http://www.investorvillage.com/smbd.asp?mb=4165&mn=34816&pt=msg&mid=12554843

http://www.gata.org/node/12254

and.......

http://goldsilverworlds.com/gold-silver-experts/ted-butler-bullish-on-gold-but-jp-morgan-excessively-short-in-silver/

and......

http://www.silverdoctors.com/srsrocco-fundamentals-will-win-in-the-end-but-algos-are-still-fully-in-control-of-pm-markets/#more-21598

Critical levels for gold and silver ..... 1550 looks like a key level for gold , 27.50 for silver...

http://jessescrossroadscafe.blogspot.com/2013/02/intermediate-gold-chart-1550-to-1570.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+JessesCafeAmericain+%28Jesse%27s+Caf%C3%A9+Am%C3%A9ricain%29

This looks like a long consolidation, with a range trade of 1550 to 1800.

If we do get down as low as 1570 one might be inclined to step in and buy, adding to longer term holdings and for a trade, with an eye to that 1550 as a low and an upside target north of 1700.

I am sure most traders on the Street are seeing/thinking the same thing. So it might take some agility, and scaling in. And of course if too many specs pile on there, the bullion banks will deliver a short term smacking on general principle. That's what they do. It is tough playing against the house, especially when they get to deal your cards face up.

But I will also be keeping an eye on the stock markets, to see if they correlate with the metals, or if not, and how the VIX fares.

http://www.bloomberg.com/news/2013-02-14/billionaires-soros-bacon-reduce-gold-holdings-as-prices-slump.html

http://seekingalpha.com/article/1189131-why-gold-investors-should-carefully-watch-the-passion-play-of-john-paulson?source=yahoo

http://www.caseyresearch.com/gsd/edition/january-gold-imports-india-surge-23-percent-hit-18-month-high

|

| About Us • Contact Us • Follow Us on Twitter • Members Directory • Help • Advertise Not a member yet? What are you waiting for? Join Now Want to contribute? Support InvestorVillage by donating © 2003-2012 Investorvillage.com. All rights reserved. User Agreement |    | ||

http://www.gata.org/node/12254

Treasury's report on gold at Fed is like queen's visit to Bank of England's vault, Turk says

Submitted by cpowell on Wed, 2013-02-20 00:38. Section: Daily Dispatches

7:30p ET Tuesday, February 19, 2013

Dear Friend of GATA and Gold:

Continuing his interview with King World News today, GoldMoney founder and GATA consultant James Turk says the U.S. Treasury's report this week on gold held by the Federal Reserve is the equivalent of Queen Elizabeth's recent visit to the Bank of England's gold vault. "It's trying to make people (and countries) feel comfortable that the gold is really there," Turk says. "But why should they keep gold in other vaults? We're not on a gold standard anymore. We don't need to have gold stored in different vaults around the world to settle international payments. The gold is really just a country's reserve, and the only way you can make certain that you have control of that reserve is to store it in your own central bank's vault."

An excerpt from the interview is posted at the King World News blog here:

http://www.gata.org/node/12253

Treasury 'audit' on gold at Fed is 'rubbish,' Turk tells King World News

Submitted by cpowell on Tue, 2013-02-19 20:21. Section: Daily Dispatches

3:12p ET Tuesday, February 19, 2013

Dear Friend of GATA and Gold:

The U.S. Treasury Department's new report about its "audit" of U.S. gold held by the Federal Reserve is "total rubbish," GoldMoney founder and GATA consultant James Turk tells King World News today.

"They didn't audit the gold," Turk says. "All they looked at was the 'Treasury's schedule,' and that's an exact quote -- 'Treasury's schedule' -- of how much gold it's keeping in the various Federal Reserve banks. So again it's basically just looking at paper or record keeping and saying, 'Yes, this record keeping says that all of that gold is there.'

"But there is no indication whatsoever in the Treasury announcement that they actually verified that the bars existed or went into the vault. So I don't know where the news reports came from about drilling bars and all of that kind of stuff because there was nothing whatsoever about that in the actual announcement from the Treasury itself. Again, it just looks like more disinformation or propaganda to make people (and countries) feel that the gold is really there, and that the Treasury did an audit, but they really didn't."

An excerpt from Turk's interview is posted at the King World News blog here:

The Treasury Department report itself is posted at the department's Internet site here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

200 MILLION OUNCES OF PAPER SILVER TRADED IN 1 MINUTE FRIDAY DURING CARTEL SILVER RAID!

and.......

http://goldsilverworlds.com/gold-silver-experts/ted-butler-bullish-on-gold-but-jp-morgan-excessively-short-in-silver/

Ted Butler: Bullish on Gold But JP Morgan Excessively Short in Silver

The recent gold and silver price takedown and the related negativity in the mainstream press were a reason for thorough investigation. The article “Noise vs Facts” on Gold Silver Worlds was intended to focus on the real facts. Investors should not be mislead by interpretations. More in-depth analysis is required to truly understand what is going on primarily in the futures market. With his extensive background and knowledge we trust on Ted Butler’s COT analysis (which is at the core of the short term price setting). He wrote the following paragraphs to his paid subscribers on Saturday February 16th. His insights reveal a different picture than the one on the surface – for sure the one that was created by the mainstream media – so we are more than happy to share it with our readers.

http://www.zerohedge.com/news/2013-02-18/shanghai-gold-exchange-volume-soars-record-india-gold-imports-surge-18-month-highThe good news is that the deliberate price smash appears to have fulfilled its objective, namely, to allow the commercials to buy great quantities of COMEX gold and silver contracts. When the commercials buy all they can shake from the tree, a price bottom is formed. The bad news is the blatant nature of the deliberate price smash, which confirms that a market manipulation exists for which a specific federal agency was expressly created to prevent.Whereas gold’s COT structure in undeniably bullish on historical measurements, silver is a long way from what would be considered flat-out bullish (as is the case in gold). There is a single factor underlying this difference – JPMorgan.Back in the summer of 2012 and in December 2011, there was a strong feeling among many that JPMorgan might be able to completely eliminate its short position (then between 12 to 14,000 contracts) on lower prices. Instead, we rallied and on both occasions JPMorgan added aggressively to its concentrated short position. Today, JPMorgan’s short silver position is at least double the former low levels (if they reduced it as much as I think in the past three days). That’s a radically different setup, so much so that I would label it as the key factor in silver and gold at this point. Certainly, I hope everyone realizes that what I am saying is that the silver manipulation is more intense at this point, because of JPMorgan, than it ever was. That more observers than ever seem to see this (except for the see, hear and speak no evil monkeys at the CFTC, CME and JPM) is important beyond belief.

