http://rt.com/op-edge/spain-jihadis-terror-war-669/

http://hat4uk.wordpress.com/2013/05/01/exclusive-how-draghi-was-buying-spanish-bonds-while-claiming-only-that-he-might-do-so/

The caption on the left here shows you what the average eurozone citizen makes of the real state of play at the European Central Bank. But the suggestion of that caption is that, somehow, the ECB run by Mario Draghi is out of control. More accurately, the bank is beyond anyone’s control. The Slog analyses how, when the chips are down, Europe’s central banker simply does what he wants.

The caption on the left here shows you what the average eurozone citizen makes of the real state of play at the European Central Bank. But the suggestion of that caption is that, somehow, the ECB run by Mario Draghi is out of control. More accurately, the bank is beyond anyone’s control. The Slog analyses how, when the chips are down, Europe’s central banker simply does what he wants.

To suggest the cleanup of undercapitalized banks is in an "advance stage" is complete nonsense. It only makes partial sense if there is a zero percent probability of haircuts on Spanish sovereign debt.

I suggest the probability of haircuts on Spanish government bonds is far greater than 50%. And since Spanish banks are loaded to the gills with sovereign debt, the banks are severely undercapitalized by implication.

S&P Predicts 20% Drop in Spain's Housing Prices

Courtesy of Mish-Modified google translate from El Economista, please consider S&P predicts that housing in Spain fall by 20% over the next four years.

I am of the opinion the S&P is overly optimistic about Spain, about France, and about the Netherlands.

The European recession is worsening, credit conditions are awful, employment conditions are awful, and there are scant buyers of property because discounts are not large enough and credit is nowhere to be found.

None of this remotely takes into consideration the very strong likelihood of a Spanish debt writedown in the next year or so.

Mike "Mish" Shedlock

Growth in consumer lending has come to a crawl as bank deleveraging continues. With retail credit growth curtailed, corporations have no pricing power. Signs of deflationary pressures are already in place.

Of course just like Japan, the Eurozone may face rising public sector debt, as austerity is put on the back burner. In fact many in Europe now blame the austerity drive by Germany for the deflationary risks the region currently faces.

The lone arrangers: Spain deflects austerity attention on ‘jihadis’

Published time: May 01, 2013 12:26

The lone arrangers: Spain deflects austerity attention on ‘jihadis’

With the arrest of a young Algerian, allegedly a cyber-jihadi, Spain is the first Western country to follow the new paradigm of the War on Terror after Boston: the hunt is on for the Lone Wolf.

The headline on the cover of the extremely right-wing Spanish daily La Razon was straight from the Murdoch press; The ‘lone wolves’ detained in Spain contacted the bloodiest AQIM group – as in Al-Qaeda in the Islamic Maghreb. And the caption for the photo splashed on the cover, pulled from a Facebook page, dealt the killer blow. The jihadi flag in front of the Pilar in Zaragoza: Nou Mediouni, one of the arrested (image), praised the “heroes” of Islam in his Facebook page.

I had just landed in Barcelona – on my way to Zaragoza – coming from London and countless hours plunged into the mysteries surrounding the Boston bombing. At the airport, this is my very first image of Spain; enough to imprint that the former Bush administration-coined Global War on Terror (GWOT) has just been rebranded The Age of the Lone Wolf.

So what was really going on in Zaragoza? Was global jihad about to take over that Catholic fortress, the Pilar, along with its adoration of the Blessed Virgin Mary since the dawn of Christianity in Spain?

Anatomy of a cyber-jihadi

It turned out that the local ‘jihadi’ is Nou Mediouni, 23, an Algerian student of information technology. He is accused of being a member of an AQIM cell in Spain. Evidence; mostly messages found in a forum about AQIM where he wrote about the Boston bombing that “what you feel now is what children in Afghanistan, Syria and Iraq feel.”

