and the thoroughly corrupt monied interests. But based on what we have seen, it is certainly not out of the question.

Let's see how all this plays out.

The Last Time the Feds Devalued the Dollar to Save the Banks

14 January 2009

We dipped once again into the Federal Reserve Bulletin Publication from June, 1934 to take a closer look at the growth of the monetary base, and found an interesting graphic that shows the accounting for the January 1934 devaluation of the dollar and the subsequent result on Bank Reserves in the Federal Reserve System.

As you will recall, the Gold Act, or more properly Executive Order 6102 of April 5, 1933, required Americans to surrender their gold coinage and certificates to the Federal Reserve Banks by May 1, 1933. There were no prosecutions for non-compliance except one benchmark case which was brought voluntarily by a person who wished to challenge the act in court.

After a substantial portion of the gold was turned in by US citizens and taken from their bank based safe deposit boxes, the government officially devalued the dollar from 20.67 to 35.00 per ounce in the Gold Reserve Act of January 31, 1934.

The proceeds from this devaluation were used to provide a significant boost to the Federal Reserve member bank positions as shown in the first chart below.

The inflation visited on the American people because of this action helped to take the CPI as it was then measured up 1200 basis points from about -8% to +4% by the end of 1933. To somewhat offset the monetary inflation the Fed also contracted the Monetary Base which served the nascent recovery in the real economy rather poorly and is viewed widely as one of a series of policy errors.

Considering that the actions did little for the employment situation this was painful medicine indeed to those who were dependent on wages.

Fortunately at the same time FDR was initiating the New Deal programs which, despite continual opposition from a Republican minority in Congress, managed to provide a small measure of relief for the 20+% public that was suffering from unemployment and wage stagnation.

People ask frequently "Will the government seize gold again?"

While there is no certainty involved in anything if a government begins to overturn the law and seize private property, one has to ask for the context and details first to understand what happened and why, to understand the precedent.

Technically, the government did not engage in a pure seize of private property, since at that time the US was on the gold standard, and much of the gold holdings of US citizens were in the form of gold coinage and certificates.

Governments always make the case that the currency is their property and that the user is merely holding it as a medium of exchange. The foundation of the argument was that the government required to recall its gold to strengthen the backing of the US dollar against the net outflows of gold for international trade. The devaluation helped with this as well, since dollars brought less gold for trade balances.

People also ask, "Why didn't the government just revalue the dollar without trying to recall all the gold from the American public?"

The answer would seem to be that this would have been more just, more equitable recompense for the public. The Treasury could have purchased gold from the public to support its foreign trade needs.

But it would have left much less liquidity for the banks.

One can make a better case that the recall of the gold, with the subsequent revaluation to benefit a small segment of the population in the Banks, was a form of seizure of wealth without due compensation. Hence the lack of active prosecutions.

So, will the government take back gold again to save the banks by devaluing the dollar?

Highly unlikely, because they not only do not need to this, since the dollar is no longer backed by gold, and is a form of secular property except perhaps for gold eagles, but they do not have to, because they are devaluing the dollar already to save the banks.

This time the confiscation of wealth to save the banks is called TARP. (And QE I&II, financial asset inflation, and gold leasing and suppression with the soft confiscation of price manipulation. - Jess).

If one thinks about it, US Dollars are being created and provided directly to the banks to boost their free reserves significantly, at a scale comparable and beyond to 1933-34.

The confiscation of wealth is being spread among all holders of US dollars and dollar assets, foreign and domestic, in the more subtle form of monetary inflation.

Granted, the government must be more opaque to mask their actions in order to sustain confidence in the dollar while the devaluation occurs, but this is exactly what is happening, and all that is required to happen in a fiat regime.

There is no need to seize widely held exogenous commodities like gold and oil, but merely dampen any bellwether signals that a significant devaluation of the dollar is once gain being perpetrated on the American people in order to save the banks.

Its fascinating to look carefully at this next chart below.

First, notice the big drop in gold in circulation of 9.8 million ounces, or roughly 36% of the measured inventory at the end of 1932. Think someone was front-running the dollar devaluation? We suspect that the order went out to start pulling in the gold stock to the banks.