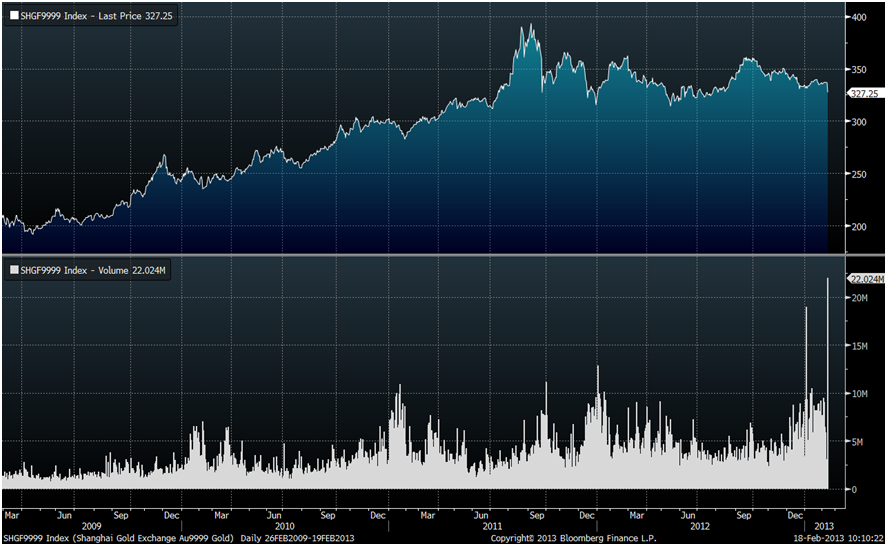

Shanghai Gold Exchange Volume Soars To Record As India Gold Imports Surge To 18 Month High

Submitted by Tyler Durden on 02/18/2013 08:47 -0500

India’s gold imports in January surged 23 per cent from a year ago to their highest in 18 months as traders snapped up supplies ahead of a hike in duty, undermining the government’s efforts to control a ballooning current account deficit.

India’s gold imports in January surged 23 per cent from a year ago to their highest in 18 months as traders snapped up supplies ahead of a hike in duty, undermining the government’s efforts to control a ballooning current account deficit.

While the recent move in gold lower, attributed primarily to the fickle rotations of assorted hedge funds who have gotten crushed on their AAPL holdings and thus forced to liquidate profitable positions mostly in ETFs and other paper gold representations (as demand for physical precious metals has never been greater), has seen many pundits scream (as they do every year) that the move higher in gold and precious metals is over, what everyone as usual forgets is that the big move up in gold in 2011 was not driven by Soros or Paulson or Einhorn buying (or selling) laughable amounts of the yellow metal but by relentless end consumer demand out of China and India, when inflation was surging. And with the entire world now openly reflating the one country that has the lowest buffer to hot external money - China - is about to see prices for all products go parabolic once more. It's just a matter of time. Of course, last week's Lunar New Year and closed exchanges bought some time for the bearish gold thesis, but that is now over, quite literally with a bang as demand out of both China and India explodes out of the gates, proving that the sensible money is merely waiting for every dip in the PM complex to buy.

As GoldCore reports, gold volumes for the benchmark cash contract on the Shanghai Gold Exchange soared to a record today (see chart below), as the market re-opened after the New Year’s week long holiday and bargain hunters started buying.

The volume for bullion of 99.99% purity exceeded 22,000 kilograms (22 metric tons), according to data compiled by Bloomberg. Prices fell 2.8% to 327.25 yuan/gram ($1,630.29/oz) as of 5:04 p.m. Singapore time.

“Chinese investors returned to the market today after the holiday, and the slump in gold prices in the past week provided great incentive for buying as many Chinese are still holding a bullish outlook on gold,” Qu Mingyu, a trader at Bank of China Ltd., the 4th largest lender

by assets, commented today.

As for India, this article from the Gulf Todayshould put to rest any worries that Indians have, after centuries of treating gold as true money, suddenly stopped doing so after a brief 10% pullback.

India’s gold imports surge 23% in January

India’s gold imports in January surged 23 per cent from a year ago to their highest in 18 months as traders snapped up supplies ahead of a hike in duty, undermining the government’s efforts to control a ballooning current account deficit.

India’s gold imports in January surged 23 per cent from a year ago to their highest in 18 months as traders snapped up supplies ahead of a hike in duty, undermining the government’s efforts to control a ballooning current account deficit.

The world’s top bullion buyer imported 100 tonnes of gold last month, the head of the Bombay Bullion Association said on Friday. This is about 40 per cent more than the country’s average monthly imports last year.

“The total imports figure for 2012 was around 860 tonnes, so 100 tonnes in a month is too high. Also oil is trading firm above $95 (per barrel), so this will impact the oil import bill and overall deficit targets,” said Navneet Damani, associate vice president with Motilal Oswal Commodities.

Alarmed by the mounting current account deficit that hit a record 5.4 per cent of gross domestic product in July-September the government moved to rein in its gold imports - second only to oil in value - by raising the import duty on the precious metal to 6 per cent from 4 per cent on Jan.21.

“So many people imported and dumped gold after rumours from the first week of January of an import duty hike. People waited for the duty to increase and earn more profits,” said Mohit Kamboj, president of the Bombay Bullion Association.

The government will announce its budget for the year beginning April 1, 2013 on Feb.28 and if gold imports continue apace, traders are concerned New Delhi may take further action to curb demand.

The Reserve Bank of India has indicated it could limit gold imports by banks, which corner about 60 per cent of the supply, if the deficit remains at 5.5-6 per cent of GDP for the next three to four quarters

Given India’s passion for the precious metal, traders and industry experts expect any impact from the Jan.21 duty hike to be short term. They see imports tapering off in February and March and the bearish mood lifting after that.

Gold is considered a sign of wealth and good fortune, and is traditionally given at weddings and festivals in India.

Demand could be as much as 965 tonnes in 2013, the World Gold Council said on Thursday, without giving an estimate for imports. In 2012, imports accounted for virtually all the demand of 864 tonnes at 860 tonnes - down 11.25 per cent from a year ago, partly as a result of a previous tax hike.

Spot gold prices have gained for the last 12 years and its attraction, while Indian inflation continues to eat into returns from other investments, remains high.

If prices do not rise any more in the next two to three months, buying will re-emerge, said Daman Prakash Rathod, director with Chennai-based MNC Bullion. India’s fiscal deficit is expected to reach 5.3 per cent of gross domestic product by the end of March.

and......

and from South Africa , more mine viloence......

http://www.zerohedge.com/news/2013-02-18/platinum-spikes-following-report-people-shot-outside-amplats-south-african-minePlatinum Spikes Following Report Of People Shot Outside Amplats South African Mine

Submitted by Tyler Durden on 02/18/2013 09:02 -0500

The tender (and doomed to fail) truce obtained several months ago between miners and platinum mining companies is formally over, following reports from Johanesburg thatat least five workers have been shotoutside of the the Rusetenberg mine by security officials during a standoff between rival unions.

- FIVE WORKERS AT AMPLATS MINE SHOT OUTSIDE RUSTENBURG: ENCA

- 5 SOUTH AFRICAN WORKERS SHOT BY MINES SECURITY, ENCA REPORTS

- S. AFRICA POLICE HAVE RECIEVED REPORTS MINERS WERE SHOT :AMS SJ

- S. AFRICA POLICE: DEATHS, INJURIES AT AMPLATS MINE UNCO

- Reuters adds: "Johannesburg - At least five workers were shot on Monday after security guards at an Anglo American Platinum mine in Rustenburg opened fire following clashes between rival union factions, eNCA television said. The station said it believed one worker at the Siphumelele shaft had been killed."Platinum spikes immediately on the news:As for shares of Amplats, imagine the inverse.

- AMPLATS FALLS AS MUCH AS 4.6% AFTER REPORTS OF MINE SHOOTING

http://www.silverdoctors.com/srsrocco-fundamentals-will-win-in-the-end-but-algos-are-still-fully-in-control-of-pm-markets/#more-21598

SRSROCCO: FUNDAMENTALS WILL WIN IN THE END, BUT ALGOS ARE STILL FULLY IN CONTROL OF PM MARKETS

Critical levels for gold and silver ..... 1550 looks like a key level for gold , 27.50 for silver...

http://jessescrossroadscafe.blogspot.com/2013/02/intermediate-gold-chart-1550-to-1570.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+JessesCafeAmericain+%28Jesse%27s+Caf%C3%A9+Am%C3%A9ricain%29

Intermediate Gold Chart - 1550 to 1570 For a Range Trade, If It Gets There

This looks like a long consolidation, with a range trade of 1550 to 1800.

