http://www.zerohedge.com/news/2013-02-10/guest-post-china-surpasses-us-number-one-global-trading-power

( As the number one trading nation , China is flexing its muscles... )

Guest Post: China Surpasses U.S. As Number One Global Trading Power

Submitted by Tyler Durden on 02/10/2013 10:53 -0500

Submitted by Brandon Smith from Alt-Market

China Surpasses U.S. As Number One Global Trading Power

Back in 2008, at the onset of the derivatives and credit collapse, I wrote several economic editorials discussing what I saw as the single most vital trend in the global fiscal system, and how it would cause a disastrous upheaval that would leave the U.S. and the dollar financially sunk. This trend, which seemed to take serious root in 2005, was the massive shift by China from an export dependent source of cheap manufacturing and labor, into a moderate exporter, and consumer hub, and currency powerhouse. In my view at the time, the evidence suggested that China was positioning itself to decouple from its dependence on U.S. markets and the dollar. I was, of course, attacked as a “doom monger” and “conspiracy theorist”. Five years later, the critics have changed their tune…

For the past decade, China has been slowly but surely issuing Yuan denominated bonds and securities around the globe, while simultaneously forming bilateral trade agreements with multiple nations and cutting out the U.S. dollar as the world reserve currency. This process has gone mostly ignored by the mainstream financial media. However, I and many other independent analysts could not overlook the red flags. I tried to summarize as much of the situation and facts as I could in my article ‘How The U.S. Dollar Will Be Replaced’, which was published in May of last year:

The biggest question for me was, if China is one of the largest holders of Forex reserves on the planet, and had the largest savings of any nation, WHY did they feel the need or desire in 2005 to begin issuing Yuan denominated debt? Why begin borrowing capital from foreign creditors? They certainly didn’t need the money. Why were they moving away from export dependency and building a consumer base? And why attempt to proliferate their currency? Wouldn’t the pursuit of global Yuan circulation lead to an eventual increase in valuation? Didn’t the Chinese want their currency cheap so that they could maintain export superiority? What did the Chinese know in 2005 that we didn’t?

Well, apparently they were either psychic, or SOMEONE gave them advanced warning. They knew that there would be a crisis in American consumption and that this would lead to severe reduction in imports, which is why they began building trade deals within the ASEAN trading bloc to insulate themselves. They knew that there would be considerable devaluation in the dollar, which is why they converted much of their long term treasury holdings to short term treasury bonds that they could dump with far more ease, and they knew that the IMF would be promoting Special Drawing Rights as a new reserve replacing the dollar, which is why they have been spreading the Yuan everywhere, earning them favor with the global banksters and inclusion in the basket currency. In fact, China has been pumping Yuan into global markets even faster than the Federal Reserve has been printing the dollar:

China is flooding the system with Yuan! This means only one thing; China is no longer seeking to maintain the traditional trade relationship it has had with the U.S.

To make my case even more clear, I would point out that China has not only become the world’s largest gold producer, but also its largest BUYER, recently surpassing India. Official estimates place Chinese gold purchases in 2012 at around 800 tons; an astonishing increase in their stockpile.

The U.S. and the Federal Reserve can’t even deliver gold it is supposed to be holding for others, including Germany.

China has also recently quadrupled imports of rice and tripled wheat and corn imports in only one year. Why? Again, I ask, what do they know that we are not being told?

As I have stated for many years, China is being groomed as an alternative economic engine in opposition to the U.S., and that this will lead to an eventual dump by them of the Greenback. This scenario is not only based on my opinion, it has also been spoken of openly by elitist financiers, including George Soros.

This past month, the same plan has been reiterated by Zhu Min, the deputy managing director of the IMF. In his statement, he proclaimed that the shift by China into a more consumer based system had been successful, and that the Yuan or RMB, was on the way to becoming a world reserve currency:

I believe that the moment for the epic changeover, and all the political and financial conflict that comes with it, has begun…

It has been announced this week that China surpassed the U.S. for the first time ever as the number one trading power in the world:

U.S. exports and imports last year totaled $3.82 trillion, the U.S. Commerce Department said last week. China’s customs administration reported last month that the country’s total trade in 2012 amounted to $3.87 trillion. China had a $231.1 billion annual trade surplus while the U.S. had a trade deficit of $727.9 billion:

“It is remarkable that an economy that is only a fraction of the size of the U.S. economy has a larger trading volume,” Nicholas Lardy, a senior fellow at the Peterson Institute for International Economics in Washington, said in an e-mail. “The surpassing of the U.S. is not because of a substantially undervalued currency that has led to an export boom,” said Lardy, noting that Chinese imports have grown more rapidly than exports since 2007.”

