Zero Hedge....

Oil Prices Collapse After OPEC Keeps Oil Production Unchanged

Submitted by Tyler Durden on 11/27/2014 - 09:58

But, but, but... all the clever talking heads said they wil have to cut...

*OPEC KEEPS OIL PRODUCTION TARGET UNCHANGED AT 30M B/D: DELEGATE

WTI ($70 handle) and Brent Crude (under $75 for first time sicne Sept 2010) are collapsing... as will US Shale oil company stocks and bonds (and thus all of high yield credit) tomorrow.

19 US Shale Areas That Are Suddenly Endangered, "The Shale Revolution Doesn't Work At $80"

Submitted by Tyler Durden on 11/26/2014 - 15:41

“Everybody is trying to put a very happy spin on their ability to weather $80 oil, but a lot of that is just smoke... The shale revolution doesn’t work at $80, period.”

For The World's Largest Rig Operator, The "Recovery" Is Now Worse Than The Post-Lehman Crash

Submitted by Tyler Durden on 11/26/2014 - 12:24

The last time the world's largest oil and gas drill operator, Seadrill , halted its dividend payment was in 2009, shortly after Lehman had filed and the world was engulfed in a massive depression. Retrospectively, this made sense: the company was struggling not only with depressionary oil prices, but with a legacy epic debt load as can be seen on the chart below. So the fact that the stock of Seadrill collapsed by 20% today following a shocking overnight announcement that it had once again halted its dividend despite what is a far lower debt load than last time, indicates that when it comes to energy companies, the current global economic "recovery" - if one believes the rigged US stock market - is actually worse than the Lehman collapse.

US "Secret" Deal With Saudis Backfires After Oil Minister Says US Should Cut First

Submitted by Tyler Durden on 11/26/2014 - 08:21

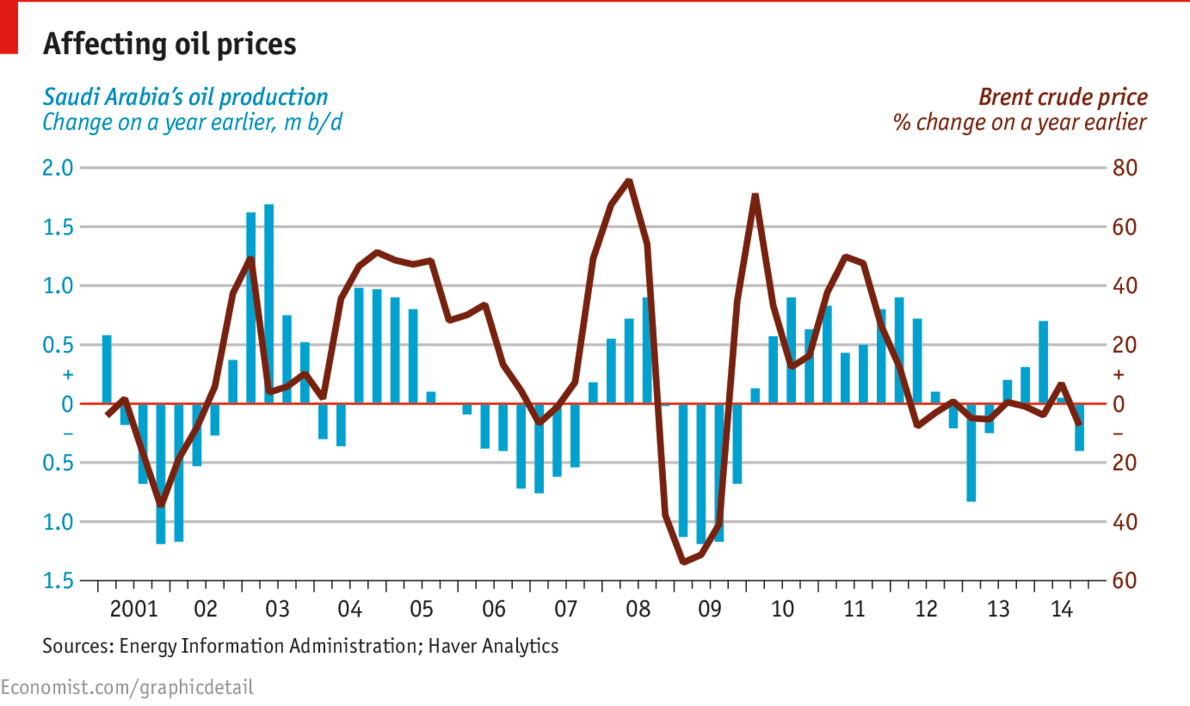

Who could have seen this coming? With oil prices holding at 4-year lows, heavily pressuring around half of US shale production economics, the "secret" US deal (see here and here) with Saudi Arabia to crush Russia via oil over-supply in a slumping demand world appears to be backfiring rapidly for John Kerry and his strategery team. Capable of withstanding considerably lower prices for longer, Saudi Arabia's oil minister Ali al-Naimi proclaimed "no one should cut production and the market will stabilize itself," adding rather ominously (for the US economy and HY default rates), "Why should Saudi Arabia cut? The U.S. is a big producer too now. Should they cut?" With prices expected to drop to $60 on no cut, maybe the "unequivocally good" news for the US economy from lower oil prices should berethunk.

Chart of the day.... and key comment from 11/26 !

Chart of the day.... and key comment from 11/26 !

http://www.zerohedge.com/news/2014-11-26/us-secret-deal-saudis-backfires-after-oil-minister-says-us-should-cut-first

****

Which led the Saudi Minister to comment...

