Tweets.....

What do you do on a train to Carlisle? Why, write about the Austrian Fannie Mae, of course: http://www.forbes.com/sites/francescoppola/2015/03/28/the-austrian-fannie-mae/ … h/t @barnejek

#Greece | Brussels Group mtng not going well, @tovimagr reports. If no breakthrough until 2moro, Greek Econ Cabinet mtng Sunday pm critical

Greek reform list met with skepticism by Troika. http://news.xinhuanet.com/english/2015-03/28/c_134106099.htm …

#Greece | Brussels Group discussions positive, although there are disagreements ~Greek gov't official

Greek banking system continues to bleed deposits, at least €3bn leaves in "first weeks" of March http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_27/03/2015_548608 …

The Greek Analyst retweeted

#Greece govt's reform list under discussion with Brussels Group sees 13 major actions, @EFSYNTAKTON reports:

1.… http://twishort.com/MgUhc

The Greeks, money already stuffed under mattresses, may learn their fate this weekend

http://qz.com/371908/the-greeks-money-already-stuffed-under-mattresses-may-learn-their-fate-this-weekend …

#Syriza did a great job so far: Greek Reform Deadlock Creates Extra €10-20bn Fund Gap, BBG reports citing Der Spiegel. #Grexit

Fitch cuts #Greece's rating to CCC, 3 notches above default, on uncertainty over aid release. http://reut.rs/1xH34W3

Fitch:it is likely Eurogroup will want the #Greece govt 2 demonstrate they have implemented some part of this list before funds r disbursed

Fitch: We expect that govt will survive the current liquidity squeeze without running arrears on debt obligations #Greece

Andreas Lubitz wanted do something 'that would change the system', ex-girlfriend says http://on.rt.com/204foo

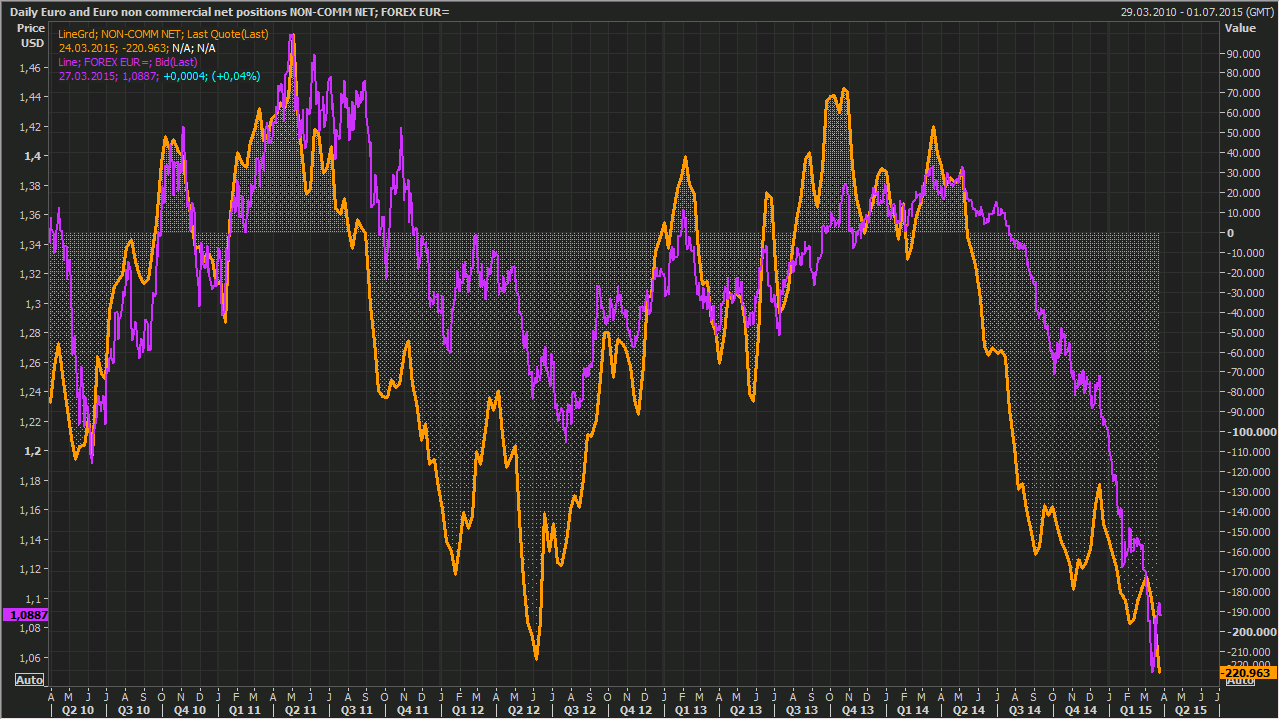

#Euro positioning hits an all-time short. Specs increase thier net shorts to 220,963 contracts http://bloom.bg/1H7rtUi