“According to O’Neill (Goldman Sachs Jim O’Neill), the trade figures underscore the need to draw China further into the global financial and trading architecture that the U.S. helped create.

“One way or another we have to get China more involved in the global organizations of today and the future despite some of their own reluctance,” O’Neill said, mentioning China’s inclusion in the International Monetary Fund’s Special Drawing Rights currency basket. “To not have China more symbolically and more importantly actually central to all these things is just increasingly silly.”

For those who are still not aware of why this is such a big deal, it is essentially a turning point moment in global trade. There is no doubt that China will now be inducted into the SDR, and that their importance as a trade and consumption center will quickly lead to a move away from the dollar. To put it simply, the dollar is going to lose its world reserve status VERY soon. Many will cheer this change as necessary progress towards a more “globally conscious” economic system. However, it’s not that simple. Total centralization is first and foremost the dream of idiots, and in any mutation (or amputation) there is always considerable pain involved. The proponents of this “New World Order” (their words, not mine) seem to have placed the U.S. squarely in their crosshairs as the primary recipient of this fiscal pain.

In my early analysis, I felt it possible that Japan would be inducted willingly into the new ASEAN trading bloc and that they would swiftly fall in line with a dump of the dollar, mainly because their export markets were suffering greatly due to the decline in American purchases. Now it appears that Japan has not been as pliable as the globalists wanted, and so, a war may be on the table in the Pacific.

Rhetoric in Chinese newspapers has been very heated and provocative, and the tensions surrounding the Senkaku/Diaoyu Islands is reaching a boiling point. The two countries have done everything so far EXCEPT shoot at each other, and that will be happening in due course now that China is allegedly locking offensive radar onto Japanese ships. Even Chinese films released in the past two years have been soaked with anti-Japan propaganda, most of them usually set during WWII around the brutal invasion and subjugation by the Japanese in Chinese provinces.

The recipe is one of inevitable disaster, with the U.S. at the center of a boiling pot. As I pointed in my last economic piece, we must now look to events rather than numbers to gain insight into where we are headed. The time has come. China is nearly ready for IMF inclusion. Volatility around the world is high. Our government has a final decision to make on the Fiscal Cliff in March, not to mention the sudden push for possible gun registration and confiscation. My instincts tell me that so many explosive aspects coalescing together at the same tenuous moment is not a coincidence. The next few months call for hyper-vigilance and every ounce of energy we can muster to educate as many people as possible in as short a time as possible.

I say again, China has surpassed the U.S. in global trade. A drop of the dollar is the obvious next step…

and....

http://www.zerohedge.com/news/2013-02-09/china-mobilizing-war-japan

Is China Mobilizing For A War With Japan?

Submitted by Tyler Durden on 02/09/2013 23:17 -0500

We don't know if it merely a coincidence that a story has emerged discussing a Chinese mobilization in response to the ongoing territorial feud with Japan over the Diaoyu/Senkaku islands (and the proximal massive gas field) the very week that China celebrates its new year (and days after news that a Chinese warship was very close to firing on a Japanese destroyer). We don't know how much of the story is based in reality, and how much may be propaganda or furthering someone's agenda. What we do know is that the source of the story: offshore-based, Falun Gong-affiliated NTDTV has historically been a credible source of information that the China communist party desperately tries to censor, such as breaking the news of the SARS epidemic in 2003 some three weeks before China publicly admitted it. Its motto is "to bring truthful and uncensored information into and out of China." If that is indeed the case, and its story of major troop movements and mobilization of various types of military vehicles and artillery into the Fujian and Zhejian provinces, bordering the East China Sea and closest to the Diaoyu islands, is accurate, then hostilities between China and Japan may be about to take a major turn for the worse.

