Friday afternoon / evening updates.....

http://www.zerohedge.com/news/2013-08-16/gold-or-tungsten-heres-how-know

( When you see infomercials peddling gold testing devices , gold mania will be for real... )

http://www.caseyresearch.com/gsd/edition/eric-sprott-sneaks-gata-into-the-toronto-globe-and-mail

http://www.zerohedge.com/news/2013-08-16/gold-or-tungsten-heres-how-know

( When you see infomercials peddling gold testing devices , gold mania will be for real... )

Gold Or Tungsten? Here's How To Know

Submitted by Tyler Durden on 08/16/2013 20:18 -0400

We hope the Bundesbank, and certainly the German people, will be using one of these in the near-term (up to and including 2020 ) future.

From Olympus:

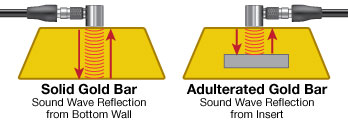

Ultrasonic Testing of Gold Bars

Application:

Nondestructive verification of the physical integrity of gold bars.

Background:

Gold bullion bars have been fraudulently adulterated through the insertion of slugs of inexpensive base metal of similar density. These insertions are difficult or impossible to detect through weighing, radiography, or X-ray fluorescence, so some precious metals processors have resorted to drilling or cutting bars to verify integrity. However a simple ultrasonic test can quickly and reliably locate inserts with no need to drill, cut, or otherwise alter the bar.

Equipment:

Any Olympus NDT flaw detector or phased array instrument can be used for this test. These include the EPOCH XT, EPOCH 600, EPOCH 1000, OmniScan SX, and OmniScan MX2. The recommended transducer frequency will typically be 2.25 MHz.

Procedure:

Adulteration of a gold bar by means of inserts will cause predictable changes in the way ultrasonic waves pass through the metal. Inserts of material other than gold in a bar will change the pattern of wave reflections, a response that can also be caused by internal voids. Large inserts that fill most of the volume of the bar can also be detected through changes in sound velocity.

1. Pulse/echo reflection method

Ultrasonic waves traveling through any medium will continue propagating in the same direction until they strike a boundary with a different material, which will cause them to reflect back to their source. Ultrasonic flaw detectors and phased array instruments generate pulses of high frequency sound waves with small, hand-held transducers. The sound energy is coupled into the test piece and the instrument monitors and displays the pattern of reflected echoes. Reflections coming from inside a gold bar, rather than the opposite surface, change the pattern and indicate either an insert of another metal or a internal void.

This test is set up by coupling the transducer to a known good bar and identifying the echo from the bottom surface. A flaw gate may be used to monitor the interval ahead of this back wall. Any echoes appearing within the region marked by the gate indicate that the sound beam is reflecting off a discontinuity, and the bar should be further inspected by other means. Typical screen displays are seen below.

Conventional flaw detector images from solid metal (left) and metal with discontinuity (right).

Note: Echo appearing in region marked by red gate.

Note: Echo appearing in region marked by red gate.

|  |

Phased array images from solid metal (left) and metal with discontinuity (right). The discontinuity appears as an indication in what should be a white region of the image.

|  |

2. Velocity method

The sound velocity in pure gold is 3,240 m/S or .1275 in/uS. The harder gold alloys used in jewelry will typically be somewhat faster, but will similarly have a specific velocity associated with a given alloy. If the sound velocity in a bar deviates from the expected value, then the metal content has been altered.

This test is set up by coupling the transducer to a known good bar and identifying the backwall echo. That backwall echo may be marked by a flaw gate. If the position of that echo changes with no accompanying change in bar thickness, then the sound velocity in the metal has changed and the bar should be further inspected by other means. The most common adulterants increase sound velocity and thus move the echo to the left, as seen above.

Note: With small modifications these test can be applied to other precious metals such as silver and platinum as well. Contact Olympus NDT for further information.

* * *

Of course, judging by the following photo showing a Bundesbank officer using precisely such an Olympus device to verify the authenticity of its gold, one can be confident that Herr Weidmann is well-aware that not everything that glitters within the global central bank cartel is gold.

h/t Ro

The End Times begin: Hathaway gets real and CNBC broadcasts him

Submitted by cpowell on Fri, 2013-08-16 18:04. Section: Daily Dispatches

2:04p Friday, August 16, 2013

Dear Friend of GATA and Gold:

The End Times began at 12:20 p.m. Eastern today.

The Tocqueville Gold Fund's John Hathaway, a thoroughly respectable member of the financial establishment who only in recent weeks has begun to acknowledge the manipulation of the gold market by Western central banks, went on CNBC's "Fast Money" program, declared that a short squeeze is under way in gold because the paper gold market is leveraged at 100 to 1, and was not cut off.

