http://www.zerohedge.com/news/2013-09-24/tip-box-fed-made-it-possible-many-people-leak-it

From The Tip Box: "The Fed Made It Possible For Many People To Leak It"

Submitted by Tyler Durden on 09/24/2013 16:43 -0400

A reader, who shall remain anonymous, provides some much needed color on today's Fed data-leaking fiasco du jour, reported previously on at least two occasions by Zero Hedge.

I knew of the Fed decision and growth forecasts around 5-6 minutes before 2 pm last Wednesday, even though I was not there. I work at a news organization represented at the Fed statement “lockup” and the Bernanke press conference last week. This was in no way secure the way the Labor and Commerce Department lockups are. Those in the Fed statement lockup were able to communicate by text message and email after they received the statements and before 2 pm. Those in the room awaiting the press conference also were able to communicate electronically after the received the statement, several minutes before 2 pm. Everything was honor-based, but anyone in their respective newsrooms could have gotten the information early from them and passed it on. Given the large number of reporters involved, there are many ways the decision could have gotten into the market several minutes before the announcement. I am truly surprised it was only seen in gold trade. The fact is, though, the Fed made it possible for many people to leak it.

And banish the thought that the Fed itself could have made a "gross mistake" and actually sent out the decision or the statement earlier to one or more conflicted parties on purpose. After all, we know it only does that with the Fed Minutes.

http://www.zerohedge.com/news/2013-09-20/gold-einstein-and-great-fed-robbery

Gold, Einstein And The Great Fed Robbery

Submitted by Tyler Durden on 09/20/2013 18:42 -0400

One week after we released the following damning evidence (below) of fraud in the "markets", CNBC has now claimed their scoop. Crucially, it seems, after reading Nanex's concise explanation of the proof of fraud, theFed has now launched a probe into the release of its own FOMC statements. ... Our question then is, unless Nanex and ZeroHedge had pointed out this obvious cheat, would the fraudsters still be considered too big to care about special relativity, and if a fallen HFT tree collapses its wave function in the forest, and nobody reports, did an HFT tree just fall?

One of Einstein's great contributions to mankind was the theory of relativity, which is based on the fact that there is a real limit on the speed of light. Information doesn't travel instantly, it is limited by the speed of light, which in a perfect setting is 186 miles (300km) per millisecond. This has been proven in countless scientific experiments over nearly a century of time. Light, or anything else, has never been found to go faster than 186 miles per millisecond. It is simply impossible to transmit information faster.

Too bad that the bad guys on Wall Street who pulled off The Great Fed Robbery didn't pay attention in science class. Because hard evidence, along with the speed of light, proves that someone got the Fed announcement news before everyone else. There is simply no way for Wall Street to squirm its way out of this one.

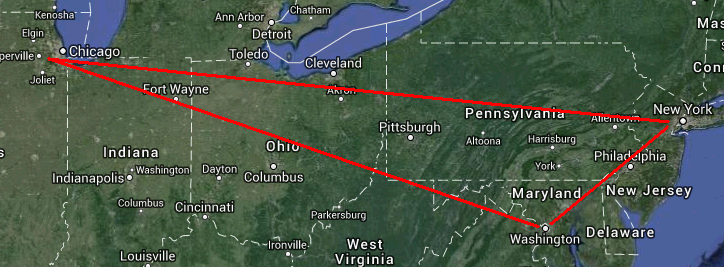

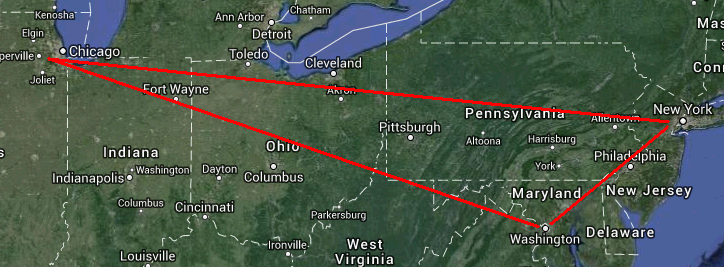

Before 2pm, the Fed news was given to a group of reporters under embargo - which means in a secured lock-up room. This is done so reporters have time to write their stories and publish when the Fed releases its statement at 2pm. The lock-up room is in Washington DC. Stocks are traded in New York (New Jersey really), and many financial futures are traded in Chicago. The distances between these 3 cities and the speed of light is key to proving the theft of public information (early, tradeable access to Fed news).

We've learned that the speed of light (information), takes 1 millisecond to travel 186 miles (300km). Therefore, the amount of time it takes to transmit information between two points is limited by distance and how fast computers can encode and decode the information on both sides. Our experienceanalyzing the impact of hundreds of newsevents at the millisecond level tells us that it takes at least 5 milliseconds for information to travel between Chicago and New York. Even though Chicago is closer to Washington DC than New York, the path between the two cities is not straight or optimized: so it takes information a bit longer, about 7 milliseconds, to travel between Chicago and Washington. It takes little under 2 milliseconds between Washington and New York.

Therefore, when the information was officially released in Washington, New York should see it 2 milliseconds later, and Chicago should see it 7 milliseconds later.Which means we should see a reaction in stocks (which trade in New York) about 5 milliseconds before a reaction in financial futures (which trade in Chicago). And this is in fact what we normally see when news is released from Washington.

