11/30/14.....

24 HOUR GOLD

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif) |

Predictable rout after the Swiss vote !

Top news story

Swiss voters look set to reject gold initiative: SRF: ZURICH (Reuters) - Swiss voters looked set to reject two... http://bit.ly/128XaOY

11/29/14...

Sputnik.....

http://sputniknews.com/business/20141129/1015298030.html

© SPUTNIK. VITALIY BEZRUKIKH

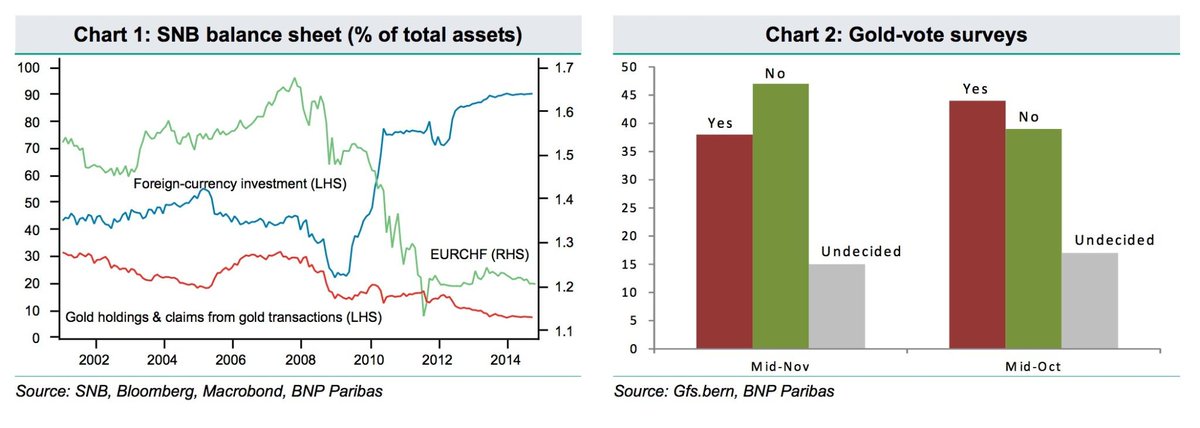

If passed, the referendum would force the Swiss National Bank to convert a fifth of its assets into gold and repatriate all of its overseas bullion.The Swiss National Bank has recently disclosed where it stashes its 1,040 tons of gold: almost a third is kept overseas, in Britain and Canada.

According to Swiss National Bank President Thomas Jordan, 70 per cent of the reserves are stored in Switzerland, 20 per cent with the Bank of England and 10 per cent with the Bank of Canada.

The vote would also require the Swiss central bank to buy large amounts of gold from the global market in order to transform their currency to a gold-based standard.

According to Business Insider, a “yes” result in the referendum will mean the SNB cannot sell its gold reserves and that the nation’s gold must be stored physically in Switzerland. In addition, it would stipulate that at least 20 percent of the bank’s assets must be held in gold.

Experts predict that the national currency may see a steep rise in value, which could put deflationary pressure on Switzerland. This would have a potentially profound affect on the nation’s economy, which relies heavily on exports, as a rise in the value of the franc against the Euro would make Swiss products more expensive. Some are suggesting that the SNB introduce a negative interest rate to counter this issue.

In case the SNB meets the requirements, Switzerland may become the third largest holder of gold reserves after the United States and Germany.