If we do get down as low as 1570 one might be inclined to step in and buy, adding to longer term holdings and for a trade, with an eye to that 1550 as a low and an upside target north of 1700.

I am sure most traders on the Street are seeing/thinking the same thing. So it might take some agility, and scaling in. And of course if too many specs pile on there, the bullion banks will deliver a short term smacking on general principle. That's what they do. It is tough playing against the house, especially when they get to deal your cards face up.

But I will also be keeping an eye on the stock markets, to see if they correlate with the metals, or if not, and how the VIX fares.

http://www.bloomberg.com/news/2013-02-14/billionaires-soros-bacon-reduce-gold-holdings-as-prices-slump.html

Billionaires Soros, Bacon Cut Gold Holdings on Decline

By Debarati Roy & Phoebe Sedgman - Feb 15, 2013 10:51 AM ET

Play

Are Soros, Bacon Moves a Signal to Get Out of Gold?

Billionaire investors George Soros and Louis Moore Bacon cut their stakes in exchange-traded products backed by gold last quarter as futures dropped the most in more than eight years. John Paulson maintained his holding.

Soros Fund Management LLC reduced its investment in the SPDR Gold Trust, the biggest fund backed by the metal, by 55 percent to 600,000 shares as of Dec. 31 from three months earlier, a U.S. Securities and Exchange Commission filing showed yesterday. Bacon’s Moore Capital Management LP sold its entire stake in the SPDR fund and lowered holdings in the Sprott Physical Gold Trust. Paulson & Co., the largest investor in SPDR, kept its stake at 21.8 million shares.

The fourth-quarter decisions by Soros and Bacon may bolster speculation that gold’s 12-year bull-run is coming to an end as economic data from the U.S. to China show signs of recovery, curbing haven demand. Global ETP holdings have lost 0.9 percent since reaching a record on Dec. 20. UBS AG reduced its one-month price target yesterday by 6.8 percent, saying economic optimism “takes the shine off defensive assets,” including bullion. Gold futures fell to a five-month low today.

“The reduction in holdings by George Soros may unnerve the market a little bit,” said Nick Trevethan, a senior commodities strategist at Australia & New Zealand Banking Group Ltd. “The market may also be watching Paulson, and those are steady.”

Gold fell below $1,600 an ounce today for the first time since August. Futures for April delivery slumped 1.8 percent to $1,605.40 at 10:49 a.m. on the Comex in New York, after touching $1,596.70, the lowest since Aug. 15. The most-active contract, which has lost 4.3 percent this year, declined 5.5 percent in the final three months of 2012, the biggest quarterly decline since June 2004.

‘Downside Risks’

Hedge funds have cut bets on a gold rally by 56 percent since reaching a 13-month high in October as manufacturing rebounded from the U.S. to China. It’s increasingly probable that prices peaked in 2011 and so-called downside risks are building as the world expands, Tom Kendall, an analyst at Credit Suisse Group AG in London, said in a report e-mailed Feb. 1. Futures rallied to $1,923.70 on Sept. 6, 2011.

Growth will accelerate in the U.S. and China, the two largest economies, in the coming quarters, according to more than 100 economists surveyed by Bloomberg. In the U.S., claims for jobless benefits dropped 27,000 to 341,000 in the week to Feb. 9, fewer than any of the 49 economists surveyed by Bloomberg projected, the Labor Department said yesterday.

Lone Pine Capital LLC, the hedge fund run by Stephen Mandel Jr., and Scout Capital Management LLC sold their entire stakes in the SPDR Gold Trust in the quarter, filings showed.

‘Looking Better’

Global gold investment, including bars, coins and ETPs, dropped 8.3 percent to 424.7 tons in the fourth quarter from a year earlier, the World Gold Council said in a report yesterday. Full-year investment slid 9.8 percent to 1,534.6 tons, it said.

The Standard & Poor’s 500 Index climbed to a five-year high yesterday and has surged 6.7 percent in 2013. The gauge has more than doubled since bottoming in March 2009 as the U.S. Federal Reserve conducted three rounds of bond buying to lower interest rates, boost growth and support the labor market.

The U.S. central bank will keep purchasing securities at the rate of $85 billion a month, according a statement from the policy-setting Federal Open Market Committee on Jan. 30. Gold may have a sharp rally as investors seek so-called real assets, Elliott Management Corp., the hedge fund founded by Paul Singer, said in a document accompanying its fourth-quarter report on Jan. 28, a copy of which was obtained by Bloomberg.

‘Come Back’

While people would rather invest in “economically sensitive commodities and equities” as data improved, “we may see people come back to gold if troubles in Europe get worse and problems in the U.S. reappear,” said Adrian Day, who manages about $160 million of assets as president of Adrian Day Asset Management in Annapolis, Maryland.

Germany’s economy, the largest in Europe, contracted 0.6 percent in the fourth quarter, and French GDP dropped 0.3 percent, according to data this week. Japan’s economy, the world’s third largest, is in recession after contracting an annualized 0.4 percent in the final quarter of 2012, following a revised 3.8 percent fall in the previous three months.

Michael Vachon, a spokesman for Soros, was not immediately available when called for comment and did not reply to an e- mail. Armel Leslie, a spokesman for New York-based Paulson & Co., which manages $18 billion, declined to comment. Kenny Juarez, a spokesman for Moore Capital, also declined to comment.

Money managers who oversee more than $100 million in equities must file a Form 13F with the SEC within 45 days of each quarter’s end to show their U.S.-listed stocks, options and convertible bonds. The filings don’t show non-U.S. securities or how much cash the firms hold.

“The economy is looking better, and people are moving to more remunerative assets like equities,” Paul Dietrich, chief executive officer of Foxhall Capital Management Inc., said in a telephone interview from Alexandria, Virginia. “A lot of people have lightened up on gold.”

http://seekingalpha.com/article/1189131-why-gold-investors-should-carefully-watch-the-passion-play-of-john-paulson?source=yahoo

Last we checked, as of September 30, 2012, the SPDR Gold Trust ETF(GLD) was John Paulson's largest holding. About 30% of his portfolio was in GLD. In turn, Paulson was the second largest holder of GLD -- about 10% of total GLD shares was held by John Paulson. The new numbers are out, and not much has changed in 3 months. Paulson has still not slimmed his GLD holdings. In turn, he is sitting on about $250 million in paper losses, as gold has dropped about 5% in the last quarter.

How much more pain can John Paulson take?

The market has already put a big target on Paulson's position. Morgan Stanley has recommended that investors run away from Paulson.Citigroup's private bank has pulled significant money ($410M) from Paulson's hedge fund as well. Other hedge funds are shorting gold to force Paulson's hand. Now, it seems that other big shots who bet big and bet wrong on gold are folding. Soros, Robertson, and Pimco are all starting to liquidate their long positions in gold as the inexorable downtrend in gold continues.

Reports MoneyNews:

Notable institutional investors, including George Soros, Julian Robertson and Allianz's Pimco reduced their bets on gold during the quarter, when bullion posted its biggest quarterly loss in more than four years.