We don't know if it merely a coincidence that a story has emerged discussing a Chinese mobilization in response to the ongoing territorial feud with Japan over the Diaoyu/Senkaku islands (and the proximal massive gas field) the very week that China celebrates its new year (and days after news that a Chinese warship was very close to firing on a Japanese destroyer). We don't know how much of the story is based in reality, and how much may be propaganda or furthering someone's agenda. What we do know is that the source of the story: offshore-based, Falun Gong-affiliated NTDTV has historically been a credible source of information that the China communist party desperately tries to censor, such as breaking the news of the SARS epidemic in 2003 some three weeks before China publicly admitted it. Its motto is "to bring truthful and uncensored information into and out of China." If that is indeed the case, and its story of major troop movements and mobilization of various types of military vehicles and artillery into the Fujian and Zhejian provinces, bordering the East China Sea and closest to the Diaoyu islands, is accurate, then hostilities between China and Japan may be about to take a major turn for the worse.

The second largest oilfield in China, the Shengli field, lies just to the west of Bohai Bay, but the onshore fields will be covered in more detail in a later post.

CNOOC is also producing oil from the Xijiang oil field in the East South China Sea. This field started production in 2008, when it was projected to produce 40 kbd from fifteen wells.

(Note this should not be confused with the Xinjiang Oil Province in northern Xinjiang Uygur Autonomous Region, which is a heavy oil deposit which the Chinese are developing using a SAGD technique.)

However, oil fields off the China coast have been in development sufficiently long that some are now depleting. The Lufeng 22 field some 150 miles south-east of Hong Kong has been officially shut down in June 2009. It had 5 long horizontal wells, which ran up to 2 km in the lateral.

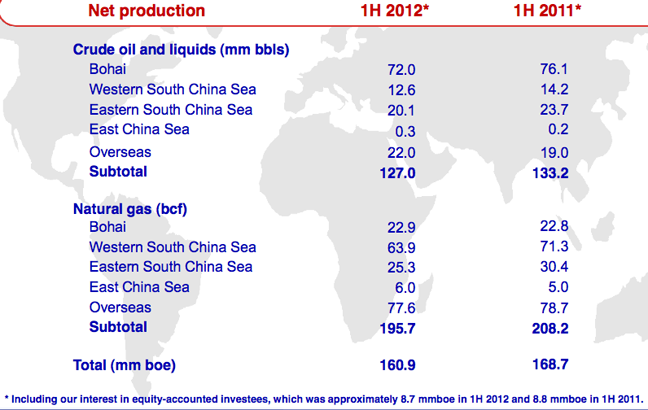

Thus when one compares production from the different CNOOC sources in the first half of this year, relative to last year, the increasing role that overseas investments will be called up to maintain overall production levels becomes more evident. Those investments are in the Long Lake Oil Sands in Canada which they acquired with Nexen, and the Missan Oilfield in Iraq. It should be noted, however, that this is still up considerably from the 469,407 bd that the company averaged in 2007. However the 450 kbd anticipated from Iraq is sure to help more.

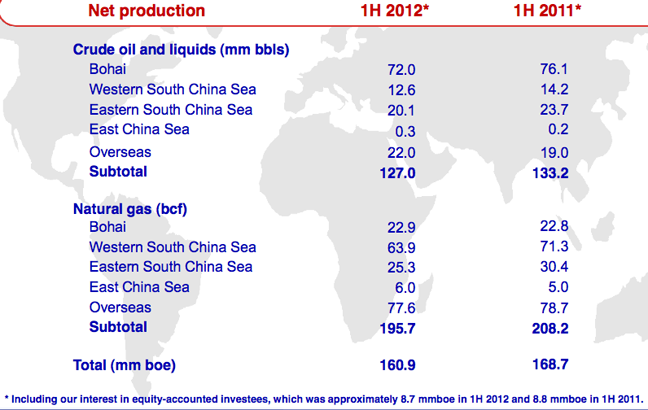

Figure 2. Comparative production from the various CNOOC operations, 2012 v 2011. (CNOOC Midyear Review)

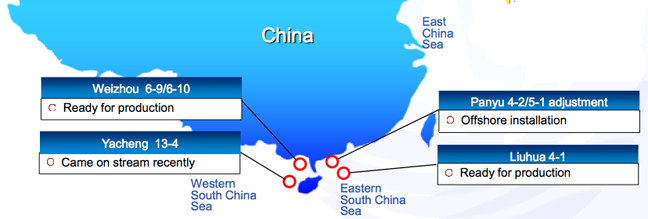

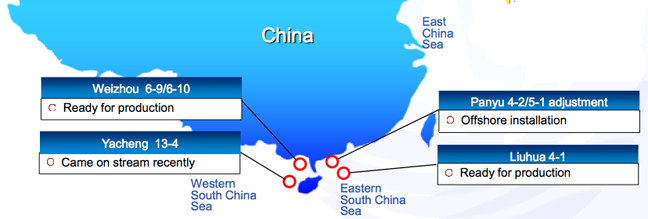

When one realizes that about 25% of the oil comes from the South China Sea, this tends to draw a little emphasis to the ongoing disputes in that region. There are four projects scheduled for production in the region this year - they are Weizhou and Yacheng in the Western South China Sea, and Panyu and Liuhua in the Eastern. Added to these are the discoveries at Enping in the Eastern South China Sea, and Dongfang in the Western.