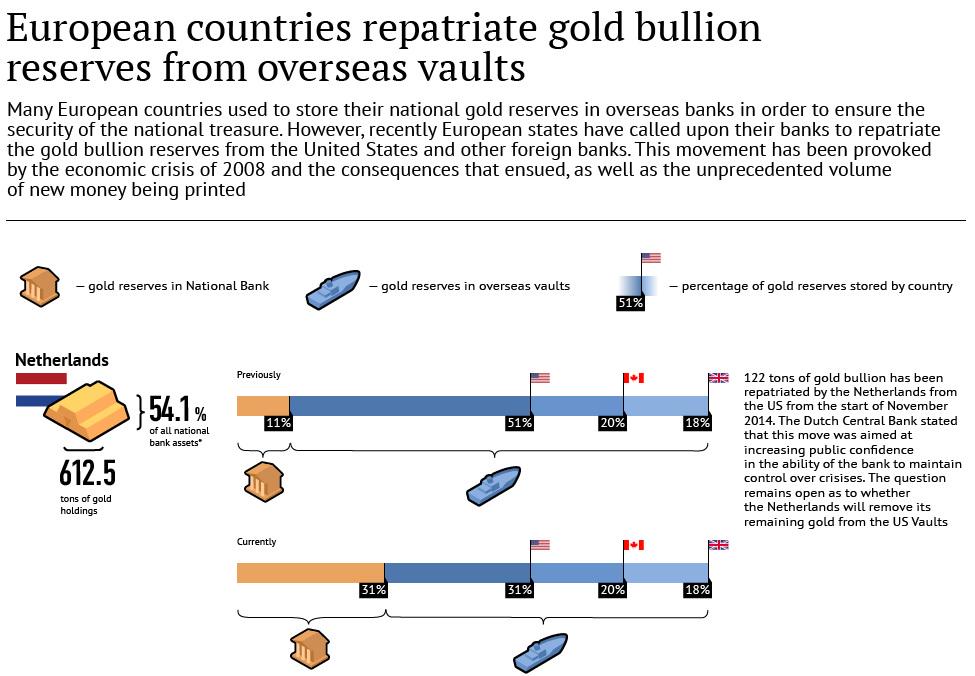

European countries repatriate gold bullion reserves from overseas vaults

GATA....

French National Front leader understands the gold fraud, von Greyerz tells KWN

Submitted by cpowell on Sat, 2014-11-29 17:27. Section: Daily Dispatches

5:25p GMT Saturday, November 29, 2014

Dear Friend of GATA and Gold:

Swiss gold fund manager Egon von Greyerz, a leader of the Swiss Gold Initiative, tells King World News today that the French National Front leader, Marine Le Pen, understands the fraud of gold leasing and that public audits of national gold reserves will expose the exaggeration of the world's gold supply. An excerpt from the interview is posted at the KWN blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

LBMA takes stake in gold, platinum, palladium benchmarks

Submitted by cpowell on Sat, 2014-11-29 17:16. Section: Daily Dispatches

By Jan Harvey

Reuters

Friday, November 28, 2014

Reuters

Friday, November 28, 2014

LONDON -- The London Bullion Market Association will take on intellectual property rights for gold, platinum, and palladium price benchmarks when they are launched by new administrators, the industry body said on Friday.

London's bullion price benchmarks, or fixes, were transformed this year as regulatory scrutiny and accusations of market manipulation made price-setting among a handful of banks untenable.

ICE Benchmark Administration was named as the new operator of what will become the LBMA Gold Price early next year after the previous precious metals benchmarks, known as the fixes, were wound down. ...

... For the remainder of the report:

Gold pricing power moving from paper to physical markets, Kiener tells CNBC

Submitted by cpowell on Sat, 2014-11-29 17:12. Section: Daily Dispatches

5:10p GMT Saturday, November 29, 2014

Dear Friend of GATA and Gold:

Gold pricing power is moving from the price-manipulating Comex paper market to physical markets in Asia, according to Juerg Kiener, managing director of Swiss Asia Capital in Singapore, who spoke with CNBC in a four-minute interview Thursday. Kiener also discussed the attempts by European central banks to repatriate their gold from the United States. The interview can be viewed here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Zero Hedge: GOFO signals growing shortage of real metal

Submitted by cpowell on Fri, 2014-11-28 19:58. Section: Daily Dispatches

3p ET Friday, November 28, 2014

Dear Friend of GATA and Gold:

Zero Hedge reports today that the gold forward offered interest rate has sunk to the lowest level in history, signifying that market participants are paying to borrow gold and that there is a great shortage of metal among commercial and central banks.