Paulson is a smart guy. It is unlikely that he will wait to be the last guy at the party. At some point, therefore, we will likely see Paulson starting to sell GLD in bulk. It may not even be his choice if he is faced with massive redemption. This is something no one can predict, but this has in the past happened to some of the hedge fund greats -- remember Long Term Capital Management? Unfortunately, if this happens, we may get a crash in gold -- a catastrophic drop if Paulson's hand is forced. With Soros et al selling, gold dropped about 5%. Paulson's position is far bigger than theirs. A 10-20% drop is, therefore, more likely if Paulson were to liquidate his position.

* * *

http://www.caseyresearch.com/gsd/edition/january-gold-imports-india-surge-23-percent-hit-18-month-high

January Gold Imports Into India Surge 23 Percent, Hit 18-Month High

Feb

16

"Well, was that the bottom? Beats me, but if I had to bet a dollar, I'd say we're pretty close...at least in gold."

¤ YESTERDAY IN GOLD AND SILVER

The gold price traded pretty flat through Far East trading on their Friday...but then dipped slightly at the London open going into the a.m. gold fix. From there it traded flat until 1:00 p.m. GMT...8:00 a.m. in New York...and about twenty minutes before the Comex open.

By the time that JPMorgan et al were done for the day, the low tick checked in at $1,596.00 spot around 10:35 a.m. Eastern time. From there, the price rallied back to the $1,610 spot mark, but wasn't allowed to trade above that price for the rest of the Friday session.

On an engineered price decline of this magnitude, the trading volume was immense...around 284,000 contracts, give or take...and gold closed at $1,610.10 spot...down $24.30 on the day.

By the time that JPMorgan et al were done for the day, the low tick checked in at $1,596.00 spot around 10:35 a.m. Eastern time. From there, the price rallied back to the $1,610 spot mark, but wasn't allowed to trade above that price for the rest of the Friday session.

On an engineered price decline of this magnitude, the trading volume was immense...around 284,000 contracts, give or take...and gold closed at $1,610.10 spot...down $24.30 on the day.

Of course silver was the metal that "da boyz" were really after...and it was under light selling pressure right from the moment that Far East trading began on their Friday morning. However, by 1:00 p.m. GMT in London, silver was only down about a dime from Thursday's close.

But once the engineered price decline began, it was sold down hard throughout the entire Comex trading session...and the low tick of the day [$29.59 spot] was set at precisely 2:45 p.m. Eastern time in electronic trading.

But once the engineered price decline began, it was sold down hard throughout the entire Comex trading session...and the low tick of the day [$29.59 spot] was set at precisely 2:45 p.m. Eastern time in electronic trading.

The subsequent rally wasn't allowed to get far...although the price did recover about 20 cents from its low.

Silver closed the Friday trading day at $29.80 spot...down 60 cents from Thursday's close. Gross volume was around 96,000 contracts, but once the spreads and roll-overs for March were subtracted, the net volume was only 44,000 contracts.

The dollar index opened at 80.39 on Friday morning in Japan...and hit its nadir [80.22] just minutes before the London open. The high tick [80.57] was in around 7:30 a.m. in New York...and from there the index faded a hair in the close. The dollar index finished the day at 80.48...up about 10 basis points.

Silver closed the Friday trading day at $29.80 spot...down 60 cents from Thursday's close. Gross volume was around 96,000 contracts, but once the spreads and roll-overs for March were subtracted, the net volume was only 44,000 contracts.

The dollar index opened at 80.39 on Friday morning in Japan...and hit its nadir [80.22] just minutes before the London open. The high tick [80.57] was in around 7:30 a.m. in New York...and from there the index faded a hair in the close. The dollar index finished the day at 80.48...up about 10 basis points.

* * *

The CME's Daily Delivery Report showed that 78 gold and 65 silver contracts were posted for delivery on Tuesday within the Comex-approved depositories. It was "all the usual suspects" in gold...and in silver it was Jefferies as the big short/issuer of note once again with 60 contracts issued...and Canada's Bank of Nova Scotia stopping 63 contracts. The link to yesterday's Issuers and Stoppers Report is here.

There were no reported changed in either GLD or SLV yesterday.

The U.S. Mint had a small sales report yesterday. They sold 5,000 ounces of gold eagles...1,000 one-ounce 24K gold buffaloes...and 35,000 silver eagles. Month-to-date the mint has sold 43,000 ounces of gold eagles...3,000 one-ounce 24K gold buffaloes...and 1,643,500 silver eagles. Based on these sales, the silver/gold sales ratio for February to date stands at just under 36 to 1.

Over at the Comex-approved depositories on Thursday, they didn't report receiving any silver, but did ship 350,997 troy ounces of the stuff out the door...and the link to that activity is here.

I'm happy to report that were big improvements in the Commercial net short positions in both silver and gold in yesterday's Commitment of Traders Report from the CFTC.

In silver, the Commercial net short position declined by 5,149 contracts...or 25.7 million ounces. The total Commercial net short position is now down to 234.0 million ounces of silver.

The Big 4 traders are short 256.7 million ounces of silver, or 109.7% of the entire Commercial net short position...and Ted Butler says that JPMorgan Chase is short 167.5 million ounces of that amount all by itself.

The '5 through 8' traders are short an additional 54.2 million ounces of silver, bringing the Big 8's total up to 310.9 million ounces...of which JPMorgan Chase holds over 50% of the Big 8's short position on its own.

There were no reported changed in either GLD or SLV yesterday.

The U.S. Mint had a small sales report yesterday. They sold 5,000 ounces of gold eagles...1,000 one-ounce 24K gold buffaloes...and 35,000 silver eagles. Month-to-date the mint has sold 43,000 ounces of gold eagles...3,000 one-ounce 24K gold buffaloes...and 1,643,500 silver eagles. Based on these sales, the silver/gold sales ratio for February to date stands at just under 36 to 1.

Over at the Comex-approved depositories on Thursday, they didn't report receiving any silver, but did ship 350,997 troy ounces of the stuff out the door...and the link to that activity is here.

I'm happy to report that were big improvements in the Commercial net short positions in both silver and gold in yesterday's Commitment of Traders Report from the CFTC.

In silver, the Commercial net short position declined by 5,149 contracts...or 25.7 million ounces. The total Commercial net short position is now down to 234.0 million ounces of silver.

The Big 4 traders are short 256.7 million ounces of silver, or 109.7% of the entire Commercial net short position...and Ted Butler says that JPMorgan Chase is short 167.5 million ounces of that amount all by itself.

The '5 through 8' traders are short an additional 54.2 million ounces of silver, bringing the Big 8's total up to 310.9 million ounces...of which JPMorgan Chase holds over 50% of the Big 8's short position on its own.

As far as concentration goes...the Big 4 are short 50.5% of the entire Comex futures market in silver...of which 33 percentage points of that amount is held by JPMorgan on its own. Just think about that for a second....one trader is short one third of the entire silver market! And it's my opinion the Canada's own Bank of Nova Scotia is short about 11 percentage points of the Comex silver market as well...so these two banks are short about 44% of the entire silver market between them on a net basis...and these are minimumpercentages.

The '5 through 8' traders are short another 10.7 percentage points of the Comex futures market in silver. So the Big 8 are short over 61% of the silver market on a net basis.

In gold, the Commercial net short position declined by 13,954 contracts, or 1.40 million ounces. The Commercial net short position in gold is now down to 16.07 million ounces.

The Big 4 are short 9.92 million ounces...and the '5 through 8' largest traders are short an additional 5.66 million ounces. The Big 8 are short 15.58 million ounces of gold, or 97.0% of the entire Commercial net short position.

