http://www.zerohedge.com/news/2013-05-14/jpm-eligible-gold-plunges-new-record-low-and-why-it-could-have-been-much-worse

( So this works until registered gold goes bye bye - then what ? )

and.....

http://silverdoctors.com/metal-shortages-a-precursor-for-the-main-event/#more-26575

and......

http://harveyorgan.blogspot.com/2013/05/indians-have-only-received-10-of-gold.html

( So this works until registered gold goes bye bye - then what ? )

JPM Eligible Gold Plunges To New Record Low, And Why It Could Have Been Much Worse

Submitted by Tyler Durden on 05/14/2013 20:44 -0400

Back on April 25, in the aftermath of the latest epic precious metals takedown, we reported that something odd had happened: overnight, total Eligible gold held in the vaults of JPM dropped by 65%, or 260.8k ounces in one day, to a record low of only 141.6K ounces. Contrast that with the 2 million Eligible ounces the JPM vault at the basement of 1 CMP held when it reopened.

Since that moment, many were curious if this may not be the start of the proverbial "run on the vault", and whether JPM's COMEX holdings could actually run out, and if so what happens then. And finally: is the dramatic plunge in gold related to any of this (and certainly to the Bundesbank's repatriation of NY Fed gold for the next five years)? In the ensuing days, JPM's Eligible gold fluctuated in a tight range, until today, when another 22,780 oz were withdrawn from Blythe Masters' metals cellar, bringing JPM's eligible gold to a fresh record low of only 137,377 troy ounces.

But this is only half the story: the details are as always behind the scenes.

Because what the chart above does not show is how, quietly, JPM managed to keep its eligible inventory constant even in light of various withdrawal demands.

The chart below looks at the relative moves in JPM Eligible and Registered gold, starting with the massive withdrawal day, April 25. What is immediately obvious is that the only reason JPM's eligible gold hasn't plunged, is due to the periodic "adjustments" out of Registered into Eligible gold, which on essentially all days in the past three weeks netting out, and for every ounce converted into eligible, one ounce was removed from registered gold.This also explains why even with the three distinct sizable withdrawal days, of 24K, 57.9K, and 22.8K on May 2, May 8 and May 14.

Incidentally, when asked about the rationale behind such seemingly arbitrary reclassifications, and warrant cancellation of registered gold into eligible gold, a market surveillance analyst at the CME replied as follows:

...the adjustment column does reflect the issuance and cancellation of warrants, but it can be used for other purposes as well. Anything that is not received or withdrawn would be reported in the adjustment column.

In other words, JPM and the Comex have full liberty to adjust what is eligible and what is registered, at will, and can thus easily replenish inventory even when it is about to run out.

And run out, it almost would have.

Because if one ignores the 100k or so ounces of Registered gold that were reclassified to replenish eligible inventory, JPM's eligible gold would, as of right now, be down to a negligible 36,931 ounces, or just over 1 ton!

At that point JPM would be down to one withdrawal request away from declaring force majeure on its eligible gold holdings, and all the unpleasant consequences that this would entail for future delivery requests.

Source: COMEX

and.....

http://www.zerohedge.com/news/2013-05-14/south-african-mint-short-gold

( How is it that South Africa - a gold mining country , could have its Central Bank short of gold ? )

Is The South African Mint Short Of Gold?

Submitted by Tyler Durden on 05/14/2013 19:24 -0400

Submitted by Michael Krieger of Liberty Blitzkrieg blog,

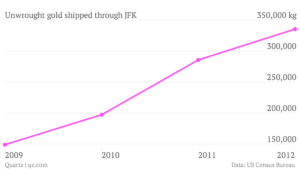

In what may be the strangest story I have seen in a while related to the gold market, it appears $982 million worth of gold has left JFK international airport in New York to some undisclosed location in South Africa. While it remains unclear what purpose this gold serves, it seems the most likely explanation is to fulfill demand for Krugerrands (South Africa’s popular gold bullion coin) to meet elevated demand in the face of constricted mine production. This story is timely coming on the heels of the article I posted yesterday about how Dubai’s gold demand is running at 10x normal levels. This is a bizarre story, so if anyone has further color I’d love to hear it.

From Quartz:

Examining US trade data, we were surprised to see that South Africa’s $402 million trade surplus with the United States in January had turned into a $689 million deficit by March.Why?It turns out the $1.1 billion swing is entirely due to unusual shipments of gold from the US to South Africa in February and March. So far this year, 20,013 kg of unwrought gold, worth $982 million, has left John F. Kennedy International Airport (JFK), in New York, for somewhere in South Africa, according to the US Census Bureau’s foreign trade division.(Unwrought gold includes bars created from scrap as well as cast bars, but not bullion, jewelry, powder, or currency.)The shipments from JFK were the only unwrought gold to leave the US for South Africa in 2013; another large shipment occurred in September 2012.However, the strikes that rocked South Africa’s mining industry last year briefly caused gold output to fall sharply, around the same time as last autumn’s big gold shipment from JFK. Overall 2012 production declined by a relatively modest 6% (pdf) over the year before, according to a preliminary figure from the US Geological Survey; but those first estimates have sometimes proven wide of the mark. (In 2009 the USGS estimated South Africa’s 2008 production to be 250 tons; it subsequently revised the figure to 213 tons.) So it could be that the strikes dealt a more severe blow to the country’s gold industry than the data show.Still, even if gold output did fall precipitously, it’s not clear why South Africa would need to start importing it. One possible destination for the gold is the South African Mint, which produces legal-to-own gold coins called Krugerrands; the gold used in them is first refined by the Rand refinery. Calls to the South African embassy in Washington, DC were not returned.

