https://www.bullionstar.com/article/chinese%20gold%20demand%201063%20mt%20ytd

Chinese Gold Demand 1063 MT YTD

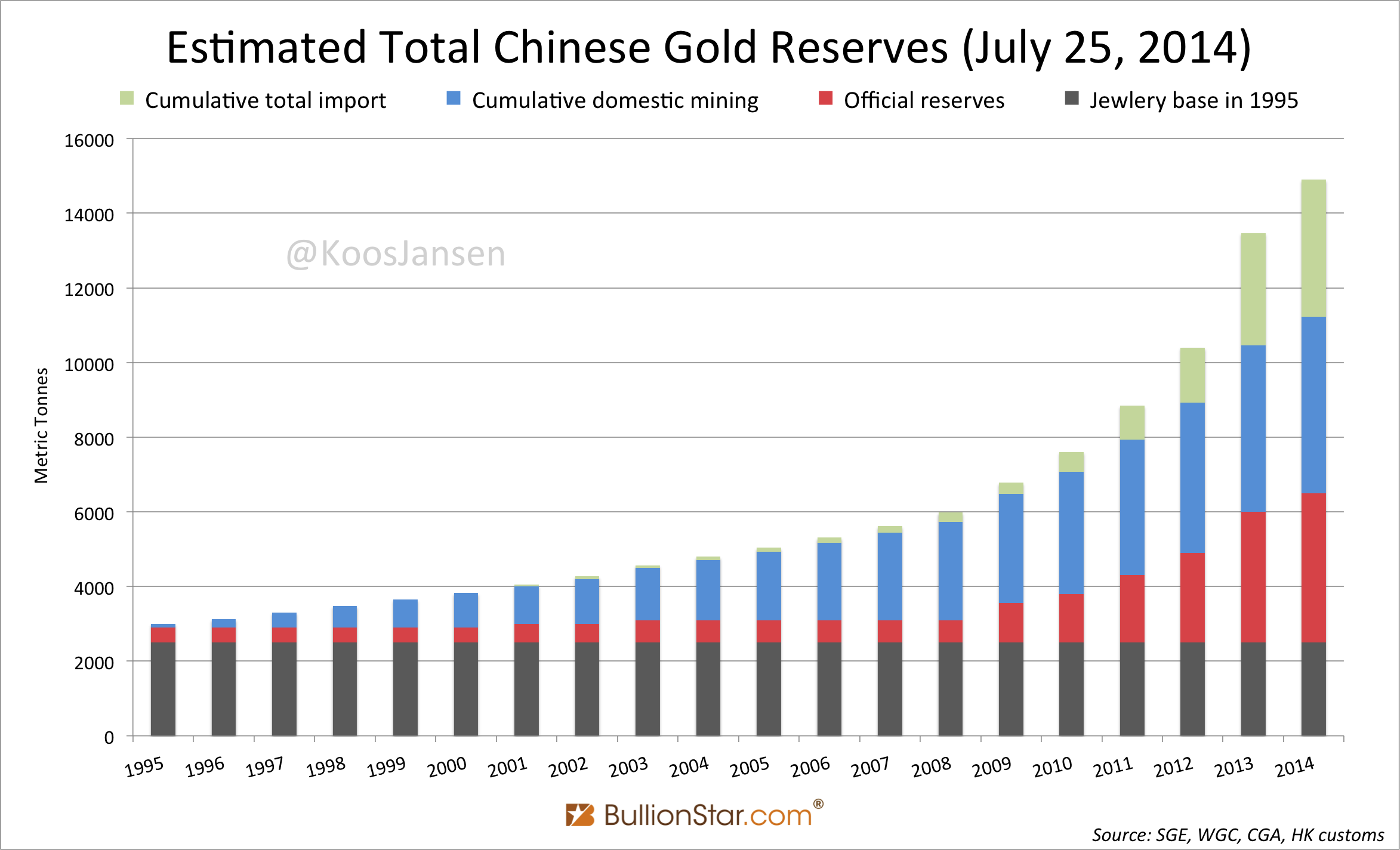

Total Chinese Reserves Reach 15,000 Tonnes

Published: 04-08-2014 20:32

For ten days I've been on vacation without internet, hence I missed one week to report on withdrawals from the Shanghai Gold Exchange (SGE) vaults. Here is a quick overview of what happened in the Chinese gold market in week 29 and 30.

