http://www.zerohedge.com/contributed/2012-10-28/supersonic-fiscal-free-fall

http://www.zerohedge.com/news/2012-10-28/what-fiscal-cliff-obama-planning-another-tax-cut-fiscal-stimulus

Supersonic Fiscal Free Fall

Submitted by Tim Knight from Slope of Hopeon 10/28/2012 18:10 -0400

Here is my take on how it will all go down. Obama wins a very close presidential election by a mere 25-35 electoral votes. The Republicans remain in control of the House 240 to 195, and the Senate ends up with a very slim Democratic majority. Basically status quo as far as party control goes, except that the Republicans feel most energized about their unexpected national resurgence, perhaps even winning the popular vote outright. Leaving BamBam with a much less intimidating mandate club in his puny little hands, then his first swing around. As it turns out, old Flintstone Mitt sure gave him one heck of a run for the money, literally I might add.

Here is my take on how it will all go down. Obama wins a very close presidential election by a mere 25-35 electoral votes. The Republicans remain in control of the House 240 to 195, and the Senate ends up with a very slim Democratic majority. Basically status quo as far as party control goes, except that the Republicans feel most energized about their unexpected national resurgence, perhaps even winning the popular vote outright. Leaving BamBam with a much less intimidating mandate club in his puny little hands, then his first swing around. As it turns out, old Flintstone Mitt sure gave him one heck of a run for the money, literally I might add.

From Slope of Hope's Sunday favorite BDI, here comes Evil Plan 93.0:

Well, my fellow Slope-a-Dopes, I've been hearing a lot about the dreaded "Fiscal Cliff" for quite some time now. So I decided to take a flying frog freelance free fall leap into the woefully written word abyss, to see if I could sort out for myself, when and how we would experience the coming sensational supersonicsplat.

First off, let's review what the term "Fiscal Cliff" actually means. In order to understand something it's usually best to know exactly what it is.

This definition from About.com:

“Fiscal cliff” is the popular shorthand term used to describe the conundrum that the U.S. government will face at the end of 2012, when the terms of the Budget Control Act of 2011 are scheduled to go into effect.

Among the laws set to change at midnight on December 31, 2012, are the end of last year’s temporary payroll tax cuts (resulting in a 2% tax increase for workers), the end of certain tax breaks for businesses, shifts in the alternative minimum tax that would take a larger bite, the end of the tax cuts from 2001-2003, and the beginning of taxes related to President Obama’s health care law. At the same time, the spending cuts agreed upon as part of the debt ceiling deal of 2011 will begin to go into effect. According to Barron's, over 1,000 government programs - including the defense budget and Medicare are in line for "deep, automatic cuts."

Now that we are facing this self inflicted sequestration law that the U.S. Congress has imposed on itself (Budget Control Act of 2011), the Government has three basic options moving forward:

1) They could simply let the stated law scheduled for the beginning of 2013 go into effect. This draconian, albeit way overdue fiscal budget policy measure, features a number of tax increases and spending cuts that are expected to weigh heavily on economic growth, which would most likely drive the economy back into a recession or even worse. The positive side of taking this bold step, would be that the deficit, as a percentage of GDP, would be cut in half.

2) They could repeal some or all of the scheduled tax increases and spending cuts, and once again raise the debt ceiling. This would of course add to the current $16 trillion mega debt deficit, and demonstrate to the world that the Nation is unwilling or unable to get its unmanageable fiscal budget under control, increasing the odds that the United States could face a crisis similar to that which is occurring in Europe.

3) They could draw up some middle of the road map, with a combination of moderate tax increases and fewer spending cuts, in a measured attempt to address the run away budget deficit over a longer period of time, which would have a more modest impact on current growth. The critical issue here is, would this approach be viewed as credible, or simply seen as just another bogus boot of the same proverbial can.

After Bambi's narrow victory, the market gives him a minor reward, and pops back up towards this years highs. However, once the big eared Asses have finished their obligatory week long celebratory partying, and the Elephants are done crying into their trunks. Suddenly seemingly out of nowhere, equities will reverse course, as the investor class starts pressing the politicians to get their act together on the long term fiscal sustainability of the United States of America.