"Why should Saudi Arabia cut? The U.S. is a big producer too now. Should they cut?"

* * *

Tweets.....

WTI Crude Crashes Below $70 For First Time Since June 2010 http://www.zerohedge.com/news/2014-11-27/wti-crude-crashes-below-70-first-time-june-2010 …

Bad day for Russia: EU agrees new sanctions and OPEC agrees to keep current production target, oil price falling

OPEC Votes Not To Cut Production, Oil Prices Plummet http://www.businessinsider.com/opec-votes-not-to-cut-production-oil-prices-plummet-2014-11 … via BI

OPEC Policy Ensures U.S. Shale Crash, Russian Oil Tycoon Says: OPEC policy on crude production will probably e... http://binged.it/1yg2Otd

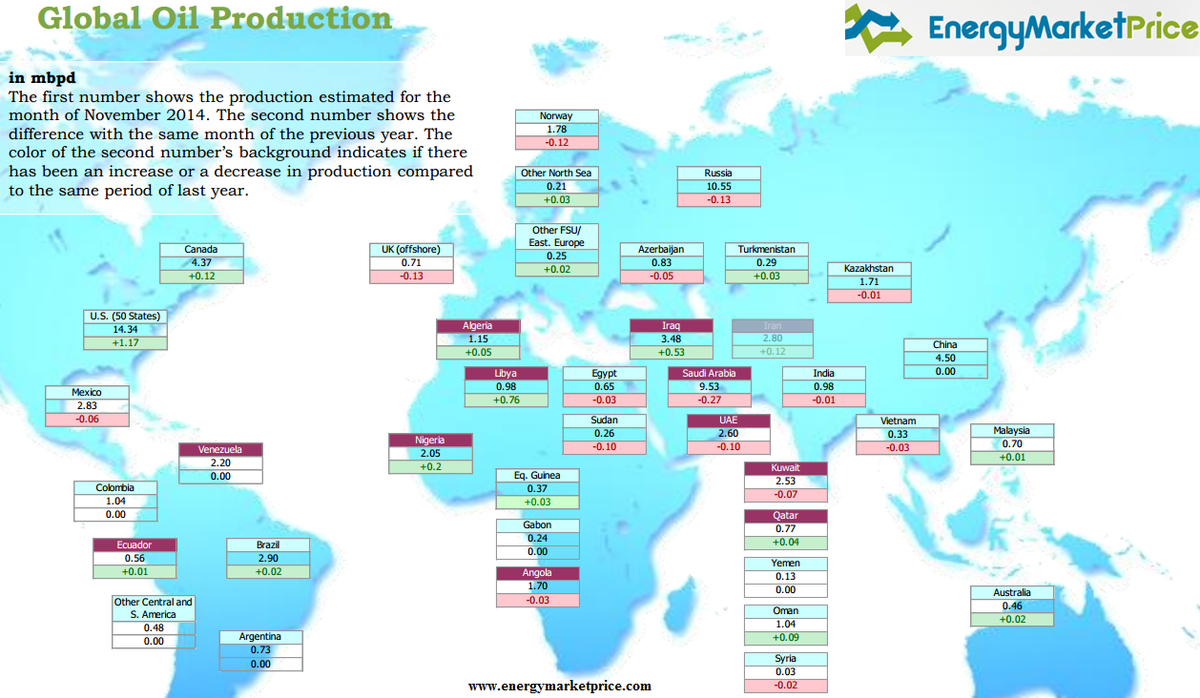

High risk #oil prices could slide to $60/barrel if #OPEC doesn't cut production - November #global oil production

Will be surprised if #Gulf members agree to cut production at #OPEC meeting if it means handing market share to shale producers.

OPEC Meet - Iraq Oil Minister says, Crude has $65-$70/BBL price floor. U.S. Shale has added to surplus in oil market.

OPEC Meet - Iran Oil Minister says, OPEC meeting won't be very difficult.

10:16:16 DJFN *DJ Venezuela Foreign Minister: Would Agree With Decision to Cut 5% of OPEC Production

OPEC: Reuters - #Venezuela foreign minister says oil market over-supplied by 2 million bpd

VENEZUELA FM : WILL PROPOSE #OPEC CUTS OUTPUT

Is $60 the new $100? @petromatrix says numerous mentions of $60 per barrel out of Vienna suggests it cd be the new floor. #OPEC #oil

#Oil falls $2 to 4-year low as #OPEC production cut seen unlikely. Price wars ahead? http://reut.rs/11X05Ky

Oil Price Plunge Suggests An OPEC Cut Is Unlikely - Oil prices fell on Thursday ahead of a major meeting of OPEC m... http://ow.ly/2RgMx1

Can Vladimir Putin save Saudi Arabia's sheikhs from the glut of oil? http://gu.com/p/43k2e/tw

#OPEC analyst: “Don’t get a deal, we’ll probably be at $70 soon, and we could go down into the 60s.” http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/oil-could-plummet-below-70-if-opec-fails-to-cut-production/article21783113/

Sanctions Watch

Sanctions Watch

DiscoTonio

DiscoTonio

World Wide News!

World Wide News!

zak brophy

zak brophy  Bloomberg TV India

Bloomberg TV India  Madz

Madz  Sri Jegarajah

Sri Jegarajah  shoby

shoby  Emiko Terazono

Emiko Terazono  Global Markets Forum

Global Markets Forum  Bleutrade

Bleutrade

The Guardian

The Guardian

Anders Östlund

Anders Östlund

Donatella Rovera

Donatella Rovera

No comments:

Post a Comment