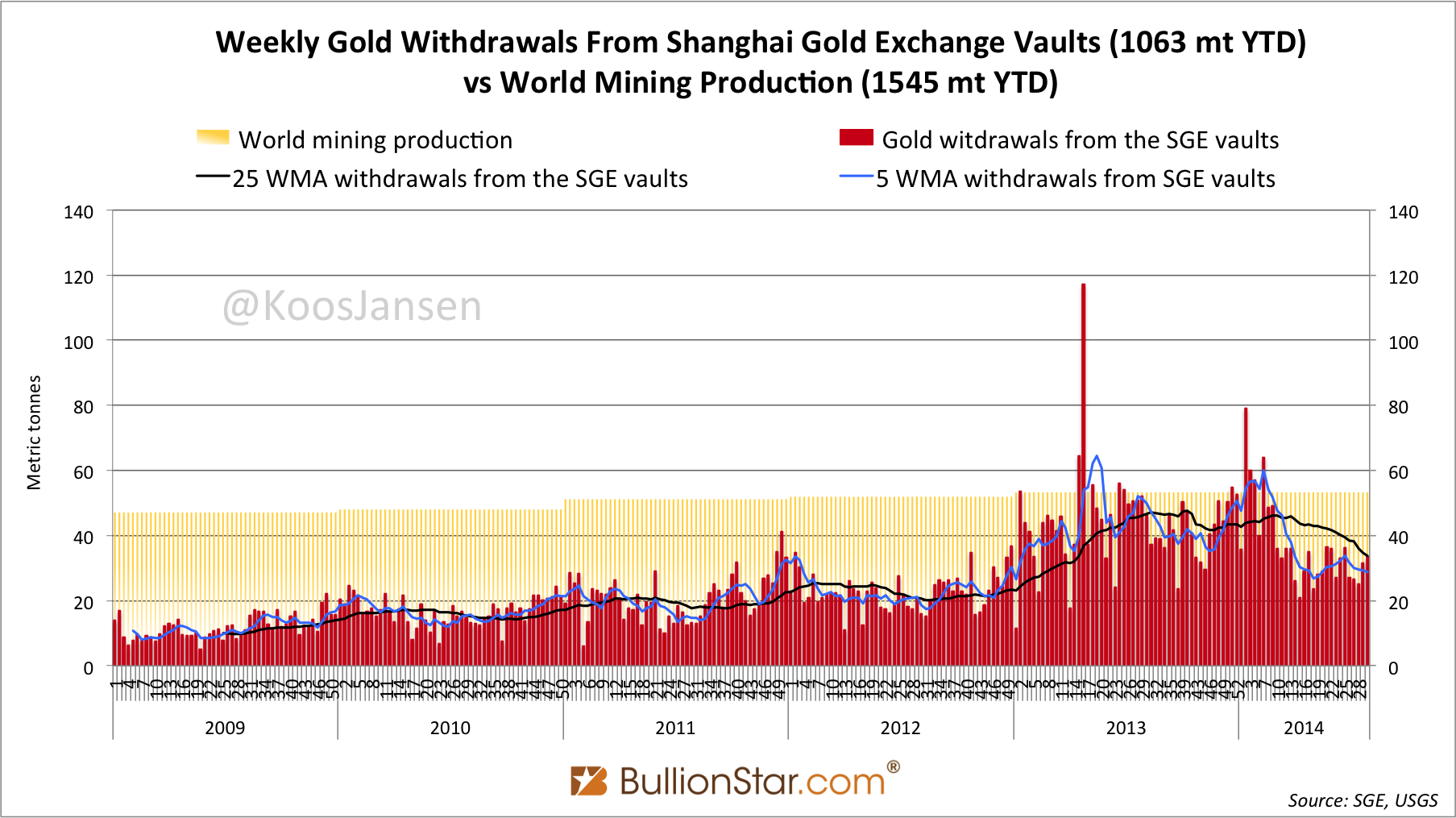

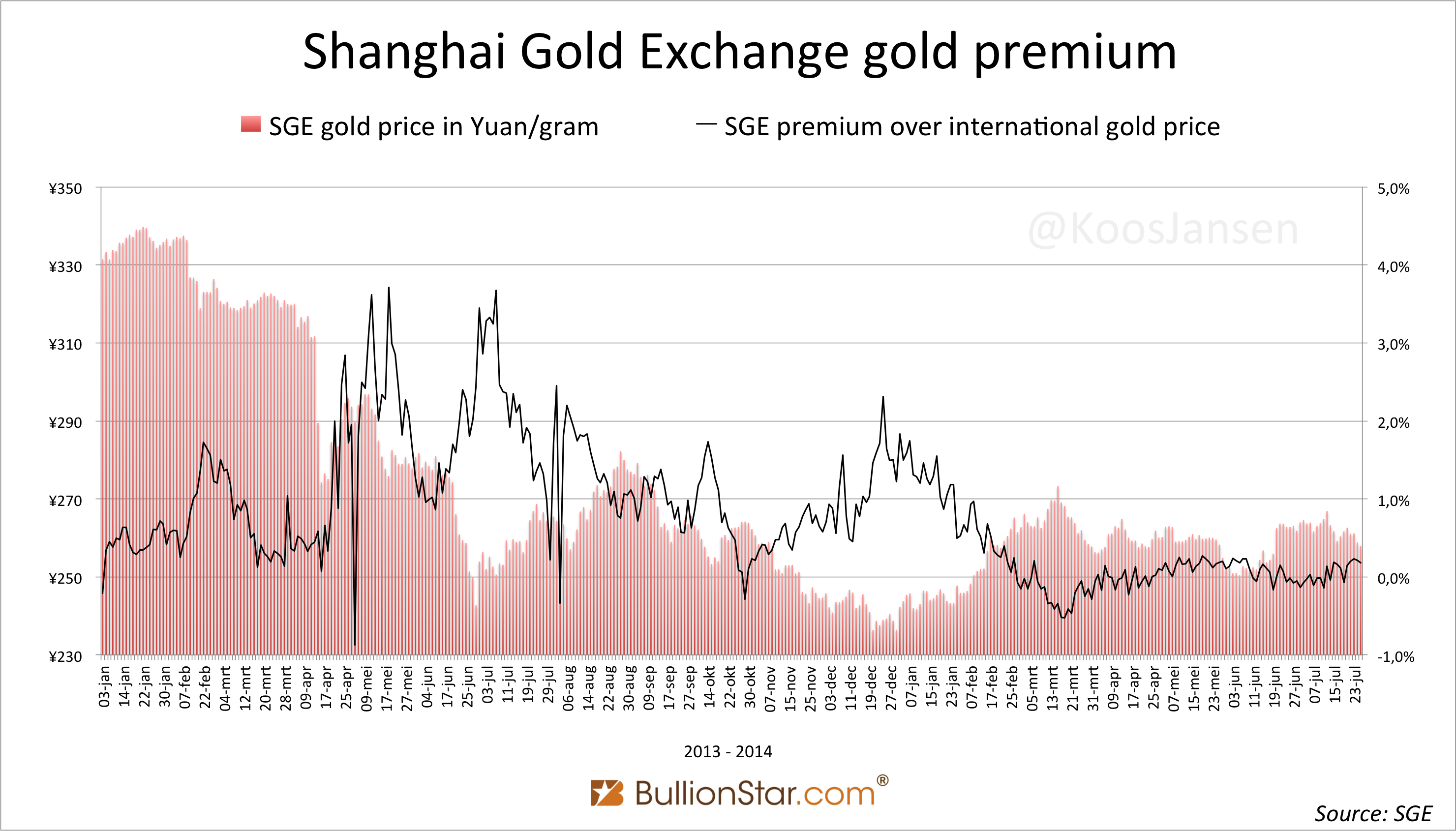

In week 29 (July 14 -18) 32 metric tonnes were withdrawn from SGE vaults and in week 30 (July 20 - 25) 33 tonnes were withdrawn. Both lower than the year to date average of 35.4 tonnes, but higher than the five week moving average trend (5 WMA). In total 1063 tonnes has been withdrawn year to date. The premium on gold at the SGE is still hovering around zero.

Using SGE withdrawals as a reference, China mainland has net imported 670.7 tonnes year to date. Based on net imports, Chinese mining, a jewelry base of 2,500 tonnes in 1995 and guessing how much the PBOC has accumulated since 2009, total estimated Chinese gold reserves stand at 14,901 tonnes as of July 25. This is 11 grams per capita. I believe this estimate is conservative as it's likely the jewelry base (calculated by the World Gold Council in 1995) does not include gold hoards by wealthy Chinese families and I don't have good import data from prior to 2007. For a detailed explanation on how I calculated estimated total Chinese gold reserves read the last bit of this article.

My research indicates that SGE withdrawals equal Chinese wholesale gold demand. For more information click this link.