The market wants a very viable veritable verifiable budget deal on the table now, and wants it fast. After all, we can't become gonzo gringo goners, like a bunch of goofy Greeks with greedy greased palms. The S&P will start heading below 1400 in a hurry. The pressure will brutally build big time, for a solid state long term deficit real deal resolution, before the 2011 sexy Cinderella sequester drop deadline of midnight December 31st perilously passes.

The rabid resurgent Republicans feeling their oats, will decide to use the market like a hammer on Obumer's pin head.....bam.....bam....bam. Pressing the bet for fewer tax hikes and more spending halts. The definately determined demolition crew conservatives will man handle the late night jackhammers, taking the grand bargain vote down to the eleventh hour. Sorry for all the ear piercing noise emanating from torn up Pennsylvania Avenue Mr. President, no soulfully singing merry Christmas carols with Sasha, Malia & Michele this sour Santa season.

The market will make multiple lower lows heading into bawling bare baby Jesus week at sub 1330, and approach the New Year lurching back and forth 30-40 SPX points at a clip, as the law makers continue their decidedly dangerous death deifying dueling debutant dance, nearly wiping out the entire year's stock gains. Finally, just as Cinderella is about to make her big bad ballroom exit, a marginally magnificent deal is magically struck as the clock strikes twelve, whereby the market maker mavens then surge the intensely ignited indices right back over 1370. Happy New Year you seriously stressed Slopers!

All is well again in America's forever fiat fairyland...........or is it.............stay tuned for a superstitious supersonic shit storm in 2013...........Evil Plan 93.0 man the terrifying turbo torpedoes.

BDI SOH's Idiot Savant

http://www.zerohedge.com/news/2012-10-28/what-fiscal-cliff-obama-planning-another-tax-cut-fiscal-stimulus

What Fiscal Cliff? Obama Planning Another "Tax Cut" Fiscal Stimulus

Submitted by Tyler Durden on 10/28/2012 19:56 -0400

http://www.zerohedge.com/news/2012-10-25/guest-post-fiscal-cliff-and-demographic-drag

and......

http://www.zerohedge.com/news/2012-10-25/presidential-election-preview-1-timeline-and-fiscal-cliff-flowchart

and .......

http://www.zerohedge.com/news/2012-10-15/reminder-why-fiscal-cliff-compromise-not-coming-any-time-soon

Since it would appear that QEternity has ostensibly failed in its main goal of pushing the stock market higher (and mortgage rates lower), the White House seems to be scrambling. Obama administration officials have concluded that the economy, while improved (apparently), is still fragile enough to warrant another bout of stimulus. The same old kitchen sink is being thrown at the problem as they are now resorting to the same fiscal stimulus that has also failed time and time again (as we noted here). AsWaPo strawmans reports the White House is discussing the idea of a tax cut that it believes will lift American's take-home pay and boost a still-struggling economy (citing people familiar with the administration's thinking).

Once again we expect 'economists' to come up with counter-factual forecasts.

We can't help but get the terrible feeling of deja vu here (paging Christine Romer). Electioneering? for sure; Will we hear "We have a plan"; of course; but in reality for this to make any sense (in the debt-deleveraging balance sheet recession that we find ourselves in), we must wipe from our minds for one moment the looming fiscal cliff (that our politicians seem stuck with irreconcilable differences), the debt-ceiling/deficit/AAA downgrade debate, and the utter failure of linear-Keynesian model forecasts for stimulus effects in the past.