Meanwhile how about this chart, courtesy of the Quartz article.

Full article here.

http://silverdoctors.com/metal-shortages-a-precursor-for-the-main-event/#more-26575

Submitted By Bill Holter, Miles Franklin Ltd,:

The last 4 weeks has seen huge and unprecedented global demand for both Gold and Silver. Between just China and India the demand was close to 400 tons of Gold…then you add in the rest of the world. Compare this 400 tons (from just 2 countries) to the 200+ tons that was dug out of the ground over the same time frame. During this period we saw sovereign mints go into “ration” mode as they could not keep up with demand and struggled to procure the necessary volumes of blanks. We also saw “junk” Silver supply completely wiped out with none available, prior to the supply shut out junk was $5-$6 over paper spot or a 20-25% premium before any dealer markups. Delivery times for both metals were stretched out 3-6 weeks depending on product.

Basically this “episode” has shown just how fragile the supply chain really is. While premiums have now slightly lessened and delivery times a little bit shorter I think it is important that you look at what just happened as merely a precursor or warning if you will to what WILL happen. Here in the U.S. people are still sleeping for the most part, maybe not “soundly” but they are sleeping with the thoughts that “the government will never let it happen”. As long as current policies are continued, they ARE MAKING “it” happen.

What we have just witnessed in merely a pre shock warning and a “roadmap” if you will to what will eventually happen. A mad rush into the metals can begin at any time for any number of reasons. The list just keeps growing as does the fiat outstanding that will do the “chasing”. The problem is that as just illustrated, supply has no depth whatsoever and the bottom of the barrel has already been exposed. The next time a wave of buying hits this market (not that the current wave is done) may be the last time that the demand gets met by supply. Once supply is gone, it is gone. This is not like the banking system where a bank runs out of money and calls their central bank for more. It takes real sweat, labor, equipment and capital to dig Gold and Silver out of the ground, “supply” doesn’t happen with the wave of a magic maestro’s wand.

Another “anomaly” if you will in the precious metals market is that demand will actually increase if supply gets tighter or price begins to go exponential. This is the fear factor where once you are told “you can’t have that because there isn’t any available” makes you want it even more. Forget about greed, “fear” is what will take the physical product out of the market. It could be anything that tips the scale, it could be a European sovereign or a bank. It certainly could be the Japanese bond market that is currently in crash mode. It could be further QE in the US or a slowdown of QE. It could even be that US “goodwill” fails because of the Bhengazi and IRS sleights of hand. It could be anything from anywhere on the planet, it could be as minuscule as an ATM machine running out of cash in the tiny country of Luxembourg. The financial forest is tinder dry while politicians, bankers and alchemists of modern finance the world over are throwing cigarette butts and fireworks in all directions.

I know that I must sound like a broken record here but supply cannot meet demand which is THE most basic premise. Supply has had to come from somewhere and that “somewhere” now has less inventory that it did just one month ago. How many more body shots can the supply take? I don’t know the answer to this question, I do know that sooner or later a run on the bank is a certainty and that the bank does not have unlimited supply. Don’t be one of those who will say “woulda coulda shoulda” because you still “can”…for now.

Regards, Bill H.

Gene Arensberg: U.S. banks buy gold futures in dramatic position change

Submitted by cpowell on Tue, 2013-05-14 18:52. Section: Daily Dispatches

2:46p ET Tuesday, May 14, 2013

Dear Friend of GATA and Gold:

Big U.S. investment banks have reduced their net short position in gold to the lowest level since 2008, the Got Gold Report's Gene Arensberg reports today.

Arensberg writes: "In just one month, as gold fell a net $123.45 or 7.8 percent (from $1,575.67 on April 2 to $1,452.22 on May 7), U.S. banks covered or offset 60 percent of their net short bets on gold, down to an extremely small 16,781 contracts net short. We have to go all the way back to the June 3, 2008, bank participation report to find a time when the U.S. banks, including bullion banks, showed a lower number of net short bets held."

The implication is that the gold futures price smashdown is over.

Arensberg's commentary is headlined "U.S. Banks Buy Gold Futures in Dramatic Position Change" and it's posted at the Got Gold Report here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

and......

http://harveyorgan.blogspot.com/2013/05/indians-have-only-received-10-of-gold.html

Indians have only received 10% of gold purchases that they bought/gold and silver whacked again/more comex gold leaves vaults/GLD and SLV remain constant/

Gold closed down $12.10 to $1424.70 (comex closing time). Silver fell by only 37 cents to $23.36 (comex closing time)

In the access market at 5 pm gold and silver are the following :

gold: $1425.20.

silver: $23.41

Gold was on a tear in Asia last night. However as soon as the bankers showed up for work in London , down went gold and silver again. As long as our regulators just sit there, this will continue despite the fact that the physical gold and silver markets are on fire. (see below)

At the Comex, the open interest in silver fell by 291 contracts to 145,175 contracts despite silver's tiny rise on Monday. The silver OI is holding firm at elevated levels . The open interest on the gold contract rose by 4494 contracts to 445,178 as we still have a few more dumb paper players willing to take on the crooked bankers. With gold's small fall in price on Monday, one would have thought that the OI would have fallen and not rise. The gold deliveries for May rose considerably today surpassing 8 tonnes at 8.556 tonnes and this is an off month for gold. In silver we continue to see the total number of ounces standing rise above the quantity that stood on first day notice. The number of silver ounces, standing for delivery in May now stands at 17.400 million oz. ( On first day notice: 14.860 million oz.)