Zero Hedge writes: "But how, the skeptics will ask, is it possible that there is a shortage of gold when gold prices keep tumbling day after day? Simple: The shortage involves gold 'available' in the repo market -- that is, gold that already has been rehypothecated one or more times. Keep in mind that central banks rarely if ever purchase gold outright in the open market, unlike Russia, of course (and perhaps China), which has been engaging in an unprecedented gold-buying spree over the past year. The rest of the commercial and central banks merely rely on shadow banking conduits and other repo channels to satisfy their gold needs, all of which merely demand the 'presence' of synthetic if not actual physical gold. ...

"Then there is of course the wild card of the Swiss gold referendum on Sunday, where a yes vote would lead to the immediate collapse of the gold price suppression mechanism as the swap-based gold shortage breaks through merely shadow conduits and finally makes its way to the real market. Which, of course, is why it will never be allowed to happen."

Indeed, one has to wonder if the attack on gold in the futures markets this week has been engineered to encourage Swiss voters to keep trusting their central bank.

Zero Hedge's commentary is headlined "Gold Shortage, Worst In 21st Century, Sends 1-Year GOFO To Lowest Ever ... and India Just Made It Worse" and it's posted here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Mike Kosares: Oil's drop threatens credit crisis but not gold

Submitted by cpowell on Fri, 2014-11-28 19:30. Section: Daily Dispatches

2:30p ET Friday, November 28, 2014

Dear Friend of GATA and Gold:

Oil's price decline can't be welcomed by central banks trying to engineer inflation, USAGold's Mike Kosares writes today, and it even threatens to trigger another credit crisis. Kosares writes: "Those who are driving gold down today on the commodities exchanges forget that gold's rise over the last several years (despite its interim downside correction) has been in response to disinflation, not inflation -- and demand remains strong due to concerns about the stability of the financial system itself."

Kosares' commentary is headlined "Quick Take on Oil's Collapse, Gold's Drop, and Worries about an Oil-Driven Credit Collapse" and it's posted at USAGold here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

In surprise move, India drops gold import obstruction

Submitted by cpowell on Fri, 2014-11-28 16:22. Section: Daily Dispatches

By Suvashree Choudhury and Meenakshi Sharma

Reuters

Friday, November 28, 2014

Reuters

Friday, November 28, 2014

MUMBAI, India -- India has scrapped a rule mandating traders to export 20 percent of all gold imported into the country, in a surprise move that could cut smuggling and raise legal shipments into the world's second-biggest consumer of the metal after China.

Along with a record duty of 10 percent, India introduced the so-called 80:20 import rule tying imports to exports of jewellery last year to bring down inbound shipments and narrow the current account deficit that had hit a record.

"It has been decided by the Government of India to withdraw the 20:80 scheme and restrictions placed on import of gold," the Reserve Bank of India said today, without giving a reason for the change in the rule. ...

... For the remainder of the report:

Alasdair Macleod: Russia's monetary solution

Submitted by cpowell on Fri, 2014-11-28 13:21. Section: Daily Dispatches

8:22a ET Friday, November 28, 2014

Dear Friend of GATA and Gold:

Russia's best strategy in the currency war being waged against it by the West may be link the ruble to gold, GoldMoney research Alasdair Macleod writes today.

Macleod writes: "By adopting a gold exchange standard Russia is almost certain to raise fundamental questions about the other G20 nations' approach to gold, and to set back western central banks' long-standing attempts to demonetise it. It could mark the beginning of the end of the dollar-based international monetary system by driving currencies into two camps: those that can follow Russia onto a gold standard and those that cannot or will not. The likely determinant would be the level of government spending and long-term welfare liabilities, because governments that leech too much wealth from their populations and face escalating welfare costs will be unable to meet the conditions required to anchor their currencies to gold. Into this category we can put nearly all the advanced nations, whose currencies are predominantly the dollar, yen, euro and pound. Other nations without these burdens and enjoying low tax rates have the flexibility to set their own gold exchange standards should they wish to insulate themselves from a future fiat currency crisis."

