Tweets....

Everyone passes - FED STRESS TEST SHOWS ALL 31 BANKS EXCEED MINIMUM REQUIREMENTS

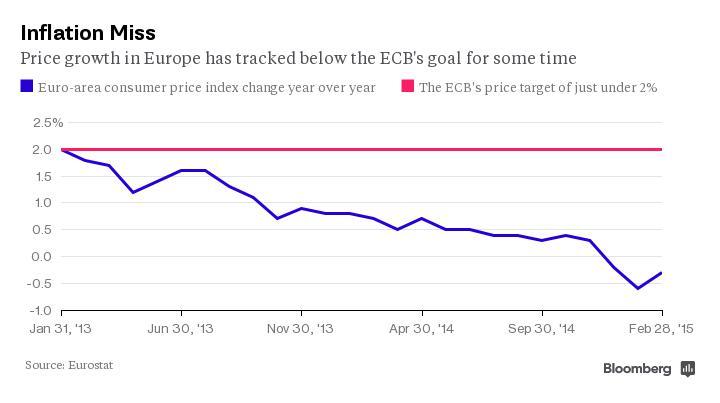

As a reminder, the "worst case" of the ECB stress test did not assume deflation http://www.zerohedge.com/news/2014-10-26/chart-crushes-all-credibility-ecbs-latest-stress-test …

fred walton retweeted

Important: ESM Regling: Greece Could Plunge Into Deficit In 2015; primary surplus "melting away" - Handelsbaltt

http://goo.gl/2H6wZx ”

fred walton retweeted

i

nteresting theory that ECB is actually helping Greece with liquidity crunch. Read last para http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_05/03/2015_547930 … via @ekathimerini

fred walton retweeted

#Greece parl speaker Constantopoulou says Syriza & ANEL parl groups "will not tolerate a deviation for our pre-election pledges".

@TheStalwart @Frances_Coppola @edwardnh @OpenEurope @albertjohn @YanniKouts Nice summary of the Public Sector Purchase Program aka QE...

fred walton retweeted

ECB's QE Q&A includes 6 occurrences of the word "flexbility". http://www.ecb.europa.eu/mopo/liq/html/pspp-qa.en.html …

@TheStalwart @Frances_Coppola @edwardnh @OpenEurope @albertjohn @YanniKouts Nice summary of the Public Sector Purchase Program aka QE...

"Varoufakis said that [he] has an alternative plan to plug financing shortfall without specifying what it was" http://www.bloomberg.com/news/articles/2015-03-04/greece-struggles-to-make-debt-math-work-amid-bailout-standoff …

Greece cannot rely on ECB to dodge funding crunch, Draghi says http://dlvr.it/8rLbb9

Draghi: ECB asked Eurogroup to make sure recapitalisation fund for Greek banks be readily available to face any sudden negative contingency

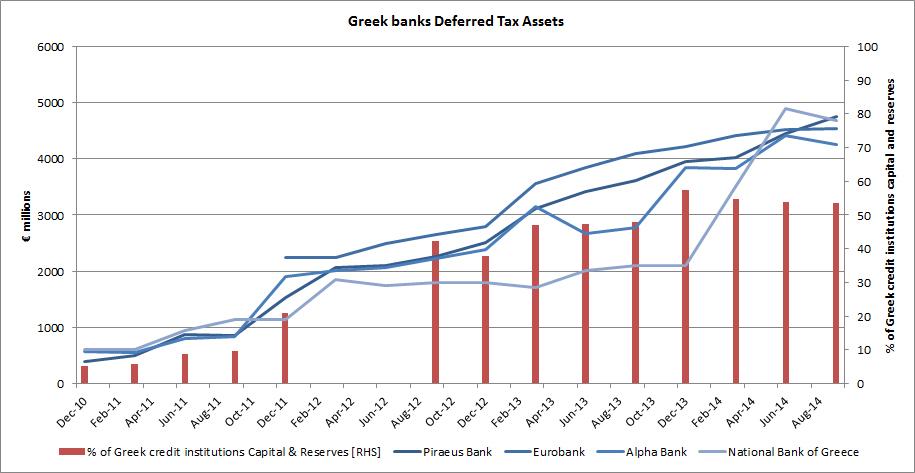

Are #Greece banks solvent? Very high level of deferred tax assets as share of capital... http://www.forbes.com/sites/raoulruparel/2015/02/20/are-greek-banks-insolvent/ …

Draghi: "Greek banks at the present time are solvent"

Varoufakis: "Greece already is bankrupt"

- Discuss

Draghi: One condition for ELA is that it be given to solvent banks with adequate collateral. Greek banks are solvent at the moment.

UKRAINE GOVT SAYS GDP MAY FALL 5.5% TO 11.9% THIS YR: STATEMENT. Is that the upside case?

Draghi: Purchases not supposed to take place for countries under a bailout programme during review period.

Draghi: Condition to resume ECB financing of Greek banks is process which suggests successful completion of review be put in place fast.

Draghi: Will not buy bonds yielding below deposit rate

Why did ECB allow Samaras to raise t-bill by €3bn just after his election but won't let Tsipras do the same? Looks inconsistent. @YanniKouts

RT @fwred: Reference to Art.123 means ECB still against extending the cap on #Greece T-bills as a solution 2 cover short-term funding needs

Draghi reminds EU Treaties forbid ECB monetary financing - i.e. ECB printing money to buy government debt.