However, upon close analysis of millisecond time-stamps of trades in stocks and futures (and options, and futures options, and anything else publicly traded), we find that activity in stocks and futures exploded in the same millisecond. This is a physical impossibility. Also, the reaction was within 1 millisecond, meaning it couldn't have reached Chicago (or New York): another physical possibility. Then there is the case that the information on the Fed Website was not readily understandable for a machine - less than a thousandth of a second is not enough time for someone to commit well over a billion dollars that effectively bought all stocks, futures and options.

The Data

Minutes before the Fed announcement at 14:00 on September 18, 2013, there was significant activity in Comex Gold Futures (traded in Chicago) and the ETF symbol GLD (traded in New Jersey). This gives us an opportunity to measure closely, the exact (to the millisecond) amount of time between trading between these two instruments. The first two charts show about 3.5 minutes of time around the Fed Announcement release, giving us an overview. The stack of charts that follow allow you to easily compare between GLD (New York) and GC Futures (Chicago) for 6 different active periods. You will see that in the first 5 pairs - before the announcement, activity first shows up in GC Futures, followed by activity in GLD between 5 and 7 milliseconds later. In the last pair, which compares activity at exactly 14:00:00.000, you will see both GC futures and GLD react exactly at the same time.

See also: More Charts of Evidence.

1. Animation of December 2013 Gold (GC) Futures followed by GLD stock on September 18, 2013 from 13:57 to 14:00:30.

2. Zooming in 150 milliseconds of time for the high activity periods minutes before and during the annoucement.

The chart shows first, Gold Futures (GC - traded in Chicago) followed by GLD (traded in New York)and clearly show events minutes before the news release: you can clearly see that Gold Futures (GC) trades before GLD. The chart shows the event at 14:00:00, where Gold Futures trades at the exact same time as GLD stock. This is physically impossible unless information was already present in Chicago and New York. It's easiest if you compare the bottom panels of each chart which shows trading volume for each millisecond.

The chart shows first, Gold Futures (GC - traded in Chicago) followed by GLD (traded in New York)and clearly show events minutes before the news release: you can clearly see that Gold Futures (GC) trades before GLD. The chart shows the event at 14:00:00, where Gold Futures trades at the exact same time as GLD stock. This is physically impossible unless information was already present in Chicago and New York. It's easiest if you compare the bottom panels of each chart which shows trading volume for each millisecond.

Conclusion

There are 2 possibilities, and both aren't good news for Wall Street.

1. Released by a News Organization

The Fed news was condensed by a news service into a simple "No Tapering" message that was placed on news servers co-located next to trading machines in both New York and Chicago at some time before 2pm. The news machines are programmed to release the information at precisely 2pm, allowing the algos to react immediately at both locations. This is how some news services release privately compiled statistics like the Consumer Confidence or Chicago PMI.

In those cases, we see the exact behavior as in the last 2 charts above - an immediate reaction in New York and Chicgo. But the Fed news was released from a lock-up room which prevents transmission of any information to the outside world. Given that several large news organizations were recently caught doing this we think it's less likely they would do something so bold, so soon. That leaves us with possibility number 2.

2. Leaked to Wall Street

The Fed news was leaked to, or known by, a large Wall Street Firm who made the decision to pre-program their trading machines in both New York and Chicago and wait until precisely 2pm when they would buy everything available. It is somewhat fascinating that they tried to be "honest" by waiting until 2pm, but not a thousandth of a second longer. What makes this a more likely explanation is this:we've found that news organizations providing timed release services aren't so good about synchronizing their master clock - and often release plus or minus 15 milliseconds from actual time. Their news machines in New York and Chicago still release the data at the exact same millisecond, but with the same drift in time as the master clock. That is, we'll see an immediate market reaction at say, 15 milliseconds before the official scheduled time, but in the same millisecond of time in both New York and Chicago. Historically, these news services have shown a time drift of about 30 milliseconds (+/- 15ms), which places the odds that this event was from a timed news service at about 10%.

What also makes this the more likely conclusion is this: we know the Bureau of Labor Statistics has recently hardened access to their lock-up room, weeding out all but respected news organizations. So imagine a reporter for one of these news organizations who is tasked with distilling the Fed news into a simple message that machines could read in less than a millisecond and interpret to mean, "buy all the things now".; It's unlikely that Wall Street would place so much responsibility on one news reporter. It is also unlikely that respected news organizations would tolerate this behavior.

We think it was leaked. The evidence is overwhelming.

http://www.zerohedge.com/news/2013-09-18/who-leaked-fomc-statement-gold-traders

Who Leaked The FOMC Statement To Gold Traders?

Submitted by Tyler Durden on 09/18/2013 14:42 -0400

Beginning 3 minutes before the release of the FOMC Statement, gold spot and futures prices began to rise notably. We noted this accordingly.

Bonds did not. Stocks did not. FX did not. Around 4300 contracts changed hands in the Dec Futures - massively more than average volume - before the statement came out and drove prices further up. In those 3 minutes Gold prices jumped $11... so the question is - lucky guess... or which big bullion bank got the nod?

And courtesy of Nanex:

No comments:

Post a Comment