Via Washington Post:

The White House is weighing the idea of a tax cut that it believes would lift Americans’ take-home pay and boost a still-struggling economy, according to people familiar with the administration’s thinking, as the presidential candidates continue battling over whose tax policies would do more for the country.Obama administration officials have concluded that the economy, while improved, is still fragile enough that it may need another bout of stimulus. The tax cut could replace the payroll tax cut championed by President Obama in 2011 and 2012, which was designed as a buffer against economic shocks such as the financial crisis in Europe and high oil prices. It expires at year’s end.The administration’s work on the proposal comes as each presidential candidate is under intense pressure to demonstrate he has the better tax plan....Any new tax cut would require congressional approval after the election. Administration officials have said in the past that the payroll tax cut should be allowed to expire at the end of the year, and the White House has not said publicly whether it is considering an alternative.A growing number of voices have been calling on the White House and Congress to extend the payroll tax cut, which has meant about $1,000 in extra take-home pay annually for the average family. Thesesupporters include Harvard professor Lawrence H. Summers, formerly Obama’s top economic adviser, and Rep. Chris Van Hollen of Maryland, the top Democrat on the House Budget Committee.“If we’re going to look at anything, we should be looking at a payroll tax cut or other measures that have a similar effect,” Van Hollen said in an interview.The White House declined to confirm whether it is exploring a new policy, with an official saying late Friday only that “there’s no specific new proposal such as this one at this time.”The payroll tax cut... is considered particularly effective by economists because it shows up in every paycheck.Economists say it may have boosted economic growth each year by about 1 percent, helping create hundreds of thousands of jobs....some lawmakers, particularly Democrats, don’t like the idea of using a tax that ordinarily goes to fund Social Security. Any lost revenue as a result of the payroll tax cut has been offset by additional taxpayer money. Still, powerful interest groups such as the AARP have criticized using the payroll tax cut for short-term stimulus.The administration is looking to replicate the effect of the payroll tax cut without relying on Social Security revenue, sources said. The people familiar with the deliberations declined to be named because the discussions are ongoing.One option is to have employers reduce how much in federal taxes is withheld from employees’ paychecks, up to a certain amount per year.This was precisely the type of tax cut provided in the 2009 stimulus bill, which sought to jolt the economy out of recession through $831 billion in increased spending, aid to states and tax cuts.The tax credit was limited to individuals with an adjusted gross income of $95,000 or less and couples with an adjusted gross income of $190,000 or less. Economists say that low- and moderate-income people have the greatest propensity to spend any additional income....Obama is calling on lawmakers to immediately renew the Bush tax cuts for families earning less than $250,000 per year, while allowing the tax cuts for those making more to expire. Republicans refuse to decouple the tax cuts.Read that again - and we dare you not to laugh! This is Keynesian-based Einsteinian madness at its very best...One report that apparently has scared the administration into action is the following from the National Association Of Manufacturers - Fiscal Shock.Fiscal Shock Conclusion:The inaction and stalemate in Washington will continue to weigh heavily on consumer and business confidence as the year winds down. Even if the Administration and Congress resolve the uncertainty before the end of the year, economic growth already has sustained significant damage. The short-term fiscal contraction set for 2013 will trigger long-run durable losses to GDP, productivity and real income.Even under the best-case scenario, it will take almost a decade for economic activity and employment to reach the levels they would have reached without a fiscal shock. While the spending cuts and tax increases reduce the federal deficit and debt, the substantial negative consequences of not addressing the end-of-year fiscal crisis before it happens will be devastating.

http://www.zerohedge.com/news/2012-10-25/guest-post-fiscal-cliff-and-demographic-drag

Guest Post: The Fiscal Cliff and Demographic Drag

Submitted by Tyler Durden on 10/25/2012 14:13 -0400

Submitted by Charles Hugh-Smith ofOfTwoMinds blog,

Federal spending is heading for a fiscal cliff while millions of retirees are starting to draw Federal benefits.

We know two things about the future:

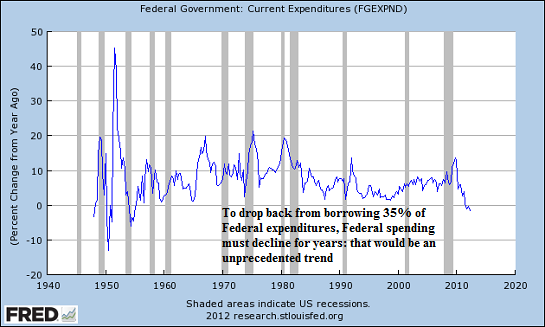

1. Borrowing 35% of Federal expenditures every year is unsustainable. (2012 Federal budget = $3.8 trillion, Federal deficit = $1.3 trillion, 34.2% of every Federal dollar spent is borrowed)

