http://www.telegraph.co.uk/finance/debt-crisis-live/9654748/Debt-crisis-Weak-services-data-raises-triple-dip-risk-live.html

11.08 A slightly different look at that Turkey upgrade from a global macro strategist.

11.01 Over to Turkey, which has been looking to join the EU for the past few years. Fitch has become the first international credit rating agency to upgrade the country to investment grade.

Fitch expects the economy to remain more volatile than investment grade peers, but believes sovereign creditworthiness has become more resilient to shocks. At some point, an external financing shock and a recession are likely. However, the agency believes the country's strong sovereign, bank and household balance sheets, and economic and exchange rate flexibility provide important buffers against shocks spreading into a wider financial crisis.

The ratings changes are:

Fitch Ratings has upgraded the Republic of Turkey’s Long-term foreign currency Issuer Default Rating (IDR) to ‘BBB-’ from ‘BB+’ and the Long-term local currency IDR to ‘BBB’ from ‘BB +’. The Outlooks on the Long-term ratings are Stable. The agency has also upgraded Turkey’s Short-term foreign currency IDR to ‘F3′ from ‘B’ and the Country Ceiling to ‘BBB’ from ‘BBB-’.

http://www.zerohedge.com/news/2012-11-05/gold-and-silver-worth-14-billion-carried-baggage-turkey-iran-uae-and-middle-east-sep

Gold And Silver Worth $1.4 Billion Carried In Baggage From Turkey To Iran, UAE And Middle East in September

Submitted by Tyler Durden on 11/05/2012 08:08 -0500

Submitted by GoldCore Gold Bullion

Gold And Silver Worth $1.4 Billion Carried In Baggage From Turkey To Iran, UAE And Middle East in September

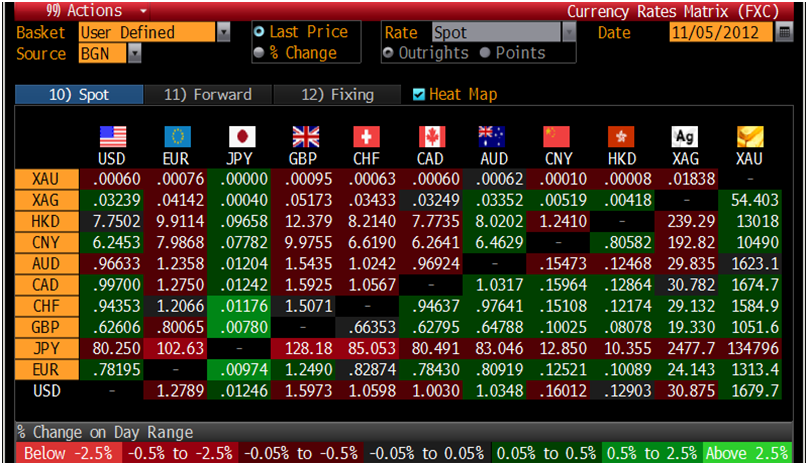

Today’s AM fix was USD 1,679.00, EUR 1,313.05, and GBP 1,050.82 per ounce.

Friday’s AM fix was USD 1,708.25, EUR 1,325.77, and GBP 1,061.29 per ounce.

Silver is trading at $31.05/oz, €24.39/oz and £19.51/oz. Platinum is trading at $1,550.32/oz, palladium at $597.38/oz and rhodium at $1,070/oz.

Gold dropped $35.70 or 2.08% in New York on Friday and closed at $1,678.00. Silver hit a low of $30.789 and finished with a loss of 4.01%. Gold and silver were down nearly 2% and 3% on the week.

Gold edged up a bit on Monday, limiting the fall after the better than expected US jobs number sent the yellow metal downward to a two month low.

If the US Fed doesn’t need to embark on more stimulus measures this may limit the yellow metal’s appeal with investors who see continuous money printing by central banks as increasing inflation and debasing currencies.

The US dollar limited gold’s rebound as it hit its highest in 2 months as investors parked money there before the US election.

This week there is an ECB policy meeting on November 8th and also a key gathering of the Chinese Communist Party.

US Economic highlights include ISM Services at 1500 GMT today. Wednesday’s data is Consumer Credit, Thursday Initial Jobless Claims and the Trade Balance and Friday Export & Import Prices, Michigan Sentiment, and Wholesale Inventories are published.

Turkey’s trade deficit has been shrinking and the country has enjoyed the best bond rally in the emerging markets this year due in part to the contributions of airline passengers transporting gold in their baggage.

Statistics from Istanbul’s 2 main airports show $1.4 billion of precious metals were registered for export in September.

Iran is Turkey’s largest oil supplier and Turkey has been paying for the oil not only with liras but also with gold bullion. Turkey exported $11.7 billion of gold and precious metals since March, when Iran was barred from the Society for Worldwide Interbank Financial Telecommunication, (Swift) making it nearly impossible for Iran to complete large international fund transfers. Of the $11.7 billion, $10.2 billion or 90% was to Iran and the United Arab Emirates, according to data on Turkey’s state statistics agency’s website.

Turkey’s current account deficit is second in the world at $77.1 billion or 10% of GDP while the US currently holds the top spot.

The problem with Turkey switching from a net importer to a net exporter of gold bullion this year is that the foreign trade data is misrepresented. Turkey’s use of precious metals is a key factor to help turn around its nation’s current junk bond rating status.

We mentioned before the government’s efforts to move the $302 billion in privately held gold, into government banks to increase the money supply in the economy.

“October data will be very critical” as the US urged Turkey not to export gold to Iran or the UAE, “which means indirectly to Iran,” Ozgur Altug, chief economist at BGC Partners in Istanbul, said in an e-mailed report yesterday.

The increase in precious metal exports accounted for three quarters of the 14% one year gain in total exports in the first nine months, Gulay Girgin, chief economist at Oyak Securities in Istanbul, said in an e-mailed report yesterday.

“If you look at Turkey’s trade figures without gold, it doesn’t look that great,” Gizem Oztok Altinsac, an economist at Garanti Yatirim, the investment unit for Turkey’s biggest bank, said by phone yesterday. “I think the analysts are paying a lot of attention to this, but at the end of the day, the bottom line is the current-account deficit, and that’s getting better.”

For breaking news and commentary on financial markets and gold, follow us on Twitter.

Gold edges higher as dollar retreats – Market Watch

Bundesbank Continues Golden Damage Control – Zero Hedge

Election outcome will have no impact on the price of gold – The Daily Reckoning

The Great Precious Metals Managed Retreat – Resource Investor

No comments:

Post a Comment