Again, at the Comex, gold is departing as investors are frightened to death of a confiscation similar to what happened at MFGlobal or Refco. Tonight, the Comex registered or dealer gold rests at 1.836 million oz or 57.10 tonnes. The total of all gold at the comex again fell and this time it is well below the 8 million oz at 7.943 million oz or 247.06 tonnes of gold.

The GLD for a change reported so far no change in inventory.

The SLV inventory of silver remained constant.

In other physical news, we see that Indian dealers have only received 10% of the gold that they have bought. As I reported to you on previous occasions, we are seeing many cracks at the London LBMA.

David Yanofsky, of Bloomberg has discovered that in Jan February 1 billion usa dollars worth of gold was shipped to South Africa. This is very noteworthy as it represents 50% of USA production for those two months.

And the head scratcher? Why would South Africa which produces lots of gold import gold from the USA?

In paper news, German confidence was down as the big ZEW confidence number was reported.

Overnight, Japan had another violent session with the 10 year bond yield rising another 9 basis points. It was within another basis point of forcing another halt to trading. It looks to many that Abe and Kuroda are losing control of this big market.

We will go over these and other stories but first.....................

Let us now head over to the comex and assess trading over there today:

The total gold comex open interest rose today by 4494 contracts from 440,684 up to 445,178 with gold falling by $2.50 on Monday. With the fall in gold price one would have thought that the OI would have contracted and not increased. We no doubt had a few new ball players enter the arena at these lower prices for gold willing to take on the crooked bankers. The front non active delivery month of May saw its OI rise by 206 contracts down up to 895. However we had 39 delivery notices filed on Monday. Thus we gained 299 contracts or 29,900 additional gold ounces will stand for delivery in May. The next active contract month is June and here the OI fell by 9093 contracts to 209,286 as most of these paper players rolled into August. June is the second biggest delivery month in gold's calender and first day notice is less than 3 weeks away. The estimated volume today was good at 186,126 contracts. The confirmed volume on Monday was also good at 186,410 contracts.

The total silver Comex OI fell by 291 contracts from 145,466 down to 145,175 with silver's rise in price of 4 cents on Monday. The front active silver delivery month of May saw it's OI fall by 115 contracts down to 617. We had 138 delivery notices filed on Monday so we gained 23 contracts or an additional 115,000 oz will stand for delivery in May. The next delivery month for silver is June and here the OI fell by 5 contracts to stand at 369. The next big active contract month is July and here the OI fell by 360 contracts to rest tonight at 78,436. The estimated volume today was good, coming in at 39,805 contracts. The confirmed volume on Monday was also good at 37,926.

end

Has GLD ETf's gold physical inventory been emptied out ? Note once again the GLD has maintained current flatline for alleged inventory at around 1051.65 tons......

In the access market at 5 pm gold and silver are the following :

gold: $1425.20.

silver: $23.41

Gold was on a tear in Asia last night. However as soon as the bankers showed up for work in London , down went gold and silver again. As long as our regulators just sit there, this will continue despite the fact that the physical gold and silver markets are on fire. (see below)

At the Comex, the open interest in silver fell by 291 contracts to 145,175 contracts despite silver's tiny rise on Monday. The silver OI is holding firm at elevated levels . The open interest on the gold contract rose by 4494 contracts to 445,178 as we still have a few more dumb paper players willing to take on the crooked bankers. With gold's small fall in price on Monday, one would have thought that the OI would have fallen and not rise. The gold deliveries for May rose considerably today surpassing 8 tonnes at 8.556 tonnes and this is an off month for gold. In silver we continue to see the total number of ounces standing rise above the quantity that stood on first day notice. The number of silver ounces, standing for delivery in May now stands at 17.400 million oz. ( On first day notice: 14.860 million oz.)

Again, at the Comex, gold is departing as investors are frightened to death of a confiscation similar to what happened at MFGlobal or Refco. Tonight, the Comex registered or dealer gold rests at 1.836 million oz or 57.10 tonnes. The total of all gold at the comex again fell and this time it is well below the 8 million oz at 7.943 million oz or 247.06 tonnes of gold.

The GLD for a change reported so far no change in inventory.

The SLV inventory of silver remained constant.

In other physical news, we see that Indian dealers have only received 10% of the gold that they have bought. As I reported to you on previous occasions, we are seeing many cracks at the London LBMA.

David Yanofsky, of Bloomberg has discovered that in Jan February 1 billion usa dollars worth of gold was shipped to South Africa. This is very noteworthy as it represents 50% of USA production for those two months.