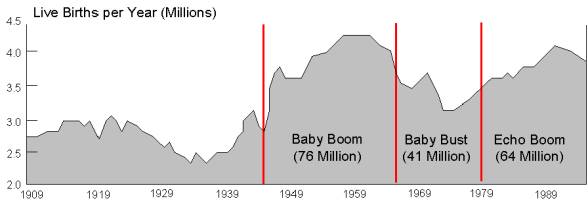

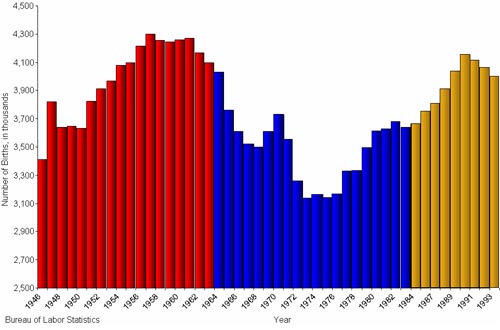

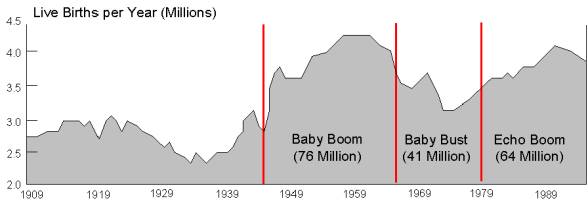

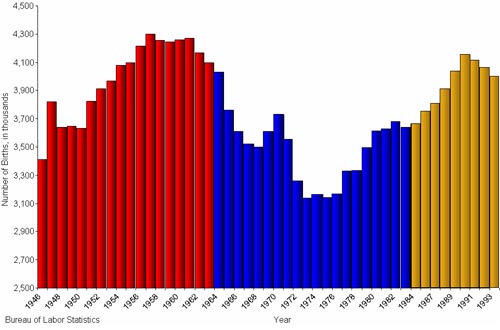

2. The Baby Boom generation of 75+ millionmay be working longer, but they are also retiring en masse, joining the ranks of Social Security and Medicare beneficiaries at the rate of 10,000 per day, a flood that will not ebb until the late 2020s. (The Baby Boom is generally defines as those born between 1946 and 1964, though many quibble with the 1964 date. The choice of parameter doesn't change anything about the consequences.)

The first Boomers qualified for early Social Security retirement (age 62) in 2008 and for Medicare (age 65) in 2011. The biggest cohort years (almost 4 million a year) will start reaching early retirement (62) in 2014 and Medicare (65) in 2017. The number of people entering these programs will rise every year from 2014 to 2020, and then remain constant at 4+ million a year until 2025.

Here are three views of the Baby Boom for context:

Frequent contributor B.C. calls this enormous transfer of people from wage earners to retirees drawing government benefits the demographic drag, as it will reduce consumer spending, wages and taxes while dramatically increasing Federal spending.

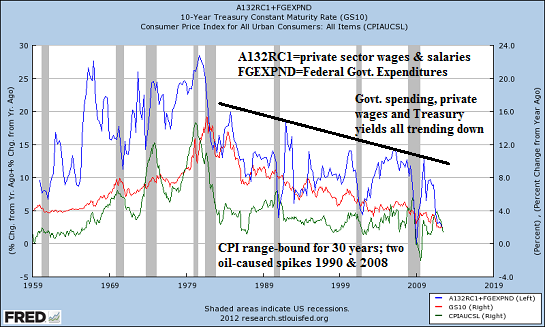

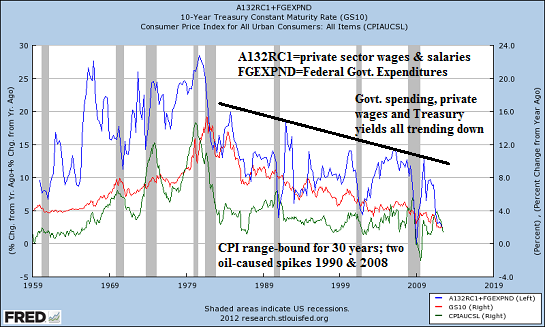

Here is a chart courtesy of B.C. that overlays year-over-year changes in private-sector wages+Federal expenditures, Treasury bond yields and the consumer price index (CPI). Note the downtrend in wages+Federal spending and Treasury yields, and the range-bound CPI.