Like clockwork, only one hour after Mediouni was arrested – alongside one Hassan El Jaaouani, 52, Moroccan, arrested in Murcia, whose profile reads like a smuggler of cheap goods - Spain’s Interior Minister Jorge Fernandez classified both as “lone wolves” and compared them with the Chechen Tsarnaev brothers, accused of being the perpetrators of the Boston bombing.

The Spanish judiciary, arguably hinting that Fernandez was reading too much US think tank nonsense, counter-attacked, insisting there was no conclusive proof to accuse either of being AQIM jihadis.

It soon became clear that neither Mediouni nor Jaaouni had anything lone wolf about them – since certified lone wolves live in isolation (no family) and make sure they do not follow Islam’s precepts. There are very few “pure” lone wolves able to pick a target, buy the materials, fabricate a bomb and successfully detonate it, operating by themselves without taking orders from any group.

Spanish police took no time to leak to mainstream media that Mediouni had extensive contacts with one El Youbi, a big shot at the katiba – combat unit – of infamous one-eyed jihadi Mokhtar Belmokhtar (whomay or may not have been killed in Mali). Mediouni ‘may’ have been – digitally - recruited by a Moroccan Islamist currently in jail. And he ‘may’ have received instructions to travel to an AQIM jihadist training camp in northern Mali.

The Interior Ministry itself characterized Mediouni as an “aspiring martyr” – a dangerous cyber-jihadi killing machine that was mostly an active member of the ‘Muslims in Spain’ Facebook page, from which that incriminating photo was taken. Yet the page, founded in September 2012, was mostly concerned about…Syria.

The irony of NATO member Spain accusing a sympathizer of NATO-supported Syrian ‘rebels’ is too precious for words.

Anyway, Omar Tambedou, the Senegalese imam of the mosque attended by Mediouni, in the popular Zaragoza neighborhood of Las Fuentes, dismissed it all: “He is a Muslim brother and I know him as a student, a normal kid. He came to pray at the mosque. He is a good person.”

As for Mediouni’s father – who’s been in Spain for 14 years – he insisted, “Everything is a lie. This is not a democratic country. I thought we were well here, but it turns out we’re worse than in my own country.”He denies his son went to the Maghreb; “He went to Turkey on a package trip, didn’t even go to Syria.” But it was up to one of Mediouni’s uncles to provide the killer argument; “You’re not a terrorist if you are against the invasion of Iraq. Millions of Spaniards protested in the streets.”

In the end, the judiciary took no chances, sending Mediouni to prison, accused of being integrated to a terrorist organization; as for petty thief Jaaouni, he’s free but cannot leave Spain and has to report to police every 2 weeks.

Mass profiling ahead

All this had been going on for no less than over a year – with the French and the Moroccans collaborating with the Spaniards.

So why now? The pretext for Mediouni’s arrest was of course Boston; to forcefully imprint on public opinion, across Western Europe, the ‘lone wolf’ narrative. EU counter-terrorism agencies are convinced Spain – especially in the southeast, in Alicante and Murcia - is the preferred transit point for jihadis coming from northern Africa to set up dormant cells across Europe.

Now everyone still able to buy tapas and sangria knows that AQIM has a press office called Al Andalus – a reference to the Spanish territories once ruled by Islam; and that AQIM (and not the troika) is the utmost threat to the Spanish nation, as they’re obsessed on founding a Global Caliphate.

Not by accident, in the same week of the Boston bombing – something already planned way in advance – anti-terrorist units in all EU member countries played out the possibility of simultaneous terror attacks in nine countries, Spain included. For instance, in Spain there was a simulated attack against a bus, in Austria against a school, in Ireland against an electricity plant, in Sweden against a ferry and in Belgium against a high-speed train. The exercise – the most ‘complex’ in the EU so far - was code-named Common Challenge.

To divert attention from the absolute devastation of the Spanish dream, the new Lone Wolf paranoia works wonders. This past week the official unemployment rate reached a staggering 27.1 per cent, affecting 6,202,700 people (and their families). In affluent Catalonia, unemployment is at 24.53 per cent, but in some regions such as Andalusia it’s a horrid 36.87 per cent. For those under 25, unemployment reached an astonishing 57.2 per cent (and Italy is catching up fast, already at 38.4 per cent).