And the head scratcher? Why would South Africa which produces lots of gold import gold from the USA?

In paper news, German confidence was down as the big ZEW confidence number was reported.

Overnight, Japan had another violent session with the 10 year bond yield rising another 9 basis points. It was within another basis point of forcing another halt to trading. It looks to many that Abe and Kuroda are losing control of this big market.

We will go over these and other stories but first.....................

The total gold comex open interest rose today by 4494 contracts from 440,684 up to 445,178 with gold falling by $2.50 on Monday. With the fall in gold price one would have thought that the OI would have contracted and not increased. We no doubt had a few new ball players enter the arena at these lower prices for gold willing to take on the crooked bankers. The front non active delivery month of May saw its OI rise by 206 contracts down up to 895. However we had 39 delivery notices filed on Monday. Thus we gained 299 contracts or 29,900 additional gold ounces will stand for delivery in May. The next active contract month is June and here the OI fell by 9093 contracts to 209,286 as most of these paper players rolled into August. June is the second biggest delivery month in gold's calender and first day notice is less than 3 weeks away. The estimated volume today was good at 186,126 contracts. The confirmed volume on Monday was also good at 186,410 contracts.

The total silver Comex OI fell by 291 contracts from 145,466 down to 145,175 with silver's rise in price of 4 cents on Monday. The front active silver delivery month of May saw it's OI fall by 115 contracts down to 617. We had 138 delivery notices filed on Monday so we gained 23 contracts or an additional 115,000 oz will stand for delivery in May. The next delivery month for silver is June and here the OI fell by 5 contracts to stand at 369. The next big active contract month is July and here the OI fell by 360 contracts to rest tonight at 78,436. The estimated volume today was good, coming in at 39,805 contracts. The confirmed volume on Monday was also good at 37,926.

Comex gold/May contract month:

We had 0 customer deposits today:

total customer deposit: nil oz

We had two customer withdrawals today:

i) Out of JPMorgan: another 22,759.857* oz

ii Out of Scotia: 32,049.093 oz

* this brings the customer account of JPMorgan to a low of 137,377.049 oz or 4.27 tonnes of gold.

1857 contracts x 100 oz per contract or 185,700 oz (served) + 894 notices or 89,400 oz (to be served upon) = 275,100 oz or 8.556 tonnes of gold.

This is extremely high for a non active month. We gained 29,900 additional gold ounces standing for the May comex gold contract today.

The big June delivery month will surely be exciting to watch judging by the huge demand for gold in May. We will watch what happens with JPMorgan with respect to its customer gold remains (at a very low 4.9 tonnes of gold) and the entire comex dealer gold at its nadir at 1.836 million oz.

May 14/2013

Ounces

| |

Withdrawals from Dealers Inventory in oz

|

nil

|

Withdrawals from Customer Inventory in oz

|

54,808.95 (Scotia, JPM)

|

Deposits to the Dealer Inventory in oz

|

nil

|

Deposits to the Customer Inventory, in oz

| nil |

No of oz served (contracts) today

|

1 (100 oz)

|

No of oz to be served (notices)

|

894 (89,400)

|

Total monthly oz gold served (contracts) so far this month

|

1857 (185,700)

|

Total accumulative withdrawal of gold from the Dealers inventory this month

|

nil

|

Total accumulative withdrawal of gold from the Customer inventory this month

| 538,242.18 oz |

We had good activity at the gold vaults.

The dealer had 0 deposits and 0 dealer withdrawals.

We had 0 customer deposits today:

total customer deposit: nil oz

We had two customer withdrawals today:

i) Out of JPMorgan: another 22,759.857* oz

ii Out of Scotia: 32,049.093 oz

* this brings the customer account of JPMorgan to a low of 137,377.049 oz or 4.27 tonnes of gold.

We had 1 adjustment

Out of the Brink's vault: 704.63 oz was adjusted out of the customer and back into the dealer account. The JPMorgan customer vault reduces to 137,377.049 oz today.

Out of the Brink's vault: 704.63 oz was adjusted out of the customer and back into the dealer account. The JPMorgan customer vault reduces to 137,377.049 oz today.

Tonight the dealer inventory remains tonight at a low of 1.836 million oz (57.10) tonnes of gold. The total of all gold falls again considerably at the comex and this time, well below the 8 million oz as it rests at 7.943 million oz or 247.06 tonnes.

The CME reported that we had 1 notice filed today for 100 oz of gold.

To calculate the quantity of gold ounces that will stand, I take the OI standing for May (895) and subtract out Tuesday's notices (1) which leaves us with 894 notices or 89,400 oz left to be served upon our longs.

To calculate the quantity of gold ounces that will stand, I take the OI standing for May (895) and subtract out Tuesday's notices (1) which leaves us with 894 notices or 89,400 oz left to be served upon our longs.

Thus we have the following gold ounces standing for metal in May:

1857 contracts x 100 oz per contract or 185,700 oz (served) + 894 notices or 89,400 oz (to be served upon) = 275,100 oz or 8.556 tonnes of gold.

This is extremely high for a non active month. We gained 29,900 additional gold ounces standing for the May comex gold contract today.