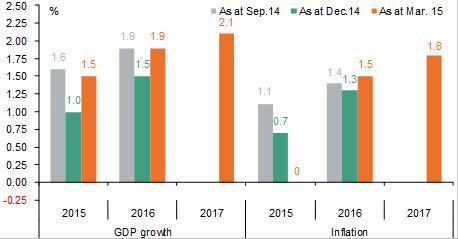

ECB sees 2015 inflation at 0.0% from previous 0.7%, 2016 inflation at 1.5% from previous 1.3%, 2017 inflation at 1.8%.

Hugo Dixon retweeted

RT @fwred: Upbeat #ECB staff forecasts for GDP: 1.5% in 2015 (up from 1.0%), 1.9% in 2016 (up from 1.5%), 2.1% in 2017 (first estimate).

Hugo Dixon retweeted

Draghi: Combined monthly purchases of public and private sector securities will amount to €60bn.

Draghi: #ECB to launch QE March 9

Euro Slides, Futures Flat Ahead Of Mario Draghi's Press Conference And Q€ Cheat Sheet http://www.zerohedge.com/news/2015-03-05/euro-slides-futures-flat-ahead-mario-draghis-press-conference-and-q%E2%82%AC-cheat-sheet …

Greek Gov't Looking More and More Like the Tower of Babel | http://GreekReporter.com http://shar.es/1WMGnz via @sharethis

Germany's Steinmeier. "Enormous loss of prestige for EU" if can't manage Greek crisis, force Grexit. Exactly

http://www.handelsblatt.com/my/politik/international/frank-walter-steinmeier-scharfe-worte-verhindern-das-sterben-nicht/11459794.html …

#Greece The seasonally adjusted unemployment rate in December 2014 was 26.0% compared to 27.3% in December 2013 and 25.9% in November 2014

#Greece FinMinistry rejects press reports that EwG discussed Gr proposals yesterday. Also rejects reports that troika is coming to Athens

Frances Coppola retweeted

Italy GDP

We're entering the most definitive period of the Greek crisis. Here's why: http://shar.es/1WMbzh #Greece #euro #ECB #IMF

Fmr finmin Venizelos to be investigated over withholding, possibly altering #LagardeList (@Kouti_Pandoras) http://ht.ly/JXtlM about time

European politicians send mixed messages over third Greek bailout http://openeurope.org.uk/daily-shakeup/growing-discontent-berlin-juncker-commission/#section-1 …

Open Europe Berlin blog: FAZ’s @PhilipPlickert says 3rd bailout for #Greece would act as “stimulus package” for #AfD http://blog.openeuropeberlin.de/2015/03/das-dritte-griechen-hilfspaket-kommt.html …

Here's #EURUSD since Sept 14 - steady downward march, now at lowest level for 11 yrs ahead of #ECB #QE

German Factory Orders (Jan) M/M -3.9% vs Exp. -1.0% (Prev. 4.2%, Rev. 4.4%) (@RANsquawk) - large fall due to large order previous month

AUSTRIA'S PFANDBRIEFBANK SAYS IT WILL SERVICE ALL OF ITS DEBT: BBG

#ECB raises #ELA ceiling by €500mln. Greek banks can now access €68.8bn of emergency liquidity, BBG reports citing website Capital.gr.

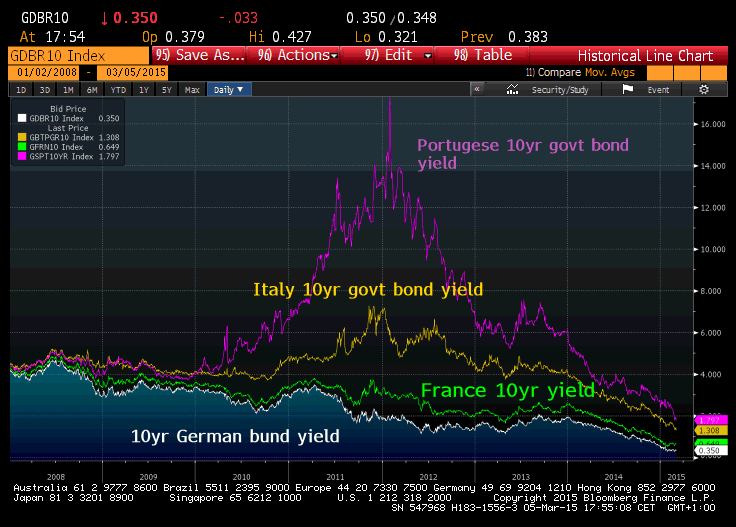

Hidden govt debt monetization by ECB? #Spain secures new low 3-, 5yr borrowing costs at auction. Sold 5yr at 0.52%

#Turkey Lira has plunged to fresh low vs Dollar as Ankara has attacked CenBank in an effort to force rates lower.

Ouch. “@barnejek: This is THE table to look at when you are interested in Turkey. Worse than Ukraine... ”

#Euro just fallen to session low of $1.1026. Acc to Citi leveraged players and real money investors are net sellers.

Why QE when data has beaten? Will there be enough assets to buy? Questions for #ECB's Draghi. http://www.bloomberg.com/news/articles/2015-03-05/five-questions-for-mario-draghi …

Manos Giakoumis

Manos Giakoumis

fred walton

fred walton

No comments:

Post a Comment