One quarter of Spain’s population is now firmly installed at the gates of poverty. Virtually half of the population – between the unemployed and pensioners - is not productive. And the current, paralyzed right- wing government is already flirting with a drastic reform of the pension system – imposed by Brussels. Basically, people over 55 will have to work many more years in order to retire with some dignity.

Doom and gloom is the norm. France’s unemployment is at 10.6 per cent, Portugal’s at 17 per cent and Greece’s at 27.2 per cent. The eurozone’s is at 12 per cent. Industrial production in Italy has fallen by 25 per cent since 2008. The number of Spanish firms filing for bankruptcy is 45 per cent higher than in 2012.

Jihad against Brussels and the troika? No chance. The name of the game – and target – now is second-generation lone wolves. Pay attention to the blitzkrieg by European elites pressing the idea that social integration of children of Muslim immigrants still remains compatible with jihadi radicalization. The next step is to profile them all. They should start thinking about moving to Siberia – where real lone wolves of the non-jihadi kind freely roam.

http://hat4uk.wordpress.com/2013/05/01/exclusive-how-draghi-was-buying-spanish-bonds-while-claiming-only-that-he-might-do-so/

EXCLUSIVE: How Draghi was buying Spanish bonds while claiming only that he “might” do so

The caption on the left here shows you what the average eurozone citizen makes of the real state of play at the European Central Bank. But the suggestion of that caption is that, somehow, the ECB run by Mario Draghi is out of control. More accurately, the bank is beyond anyone’s control. The Slog analyses how, when the chips are down, Europe’s central banker simply does what he wants.

The caption on the left here shows you what the average eurozone citizen makes of the real state of play at the European Central Bank. But the suggestion of that caption is that, somehow, the ECB run by Mario Draghi is out of control. More accurately, the bank is beyond anyone’s control. The Slog analyses how, when the chips are down, Europe’s central banker simply does what he wants.

On July 5th 2012, US Liberal economics writer Paul Krugman scoffed in the New York Times that the ECB was doing “the minimal amount” to help with the eurozone bond crisis.

On July 6th 2012, Spanish bond yields edged up to a dizzying 7%. On that same day, frustrated ECB board member Joerg Asmussen said too much was being expected of the Bank. “We must explain what the limits of our powers and mandate are,” he said in a speech. “The ECB cannot compensate for what others – notably political authorities – fail to do. There is no substitute for good policies.”

He was right: the europols were dithering and squabbling, as usual.

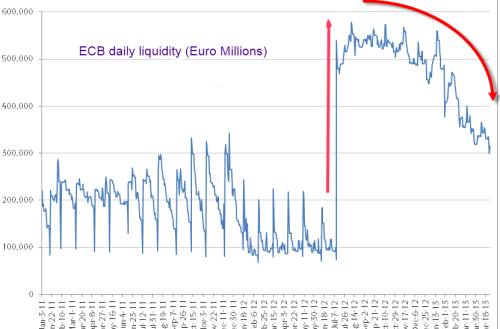

This is what happened next. The following morning, as the chart below shows, the ECB’s daily liquidity shot up from €100billion to €540billion. July 7th 2012 was a Saturday, when few if any financial folks were at their desks.

The following Monday July 9th, Mario Draghi made a full statement to the European Parliament’s Economic & Monetary Policy hearing. He didn’t think that using the weekend to secretly more than quintuple the ECB’s liquidity to nearly half a trillion euros was worthy of mention.

With Spanish yields showing no sign of abating, over the next 11 days Draghi increased the ECB daily liquidity by another €100 billion to €580 billion. Four days later on July 24th 2012, Spanish bonds reached 7.57%. The IMF’s Cristine Lagarde was in full panic mode and screaming at every pol she could find to dosomething.