Of course the CNBC "analysts" who commented following Hathaway's remarks completely missed the substance of what he said. Real financial journalism has not descended upon the West quite yet. But if reality about gold can come frankly out of Hathaway's mouth and be spread throughout the world by CNBC, are even Reuters, Bloomberg News, The Wall Street Journal, The New York Times, and the Financial Times still safe for the Federal Reserve and Wall Street and their scheme of gold price suppression and currency market rigging?

Thanks to the Got Gold Report's Gene Arensberg for calling attention to this earthquake with a preface on top of the CNBC video of Hathaway here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Gold is way oversubscribed as Comex and LBMA lose trust, Hathaway says

Submitted by cpowell on Fri, 2013-08-16 04:21. Section: Daily Dispatches

12:17a ET Friday, August 16, 2013

Dear Friend of GATA and Gold:

Tocqueville Gold Fund manager John Hathaway tells King World News that gold is oversubscribed by as much as 100 to 1 because of futures and derivatives, that there is growing distrust of the New York Commodity Exchange and the London Bullion Market Association, that people are starting to want their metal delivered and find they can't get it, and that gold mining shares are so oversold that they could triple and quadruple if the gold price simply recovers to its moving averages. An excerpt from the interview is posted at the King World News blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

http://news.goldseek.com/COT/1376681822.php

Gold COT Report - Futures

| ||||||

Large Speculators

|

Commercial

|

Total

| ||||

Long

|

Short

|

Spreading

|

Long

|

Short

|

Long

|

Short

|

148,524

|

94,598

|

19,182

|

184,321

|

245,195

|

352,027

|

358,975

|

Change from Prior Reporting Period

| ||||||

-5,288

|

-7,579

|

702

|

-3,315

|

3,400

|

-7,901

|

-3,477

|

Traders

| ||||||

105

|

92

|

65

|

54

|

62

|

194

|

188

|

Small Speculators

| ||||||

Long

|

Short

|

Open Interest

| ||||

38,520

|

31,572

|

390,547

| ||||

2,386

|

-2,038

|

-5,515

| ||||

non reportable positions

|

Change from the previous reporting period

| |||||

COT Gold Report - Positions as of

|

Tuesday, August 13, 2013

| |||||

large specs going long , commercials going short.....

Silver COT Report: Futures

| |||||

Large Speculators

|

Commercial

| ||||

Long

|

Short

|

Spreading

|

Long

|

Short

| |

36,945

|

24,236

|

17,054

|

60,196

|

80,472

| |

2,318

|

-4,924

|

-2,224

|

1,993

|

11,969

| |

Traders

| |||||

65

|

52

|

48

|

43

|

43

| |

Small Speculators

|

Open Interest

|

Total

| |||

Long

|

Short

|

135,226

|

Long

|

Short

| |

21,031

|

13,464

|

114,195

|

121,762

| ||

1,086

|

-1,648

|

3,173

|

2,087

|

4,821

| |

non reportable positions

|

Positions as of:

|

134

|

124

| ||

Tuesday, August 13, 2013

|

© SilverSeek.com

| ||||

once again , large specs went long while commercials went short.....

http://www.caseyresearch.com/gsd/edition/eric-sprott-sneaks-gata-into-the-toronto-globe-and-mail

¤ YESTERDAY IN GOLD & SILVER

The gold price didn't do much in Far East and early London trading on their Thursday, but the HFT volume was pretty heavy in early Far East trading, and I'm sure that's why the tiny rallies in gold didn't get too far.

By the time Comex trading began at 8:20 a.m. EDT in New York, gold was down a dollar and change from Wednesday's close, and at 8:30 a.m. a not-for-profit seller [read high-frequency trader] hit gold for about fifteen bucks in less than ten minutes, it's low tick of the day.

From there, the price moved quietly higher until about 12:45 p.m. EDT, and then a big price spike occurred which had all the hallmarks of a short-covering rally. That ended/got capped less than ten minutes later, and from there the gold price moved slowly higher right into the 5:15 p.m. electronic close.

Both the low and high ticks occurred in New York. Kitco recorded the low tick as $1,318.00 spot, and the high tick at $1,371.40 spot. The high came in a tiny price spike around 2:15 p.m. in electronic trading.

Gold closed at $1,366.10 spot, up $29.60 on the day. Volume was immense, 237,000 contracts net of August and September.

Here's the New York Spot Gold [Bid] chart on its own, so you can see the New York price action more clearly.

The price pattern in silver yesterday was pretty much the same as gold's, so I shan't go into the details.

The low and high price ticks were $21.66 and $23.32 spot, a big intraday move.

Silver closed at $23.01 spot, up $1.135 from Wednesday's close. Net volume was an eye-watering 73,000 contracts.