Here is B.C.'s commentary:

The sum of the year-over-year change rates of wages and Federal spending is deeply into historical recessionary/depression territory. With the demographic drag and fiscal cliff constraints ahead, who knows how slow the rate will be hereafter, and for how long.

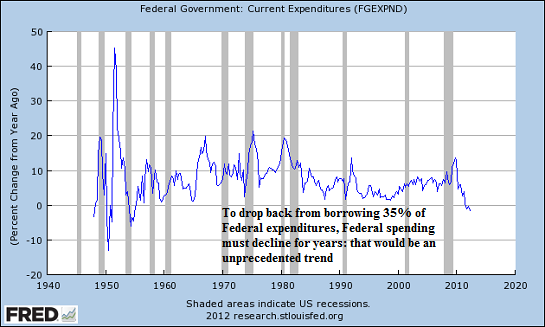

B.C. also submitted this year-over-year chart of Federal expenditures. Despite the unprecedented size of Federal deficits, both in dollars and as a percentage of peacetime budgets, the recent spurt of spending growth was lower than previous spikes.

To reduce the deficit--i.e. address the "fiscal cliff"--Federal spending will have to decline for many years. Such an extended period of declining Federal spending would be unprecedented.

This raises the obvious question: if Federal spending must decline, then where is the money going to come from to fund 75 million retirees? Calling the Central Bank of Mars: Greetings, Martian friends. Please send us 10 trillion quatloos every year from now until 2029. We promise to pay you in 2030 (heh).

and......

http://www.zerohedge.com/news/2012-10-25/presidential-election-preview-1-timeline-and-fiscal-cliff-flowchart

Presidential Election Preview 1: Timeline And Fiscal Cliff Flowchart

Submitted by Tyler Durden on 10/25/2012 09:40 -0400

The fast-approaching US presidential election is perhaps one of the most important in recent history, with Goldman noting that the fate of near-term US economic growth, medium-term US fiscal stability (and, with it, the US sovereign debt rating) and monetary policy hinging on the outcome. In an effort to provide as succinct a view of these potential events, we present a four-part series previewing the big day. Below, we lay out the key dates and likely paths to resolution of the "fiscal cliff"; the most important and most imminent challenge that the elected candidate will be forced to face just after the election.

and .......

http://www.zerohedge.com/news/2012-10-15/reminder-why-fiscal-cliff-compromise-not-coming-any-time-soon

A Reminder Of Why A Fiscal-Cliff Compromise Is Not Coming Any Time Soon

Submitted by Tyler Durden on 10/15/2012 22:30 -0400

CEOs suggest a major reason they are not spending is 'policy uncertainty', politicians blame the other side for stifling growth because of 'policy uncertainty', and brokers, bankers, & economists whine that the only reason the Dow is not at Bernanke's goal-seek'd 36,000 is the 'policy uncertainty'. If only the 'fiscal cliff' issue would go away - we'd all have a pony and life could go on. Sorry to burst that bubble; as we noted here,the market is priced for a total compromise and earnings expectations appear to imply a full fiscal cliff resolution in Q4. The hope remains that'even if we were to go off the fiscal cliff, the political reaction will be swift and vengeful and we will see a 'V'-shaped recovery - so do not worry'. There are two small (ok, very large) problems with that thesis: 1) the self-reinforcing shadow-banking collateral squeeze that would occur as asset values dump again and liabilities remain; and 2)the record-high polarization among our political class. Something to ponder as earnings outlooks continue to drop...

No comments:

Post a Comment