The turning point factor in the Spanish sovereign debt crisis has always been nailed as the July 26, 2012 policy statement by Draghithat “the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.” What Mario again didn’t say was that his bank’s liquidity dropped by a staggering €72 billion in just four hours of that very same day. Amazingly, the next day Spanish bond yields fell sharply to 6.9% – and in response to that, the Madrid stock market forged ahead by 4%.

Throughout this period, ECB President Mario Draghi said only that he “might consider the resumption of bond buying”. But it was from this moment that Wolfgang Schäuble decided the Italian was not to be trusted. Jens Weidemann was incandescent about what had happened. On July 31st, CNN was reporting that ‘The ECB is widely expected to resume limited purchases of government bonds to ease the pressure on Spain and Italy’, but in reality the central banker was already doing it.

Weidemann resigned in protest at Mario’s under-the-table bond support five weeks later on August 31st.

Far from giving him a problem, Draghi welcomed the German’s departure. Having made his last move on a Saturday, he made the next one when most people would be replete and a little drunk: Christmas Day 2012. On that day, he somehow found another €100 billion of liquidity to stash quietly away. He then shelled out a whopping €200bn during the month of January 2013.

And guess what? By January 11th 2013, FTAlphaville was writing about The Great Eurozone Bond Yield Convergence. Southern European bond yields were falling as northern ones rose slightly: the yield spreads narrowed dramatically.

Most of the financial press hailed Draghi as the hero of the hour for his gutsy statements at the time, but the truth is that, having illegally subordinated Greek bondholders earlier in 2012, the ECB President deliberately and secretly manipulated the eurozone’s ClubMed bond sector in order to create a picture of recovery that was simply false. There is no material difference between his actions in those cases, and those of Libor firms and Sovereigns working alongside central bankers to cheat the ordinary investor in the Gold and Silver markets. Similarly, those who lost heavily on Bear notes during 2012 have Ben Bernanke’s cavalier use of taxpayer QE money to thank for being slaughtered.

One massive question still remains: where did Mario get all this liquidity? Did he print it? Or did he have help from the US Fed? It’s an issue that doesn’t readily spring out of the records….but what Draghi’s behaviour in all this shows is that – as The Slog posted recently – he is completely beyond the control of any single government body or political leader. That any technocrat should have that much power is typical of the mindset of the European Union where, we have seen so many times, the lack of respect for liberal democracy and the will of the citizens is infamous bordering on legendary.

http://globaleconomicanalysis.blogspot.com/2013/05/s-predicts-20-drop-in-spains-housing.html

Wednesday, May 01, 2013 3:05 PM

S&P Predicts 20% Drop in Spain's Housing Prices Over Next 4 Years; Bad Bank to Dump Distressed Properties on Market

Spain's "bad bank", Sareb to speed up distressed property sales in an ambitious new timetable for liquidation.

The bad bank is hoping to sell almost 42,000 housing units in the next five years. This is about half of the properties in its €50 billion (£42.5 billion approximately) portfolio.Cleanup "Advance Stage" Nonsense from IMF

However, falling house prices and a desire among buyers for modern properties in prime locations could hamper these plans for swift sale. Already the value of assets is being slashed by Sareb to clear their books, but attracting investors is proving to be no easy task.

At the beginning of March the International Monetary Fund (IMF) declared: "The clean-up of undercapitalised banks has reached an advanced stage, and key reforms of Spain's financial sector have been either adopted or designed." Sareb has also been praised for its receipt of distressed real estate assets from the country's weakest banks. The bad bank has also finalised agreements with participating banks to manage the transfer of assets.

To suggest the cleanup of undercapitalized banks is in an "advance stage" is complete nonsense. It only makes partial sense if there is a zero percent probability of haircuts on Spanish sovereign debt.

I suggest the probability of haircuts on Spanish government bonds is far greater than 50%. And since Spanish banks are loaded to the gills with sovereign debt, the banks are severely undercapitalized by implication.

S&P Predicts 20% Drop in Spain's Housing Prices

Courtesy of Mish-Modified google translate from El Economista, please consider S&P predicts that housing in Spain fall by 20% over the next four years.