The reduction in gold in circulation AFTER the announcement of the Gold Act in April would be about 3.9 million ounces, or roughly 22% of the gold remaining in circulation in March 1933.

Considering that all gold coinage held by banks in the vaults was automatically seized, the voluntary compliance rate is not all that impressive. We are not sure how much of this was being held in overseas hands by non-US entities.

But beyond a doubt, there was an unjust, if not illegal, seizure of wealth by requiring citizen to turn in their gold to the banks, which was then revalued at the beginning of 1934 by 69% from 20.67 to 35 dollars.

It would have been much more equitable to devalue the dollar and to change the basis for dollar/gold first, before requiring private citizens to surrender their holdings. But of course, this would have lessened the liquidity available for direct infusion into the Federal Reserve banks.

And from Naked Capital today - December 10 , 2013....

Big Banks About to Start Booking Second Mortgage Losses They Can No Longer Extend and Pretend Away

Posted on by

Reuters has a new article, Insight: A new wave of U.S. mortgage trouble threatens, which is simultaneously informative and frustrating. It is informative in that it provides some good detail but it is frustrating in that it depicts a long-standing problem aided and abetted by regulators as new.

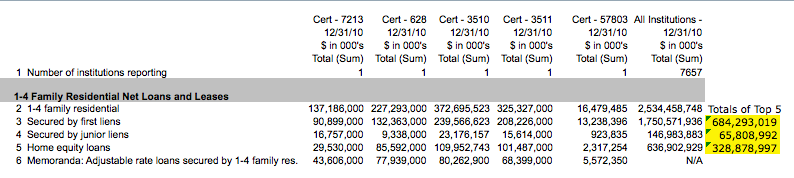

When the mortgage mess was a hotter topic than it has been of late, we would write from time to time about the second mortgage time bomb sitting at the major banks, particularly Bank of America. Unlike first mortgages, which were in the overwhelming majority of cases securitized and sold to investors, banks in the overwhelming majority of cases kept second liens (which in pretty much all cases were home equity lines of credit, or HELOCs) on their books).

This arrangement led to tons, and I mean tons, of abuses, which regulators chose to ignore or worse, actively promoted. Second liens, as the name implies, have second priority to first liens. In a bankruptcy or resturcturing, they are to be wiped out entirely before the first lien is touched (“impaired” as they say).

But the banks that had HELOCs on their books were often the servicer of the related first liens. And even though they had a contractual obligation to service those first liens in the interest of the investors, they’d predictably watch out for their own bottom line instead. For instance, if a borrower was deeply underwater, it would make sense to at least partially write down the second. If the borrower was delinquent, the servicer should write off the second and restructure (aka modify) the first mortgage. But instead you’d see banks use their blocking position as second lien holder to obstruct mortgage modifications. Worse, Bill Frey of Greenwich Financial documented that Bank of America had modified subprime mortgages securitized by Countrywide (as in reduced their value) without touching the seconds, a clear abuse (notice that this issue was raised in the BofA mortgage settlement, and bank crony judge Barbara Kapnik looks almost certain to sweep it under the rug).

Regulators played a direct hand in this chicanery. If the regulators had forced the banks to write down HELOCs, banks would have much less incentive to try to wring blood out of the turnip of underwater borrowers (particularly if the regulators had made clear they took a dim view of that sort of thing). But the authorities were far more concerned about preserving the appearance of solvency of the TBTF players.

Another dubious practice that regulators enabled was extend and pretend on HELOCs. Unlike first mortgages, where fixed payments are stipulated, HELOCs didn’t require borrowers to engage in principal amortization until typically ten years after the loan was first made (a minority of loans set the limit at five years). This is not unlike credit cards in the pre-crisis era, where banks were permitted to set the minimum payment so low as to pay interest only (banks are now required to set minimum payments high enough to that the balance would be paid off in 60 months).