As far as concentration goes, the Big 4 are short 27.1% of the entire Comex futures market in gold on a 'net' basis. The '5 through 8' largest traders are short an additional 15.4 percentage points...so, in total, the Big 8 are short 42.5% of the entire Comex futures market in gold on a net basis and, once again, those are minimum percentages.

Here's Nick's now world famous "Days of World Production to Cover Short Positions" chart. JPMorgan is short about 87 days of world silver production...and it's my opinion that Canada's Bank of Nova Scotia is short about 27 days of world silver production. That's two banks short 114 days of world silver production between them...just about four months. Also note how the four short traders in silver totally dominate the short side. The '5 through 8' trader's position...even in total...just don't matter.

The '5 through 8' traders are short another 10.7 percentage points of the Comex futures market in silver. So the Big 8 are short over 61% of the silver market on a net basis.

In gold, the Commercial net short position declined by 13,954 contracts, or 1.40 million ounces. The Commercial net short position in gold is now down to 16.07 million ounces.

The Big 4 are short 9.92 million ounces...and the '5 through 8' largest traders are short an additional 5.66 million ounces. The Big 8 are short 15.58 million ounces of gold, or 97.0% of the entire Commercial net short position.

As far as concentration goes, the Big 4 are short 27.1% of the entire Comex futures market in gold on a 'net' basis. The '5 through 8' largest traders are short an additional 15.4 percentage points...so, in total, the Big 8 are short 42.5% of the entire Comex futures market in gold on a net basis and, once again, those are minimum percentages.

Here's Nick's now world famous "Days of World Production to Cover Short Positions" chart. JPMorgan is short about 87 days of world silver production...and it's my opinion that Canada's Bank of Nova Scotia is short about 27 days of world silver production. That's two banks short 114 days of world silver production between them...just about four months. Also note how the four short traders in silver totally dominate the short side. The '5 through 8' trader's position...even in total...just don't matter.

If you'd like to view the interactive, long-term COT charts going back about sixteen years, you can do so by clicking here for silver...and here for gold.

It nearly goes without saying that since the Tuesday cut-off for yesterday's COT Report, there has been an even bigger improvement in the Commercial net short positions in both silver and gold than we had in this last report. I'm guessing between 7-10,000 more contracts in silver...and 20-30,000 additional contracts in gold...especially after the engineered price declines we saw yesterday. Yesterday was a capitulation to the down side in spades...all courtesy of JPMorgan and friends.

Further to the story about producing I.D. for buying or selling gold bullion or jewellery in the U.S.A...I got the following e-mail from reader Harry Morgan yesterday...

Hello Ed,

I just thought I'd let you know that yesterday I went to Ambassador Jewelers here in Tucson to sell (sadly) a measly 10 ounces of silver. To do so I had to submit to having my right index finger inked and fingerprinted. When I told them (politely) that I would prefer not to have to have my finger inked up and pressed onto a piece of paper I was informed that they would be unable to purchase the silver. I asked them when this process of finger printing became a standard step they told me January 1st of this year.

Furthermore, a few months ago when I went to my bank (Wells Fargo) to cash a check from Ambassador (any time you cash in more then $600 of precious metals here in Tucson you are issued a check instead of cash) the teller at the bank asked me what the check was for. I asked the bank clerk to elaborate on what she meant by 'what the check was for'. The teller (a nice young lady) told me it was now 'required policy to ask everyone who was cashing or depositing a check from a jewelry store, coin store or a coin & stamp store'. I told this clerk that in all fairness it was none of the bank's business why the jewelry store issued me a check. At this the clerk went and got the bank manager. I told the bank manager that it was none of the bank's business why the jewelry store issued me a check. The bank manager told me that he was required to record this information otherwise he could not process the check. I asked him if he couldn't process the check or the bank couldn't process the check (I was starting to get irritated).

So I said I worked at the store and this was a paycheck, then said that I had robbed a home, stolen some jewelry and sold that to Ambassador, then I said I had bought them all lunch and this check was to cover my expenses. Admittedly I was being an ass but I was very agitated about this intrusion into my personal business. So we had this little stand off until I said (firmly and evenly) that I sold a couple of my watches. At this they processed my check.

Anyway, the reason for my email was to let you/others know that, at least in Tucson, when you sell any precious metals (even 10 measly ounces of silver), you will be fingerprinted.

And so it goes ... (down the toilet).

All the best,

Harry

It nearly goes without saying that since the Tuesday cut-off for yesterday's COT Report, there has been an even bigger improvement in the Commercial net short positions in both silver and gold than we had in this last report. I'm guessing between 7-10,000 more contracts in silver...and 20-30,000 additional contracts in gold...especially after the engineered price declines we saw yesterday. Yesterday was a capitulation to the down side in spades...all courtesy of JPMorgan and friends.

Further to the story about producing I.D. for buying or selling gold bullion or jewellery in the U.S.A...I got the following e-mail from reader Harry Morgan yesterday...

Hello Ed,

I just thought I'd let you know that yesterday I went to Ambassador Jewelers here in Tucson to sell (sadly) a measly 10 ounces of silver. To do so I had to submit to having my right index finger inked and fingerprinted. When I told them (politely) that I would prefer not to have to have my finger inked up and pressed onto a piece of paper I was informed that they would be unable to purchase the silver. I asked them when this process of finger printing became a standard step they told me January 1st of this year.

Furthermore, a few months ago when I went to my bank (Wells Fargo) to cash a check from Ambassador (any time you cash in more then $600 of precious metals here in Tucson you are issued a check instead of cash) the teller at the bank asked me what the check was for. I asked the bank clerk to elaborate on what she meant by 'what the check was for'. The teller (a nice young lady) told me it was now 'required policy to ask everyone who was cashing or depositing a check from a jewelry store, coin store or a coin & stamp store'. I told this clerk that in all fairness it was none of the bank's business why the jewelry store issued me a check. At this the clerk went and got the bank manager. I told the bank manager that it was none of the bank's business why the jewelry store issued me a check. The bank manager told me that he was required to record this information otherwise he could not process the check. I asked him if he couldn't process the check or the bank couldn't process the check (I was starting to get irritated).

So I said I worked at the store and this was a paycheck, then said that I had robbed a home, stolen some jewelry and sold that to Ambassador, then I said I had bought them all lunch and this check was to cover my expenses. Admittedly I was being an ass but I was very agitated about this intrusion into my personal business. So we had this little stand off until I said (firmly and evenly) that I sold a couple of my watches. At this they processed my check.

Anyway, the reason for my email was to let you/others know that, at least in Tucson, when you sell any precious metals (even 10 measly ounces of silver), you will be fingerprinted.

And so it goes ... (down the toilet).

All the best,

Harry

* * *

selected news items....

JPMorgan Said to Fire Traders, Realign Pay Amid Slump

JPMorgan Chase & Co., grappling with Wall Street’s worst year for stock-trading since 2008, cut pay at the equities unit about 4 percent and pushed out about three dozen employees, people with knowledge of the moves said.

About two dozen U.S. traders and sales staff were fired, and some senior employees left voluntarily as the unit aligned pay more closely with revenue, said the people, asking to not be identified because the measures aren’t public. The bank also dismissed equity analysts last week, three people said, with one saying about a dozen were affected. Industry-wide equities- trading revenue fell 5 percent last year, the third straight annual drop, according to analytics firm Coalition Ltd.