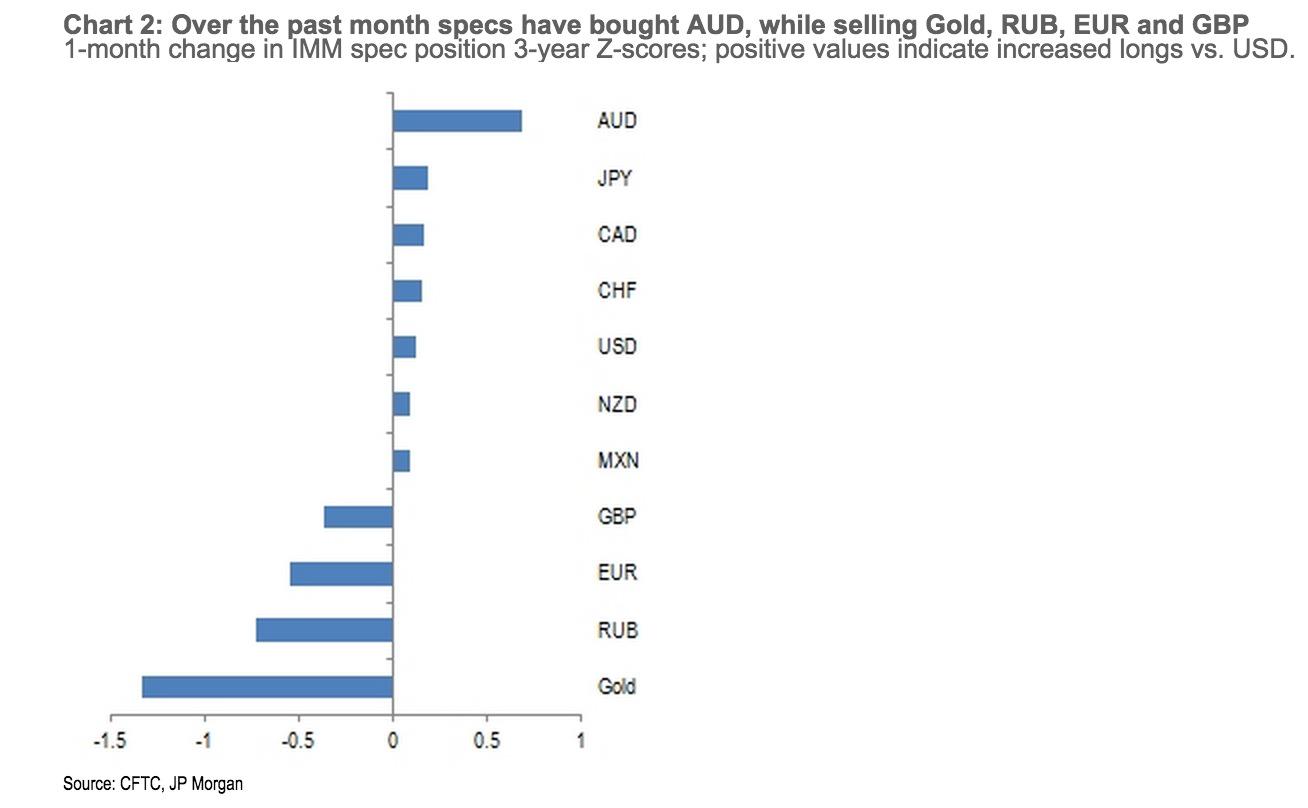

Specs are close to the shortest GBP they have been since August 2013. (via JPM)

Sareb perdió 73 millones con sus 'negocios paralelos' en 2014 http://www.economiadigital.es/es/notices/2015/03/sareb-perdio-73-millones-con-sus-negocios-paralelos-en-2014-68178.php#.VRXlOmwE-wM.twitter … via @EconoDigital

@jeuasommenulle @Frances_Coppola @barnejek Might not be long ? http://www.economiadigital.es/es/notices/2015/03/la-burocracia-mantiene-en-el-limbo-las-perdidas-de-sareb-en-2014-68489.php …

China's Banks Cut Dividends Amid Rising Bad Loans, Expectations Of Falling NIM http://www.zerohedge.com/news/2015-03-27/chinas-banks-cut-dividends-amid-rising-bad-loans-expectations-falling-nim …

No comments:

Post a Comment