If that isn’t bad enough, the banks went one step further. Banks were engaging in negative amortization, as in not even requiring borrowers to pay all the interest charges, which meant they were adding unpaid interest to principal in order to keep the mortgages looking current so as to avoid writing them down. As we wrote in 2011:

The bone of contention is that mortgage servicers, which also happen to units within the biggest US banks, have not been playing nicely at all with stressed borrowers out of an interest in preserving the value of their parent banks’ second liens. And the reason for that is that writing down second liens to anything within hailing distance of reality, given how badly underwater a lot of borrowers in the US are, would blow a very big hole in the equity of major banks and force a revival of the TARP…Anecdotally, it appears that banks use a very aggressive carrot and stick to keep seconds current. They threaten borrowers with aggressive debt collection on seconds. And on home equity lines, which are the overwhelming majority of second liens (see this spreadsheet courtesy Josh Rosner for details of the results from the five biggest servicers, click to enlarge), negative amortization is kosher.For data junkies, 1 is Citi, 2 is JPM, 3 is BofA, 4 is Wells and 5 is GMACSo what does a bank do? On day 89, before the HELOC is about to go delinquent, it tells the borrower to pay anything on it. A trivial payment is treated as keeping the HELOC current. So this explains Eisenger’s question: it’s easy for the Wells of this world to pretend that these second loans are doing fine if you will go through all sorts of hoops to make them look current, including if needed by lending them the money to make part of their interest payment. So even though a lot of commentators argue that it’s hard to argue that banks should write down their seconds if borrowers are current, what “current” really means deserves a lot more scrutiny than it has gotten.

And as Matt Stoller wrote in early 2012:

Over the past three years, the big four servicers have been keeping hundreds of billions of dollars of second mortgages on their books (mostly in the form of Home Equity Lines of Credit, or HELOCs). Many of these mortgages would seem effectively worthless, because a home equity line of credit or second mortgage on top of an already deeply underwater first mortgage has no value. You can’t use it to foreclose, because you’d get nothing out of the foreclosure – all of that would go to the first mortgage holder (usually some investor in a pension fund somewhere). It has only “hostage value”, or the ability to stop a modification or write-down from happening. The best way to clean up this situation is to have the regulators (FDIC, OCC, Federal Reserve) simply tell the banks that they must write down their second mortgages on collateral that has been impaired. That way, the incentive problem goes away. By forcing the bank to recognize the loss now, the bank will no longer stop a modification on a first mortgage. And in fact, the regulators pretty much agreed that this is what their examiners should do, when they issued new rules earlier this year on accounting for second liens.Only, the regulators haven’t done it, because the banks claim their seconds are performing. Bank of America says that these loans are worth 93 cents on the dollar. Several of the other banks don’t break out their loss reserves for seconds, so it’s hard to tell, but I think it’s clear they aren’t reserving enough. We can tell that because the Federal Reserve itself is dramatically overvaluing these seconds. In a stress test, the Fed said in its worst case scenario that the banks would lose only “$56 billion”. These are low numbers. According to their most recent investor report, Wells Fargo alone has $35 billion of second liens behind first mortgages that are underwater.

So now, after years of denial by banks and enabling by regulators, the second lien chickens are finally coming home to roost. Homeowner advocate Lisa Epstein gives an idea of how bad this looks from the borrower side:

People who’ve owned their homes for decades, never paid a bill late in their life, and got one of these HELOCs in the early to mid 2000s are starting to get seismic shocks in their monthly statements. Monthly bills going from $200 to $1,200 is met with incredulity and confidence that a mortgage servicer mistake has been made until it is clear that they’ve received a rude reminder of something most families have forgotten or never fully realized. Some have been paying interest only for 10 years and a $25,000 balloon is coming due. For most, the only option is to sell if not underwater or to default and try to negotiate a reduction and deal with the IRS 1099 issue if the Mortgage Forgiveness Act expires without extension in a few weeks, risking foreclosure. And, then there’s the question about what to do with the first mortgage if there is one.

But the Reuters piece, while doing a good job of trying to get a handle on the magnitude of this problem, peculiarly plays down they way regulators have given the banks a wink and an nod all these years:

