Tweets......

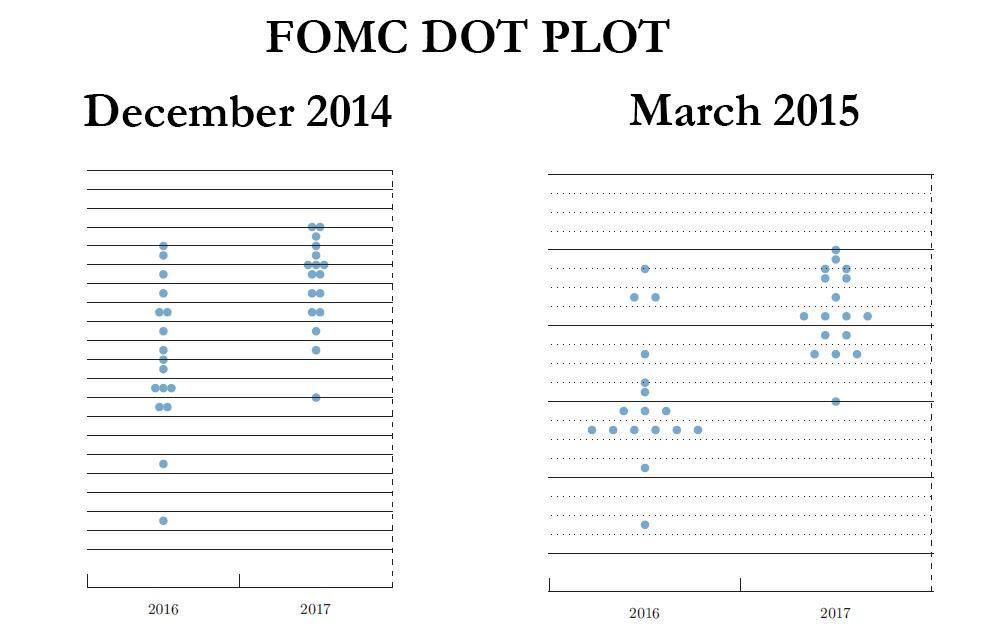

Before and After

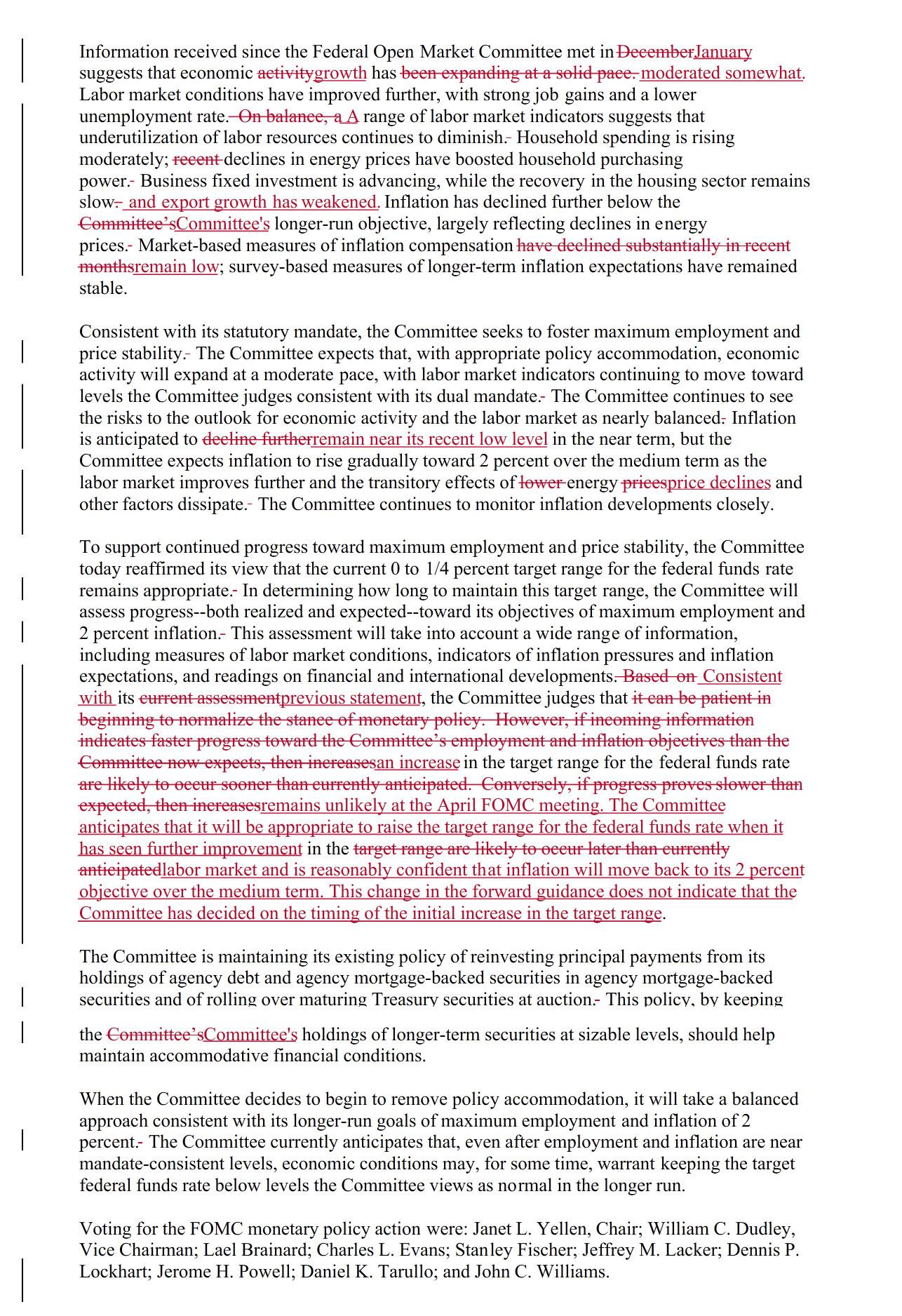

"Flexible" Fed Loses "Patience"; Cuts Growth, Inflation Forecasts (Again) http://www.zerohedge.com/news/2015-03-18/flexible-fed-loses-patience-cuts-growth-inflation-forecasts-again …

Fed Growth Cut Unleashes Panic Buying Of Everything; Dollar Plunges Most Since 2009 http://www.zerohedge.com/news/2015-03-18/fed-growth-cut-unleashes-panic-buying-everything-dollar-plunges-most-2009 …

Macro funds bye bye

bid ask spread in EURUSD now wider than Ruble pairs in December. Shut it down

