http://market-ticker.org/akcs-www?post=220071

If you were watching your trading screen today at about noon central you got a hell of a surprise when the market suddenly collapsed on huge volume, with the S&P futures dropping from 1573 to 1558 in seconds and then recovering over the next five minutes or so all of the loss.

If you were watching your trading screen today at about noon central you got a hell of a surprise when the market suddenly collapsed on huge volume, with the S&P futures dropping from 1573 to 1558 in seconds and then recovering over the next five minutes or so all of the loss.

Apparently AP's twitter account got hacked and a very real-looking tweet appeared from there claiming that the White House had been hit with two bombs and Obama was injured. It was BS and disavowed about four minutes later.

Many people, myself included, often leave "disaster stops" in place when we're daytrading and have to leave the terminal for some reason. Today, if you were one of those people, you were likely cursing loudly. I was fortunate in that while I was out for lunch at the moment of the event I didn't have anything on with a stop set in that fashion and thus I missed getting rammed by it.

The exchanges, from what I understand, have ruled that the trades that took place (such as they were) stand, since they were not "clearly erroneous."

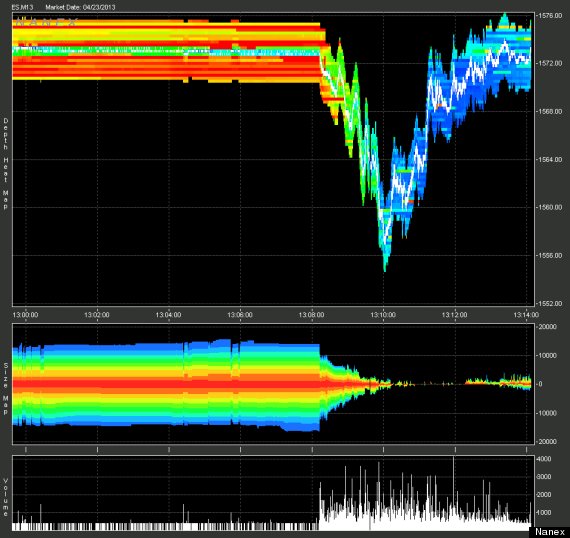

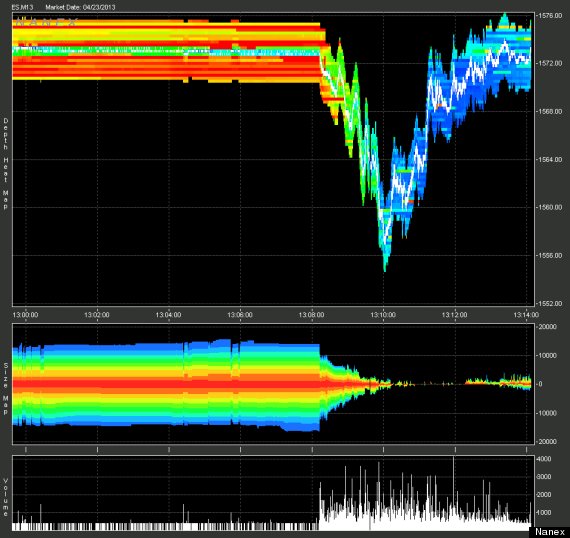

What's disturbing is the depth of the market during the event -- or rather, the utter lack thereof.

You can see the size map essentially disappear as the market's depth goes "cold."

One of the classical arguments raised by proponents of high-frequency trading and computer-based trading in general is that it "adds system liquidity." But if that was all it did there shouldn't be any impact on the market's price if that liquidity disappears. That is, if HFT and computer-based trading merely add liquidity then there should be no directional bias in their decisions nor in the outcomes when it goes away.

But there are -- repeatedly. We don't see liquidity evaporate during "flash skyrocket shots" in the general sense. Instead, we see it happen during sharp downward moves.

The original purpose of the specialist system on the NYSE was to interject a human being in the trading environment who had a duty to buy when there were no other orders to do so, and to sell when there were only buy orders. In exchange for the risk of getting caught glad-handed during severe events the specialist was given the privilege of making a spread the rest of the time.