The big June delivery month will surely be exciting to watch judging by the huge demand for gold in May. We will watch what happens with JPMorgan with respect to its customer gold remains (at a very low 4.9 tonnes of gold) and the entire comex dealer gold at its nadir at 1.836 million oz.

end

Silver:

May 14.2013: May silver:

| Silver |

Ounces

|

| Withdrawals from Dealers Inventory | nil |

| Withdrawals from Customer Inventory | 101,801.99 oz (Delaware,Brinks) |

| Deposits to the Dealer Inventory | nil |

| Deposits to the Customer Inventory | 214,163.714 (CNT,Delaware) |

| No of oz served (contracts) | 23 (115,000) |

| No of oz to be served (notices) | 594 (2,970,000 oz) |

| Total monthly oz silver served (contracts) | 2886 (14,430,000 oz) |

| Total accumulative withdrawal of silver from the Dealers inventory this month | 204,097.65 |

| Total accumulative withdrawal of silver from the Customer inventory this month | 1,434,919.2 |

Today, we had fair activity inside the silver vaults.

we had 0 dealer deposits and 0 dealer withdrawals.

We had 2 customer deposits:

Into CNT: 65,524.615 oz

Into Delaware: 148,639.099 oz

total customer deposit; 214,163.714 oz

We had 2 customer withdrawals:

1) Out of Delaware: 990.35 oz

We had 2 customer deposits:

Into CNT: 65,524.615 oz

Into Delaware: 148,639.099 oz

total customer deposit; 214,163.714 oz

We had 2 customer withdrawals:

1) Out of Delaware: 990.35 oz

ii) Out of Brinks: 100,811.64 oz

total customer withdrawals: 101,801.99 oz

total customer withdrawals: 101,801.99 oz

we had 1 adjustments today

i) Out of the CNT vault: 65,524.55 oz was adjusted out of the customer and into the dealer.

i) Out of the CNT vault: 65,524.55 oz was adjusted out of the customer and into the dealer.

Registered silver at : 45.052 million oz

total of all silver: 165.001 million oz.

The CME reported that we had 23 notices filed for 115,000 oz. To calculate the number of ounces that will stand in silver, I take the OI standing for May (617) and subtract out Tuesday's notices (23) which leaves us with 594 notices or 2,970,000 oz

Thus the total number of silver ounces standing in this active delivery month of May is as follows:

2886 contracts x 5000 oz per contract (served) = 14,440,000 + 594 contracts x 5000 oz = 2,970,000 oz ( to be served) = 17,400,000 oz.

we gained 115,000 oz of silver standing for May today. The total standing for silver is superb for May.

Thus the total number of silver ounces standing in this active delivery month of May is as follows:

2886 contracts x 5000 oz per contract (served) = 14,440,000 + 594 contracts x 5000 oz = 2,970,000 oz ( to be served) = 17,400,000 oz.

we gained 115,000 oz of silver standing for May today. The total standing for silver is superb for May.

end

Has GLD ETf's gold physical inventory been emptied out ? Note once again the GLD has maintained current flatline for alleged inventory at around 1051.65 tons......

May 14.2013: (as of 6 pm est)

Tonnes

May 10.2013:

Tonnes

May 8.2013:

Tonnes

1,051.65

Ounces33,811,468.47

Value US$48.465 billion

May 13.2013:

Tonnes1,051.65

Ounces33,811,468.47

Value US$48.364 billion

May 10.2013:

Tonnes

1,051.65

Ounces33,811,468.47

Value US$48.222 billion

May 9.2013:

Tonnes1,054.18

Ounces33,892,812.62

Value US$49.641 billion

May 8.2013:

Tonnes1,051.47

Ounces33,805,784.75

Value US$49.598 billion

Select news and views......

This is interesting: $1 billion of Unwrought gold shipped to South Africa.

Maybe this gold is coin melt or official gold of the uSA that arrived from Fort Knox;

The USA produces around 20 tonnes a month. Using Jan and Feb's price of gold that equates to 980

million dollars worth of gold.

(courtesy David Yanofsky/Bloomberg)

$1 billion of gold has been shipped from New York to South Africa this year

When South Africa makes so much gold of its own, why does it need to import it? Getty Images/Tom Stoddart

Examining US trade data, we were surprised to see that South Africa’s $402 million trade surplus with the United States in January had turned into a $689 million deficit by March. Why?

It turns out the $1.1 billion swing is entirely due to unusual shipments of gold from the US to South Africa in February and March. So far this year, 20,013 kg of unwrought gold, worth $982 million, has left John F. Kennedy International Airport (JFK), in New York, for somewhere in South Africa, according to the US Census Bureau’s foreign trade division. (Unwrought gold includes bars created from scrap as well as cast bars, but not bullion, jewelry, powder, or currency.)

The shipments from JFK were the only unwrought gold to leave the US for South Africa in 2013; another large shipment occurred in September 2012.

South Africa has an enormous mining industry, and a lot of the material leaves the country–$1.72 billion worth of precious stones and metals were exported in March according to the South African Revenue Service. Although the country’s gold output has been falling steadily for decades, it remains one of the world’s largest producers and is still primarily an exporter. In fact ordinary South Africans are legally prohibited from importing or owning unwrought gold. (Refiners, dealers, and jewelers are granted licenses.)