Macleod's commentary is headlined "Russia's Monetary Solution" and it's posted at GoldMoney here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Deutsche Bank shutters precious metal trading amid cuts

Submitted by cpowell on Fri, 2014-11-28 13:03. Section: Daily Dispatches

By Elisa Martinuzzi and Nicholas Comfort

Bloomberg News

Friday, November 28, 2014

Bloomberg News

Friday, November 28, 2014

Deutsche Bank, Europe's biggest investment bank, is exiting physical trading of precious metals as it scales back its securities unit to improve returns.

Some parts of the business may be shifted to other units of Deutsche Bank and the firm will continue to trade derivatives linked to precious metals, a London-based spokesman for the bank said in a statement today.

Global banks are exiting or paring back their commodities arms as regulators order them to increase buffers for potential trading losses and avoid a repeat of taxpayer-funded rescues. Deutsche Bank's move is part of an overhaul of its securities unit to help boost profitability and increase the proportion of capital on its balance sheet by shrinking assets. ...

... For the remainder of the report:

Koos Jansen: Dutch wanted their gold back more than the Bundesbank did

Submitted by cpowell on Thu, 2014-11-27 15:15. Section: Daily Dispatches

10:14a ET Thursday, November 27, 2014

Dear Friend of GATA and Gold:

Bullion Star market analyst and GATA consultant Koos Jansen today analyzes how the Netherlands central bank managed to repatriate of a lot of its gold stored with the U.S. government even as the German Bundesbank has not managed to. Jansen's conclusion: The Dutch central bank actually wanted its gold returned, the Bundesbank not so much. His commentary is headlined "Dutch Gold Repatriation: Why, How, And When" and it's posted at Bullion Star here:

Jansen also calls attention to a Citigroup report scoffing at the Swiss Gold Initiative, a report disparaging gold as "a 6,000-year-old bubble" that yet may continue for another 6,000 years, which would make the bubble seem rather iron-clad. Jansen's commentary on the Citigroup report is headlined "Citibank Releases Anti-Gold Report Before Swiss Gold Referendum" and it's posted at Bullion Star here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Curbing central banks is the point of the Swiss Gold Initiative

Submitted by cpowell on Wed, 2014-11-26 22:50. Section: Daily Dispatches

Ron Paul and Other Gold Bugs Keep Fingers Crossed for Swiss Vote that Could Add $50 to Price of Gold

By Debbie Carlson

The Guardian, London

Wednesday, November 26, 2014

The Guardian, London

Wednesday, November 26, 2014

Swiss voters are likely to reject a November 30 referendum to force the Swiss National Bank to hold 20% of its reserves in gold, but you can't crush a gold bug.

Die-hard gold fans -- known as "gold bugs" -- aren't discouraged by the impending rejection of the Swiss people for their favorite metal. ...

... The Swiss National Bank and the major Swiss political parties are against the measure. On Sunday SNB president Thomas Jordan said the referendum would restrict the flexibility of the bank to respond to crises.

Restricting the power of banks is the point, say the bugs.

"It is about time that the power of central banks is contained and regulated. The Swiss gold initiative, while not ideal, would be a starting point," said Marc Faber, editor of the Gloom, Boom, Doom Report, a newsletter. ...

Guillermo Barba, a Mexican independent analyst and blogger at Inteligencia Financiera Global, or Global Financial Intelligence, says the negative sentiment from politicians is influencing voters.

"It's bad propaganda's fault. Opponents are scaring voters. Swiss bureaucrats are acting like lackeys of the American establishment," he said.

"The current economic, financial and monetary situation in the world is terrible. Debts keep growing and growing, all major central banks including the Fed are still printing money like crazy and keeping artificially low interest rates," Barba said. He predicts "a global mess."

"When that happens, believe me, you will want to have your gold as close to you as possible," Barba said. ...

... For the remainder of the report:

Tocqueville's Hathaway examines comprehensive market manipulation by central banks

Submitted by cpowell on Wed, 2014-11-26 13:27. Section: Daily Dispatches

8:28a ET Wednesday, November 26, 2014

Dear Friend of GATA and Gold:

In his new letter for investors, Tocqueville Gold Fund manager John Hathaway focuses on market manipulation by central banks and their agent investment banks.