Now we have computers that the operators claim provide the same function as the old specialists. But in fact they do not, because there is no duty associated with their actions. We allow them to effectively front-run through physical location and latency advantages (that is, they see quotes and price before anyone else and thus can react faster than anyone else) and as a result during normal circumstances they effectively get to skim just as the specialists did. But they have no duty to remain online and providing that liquidity during severe market events as the specialist did and does.

So why does this privilege exist? Simply put, it exists because there are people with more power, money and political influence than you have. They have managed to buy the advantage of the old specialist system for themselves while not being saddled with the duties and costs.

It's all very nice for them.

But it's not very nice for you.

I have often written on the inherent unfairness of this arrangement, and today was yet another lesson, albeit one that only caught people who were "silly" enough to have what they thought were "disaster stops" from a fake, manufactured disaster.

Speaking of which, that does speak to the potential for a motive behind such a hack, doesn't it?

Hmmmm... I wonder if we'll ever find out exactly who did it, and more importantly -- why.

Maybe Felonious, But Not Erroneous

Apparently AP's twitter account got hacked and a very real-looking tweet appeared from there claiming that the White House had been hit with two bombs and Obama was injured. It was BS and disavowed about four minutes later.

Many people, myself included, often leave "disaster stops" in place when we're daytrading and have to leave the terminal for some reason. Today, if you were one of those people, you were likely cursing loudly. I was fortunate in that while I was out for lunch at the moment of the event I didn't have anything on with a stop set in that fashion and thus I missed getting rammed by it.

The exchanges, from what I understand, have ruled that the trades that took place (such as they were) stand, since they were not "clearly erroneous."

What's disturbing is the depth of the market during the event -- or rather, the utter lack thereof.

You can see the size map essentially disappear as the market's depth goes "cold."

One of the classical arguments raised by proponents of high-frequency trading and computer-based trading in general is that it "adds system liquidity." But if that was all it did there shouldn't be any impact on the market's price if that liquidity disappears. That is, if HFT and computer-based trading merely add liquidity then there should be no directional bias in their decisions nor in the outcomes when it goes away.

But there are -- repeatedly. We don't see liquidity evaporate during "flash skyrocket shots" in the general sense. Instead, we see it happen during sharp downward moves.

The original purpose of the specialist system on the NYSE was to interject a human being in the trading environment who had a duty to buy when there were no other orders to do so, and to sell when there were only buy orders. In exchange for the risk of getting caught glad-handed during severe events the specialist was given the privilege of making a spread the rest of the time.

Now we have computers that the operators claim provide the same function as the old specialists. But in fact they do not, because there is no duty associated with their actions. We allow them to effectively front-run through physical location and latency advantages (that is, they see quotes and price before anyone else and thus can react faster than anyone else) and as a result during normal circumstances they effectively get to skim just as the specialists did. But they have no duty to remain online and providing that liquidity during severe market events as the specialist did and does.

So why does this privilege exist? Simply put, it exists because there are people with more power, money and political influence than you have. They have managed to buy the advantage of the old specialist system for themselves while not being saddled with the duties and costs.

It's all very nice for them.

But it's not very nice for you.

I have often written on the inherent unfairness of this arrangement, and today was yet another lesson, albeit one that only caught people who were "silly" enough to have what they thought were "disaster stops" from a fake, manufactured disaster.

Speaking of which, that does speak to the potential for a motive behind such a hack, doesn't it?

Hmmmm... I wonder if we'll ever find out exactly who did it, and more importantly -- why.

http://www.zerohedge.com/news/2013-04-23/ap-reports-two-explosions-white-house-obama-injured

Hacked AP Twitter Account Reports Of Two Explosions At White House, Obama Injured

Submitted by Tyler Durden on 04/23/2013 13:12 -0400

Update 2 - Obama is fine. In other news, it may be time for @federalreserve to change their twitter passwored from QE4EVA to something more secret.

Update: yup, AP was hacked. Let's hear it for Twitter moving markets.

Please Ignore AP Tweet on explosions, we've been hacked.

Did someone just hack the AP twitter account? If not, this is not good:

Breaking: Two Explosions in the White House and Barack Obama is injured— The Associated Press (@AP) April 23, 2013

A photo of the tweet before it was deleted

No comments:

Post a Comment