However, the strikes that rocked South Africa’s mining industry last year briefly caused gold output to fall sharply, around the same time as last autumn’s big gold shipment from JFK. Overall 2012 production declined by a relatively modest 6% (pdf) over the year before, according to a preliminary figure from the US Geological Survey; but those first estimates have sometimes proven wide of the mark. (In 2009 the USGS estimated South Africa’s 2008 production to be 250 tons; it subsequently revised the figure to 213 tons.) So it could be that the strikes dealt a more severe blow to the country’s gold industry than the data show.

Still, even if gold output did fall precipitously, it’s not clear why South Africa would need to start importing it. One possible destination for the gold is the South African Mint, which produces legal-to-own gold coins called Krugerrands; the gold used in them is first refined by the Rand refinery. Calls to the South African embassy in Washington, DC were not returned.

The data do not imply that the gold originated from the New York area, only that JFK was the gold’s final point of transit before it made its way to South Africa. For instance, a US domestic cargo carrier could have delivered the gold to an international carrier in New York, who in turn hauled it across the Atlantic. The amount of unwrought gold exported through JFK has more than doubled in recent years.

In 2012, 335,204 kg was transported from the airport to other countries, up from 148,894 kg in 2009.

The shipments to South Africa amount to 16% of all unwrought gold exported through JFK in the first three months of 2013 and 9% of all unwrought gold exported from the US this year.

All the gold was not necessarily shipped at the same time. However, if it was, it would take up no more space than a washing machine. The Boeing 747-200, a cargo model of the distinctive jumbo jet, is capable of transporting a shipment six times heavier than the 20,013 kg exported so far this year. That’s all we know.

If you have a better theory about (or the full story behind) these gold shipments,feel free to get in touch.

I sent the following down to the CFTC this morning;

(courtesy J. Kim)

Indisputable Proof Paper Gold Markets are Massively Manipulated

Submitted by smartknowledgeu on 05/14/2013 06:01 -0400

“With the release of fraudulent US non-farm payroll and employment statistics today at 8:30 AM NY time, this may present the best opportunity of the month for aCOORDINATED banker attack and raid on gold and silver in the paper markets again, so beware of a potential raid again today…Though gold is up over $1475 an ounce in Asia [right now] and silver well over $24 an ounce at $24.12 again, the price movements in Asia do not matter if the bankers want to raid the price in paper markets in New York and London…I would not be surprised in the least if they go for a big raid in the range of a $40 to $50 drop in gold today.”

- Central Banks

- Exchange Traded Fund

- Fail

- Fractional Reserve Banking

- Gold Spot

- KIM

- None

- SmartKnowledgeU

- Unemployment

- Volatility

- Yen

What would you think if someone told you the following?

“Three times this week, I am going to tell you the low price of gold with near perfect accuracy, and one of those three times, I am going to tell you events that will precede the low and the exact time that gold prices will crash.”

You would likely conclude that either:

(1) I am somehow directly involved in setting the price of gold in paper derivative markets, or

(2) that since nearly perfectly predicting gold price movements three times in one week in a free market is impossible, that such an accomplishment would serve as indisputable proof that gold markets are rigged and manipulated by bankers, as none of my predicted price targets depended upon technical chart analysis of any kind.

So let’s summarize my calls regarding gold price movements on three separate occasions last week, and why I feel that the accuracy of these calls serve as indisputable proof that Central Bankers and their agent bullion banks manipulate the price of gold and silver.

(1) On Friday May 3, I told my clients that gold was going to waterfall by $40 to $1435 an ounce starting precisely at 8:30 AM in a “coordinated” attack planned by the Feds when gold was still trading at $1,475 an ounce in Asia, using a “false” unemployment data release to get the decline started. At 8:30 AM, gold started to waterfall decline all the way to a hair above $1,440 an ounce.

(2) On Sunday, May 5, with gold closing at $1,469.90 an ounce the previous Sunday and before Asian gold markets opened, I stated that gold would at least fall again to $1,430 an ounce or lower. On Tuesday, May 7, even when gold trended higher to $1,471 an ounce in Asia, I reiterated to my clients that gold would FALL to $1,430 an ounce in New York later that day. When gold declined close to $1,440 we closed out our initial GLD puts.

(3) On May 8, with gold trading at $1,455.70, I predicted that the bankers would knock gold down close to $1,400 an ounce. On Friday May 10, I amended this prediction, based on further data, to a raid that would result with gold falling to a range of $1,400 to $1,430. Gold fell to a low of $1,418.50 in NY trading that day, exactly in the range I predicted. We closed out the rest of our GLD and SLV puts that day.

For more details of the above calls, I have provided below a few sentences of the series of alerts I sent to our Crisis Investment Opportunities newsletter and Platinum Member clients last week:

On Thursday, May 2, 2013, I released this alert to clients during NY market hours:

“Were you to take a hedge against the monthly US non-farm payroll Friday gold and silver price slam that may occur tomorrow…we are looking at the May 24, 2103 puts on the GLD ETF that are trading at $2.85 a contract now at a strike of 142.00.”