Hathaway writes: "A new generation of central bankers has transformed the staid portfolios of their predecessors -- consisting of inactive pools of currency reserves and bullion -- into hedge funds that trade derivatives, futures contracts, and instruments too exotic to comprehend. The Chicago Mercantile Exchange invites them to do so. In Exhibit 1 of a January 29 letter to the Commodity Futures Trading Commission, the CME Group offered special discounts to central banks "outside of the United States" to trade such un-central-bank items as stock index futures, foreign exchange, agricultural commodities, energy, and of course precious metals. It would appear that the CME has become an important interchange by which central bankers can tweak the financial markets to affect the thought process and behavior of the investor."

Hathaway adds: "The modern-day central banker trades with counterparties that are giant commercial banks with derivative books of disturbing scale and complexity. It seems impossible that these commercial exposures could be constructed and maintained without the knowledge and complicity of the official sector. For example, Deutsche Bank, already a defendant in 1,000 lawsuits, claims derivative exposure that is 20 times the GDP of Germany and five times that of the entire eurozone. It is not a great leap to suggest that central-bank traders and their megabank opposites -- spawn of the same gene pool, schooled in the same institutions, career paths intertwined, frequenters of the same conferences, and just a speed-dial away -- are ideologically indistinguishable and intellectually and morally corrupt in equal proportion. We applaud the efforts of litigators and plaintiffs already in process and those in the wings, and look forward to the depositions and discoveries yet to come."

Hathaway's letter is titled "Monetary Techtonics" and it's posted at the King World News blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Central banks selling far more gold than is being mined, Embry tells KWN

Submitted by cpowell on Tue, 2014-11-25 23:31. Section: Daily Dispatches

6:30p ET Tuesday, November 25, 2014

Dear Friend of GATA and Gold:

Western central banks, Sprott Asset Management's John Embry tells King World News today, are "selling infinitely more paper gold than is being dug out of the ground, and it's being done specifically to hold down the price," creating enormous short positions that could spark a strong increase in the price. But, Embry adds, "There aren't any real markets in anything anymore." An excerpt from the interview is posted at the KWN blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Guardian's report on Swiss Gold Initiative quotes GATA consultant Koos Jansen

Submitted by cpowell on Tue, 2014-11-25 23:14. Section: Daily Dispatches

Fears That 'Dangerous' Switzerland Referendum Could Spark Gold Rush

By Kate Connolly

The Guardian, London

Tuesday, November 25, 2014

The Guardian, London

Tuesday, November 25, 2014

The Swiss like referendums: there were 11 last year and there have been nine more this year, on subjects ranging from who pays for abortions to whether the state should buy a certain type of new fighter aircraft.

This Sunday there are three more, but one has attracted more attention than most – because there are fears that if it wins majority support it could trigger a worldwide gold rush.

Five million Swiss voters are to decide on a proposal that would force the central bank to triple its gold reserves. The vote is being watched closely by financial markets and governments around the world. ...

"Gold continues to trigger impetuous and irrational reactions in many people," Sergio Rossi, professor of macroeconomics and monetary economics at Fribourg University, told the Swiss news agency SDA.

Others say it has rather emphasised the flaws in the monetary system. "It has shown just how unsustainable the debt-based monetary system we have is," said Koos Jansen, an Amsterdam-based gold analyst for the Singaporean precious-metal dealer BullionStar.

"The Swiss initiative is merely part of a increasing global scramble toward gold and away from the endless printing of money. Huge movements of gold are going on right now. Recently the Dutch repatriated 122 tons, Germany is bringing home its gold from the US, while the BRIC countries are accumulating large quantities of it for their banks.

"While those behind the Swiss initiative have often been portrayed as crazy, they're merely acting out of fear that their central bank is losing control of its monetary policy, and of the Swiss franc being sucked into this currency war and losing its value," he said.