This Bloomberg story was posted on their website late yesterday morning Mountain time...and I thank Manitoba reader Ulrike Marx for sending it our way. The link is here.

About two dozen U.S. traders and sales staff were fired, and some senior employees left voluntarily as the unit aligned pay more closely with revenue, said the people, asking to not be identified because the measures aren’t public. The bank also dismissed equity analysts last week, three people said, with one saying about a dozen were affected. Industry-wide equities- trading revenue fell 5 percent last year, the third straight annual drop, according to analytics firm Coalition Ltd.

This Bloomberg story was posted on their website late yesterday morning Mountain time...and I thank Manitoba reader Ulrike Marx for sending it our way. The link is here.

Matt Taibbi....Gangster Bankers: Too Big to Jail

The deal was announced quietly, just before the holidays, almost like the government was hoping people were too busy hanging stockings by the fireplace to notice. Flooring politicians, lawyers and investigators all over the world, the U.S. Justice Department granted a total walk to executives of the British-based bank HSBC for the largest drug-and-terrorism money-laundering case ever. Yes, they issued a fine – $1.9 billion, or about five weeks' profit – but they didn't extract so much as one dollar or one day in jail from any individual, despite a decade of stupefying abuses.

People may have outrage fatigue about Wall Street, and more stories about billionaire greed-heads getting away with more stealing often cease to amaze. But the HSBC case went miles beyond the usual paper-pushing, keypad-punching sort-of crime, committed by geeks in ties, normally associated with Wall Street. In this case, the bank literally got away with murder – well, aiding and abetting it, anyway.

For at least half a decade, the storied British colonial banking power helped to wash hundreds of millions of dollars for drug mobs, including Mexico's Sinaloa drug cartel, suspected in tens of thousands of murders just in the past 10 years – people so totally evil, jokes former New York Attorney General Eliot Spitzer, that "they make the guys on Wall Street look good." The bank also moved money for organizations linked to Al Qaeda and Hezbollah, and for Russian gangsters; helped countries like Iran, the Sudan and North Korea evade sanctions; and, in between helping murderers and terrorists and rogue states, aided countless common tax cheats in hiding their cash.

Despite its length, this essay by Matt Taibbi is an absolute must read from one end to the other...and I thank Marshall Angeles for sharing it with us. It was posted on the Rolling Stone website on Thursday...and the link is here.

People may have outrage fatigue about Wall Street, and more stories about billionaire greed-heads getting away with more stealing often cease to amaze. But the HSBC case went miles beyond the usual paper-pushing, keypad-punching sort-of crime, committed by geeks in ties, normally associated with Wall Street. In this case, the bank literally got away with murder – well, aiding and abetting it, anyway.

For at least half a decade, the storied British colonial banking power helped to wash hundreds of millions of dollars for drug mobs, including Mexico's Sinaloa drug cartel, suspected in tens of thousands of murders just in the past 10 years – people so totally evil, jokes former New York Attorney General Eliot Spitzer, that "they make the guys on Wall Street look good." The bank also moved money for organizations linked to Al Qaeda and Hezbollah, and for Russian gangsters; helped countries like Iran, the Sudan and North Korea evade sanctions; and, in between helping murderers and terrorists and rogue states, aided countless common tax cheats in hiding their cash.

Despite its length, this essay by Matt Taibbi is an absolute must read from one end to the other...and I thank Marshall Angeles for sharing it with us. It was posted on the Rolling Stone website on Thursday...and the link is here.

Doug Noland: Hedge Funds Gone Wild

At the same time, there is also ongoing confirmation that the incredible global policymaking and liquidity backdrop is much more successful in inflating asset markets than it is in boosting economic performance. In particular - and especially considering policy environments - economies in Europe, Japan and the U.S. continue to un-impress. This bolsters the view of a widening global gap between inflating financial asset prices and underlying economic fundamentals.

This begs the question: how might the emboldened “global macro” community play this divergence? Will they play policymaking and the inflating Bubble for all it’s worth? Or will they begin to approach speculative markets with a more contrarian bent? With some funds emboldened and still so many others desperate for performance, it seems reasonable to assume that markets become even more speculative – a game of trying to catch folks on the wrong side of trades (i.e. Apple, gold, etc.), underexposed to outperforming sectors (i.e. homebuilders and “short” stocks) and overexposed to the underperforming (i.e. “defensive”). Most call it a “new bull market”. I’ll stick with “inflating speculative Bubble”.

Doug Noland's weekly Credit Bubble Bulletin falls into the must read category for me every week. Yesterday's edition is posted at the prudentbear.comInternet site...and the link is here.

This begs the question: how might the emboldened “global macro” community play this divergence? Will they play policymaking and the inflating Bubble for all it’s worth? Or will they begin to approach speculative markets with a more contrarian bent? With some funds emboldened and still so many others desperate for performance, it seems reasonable to assume that markets become even more speculative – a game of trying to catch folks on the wrong side of trades (i.e. Apple, gold, etc.), underexposed to outperforming sectors (i.e. homebuilders and “short” stocks) and overexposed to the underperforming (i.e. “defensive”). Most call it a “new bull market”. I’ll stick with “inflating speculative Bubble”.

Doug Noland's weekly Credit Bubble Bulletin falls into the must read category for me every week. Yesterday's edition is posted at the prudentbear.comInternet site...and the link is here.

G20 set to dilute big powers' demands on currencies

The Group of 20 nations will not single out Japan over the weak yen and will disregard a call from G7 powers to refrain from using economic policy to target exchange rates, according to a text drafted for finance leaders.

A G20 delegate who has seen the communiqué - prepared by finance officials for their bosses - also said it would make no direct mention of new debt-cutting targets, something Germany is pressing for but which the United States wanted struck out.

If adopted by G20 finance ministers and central bankers meeting in Moscow on Friday and Saturday, Japan will escape any censure for its expansionary policies which have driven the yen lower and drawn demands for action from some quarters.

"There will not be a heavy clash about currencies in the end, because nobody can risk such a negative signal," said another G20 delegation source.

This Reuters story, filed from Moscow, was posted on their website mid-afternoon yesterday Eastern time...and I thank Ulrike Marx for her second offering in today's column. The link is here.

A G20 delegate who has seen the communiqué - prepared by finance officials for their bosses - also said it would make no direct mention of new debt-cutting targets, something Germany is pressing for but which the United States wanted struck out.

If adopted by G20 finance ministers and central bankers meeting in Moscow on Friday and Saturday, Japan will escape any censure for its expansionary policies which have driven the yen lower and drawn demands for action from some quarters.

"There will not be a heavy clash about currencies in the end, because nobody can risk such a negative signal," said another G20 delegation source.

This Reuters story, filed from Moscow, was posted on their website mid-afternoon yesterday Eastern time...and I thank Ulrike Marx for her second offering in today's column. The link is here.

Iraq back at the brink

It was Britain that triggered Iraq's modern tragedy, starting with its seizure of Baghdad in 1917 and the haphazard reshaping of a country to fit the colonial needs and economic interests of London. One could argue that the early and unequalled mess created by the British invaders continued to wreak havoc, manifesting itself in various ways - spanning sectarianism, political violence and border feuds between Iraq and its neighbors - until this very day.

But of course, the US now deserves most of the credit of reversing whatever has been achieved by the Iraqi people to acquire their ever-elusive sovereignty. It was US secretary of state James Baker who reportedly threatened Iraqi foreign minister Tariq Aziz in a Geneva meeting in 1991 by saying that the US would destroy Iraq and "bring it back to the stone age".