The credit rating agency Standard & Poor's does not see "signs of improvement" in the Spanish property market given the "precarious economic conditions and the heavy weight of the 'stock' of unsold homes," and anticipates that home prices will fall 20% over the next four years.S&P Optimistic

"We see little chance of that Spanish households become more solvent, as prices continue to fall, the purchasing power continues to decline and interest rates are stabilizing. This should keep demand very depressed," said S&P in a report on the European property market.

Sareb's plans to sell 45,500 homes in the next five years, about half of its portfolio, will likely determine the pace of declines in housing prices.

Should the divestiture from Sareb be gradual, housing prices in Spain will fall 8% in 2013 and 5% in 2014, after falling 10.5% in 2012 and 28% from their highs reached in March 2008.

Falls widespread in Europe

On the whole of Europe, the agency notes that the downward trend in most European property markets continue this year as a result of the economic downturn. In most countries housing prices will continue on a path "down" this year and only start to stabilize or slowdown in 2014.

After Spain, the largest decreases will occur in the Netherlands (-5.5%) and France (-5%).

I am of the opinion the S&P is overly optimistic about Spain, about France, and about the Netherlands.

The European recession is worsening, credit conditions are awful, employment conditions are awful, and there are scant buyers of property because discounts are not large enough and credit is nowhere to be found.

None of this remotely takes into consideration the very strong likelihood of a Spanish debt writedown in the next year or so.

Mike "Mish" Shedlock

http://soberlook.com/2013/04/draghi-will-act-to-avoid-deflationary.html?utm_source=BP_recent

TUESDAY, APRIL 30, 2013

Draghi will act to avoid deflationary spiral

The ECB will have no choice but to ease monetary policy and possibly prepare for more drastic actions. The Eurozone is facing a growing risk of deflation - similar to Japan. Once the inflation rate in Japan fell below 1%, the external shock of the Asian currency crisis (late 90s) sent Japan into a deflationary spiral - something the nation is still dealing with today. The Eurozone may end up facing a similar scenario.

Danske Bank: - Europe is heading into a deflationary scenario if they don’t do anything to boost the money supply. This already looks very similar to what happened in Japan in 1996 and 1997.”

|

| Source: CNN |

Growth in consumer lending has come to a crawl as bank deleveraging continues. With retail credit growth curtailed, corporations have no pricing power. Signs of deflationary pressures are already in place.

Reuters: - EU leaders are already trying to shift away from the budget cuts that have dominated the response to the debt crisis since 2009, and the data will raise the specter of deflation as companies slash prices to entice shoppers.

|

| Eurozone consumer loan growth (source: ECB) |

Of course just like Japan, the Eurozone may face rising public sector debt, as austerity is put on the back burner. In fact many in Europe now blame the austerity drive by Germany for the deflationary risks the region currently faces.

Business Spectator: - Eurozone divisions over austerity policies championed by Germany have deepened as Italy's new government joined France in demanding a change of direction for the crisis-hit bloc.Whatever the case, the ECB will have to act in order to avoid the dangers of a deflationary spiral, which could take the Eurozone years (or even decades) to exit. This article from the FT lists Draghi's possible actions this week, representing a fairly limited set of choices (rate cut, forward guidance, easing collateral requirements for banks to borrow from the Eurosystem, and outright purchases of debt linked to "small and medium sized companies"). Something will need to happen to prevent the Eurozone from looking increasingly more like Japan.

Italy's new centre-left Prime Minister Enrico Letta told parliament on Monday that the country was "dying from austerity alone", and France voiced optimism that the political tide was turning in favour of critics of austerity.

"In terms of growth policies, Francois Hollande will now have a stronger voice and be less isolated in Europe," France's minister for Europe, Thierry Repentin, told AFP.

Letta's direct challenge to the tough belt-tightening that Germany and its allies have advocated as the answer to the single currency zone's debt crisis follows criticism of the eurozone's direction from the International Monetary Fund.

No comments:

Post a Comment