Switzerland left the gold standard only in 1999, the last country in the world to do so. "They regret what they did and want to get back to the safety of gold, especially in the current environment," Jansen added. ...

... For the remainder of the report:

French populist leader joins gold repatriation campaign

Submitted by cpowell on Tue, 2014-11-25 18:15. Section: Daily Dispatches

1:16p ET Tuesday, November 25, 2014

Dear Friend of GATA and Gold:

Marine Le Pen, leader of the populist National Front political party in France and likely France's next president if the country should last until another election, has picked up the gold repatriation issue by writing to the governor of the central bank, the Banque de France. Le Pen's letter, translated from French to English, is posted at her party's Internet site here:

An official of the central bank disclosed last year that it is secretly trading gold for its own account and for other central banks "nearly on a daily basis":

That same official said this month that central banks are managing their gold reserves "more actively" these days, while worrying more about "auditability," perhaps since the gold sometimes is construed to be in more than one place at the same time:

As their national anthem enjoins the French: Aux armes, citoyens. Formez vos bataillons -- particularly around the Banque de France.

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Miles Franklin's Holter, TF Metals Report sense trouble with Comex gold

Submitted by cpowell on Mon, 2014-11-24 18:54. Section: Daily Dispatches

1:55p ET Monday, November 24, 2015

Dear Friend of GATA and Gold:

Miles Franklin market analyst Bill Holter writes today that he sees signs that someone is trying to corner the December gold contract on the New York Commodity Exchange:

The TF Metals Report's Turd Ferguson also sees signs of strain in Comex gold:

Your secretary/treasurer doesn't pay much heed to the Comex data, figuring that any shortages of metal for delivery there can always be remedied with by a call from the uncomfortably short bullion bank to the Federal Reserve Bank of New York, imploring the latter to send over the necessary metal by dipping into whatever is left of the German Bundesbank's deposit. The Bundesbank won't mind.

But someday even the foreign custodial gold vaulted with the U.S. government may be exhausted and free markets, fair dealing among nations, and simple truth may start breaking out all over, a great day announced, if not by Comex, then by something even grander:

Gabriel will warn you.

Some early morn you

Will hear his horn,

Rooty-tootin'.

Some early morn you

Will hear his horn,

Rooty-tootin'.

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Tweets......

European countries repatriate gold bullion reserves from overseas vaults – infographic http://bit.ly/1tpvImD

Federal Reserve Confirms Biggest Foreign Gold Withdrawal In Over Ten Years http://www.zerohedge.com/news/2014-11-29/federal-reserve-confirms-biggest-foreign-gold-withdrawal-over-ten-years …

“@Goldbroker_INT: Egon von Greyerz on the Swiss Gold Referendum #goldinitiative #gold #Swiss https://www.youtube.com/watch?v=aWrrzVqYMeE&feature=youtu.be&t=5m51s …”

Gold lower ahead of #Gold initiative. Citigroup says Swiss Gold vote makes no sense at all. http://www.bloomberg.com/news/2014-11-27/citigroup-seeing-gold-as-bitcoin-says-swiss-vote-makes-no-sense.html …

BNP on Swiss Gold initiative where polls show "no" in lead: 'Surveys ahead of Swiss referenda have been wrong before'

SPDR Gold Assets extend slump to lowest since Sep2010.

Jesse's Café Américain: China Takes Out Another 52.5 Tonnes of Gold For th... http://jessescrossroadscafe.blogspot.com/2014/11/china-takes-out-another-525-tonnes-of.html?spref=tw …

China flows more than a swift river..

Jesse's Café Américain: Fed Earmarked Gold Holdings Continued to Decline I... http://jessescrossroadscafe.blogspot.com/2014/11/fed-custodial-gold-continued-to-decline.html?spref=tw …

Drip , drip , drip ...

•HP•|BAMIKOLE|

•HP•|BAMIKOLE|

Sputnik

Sputnik

Holger Zschaepitz

Holger Zschaepitz

fred walton

fred walton

No comments:

Post a Comment