The US wars that extended from 1990 to 2011 included a devastating blockade and ended with a brutal invasion. These wars were as unscrupulous as they were violent. Aside from their overwhelming human toll, they were placed within a horrid political strategy aimed at exploiting the country's existing sectarian and other fault lines, therefore triggering civil wars and sectarian hatred from which Iraq is unlikely to cover for many years.

This Asia Times story from earlier this week was sent to me by Roy Stephens...and it's a must read for all students of the New Great Game. The link is here.

But of course, the US now deserves most of the credit of reversing whatever has been achieved by the Iraqi people to acquire their ever-elusive sovereignty. It was US secretary of state James Baker who reportedly threatened Iraqi foreign minister Tariq Aziz in a Geneva meeting in 1991 by saying that the US would destroy Iraq and "bring it back to the stone age".

The US wars that extended from 1990 to 2011 included a devastating blockade and ended with a brutal invasion. These wars were as unscrupulous as they were violent. Aside from their overwhelming human toll, they were placed within a horrid political strategy aimed at exploiting the country's existing sectarian and other fault lines, therefore triggering civil wars and sectarian hatred from which Iraq is unlikely to cover for many years.

This Asia Times story from earlier this week was sent to me by Roy Stephens...and it's a must read for all students of the New Great Game. The link is here.

Four King World News Blogs/Audio Interviews

The first blog is Part III of the Felix Zulauf interview. It's headlined "We Have Never Seen Anything Like This in History". The last blog is with Tom Fitzpatrick and Egon von Greyerz. It's entitled "Fantastic Gold Chart and Commentary". The first audio interview is with John Hathaway...and the second audio interview is with Felix Zulauf.

JPMorgan Sells Largest Structured Note Tied to Gold Since 2010

JPMorgan Chase & Co. sold $35 million of one-year notes linked to the price of gold, the bank’s largest offering tied to the precious metal in at least three years.

The securities, issued Jan. 2, yield three times the gains of the price of gold in London up to 15.6 percent, with no protection against losses and all capital at risk, according to a prospectus filed with the U.S. Securities and Exchange Commission. The metal’s price increased 8.3 percent last year in London.

This short story appeared on the Bloomberg website last weekend...and I thank Washington state reader S.A. for sending it. The link is here.

The securities, issued Jan. 2, yield three times the gains of the price of gold in London up to 15.6 percent, with no protection against losses and all capital at risk, according to a prospectus filed with the U.S. Securities and Exchange Commission. The metal’s price increased 8.3 percent last year in London.

This short story appeared on the Bloomberg website last weekend...and I thank Washington state reader S.A. for sending it. The link is here.

January gold imports into India surge 23 percent, hit 18-month high

India's gold imports in January surged 23 percent from a year ago to their highest in 18 months as traders snapped up supplies ahead of a hike in duty, undermining the government's efforts to control a ballooning current account deficit.

The world's top bullion buyer imported 100 tonnes of gold last month, the head of the Bombay Bullion Association said on Friday. This is about 40 percent more than the country's average monthly imports last year.

"The total imports figure for 2012 was around 860 tonnes, so 100 tonnes in a month is too high. Also oil is trading firm above $95 (per barrel), so this will impact the oil import bill and overall deficit targets," said Navneet Damani, associate vice president with Motilal Oswal Commodities.

This Reuters story was filed from Mumbai early yesterday evening India Standard Time...and my thanks go out to Ulrike Marx for bringing this article to my attention...and now to yours. The link is here.

The world's top bullion buyer imported 100 tonnes of gold last month, the head of the Bombay Bullion Association said on Friday. This is about 40 percent more than the country's average monthly imports last year.

"The total imports figure for 2012 was around 860 tonnes, so 100 tonnes in a month is too high. Also oil is trading firm above $95 (per barrel), so this will impact the oil import bill and overall deficit targets," said Navneet Damani, associate vice president with Motilal Oswal Commodities.

This Reuters story was filed from Mumbai early yesterday evening India Standard Time...and my thanks go out to Ulrike Marx for bringing this article to my attention...and now to yours. The link is here.

South Africa’s gold output down 21.2% in December

South Africa's gold output fell by 21.2 percent in volume terms in December, while total mineral production fell 7.5 percent compared with the same month last year, data showed on Thursday.

Production of non-gold minerals was 5 percent lower, Statistics South Africa said. Production of platinum group metals plunged 23.2 percent in December.

This 2-paragraph Reuters story was filed from Johannesburg...and you just read it. It was posted on the mineweb.com Internet site on Thursday...and the link to the hard copy is here.

Production of non-gold minerals was 5 percent lower, Statistics South Africa said. Production of platinum group metals plunged 23.2 percent in December.

This 2-paragraph Reuters story was filed from Johannesburg...and you just read it. It was posted on the mineweb.com Internet site on Thursday...and the link to the hard copy is here.

Turkey to Iran gold trade wiped out by new U.S. sanction

Tighter U.S. sanctions are killing off Turkey's gold-for-gas trade with Iran and have stopped state-owned lender Halkbank from processing other nations' energy payments to the OPEC oil producer, bankers said on Friday.

U.S. officials have sought to prevent Turkish gold exports, which indirectly pay Iran for its natural gas, from providing a financial lifeline to Tehran, largely frozen out of the global banking system by Western sanctions over its nuclear program.

Turkey, Iran's biggest natural gas customer, has been paying Iran for its imports with Turkish lira, because sanctions prevent it from paying in dollars or euros.

This Reuters piece, filed from Istanbul early Friday morning Eastern time, is a rehash of a story that I posted earlier this week, but it does have some more up-to-date information in it. I thank Marshall Angeles for sending it...and the link is here.

U.S. officials have sought to prevent Turkish gold exports, which indirectly pay Iran for its natural gas, from providing a financial lifeline to Tehran, largely frozen out of the global banking system by Western sanctions over its nuclear program.

Turkey, Iran's biggest natural gas customer, has been paying Iran for its imports with Turkish lira, because sanctions prevent it from paying in dollars or euros.

This Reuters piece, filed from Istanbul early Friday morning Eastern time, is a rehash of a story that I posted earlier this week, but it does have some more up-to-date information in it. I thank Marshall Angeles for sending it...and the link is here.

"To Get the Gold, They Will Have to Kill Every One of Us First” -- Tribal Leaders Fight Gold-Hungry Investors

Ecuadorian officials want to sell gold-laden land to China, but not without a fight from the legendary Shuar tribe.

Of the thousands of “Avatar” screenings held during the film’s record global release wave, none tethered the animated allegory to reality like a rainy day matinee in Quito, Ecuador.

It was late January 2010 when a non-governmental organization bused Indian chiefs from the Ecuadorean Amazon to a multiplex in the capital. The surprise decampment of the tribal congress triggered a smattering of cheers, but mostly drew stares of apprehension from urban Ecuadoreans who attribute a legendary savagery to their indigenous compatriots, whose violent land disputes in the jungle are as alien as events on “Avatar’s” Pandora.

The chiefs — who watched the film through plastic 3-D glasses perched beneath feathered headdress — saw something else in the film: a reflection. The only fantastical touches they noticed in the sci-fi struggle were the blue beanstalk bodies and the Hollywood gringo savior. “As in the film, the government here has closed the dialogue,” a Shuar chief told a reporter after the screening. “Does this mean that we do something similar to the film? We are ready.”