U.S. borrowers are increasingly missing payments on home equity lines of credit they took out during the housing bubble, a trend that could deal another blow to the country’s biggest banks….More than $221 billion of these loans at the largest banks will hit this mark over the next four years, about 40 percent of the home equity lines of credit now outstanding….The number of borrowers missing payments around the 10-year point can double in their eleventh year, data from consumer credit agency Equifax shows. When the loans go bad, banks can lose an eye-popping 90 cents on the dollar, because a home equity line of credit is usually the second mortgage a borrower has…The number of borrowers missing payments around the 10-year point can double in their eleventh year, data from consumer credit agency Equifax shows. When the loans go bad, banks can lose an eye-popping 90 cents on the dollar, because a home equity line of credit is usually the second mortgage a borrower has…For home equity lines of credit made in 2003, missed payments have already started jumping.Borrowers are delinquent on about 5.6 percent of loans made in 2003 that have hit their 10-year mark, Equifax data show, a figure that the agency estimates could rise to around 6 percent this year. That’s a big jump from 2012, when delinquencies for loans from 2003 were closer to 3 percent.This scenario will be increasingly common in the coming years: in 2014, borrowers on $29 billion of these loans at the biggest banks will see their monthly payment jump, followed by $53 billion in 2015, $66 billion in 2016, and $73 billion in 2017.

The Reuters story also says that the Office of the Comptroller of the Currency was “warning” about HELOCs in early 2012. Ahem, they were recognized as a big undeplayed risk in the infamous bank stress tests of 2009. And if the OCC was so concerned, why did it then (as now) natter about the need for more data? Why didn’t it just demand it?

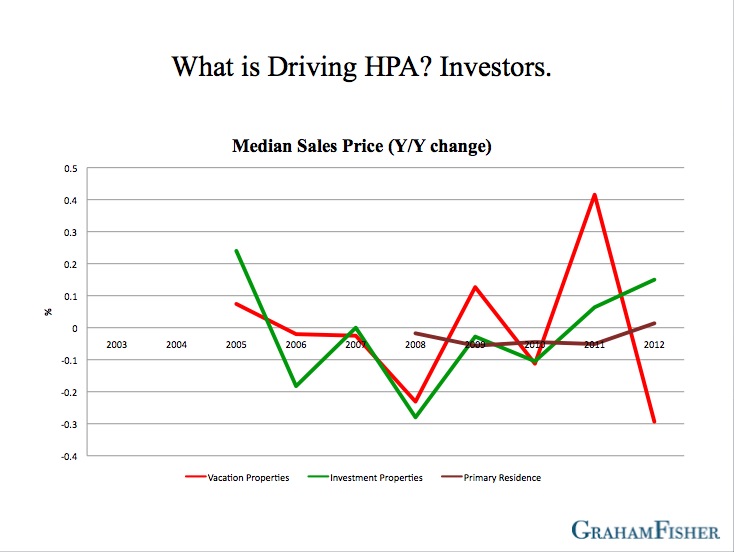

Regulators were clearly hoping that the housing market would recover enough to reduce the size of this looming time bomb. But the much-touted housing recovery has been almost entirely due to price appreciation in foreclosed properties. Josh Rosner ascertained that the year-to year median sales price increase in owner-occupied homes was a mere 1%.

Investor appetite for homes has been cooling, in part due to concerns about QE taper, in part due to one of the hoped-for exit strategies, that of turning a portfolio into a REIT and taking it public, looks to be pretty much dead. And reports of bad maintenance and tenant abuses by the kingpin investor in rentals, Blackstone, could also put a pall over the category, even for more responsible operators. So even a bit more uptick in supply due to HELOC-shock sales, short sales, and foreclosures, could put another dent in the faltering housing recovery.

The math of payment shock means the Reuters story is the harbinger of more accounts. I only hope some of them focus on how banks and regulators made matters vastly worse for borrowers through their efforts to save their own hides.

Morning Fred,

ReplyDeleteI still watch some college football and lots of high school football, never was a baseball fan though.

Surprise, we lied about Syria using chemical weapons. We won't see that getting much play on the evening news.

Wow that octopus is rather ominous looking, have a feeling that they are not the good guys for sure.

Cold rain here today, bet you have a chance for snow.

Morning Kev - I watch college football ( definitely will watch the Title Game this year )

ReplyDeleteHaven't seen any news organization on US TV discuss Seymour Hersh's missive nor do I expect that will touched....

S.P.E.C.T.R.E lives ...... imagine that ?

3- 6 inches of the white stuff in my neck of the woods , although slightly less in Philly.....Hasn't started yet but due to start falling shortly..... hopefully the snowfall is over by the evening rush hour .