Figure 3. CNOOC fields scheduled for production in the South China Sea

( CNOOC Midyear Review).

Weizhou is actually an old sandstone reservoir that has been in production for quite some time, but CNOOC now has an interest in some of the fields that are still being developed in the region, which lies in the Beibu Gulf. The reservoir has a relatively low permeability such that various different EOR techniques are being considered for the region. The new developments this year should add around 20,000 bd to production in the Beibu Gulf region.

Yacheng is a gas field that has just started production. It is anticipated to reach peak production of around 1 mcm/day next year.

Panyu is a field that CNOOC acquired from Devon Energy and ConocoPhillips has an interest as the operations move into an expanded Phase II, over the 11 kbd which has been achieved prior. Two new drilling and production platforms are being fielded. Weather in the region is considered a problem.

Liuhua, while one of the largest discoveries in the South China Sea, has a relatively heavy oil, with about a billion barrels in reserve, found in a carbonate reservoir. It was originally discovered in 1987, and was first developed in 1993. It was successfully restarted in 2007, with 25 wells producing some 23 kbd of oil, after being closed due todamage from typhoon Chanchu. The new development is Liuhua-4, which has low reservoir pressure, and so will require the use of electric submersible pumps.

We don't know if it merely a coincidence that a story has emerged discussing a Chinese mobilization in response to the ongoing territorial feud with Japan over the Diaoyu/Senkaku islands (and the proximal massive gas field) the very week that China celebrates its new year (and days after news that a Chinese warship was very close to firing on a Japanese destroyer). We don't know how much of the story is based in reality, and how much may be propaganda or furthering someone's agenda. What we do know is that the source of the story: offshore-based, Falun Gong-affiliated NTDTV has historically been a credible source of information that the China communist party desperately tries to censor, such as breaking the news of the SARS epidemic in 2003 some three weeks before China publicly admitted it. Its motto is "to bring truthful and uncensored information into and out of China." If that is indeed the case, and its story of major troop movements and mobilization of various types of military vehicles and artillery into the Fujian and Zhejian provinces, bordering the East China Sea and closest to the Diaoyu islands, is accurate, then hostilities between China and Japan may be about to take a major turn for the worse.

We don't know if it merely a coincidence that a story has emerged discussing a Chinese mobilization in response to the ongoing territorial feud with Japan over the Diaoyu/Senkaku islands (and the proximal massive gas field) the very week that China celebrates its new year (and days after news that a Chinese warship was very close to firing on a Japanese destroyer). We don't know how much of the story is based in reality, and how much may be propaganda or furthering someone's agenda. What we do know is that the source of the story: offshore-based, Falun Gong-affiliated NTDTV has historically been a credible source of information that the China communist party desperately tries to censor, such as breaking the news of the SARS epidemic in 2003 some three weeks before China publicly admitted it. Its motto is "to bring truthful and uncensored information into and out of China." If that is indeed the case, and its story of major troop movements and mobilization of various types of military vehicles and artillery into the Fujian and Zhejian provinces, bordering the East China Sea and closest to the Diaoyu islands, is accurate, then hostilities between China and Japan may be about to take a major turn for the worse.

Fujian and Zhejian provinces highlighted below:

The clip that NTDTV released late yesterday covering the news is presented below.

As for the accompanying commentary, we recreate it below in its entirety so nothing is lost in translation (original source).

http://www.theoildrum.com/node/9437NTDTV February 8, 2013 News - the continental network transmission, Fujian and Zhejiang troops for several days active. Plus before the news that Chinese warships radar has repeatedly aimed at the Japanese ships and planes, therefore, the media have speculated that China may "prepare for war" Diaoyu Islands .According to friends broke the news: February 3, Nan'an, Fujian Highway 308, artillery units practical exercise for several days.February 3 to 6, Fujian, Xiamen, Zhangzhou, Huzhou, a large troop movements, nearly 100 vehicles of various types of military vehicles, armored vehicles, artillery filled the entire road, endless, Xiamen and even the scene of a traffic jam 10 kilometers.