With some minor variations, the platinum and palladium charts look almost identical to the gold and silver charts, and here they are,

The dollar index was very 'volatile' yesterday, and that's being kind. It closed late Tuesday afternoon in New York at 81.71, traded sideways until 10 a.m. Hong Kong time before falling off a 20 basis point cliff in about fifteen minutes, hitting an interim low of 81.47. From there it traded sideways until the 8:20 a.m. Comex open, and then rose sharply to its 81.93 high that came at the 10 a.m. EDT London p.m. gold fix. It was all down hill from there, with the low tick of 81.10 coming at the 4 p.m. close of the equity markets in New York. From there it more or less traded sideways into the close, finishing the Thursday session at 81.17, down 54 points on the day.

If you check the gold chart vs. the dollar index chart, you won't see much correlation at all. If you find some, please let me know.

*****

The CME's Daily Delivery Report was a no-show yesterday, the second time in about a month, as they didn't update their website with yesterday's data, and I checked right up until I had to file at 5:20 a.m. EDT this morning.

Surprisingly enough, GLD showed a small decline yesterday, as 10,092 troy ounces were reported withdrawn. I'd guess that this would represent a fee payment of some kind. It seems to be, at least based on the price action over the last few day, that GLD is owed a fair chunk of gold. Maybe I'm being impatient, so we'll see what today's report shows. As far as SLV was concerned, there was a very large deposit reported yesterday, as an authorized participant[s] deposited 2,314,493 troy ounces of the stuff.

Joshua Gibbons, the Guru or the SLV Bar List, has updated his website with the in/out activity over at SLV for the week ending, Wednesday, August 14th. Here is what he had to say: "Analysis of the 14 August bar list, and comparison to the previous week's list: No bars were removed, added or had a serial number change. As of the time that the bar list was produced, it was over-allocated 501.5 troy ounces. This was a rare week of no movement in SLV." The link to his website is here.

There was no sales report from the U.S. Mint.

Over at the Comex-approved depositories on Wednesday, they reported receiving 31,940 troy ounces of gold, and shipped out a couple of good delivery bars totaling 199 troy ounces. All of the gold received ended up in the vault of HSBC USA. The link to that 'action' is here.

In silver, these same depositories reported receiving 595,982 troy ounces of silver, and that all went into the depositories of Canada's Bank of Nova Scotia. There was a small withdrawal of 4,977 troy ounces reported. The link to that activity is here.

******

China, Japan Sell Most US Paper In Years; Foreign Treasury Holdings At 2013 Lows

And the bid hits just keep on coming.

While previously we reported the foreigners as an aggregate class sold the most gross US securities ever in the month of June, we also learned that in June the biggest selling came from America's two largest creditors: China and Japan (excluding the Fed of course, whose P&L losses are now approaching $300 billion in the past 3 months, or would if the Fed marked to anything but unicorns).

In June, the two countries combined sold $42 billion, with each selling over $20 billion: the most in years.

The reality is that America's creditors are saying goodbye just at a time when Bernanke is preparing to taper. The bottom line: Grand total foreign TSY holdings dropped to just over $5.600 trillion, down $57 billion in one month, and the lowest total in 2013.

This very short Zero Hedge piece from yesterday has two embedded graphs that make it a must read. I thank Manitoba reader Ulrike Marx for her first contribution to today's column.

Four King World News Blogs/Audio Interviews

1. Hong Kong hedge fund manger William Kaye: "We Are Very Late In The End Game - "It's Close To Game Over". 2. Keith Barron: "Asia Shocks West By Demanding Their Gold Be Sent Home". 3. John Hathaway: "Escalating Fear Accelerating Massive Run on Physical Gold". 4. The audio interview is with Grant Williams.

Mark O'Byrne: Market manipulation explains gold price plunge amid soaring demand

In his daily commentary at GoldCore, Mark O'Byrne contrasts the recent plunge in the gold price with the explosion in metal demand and explains the paradox this way:

"All available data shows very strong supply-and-demand fundamentals and yet a huge, historic 35 percent price fall in the quarter. This lends credence to the allegations of market manipulation put forward by the Gold Anti-Trust Action Committee, whistle blower Andrew Maguire, Max Keiser, Zero Hedge, and many others in the blogosphere."

Mark's daily blog was posted on the goldcore.com Internet site yesterday...and I found it, along with Chris Powell's two paragraphs of introduction, in a GATA release yesterday. It's an absolute must read.

¤ THE WRAP

As I mentioned at the top of this column, yesterday's spike in all four precious metals had the hallmarks of a short covering rally. However, the volumes in gold and silver were really over the top, and I'm not sure what to make of it. The preliminary open interest numbers in silver and gold, although higher, are rather subdued considering the magnitude of the price move, and I'm rather happy about that.

This is another case where we'll have to wait for next Friday's Commitment of Traders Report to get some sort of clue as to what is going on internally with the traders in the both gold and silver.

