Tweets...

The Greek Analyst retweeted

#ECB's Coeure: Average maturity of bonds bought by #ECB is 9 Years. #Italy's 30yr yields drop to record low.

The Greek Analyst retweeted

Executive member of Cyprus Central Bank resigns accusing Governor of blackmailing MPs with their loans @MarketElf http://www.stockwatch.com.cy/nqcontent.cfm?a_name=news_view&ann_id=218962 …

Crazy Dollar: Dollar Index DXY briefly hits 100 in early trade for first time since 2003. Now retreats from 12yr high

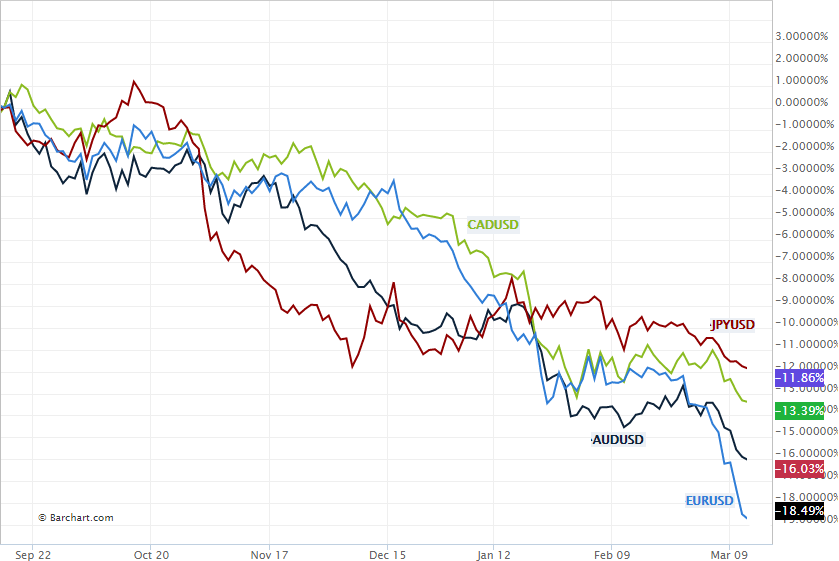

Chart: 6 months of currency declines against USD; JPY: -11.9%, CAD: -13.4%, AUD: - 16.0%, EUR -18.5% -

Edward Hugh retweeted

IMF new 4y programme for Ukraine has "debt operation" as "key consideration to proceed with the first program review" http://www.imf.org/external/np/sec/pr/2015/pr15107.htm …

Edward Hugh retweeted

Peter Spiegel retweeted

Varoufakis on Mega: Schäuble told me I lost the confidence of the German government. I told him I never had it http://www.faz.net/aktuell/wirtschaft/eurokrise/griechenland/varoufakis-ezb-nimmt-uns-die-luft-zum-atmen-13478371.html …

Crazy Dollar or melting Euro? At current downward pace (56 pips/day) #Euro will hit zero on Jul22 this year.

#Euro briefly drops below $1.05 for 1st time since Jan03 as Draghi snaps up bonds. Now $1.0511 http://bloom.bg/18cWj2d

Korea Hops on Rate-Cut Bandwagon With Move to Record Low. BOK is 24th cenbank that has cut rates this year. http://bloom.bg/1E7j9ky

Currency Carnage Continues In Asia, EURUSD 1.04 Pushes DXY Over 100 http://www.zerohedge.com/news/2015-03-12/currency-carnage-continues-asia-eurusd-104-pushes-dxy-over-100 …

zerohedge retweeted

BREAKING: Gisele Bundchen demands to be paid in dollars.

China's Latest Spinning Plate: 10 Trillion In Local Government Debt http://www.zerohedge.com/news/2015-03-11/chinas-latest-spinning-plate-10-trillion-local-government-debt …

As a reminder, the BOJ stepped in to stabilize the market 143 times, with 76% of interventions to prevent selling http://www.zerohedge.com/news/2015-03-11/how-boj-stepped-143-times-send-japanese-stocks-soaring …

If you don't know what Düsselhyp is, you might want to check it out. @SchreiberDohms report (in German): http://www.sueddeutsche.de/wirtschaft/krisenbank-duesseldorfer-hypothenbank-droht-schieflage-1.2388336 … #GermanBanks

Loukia Gyftopoulou

Loukia Gyftopoulou

alexapostolides

alexapostolides

ACEMAXX ANALYTICS

ACEMAXX ANALYTICS

No comments:

Post a Comment