In addition, on February 3 in Shiyan, Hubei, a large number of tanks, wheeled military base from Shiyan room counties is delivered to the coastal areas. Many local residents of the tense situation of some concern.Prior to this allegation, January 15 and 30, the Chinese navy guided missile frigate, twice the fire control radar lock frigates and ship-borne helicopters of the Japanese Maritime Self-Defense Force, is also considered to enter a combat state.According to mainland media quoted the "People's Daily" front-page article claiming that China will not change in point of view on the issue of the Diaoyu Islands , and have to prepare to win the war.The international media alleged that China has purchased from Russia 239 engine, used in the manufacture of the H-6K. Combat covering the Diaoyu Islands, in this model, the engine can also be used to manufacture transported -20 transport aircraft purchased.

If the engine assembled, will greatly enhance China's military power.Integrated these signs and reports, people have come to a startling conclusion: Day might want to go to war.According to military experts, the Sino-Japanese war in the Diaoyu Islands, Fujian and Zhejiang provinces, is the most important logistical base. If the war to expand, at any time, will spread to the provinces of Fujian, Zhejiang.

Tech Talk - China's Offshore Oil

Posted by Heading Out on August 26, 2012 - 7:50am

Topic: Supply/Production

Tags: beibu gulf, bohai bay, china, cnooc, offshore oil production, south china sea [list all tags]

Topic: Supply/Production

Tags: beibu gulf, bohai bay, china, cnooc, offshore oil production, south china sea [list all tags]

The recent post on Chinese claims to territory in the China Sea mentioned the rush to plant flags on different islands in the South China Sea portion as a sign of the ongoing nature of the disputes that continue to develop in the region. That status has continued with protests this last weekend in China over Japanese flag-waving over an island in the East China Sea. The islands are called Diaoyu or Senkaku, depending on whether the report is Chinese or Japanese.

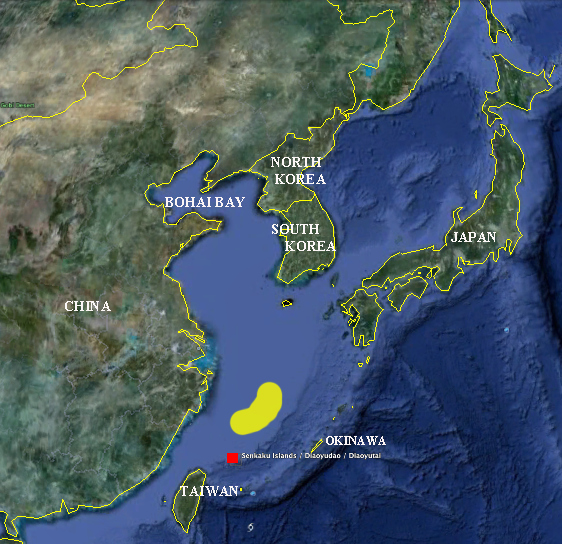

Figure 1. Location of the Senkaku/Diaoyu Islands in the East China Sea (Google Earth). The yellow patch shows the rough location of the Shirakaba/Chunxiao gas field. The Japanese claim runs through the center of the field, China says the boundary is to the East of the field (half-way between the disputed islands and Okinawa).

CNOOC, the China National Offshore Oil Corporation, and the company designated to handle their offshore deals, has been producing oil and natural gas from the field since at least March of 2011. Back then:

CNOOC has just released their Mid-year Review noting that they are on track to produce between 330 and 340 million barrels of oil equivalent (mboe) this year. They have 10 new discoveries and 18 successful appraisal wells, and have signed an agreement to co-operatively develop coalbed methane onshore in China. (Their realized gas price is $5.90/kcf, up from $4.92 over the same period last year.) However, they are running about 4.6% down in production y-o-y, which they blame partly on the production outage at the Penglai 19-3 oilfield, in Bohai Bay, due to the oil spill last year. The shut-down reduced overall company production by 40,000 bd, from a field which has been producing at some 160 kbd. The field, the largest offshore discovery in China is run in partnership with ConocoPhillips, came on line in 2002 and was the site of another small spill this June. Production at Penglai 19-3 was restarted in March, with the intention of ramping up to close to the original flow volumes.