Well, if you thought that the John Kaiser interview was long, you haven't seen anything yet. This lengthy essay was posted on the alternet.org Internet site...although it doesn't say when, as it is undated. From what I've read up to this point, it's a great read...and I thank Roy Stephens for today's final offering, which I've been saving since Tuesday...and the link is here.

Of the thousands of “Avatar” screenings held during the film’s record global release wave, none tethered the animated allegory to reality like a rainy day matinee in Quito, Ecuador.

It was late January 2010 when a non-governmental organization bused Indian chiefs from the Ecuadorean Amazon to a multiplex in the capital. The surprise decampment of the tribal congress triggered a smattering of cheers, but mostly drew stares of apprehension from urban Ecuadoreans who attribute a legendary savagery to their indigenous compatriots, whose violent land disputes in the jungle are as alien as events on “Avatar’s” Pandora.

The chiefs — who watched the film through plastic 3-D glasses perched beneath feathered headdress — saw something else in the film: a reflection. The only fantastical touches they noticed in the sci-fi struggle were the blue beanstalk bodies and the Hollywood gringo savior. “As in the film, the government here has closed the dialogue,” a Shuar chief told a reporter after the screening. “Does this mean that we do something similar to the film? We are ready.”

Well, if you thought that the John Kaiser interview was long, you haven't seen anything yet. This lengthy essay was posted on the alternet.org Internet site...although it doesn't say when, as it is undated. From what I've read up to this point, it's a great read...and I thank Roy Stephens for today's final offering, which I've been saving since Tuesday...and the link is here.

* * *

¤ THE WRAP

You've never been lost until you've been lost at Mach 3. - Paul F. Crickmore...SR-71 test pilot

Today's pop 'blast from the past' is almost fifty years old...scary stuff, as I remember this song all too well. I'm sure you will as well...and the link is here.

Today's classical 'blast from the past' is an old chestnut from the master of the romantic era...Pyotr I. Tchaikovsky and, after two unsuccessful attempts, was rewritten in the form we know it today way back in 1880. Whenever this was programmed in the Edmonton Symphony Orchestra's season, it was pretty much guaranteed to be a sold-out house...and a standing ovation at the end. This performance is with the London Symphony Orchestra with Russian Maestro Valery Gergiev conducting. The run time on this is a hair over 20 minutes...and the link is here. Enjoy!

Well, was that the bottom? Beats me, but if I had to bet a dollar, I'd say we're pretty close...at least in gold. Both Ted Butler and I are still concerned about silver, because the short position is still massive, even if JPMorgan et al took another 10,000 contract off the Commercial net short position during the last three days of the week. If you remember, I've been commenting on the lack of silver volume all week long during this engineered price decline. Even yesterday's net volume was underwhelming.

In June of last year, the Commercial net short position in silver got down around the 12,000 contract mark...and even with those estimated 10,000 contracts removed from the current Commercial net short position, it still stands at 36,000 at the moment...and that's light years off that June 2012 low.

Can JPMorgan et al get the liquidation necessary to get their short positions that low again? I don't know. But if they tried, we'd have to see significantly lower silver prices to get there. But can they, or will they? That is the $64,000 question at the moment.

Of course the other question that has to be answered is this. If we have seen the bottom, either yesterday...or early next week, what will "da boyz" do on the next rally? Will they be the short sellers of last report as they have been for the last twenty-five years, or will they stand aside at let the prices go?

As GATA's Chris Powell said many years back..."There are no markets anymore, only interventions"...and that pretty much describes what passes for monetary, financial and economic policy on Planet Earth today.

Today's pop 'blast from the past' is almost fifty years old...scary stuff, as I remember this song all too well. I'm sure you will as well...and the link is here.

Today's classical 'blast from the past' is an old chestnut from the master of the romantic era...Pyotr I. Tchaikovsky and, after two unsuccessful attempts, was rewritten in the form we know it today way back in 1880. Whenever this was programmed in the Edmonton Symphony Orchestra's season, it was pretty much guaranteed to be a sold-out house...and a standing ovation at the end. This performance is with the London Symphony Orchestra with Russian Maestro Valery Gergiev conducting. The run time on this is a hair over 20 minutes...and the link is here. Enjoy!

Well, was that the bottom? Beats me, but if I had to bet a dollar, I'd say we're pretty close...at least in gold. Both Ted Butler and I are still concerned about silver, because the short position is still massive, even if JPMorgan et al took another 10,000 contract off the Commercial net short position during the last three days of the week. If you remember, I've been commenting on the lack of silver volume all week long during this engineered price decline. Even yesterday's net volume was underwhelming.

In June of last year, the Commercial net short position in silver got down around the 12,000 contract mark...and even with those estimated 10,000 contracts removed from the current Commercial net short position, it still stands at 36,000 at the moment...and that's light years off that June 2012 low.

Can JPMorgan et al get the liquidation necessary to get their short positions that low again? I don't know. But if they tried, we'd have to see significantly lower silver prices to get there. But can they, or will they? That is the $64,000 question at the moment.

Of course the other question that has to be answered is this. If we have seen the bottom, either yesterday...or early next week, what will "da boyz" do on the next rally? Will they be the short sellers of last report as they have been for the last twenty-five years, or will they stand aside at let the prices go?

The answers to both those question should be known in the not-to-distant future. So, in actual fact, there are two $64,000 questions floating around out there...and nothing else matters except the answers to those two questions.

Here are the 3-year charts for both silver and gold. As you can see, we are pretty close to what I consider to be a major bottom...and once "da boyz" can't get any more technical fund long liquidation, the bottom will be in, regardless of the price...or the size of the Commercial net short position at the time.

So we wait.

Here are the 3-year charts for both silver and gold. As you can see, we are pretty close to what I consider to be a major bottom...and once "da boyz" can't get any more technical fund long liquidation, the bottom will be in, regardless of the price...or the size of the Commercial net short position at the time.

So we wait.

(Click on image to enlarge)

In closing today's column, I'd like to point out one more time that the world's fiat currency system...and the financial and economic system that has risen out of it since August 15, 1971...is pretty much on its last legs. What will replace it is still unknown...but the powers that be know all too well that they can't muddle along much further without everything either blowing up or melting down...and the ever-increasing signs of that are all around them.As GATA's Chris Powell said many years back..."There are no markets anymore, only interventions"...and that pretty much describes what passes for monetary, financial and economic policy on Planet Earth today.

It can't...and won't...last much longer.

Because of the President's Day holiday in the U.S. on Monday, I may or may not have a column on Tuesday...so if there isn't one posted on this website by 7:00 a.m. Eastern time on that day, you'll know why.

Because of the President's Day holiday in the U.S. on Monday, I may or may not have a column on Tuesday...so if there isn't one posted on this website by 7:00 a.m. Eastern time on that day, you'll know why.

Over a 5 minute period from 10:32-10:37 AM Friday, a massive volume spike (approximately 40,000 contracts) coincided with silver’s waterfall to $29.75- a fairly common occurrence during major cartel silver raids.

Over a 5 minute period from 10:32-10:37 AM Friday, a massive volume spike (approximately 40,000 contracts) coincided with silver’s waterfall to $29.75- a fairly common occurrence during major cartel silver raids.  Eric Sprott manages $10 billion, and he’s worried about the global financial system. He says, “There is this huge chaos going on in the financial business which I think we all sense.

Eric Sprott manages $10 billion, and he’s worried about the global financial system. He says, “There is this huge chaos going on in the financial business which I think we all sense. Yesterday we reported that

Yesterday we reported that

No comments:

Post a Comment