I further updated our position on May 3, 2013 to our clients after reviewing more data earlier that day, many hours before the COMEX open in NY. Note that the price of gold was still $1,475 an ounce at the time of this updated release:

“With the release of fraudulent US non-farm payroll and employment statistics today at 8:30 AM NY time, this may present the best opportunity of the month for aCOORDINATED banker attack and raid on gold and silver in the paper markets again, so beware of a potential raid again today…Though gold is up over $1475 an ounce in Asia [right now] and silver well over $24 an ounce at $24.12 again, the price movements in Asia do not matter if the bankers want to raid the price in paper markets in New York and London…I would not be surprised in the least if they go for a big raid in the range of a $40 to $50 drop in gold today.”

So what happened several hours later that day? Precisely at 8:30 AM as I predicted, gold started a waterfall decline that bottomed a tad above $1,440, $35 lower than its price in Asia of $1,475 when I sent out the notice of a coming banker gold and silver raid. The banker raid in gold came within $5 of our target of $1325 to $1335 for the day.

On Sunday, May 5th, I released this statement to my clients:

It is “my belief that the bankers are looking to take gold down below $1450 to at least $1430.” Gold had closed at $1469.90 that previous Friday. Thus, for my prediction to come true, gold needed to fall a very significant $40 an ounce from its price at the time of my alert.

On Tuesday, May 7, I updated this with the following release to my clients:

“With gold closing at $1471 yesterday, another $30 to $40 raid would serve the bankers well as they could release more propaganda about the "risky" nature of gold and silver in the media with another mini-raid. I am thinking…that this push may come tomorrow [Wednesday].”

Regarding our open GLD put options, I stated, “We would take at least some profits from our GLD May 24, 2013 puts with a strike of 142 off the table right now...as these puts are now trading at about $4.05 a contract. Then ensure that you have an exit strategy to protect profits on the rest of your puts.”Having opened these puts at $2.85 a contract, this yielded a quick 42% profit.

On Wednesday, May 8, I sent this notice out to my Platinum clients:

“They [the banking cartel] think they can push the paper price down closer to the $1400 level…Furthermore, even though gold is presently trading at $1455.70 as I write this, and that means another $55 drop, this is exactly what the banking cartel is aiming for.”

“They [the banking cartel] think they can push the paper price down closer to the $1400 level…Furthermore, even though gold is presently trading at $1455.70 as I write this, and that means another $55 drop, this is exactly what the banking cartel is aiming for.”

On May 10, after acquiring more data, I amended my price target for an upcoming banker raid in PMs and informed my clients several hours before COMEX open that bankers plan to"take the price of paper gold down to somewhere between the $1,400 to $1,430 level".

Thus, on two occasions last week, I predicted nearly the exact declines in gold price and predicted the exact days when the price declines would happen, and on a third day, came within $10 of the zone in which gold declined, all based on actions that I saw the Central Banks and their puppet bullion banks taking on previous days. Obviously in a free market, making such predictions with such accuracy would literally be impossible. This can only serve as extremely strong proof that gold and silver markets are NOT FREE by any definition of the word “free.”

Even so, through all this volatility, I never once advocated that my clients dump their physical gold and physical silver and try to buy back their stacks at lower prices. Why? Because during most of this time, the premiums to buy physical silver, especially 1 oz. silver coins, were at a minimum, 15% to 20% higher than the fake paper prices bankers were setting in their paper derivative markets. Because gold and silver inventories shrink rapidly with every subsequent banker raid on PM prices and demand continues to be elevated, as proven by JP Morgan’s collapse of COMEX gold warehouse deposits over the last several months, we can never be sure of when the day will arrive when one opts to sell out of their physical stack of PMs and then tragically, is unable to re-buy it. I believe this risk is not worth taking, and that people should only have used this banker raid to stack more at lower prices if possible.

Regarding the subject of mining stocks, yes, they have taken a brutal beating, and this sector of the gold/silver investment arena has yet to recover. In time, it will. Please do not focus on the short-term losses in this sector due to the brutality of the recent raid on PM stocks but rather focus on the increasingly bullish fundamentals of the physical PM markets. We firmly believe that the proper approach is a long-term horizon, for when this Central Banking charade crumbles, and it will, the gains in ALL gold/silver assets are likely to be just as fast and furious to the upside as these banking raids were brutal to the downside. Patience is usually the Achilles heel of gold and silver asset accumulators, especially given the incessant meddling of Central Banks into gold and silver markets that causes enormous volatility.

During the times gold and silver accumulators stay fully vested in mining stocks, these are admittedly the most difficult periods to emotionally handle. We acknowledge this. However, we strongly feel as though this enormous volatility causes undue emotional distress in many gold and silver accumulators that fail to focus on the fundamentals of the physical markets, which always drive long-term price behavior and instead obsess about the excessive banker rigging of paper gold and silver markets that always drives the short-term waterfall declines.

Understanding manipulation, however, is the key to remaining patient enough to reap the enormous rewards in PM markets that inevitably follow periods of excessive banker price manipulation such as the one we are currently experiencing. I firmly believe that when these banker raids in the paper price of gold and silver fail in the future (see “Why the Western Banking Cartel’s Gold and Silver Price Slam Will Backfire" here to learn why) that the confidence in global currencies such as the yen, the USD, the euro, and the pound sterling will plummet, and ultimately this rapid loss in confidence in fiat currencies is what will drive gold and silver rapidly to higher prices.