Currency Market Pulverized As Dollar Implodes After Close http://www.zerohedge.com/news/2015-03-18/currency-market-pulverized-dollar-implodes-after-close …

Dollar Flash Crashes: Currency Market Pulverized As Dollar Implodes After Close http://www.zerohedge.com/news/2015-03-18/currency-market-pulverized-dollar-implodes-after-close …

Here Is Why The Fed Can't Hike Rates By Even 0.25% http://www.zerohedge.com/news/2015-03-18/here-why-fed-cant-hike-rates-even-025 …

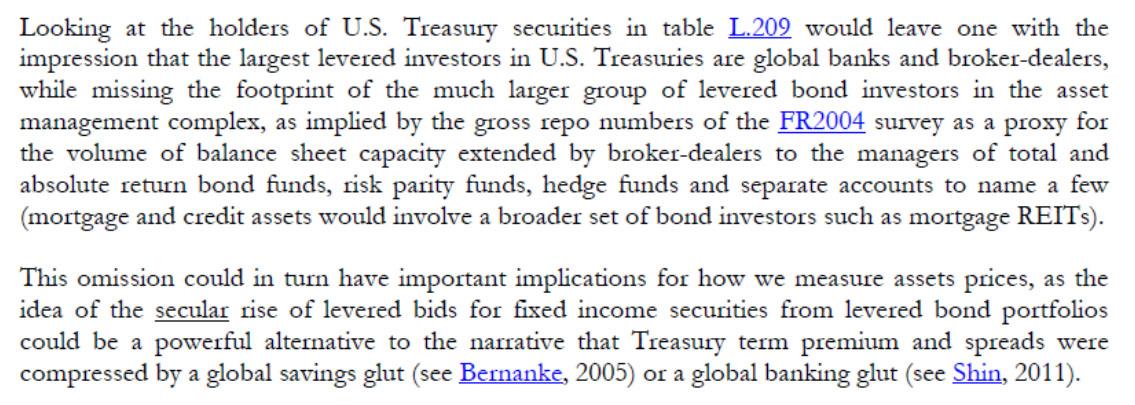

Think you understand Treasuries? Think again.

No comments:

Post a Comment