The review notes that of the three appraisal wells drilled in Bohai Bay, Penglai 9-1 was the largest oilfield in recent discoveries in the Bay, and it tied in with the discovery of oil at Penglai 15-2, which is some 8 km south. When included with a third successful appraisal in the Bay (Qinhuangdao 29-2) they have collectively expanded the reserves in the Bay area. CNOOC also note new discoveries further north in the Bay at Luda, which originally came on stream at 11 kbd in 2009."China has complete sovereignty over the Chunxiao oil and gas field and administrative authority," Chinese Foreign Ministry spokeswoman Jiang Yu told reporters at a regular news briefing.The gas field is 7 minutes flying time for the new Chinese air base at Shuimen.

CNOOC has just released their Mid-year Review noting that they are on track to produce between 330 and 340 million barrels of oil equivalent (mboe) this year. They have 10 new discoveries and 18 successful appraisal wells, and have signed an agreement to co-operatively develop coalbed methane onshore in China. (Their realized gas price is $5.90/kcf, up from $4.92 over the same period last year.) However, they are running about 4.6% down in production y-o-y, which they blame partly on the production outage at the Penglai 19-3 oilfield, in Bohai Bay, due to the oil spill last year. The shut-down reduced overall company production by 40,000 bd, from a field which has been producing at some 160 kbd. The field, the largest offshore discovery in China is run in partnership with ConocoPhillips, came on line in 2002 and was the site of another small spill this June. Production at Penglai 19-3 was restarted in March, with the intention of ramping up to close to the original flow volumes.

The second largest oilfield in China, the Shengli field, lies just to the west of Bohai Bay, but the onshore fields will be covered in more detail in a later post.

CNOOC is also producing oil from the Xijiang oil field in the East South China Sea. This field started production in 2008, when it was projected to produce 40 kbd from fifteen wells.

(Note this should not be confused with the Xinjiang Oil Province in northern Xinjiang Uygur Autonomous Region, which is a heavy oil deposit which the Chinese are developing using a SAGD technique.)

However, oil fields off the China coast have been in development sufficiently long that some are now depleting. The Lufeng 22 field some 150 miles south-east of Hong Kong has been officially shut down in June 2009. It had 5 long horizontal wells, which ran up to 2 km in the lateral.

Thus when one compares production from the different CNOOC sources in the first half of this year, relative to last year, the increasing role that overseas investments will be called up to maintain overall production levels becomes more evident. Those investments are in the Long Lake Oil Sands in Canada which they acquired with Nexen, and the Missan Oilfield in Iraq. It should be noted, however, that this is still up considerably from the 469,407 bd that the company averaged in 2007. However the 450 kbd anticipated from Iraq is sure to help more.

When one realizes that about 25% of the oil comes from the South China Sea, this tends to draw a little emphasis to the ongoing disputes in that region. There are four projects scheduled for production in the region this year - they are Weizhou and Yacheng in the Western South China Sea, and Panyu and Liuhua in the Eastern. Added to these are the discoveries at Enping in the Eastern South China Sea, and Dongfang in the Western.

( CNOOC Midyear Review).

Weizhou is actually an old sandstone reservoir that has been in production for quite some time, but CNOOC now has an interest in some of the fields that are still being developed in the region, which lies in the Beibu Gulf. The reservoir has a relatively low permeability such that various different EOR techniques are being considered for the region. The new developments this year should add around 20,000 bd to production in the Beibu Gulf region.

Yacheng is a gas field that has just started production. It is anticipated to reach peak production of around 1 mcm/day next year.

Panyu is a field that CNOOC acquired from Devon Energy and ConocoPhillips has an interest as the operations move into an expanded Phase II, over the 11 kbd which has been achieved prior. Two new drilling and production platforms are being fielded. Weather in the region is considered a problem.

Liuhua, while one of the largest discoveries in the South China Sea, has a relatively heavy oil, with about a billion barrels in reserve, found in a carbonate reservoir. It was originally discovered in 1987, and was first developed in 1993. It was successfully restarted in 2007, with 25 wells producing some 23 kbd of oil, after being closed due todamage from typhoon Chanchu. The new development is Liuhua-4, which has low reservoir pressure, and so will require the use of electric submersible pumps.

No comments:

Post a Comment