In conclusion, as someone that predicted huge declines in the gold spot price last week on three separate occasions, please understand that the same understanding of these banker gold and silver price manipulation games that led to the accuracy of my calls last week is also what leads me to conclude that the banking cartel price manipulation games in PM markets are unsustainable, on their way to imploding, and will eventually result in much higher prices in all gold/silver assets in the future. Yes, all gold and silver assets have suffered thus far this year in performance, but always remember that a focus on truth versus propaganda will always drive proper decisions when it comes to accumulating gold and silver assets and help one identify buying opportunities when they exist and further prevent one from being a "weak hand" that sells into banker manipulation ploys when Central Banks execute such fraud.

Bank of Portugal says no Cyprus-style gold sales

May 14 (Reuters) - Portugal will not replicate a deal that allowed Cyprus to sell its gold reserves under its bailout, Bank of Portugal Governor Carlos Costa said on Tuesday, adding that its reserves were unchanged at 382.5 tonnes.

"It is not applicable in Portugal," he told reporters. "What happened in Cyprus (on gold reserves), just like a lot of other things there, cannot be replicated in Portugal."

Last month Cyprus said a sale of gold reserves worth 400 million euros was among the options for its contribution towards an international bailout, which also forced bank depositors to bear part of the costs in a ground-breaking move in Europe."If we can say today that the Bank of Portugal is among a small group of central banks with adequate risk provisioning ... is mostly because we have significant gold reserves," Costa said. The value of Portugal's reserves rose 3.6 percent last year to 15.51 billion euros due to gold price fluctuations, but Costa said the actual quantity remained the same.

He added that Portugal, which resorted to an EU/IMF bailout in 2011 and has applied painful austerity measures since, remains on course to exit its three-year recession next year and grow just over 1 percent despite a worsening European downturn.

May 14 (Reuters) - Portugal will not replicate a deal that allowed Cyprus to sell its gold reserves under its bailout, Bank of Portugal Governor Carlos Costa said on Tuesday, adding that its reserves were unchanged at 382.5 tonnes.

"It is not applicable in Portugal," he told reporters. "What happened in Cyprus (on gold reserves), just like a lot of other things there, cannot be replicated in Portugal."

Last month Cyprus said a sale of gold reserves worth 400 million euros was among the options for its contribution towards an international bailout, which also forced bank depositors to bear part of the costs in a ground-breaking move in Europe."If we can say today that the Bank of Portugal is among a small group of central banks with adequate risk provisioning ... is mostly because we have significant gold reserves," Costa said. The value of Portugal's reserves rose 3.6 percent last year to 15.51 billion euros due to gold price fluctuations, but Costa said the actual quantity remained the same.

He added that Portugal, which resorted to an EU/IMF bailout in 2011 and has applied painful austerity measures since, remains on course to exit its three-year recession next year and grow just over 1 percent despite a worsening European downturn.

"There are no reasons to revise the economic forecasts," he told reporters. The bank's 2013 forecast of a 2.3 percent contraction is the same as the government's, but its 2014 growth projection is higher at 1.1 percent, compared with 0.6 percent.

is the root of all global economic problems and instability today.-END-

end

Fascinating!!: India's trading houses are only receiving 10% of the gold that they ordered:

(courtesy SR Srocco)

India’s Banks & Trading Houses Only Receiving 10% of Gold Orders

Filed in News by SRSrocco on May 13, 2013

The recent takedown in the price of gold has created huge demand for physical bullion worldwide. India’s wholesale buyers are only receiving a tenth of the gold imports that they have ordered.

According to The Economic Times India article:

end

Fascinating!!: India's trading houses are only receiving 10% of the gold that they ordered:

(courtesy SR Srocco)

India’s Banks & Trading Houses Only Receiving 10% of Gold Orders

Filed in News by SRSrocco on May 13, 2013

The recent takedown in the price of gold has created huge demand for physical bullion worldwide. India’s wholesale buyers are only receiving a tenth of the gold imports that they have ordered.

According to The Economic Times India article:

Haresh Soni, chairman of the All India Gem and Jewellery Trade Federation, said banks and trading houses importing gold are getting only 10 per cent of their orders as the demand has surged sharply after a sudden slide in gold prices last month. "If they place order for one tonne, for instance, then they are getting only around 100 kg," Soni said. "Consumers are buying in advance for family weddings scheduled in winter." Buyers have been swarming to jewellers since last month as gold prices fell 11.5 per cent in a week, from over Rs 29,000 per 10 gm on April 10 to Rs 25,680 on April 17. Since then, the prices have partially recovered to about Rs 27,500 this week.Furthermore, many Indian jewellers are expecting gold sales of 30-50% higher during the Akshaya Tritiay holiday (May 13th) compared to last year due to the lower price of gold.

"People are buying jewellery of all kinds and there is good demand for coins too," said Rajesh Mehta, chairman of Bangalore-based jeweller Rajesh Exports, which has 80 retail outlets across Karnataka under the brand name Shubh Jewellers. He expects a 30 per cent jump in demand for Akshaya Tritiya.With this sort of demand, the price of gold will not remain this low for long.http://srsroccoreport.com/indias-banks-trading-houses-only-receiving-10-of-gold-orders/indias-banks-trading-houses-only-receiving-10-of-gold-orders/

end

No comments:

Post a Comment