Talking about COT Reports, we get one today at 3:30 p.m. EDT. It's for the reporting week ending at the 1:30 p.m. EDT close of Comex trading on Tuesday, August 13th. Needless to say, I'll be more than interested in what's in it, and even more than that, what Ted Butler's take on it is. I'll let you know what I find out in this space on Saturday.

Here are the 6-month charts for both silver and gold. We are nowhere near overbought in gold, but certainly are in silver. I will not hazard a guess as to what this may, or may not, mean for these metals going forward, but I will venture a guess that any 'correction' will be short-lived before we continue to power higher.

(Click on image to enlarge)

(Click on image to enlarge)

Once again there was no follow-through rally in Tokyo or Hong Kong after yesterday's big up day in New York, as it was as quiet as the proverbial church mouse in Far East trading on their Friday, and not much has changed now that London has opened for business. As I write this paragraph at 3:46 a.m. EDT, London has been open forty-five minutes, and gold's gross volume is already north of 38,000 contracts, and silver's net volume is over 10,000 contracts. As usual, it's all of the HFT variety. After a wild Thursday, the dollar index is not doing a thing.

And as I hit the send button on today's column at 5:20 a.m. EDT, gold is down about four bucks, and silver is down fifteen cents. Gold volume is now up to a bit over 43,000 in gold, and 12,000 in silver. These are huge numbers for little or no price movement. The dollar index is now up a handful of basis points.

Today is Friday, and I'm wide open for any price scenario I find when I switch my computer on later this morning. The truth is that nobody knows what's going to happen next. All the precious metal 'analysts', including me, are making this up as we go along. We know what should happen, and why. But will it, and if so, how soon?

Like Ted Butler, I vote for right here and now, but the fact of the matter is that only JPMorgan Chase has a clue, as they are in the golden driver's seat.

Before heading off to bed, here's a little something that I'd like you to read, and spend a few minutes on, if you're so inclined.

As many of you have seen, Casey Research has put a bit of its weight behind the Hard Assets Alliance as a great way to buy gold and silver. And, as you know, I'm not a fan of any form of paper gold. It's just too easy for it to be substituted for something else. But, I can't deny its become quite popular because its just more convenient. Well, the guys behind Hard Assets Alliance say their solution is just easy as GLD, but is real ownership: direct delivery and allocated storage, outside the banking cartel.

But, in this world of complex schemes, before I buy into anything "new" with gold, I prefer to really understand what I'm getting into, and to ensure it is 100% my asset. Which is why I'm actually excited that Ed D'Agostino, HAA's general manager, has agreed to sit down and answer any of my and your questions about the program. If you haven't checked it out yet, now would be a good time to do so.

Then, send any questions you have to HAAquestions@caseyresearch.com. Our customer service folks will compile them, and then we'll sit down with Ed for a video interview to get them all answered, which I'll share just as soon as it is ready. So, here's your chance -- one I'd sure like to get with the guys from GLD or JP Morgan Chase, albeit for different reasons -- to ask any question you want of the folks behind the Hard Assets Alliance.

Enjoy your weekend, or what's left of it if you live west of the International Date Line, and I'll see you here tomorrow.

http://www.businessinsider.com/jpmorgan-buy-gold-2013-8

Since hitting a four-year low of $1179 an ounce on June 28, gold has shown some strength, rallying 15% over the past month and a half to current levels around $1360.

In a note to clients Thursday titled, "Gold and the Denver play: Gold Shrugs Off the Paulson Sale; Buy the Bounce," JPMorgan analysts John Bridges and Anant Inani point to a number of bullish factors for the shiny yellow metal:

Gold shrugged off news today that Paulson & Co had cut its exchange listed gold exposure in half and rose 2.2% to $1,365/oz. This may be delivering an exclamation mark to define the end of the 10-month, 25% fall in gold and 50% fall in gold equities, (while the S&P advanced 13%).

The World Gold Council reported today that physical gold demand remains strong, questioning the price weakness seen in paper markets. Additionally, gold supplies could be constrained in September if labor strikes are initiated in South Africa.

There’s typically some positive seasonality to the gold price in August/September helped by India, which is still the largest single (28%) gold market ... Often this strength correlates with the Denver gold conference. The conference attracts many of the larger gold investors and given the other positives for the metal (and that the depressing effect of the Q2 results is past) we would not be surprised to see a stronger gold price in the run up to the show.

We’d encourage shorter-term investors to consider getting long the gold space with a four to five week time horizon. This year the Denver Gold Forum will be from the 22nd to 25th September.

"China and India remain large physical buyers of the metal. We believe this highlights that enthusiasm for the metal remains strong amongst the majority of the world’s population," say Bridges and Inani. "Indian demand is quite seasonal related to events and festivals. While some might argue for less Indian buying due to tougher regulations and the weaker rupee making the metal more expensive, the WGC data suggests the opposite."

No comments:

Post a Comment