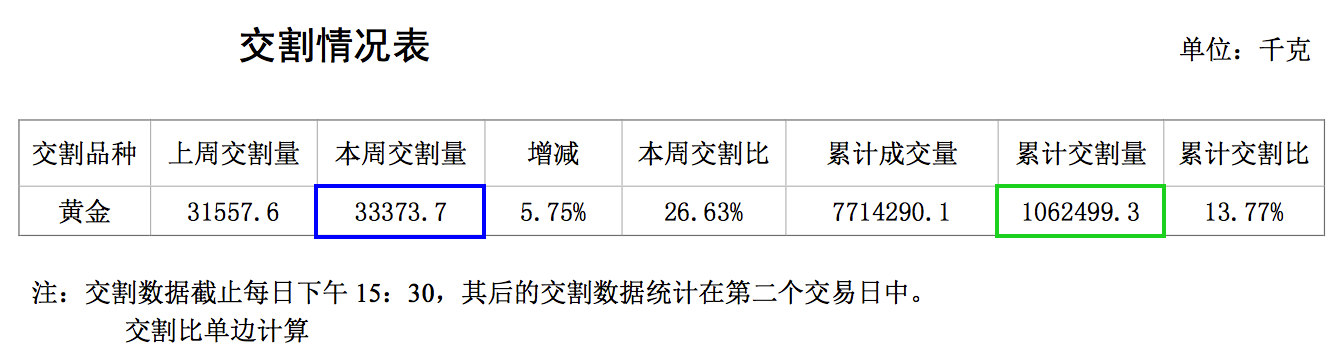

The next screen shot is from the weekly Chinese SGE trade report; the second number from the left (blue) is weekly gold withdrawn from the vaults in Kg, the second number from the right (green) is the total in Kg year to date.

The next chart shows SGE gold premiums based on data from the SGE weekly reports (it’s the difference between the SGE gold price in yuan and the international gold price in yuan).

****

Gata.....

Amid huge demand, U.S. Mint suspends sales of JFK gold coin at Illinois expo

Submitted by cpowell on Fri, 2014-08-08 01:51. Section: Daily Dispatches

By Michelle Manchir

Chicago Tribune

Thursday, August 7, 2014

Chicago Tribune

Thursday, August 7, 2014

Coin collectors like those bringing sleeping bags and waiting in line outside a convention center in Rosemont (Illinois), eager to get their hands on a new gold half dollar, will now have to turn to cyberspace to get one, officials said.

Organizers on Thursday halted sales of the New Gold Kennedy Coins at the World's Fair of Money at the Stephens Convention Center in the Northwest suburb after hundreds of people lined up there each night this week. Some were in line at 4 p.m. Tuesday with the hopes of buying the coin when sales began at 10 a.m. Thursday, said Donn Pearlman, spokesman for the American Numismatic Association.

"It just got to the point where, out of prudence, just to be careful, they decided to halt sales at retail locations," said Pearlman.

"The Mint made this decision to ensure the safety of those wanting to purchase the coin and the safety of its own employees," the U.S. Mint said in a statement Thursday.

The special half dollar, a coin valued at $1,240 that depicts President John F. Kennedy, is considered so attractive to collectors because it's dual dated -- 1964-2014 -- and because it's struck in gold, said Pearlman. It had also been on sale at Mint retail locations in Philadelphia, Denver and Washington, D.C.

"The Kennedy half dollar, when issued in 1964, was a very popular coin and still is for people who collect," Pearlman said.

The decision to halt sales is purely precautionary, Pearlman said, as no issues, injuries, or arrests involving the crowds have been reported, except for a couple of brazen line-cutters who were escorted away by security guards.

Rosemont police, who have monitored the lines in the evening and overnight, have not made any arrests, said Rosemont Deputy Police Chief John Aichinger.

"One hundred percent civil," Aichinger said of those gathered in line. "No problems whatsoever."

****

Bullion Management Group: The manipulation of the gold market is self-evident

Submitted by cpowell on Thu, 2014-08-07 12:59. Section: Daily Dispatches

8:57a ET Thursday, August 7, 2014

Dear Friend of GATA and Gold:

Paul de Sousa, executive vice president of Bullion Management Group in Toronto, has written a wonderful report summarizing some of the history, documentation, and purposes of gold price suppression by Western governments.

De Sousa begins: "Arthur Schopenhauer said that 'all truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident.' Well, it is now self-evident that the gold market is manipulated."

De Sousa's report draws heavily on GATA's work without acknowledging it. But simply coming over to the side complaining of gold price suppression is itself politically incorrect enough to risk one's respectability, and of course gratitude will always be rarer than gold.

De Sousa's report is excerpted at Bullion Management Group's Internet site here --

-- and published in full in PDF format here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Indian gold futures buyers starting to take delivery again

Submitted by cpowell on Thu, 2014-08-07 02:34. Section: Daily Dispatches

Gold Delivery on MCX Hits Highest Since April Last Year

From the Indian Express, New Delhi

Thursday, August 7, 2014

Thursday, August 7, 2014

Gold delivery on the Multi-Commodity Exchange (MCX) platform against the August contract hit the highest since April last year, in a welcome change for the country's largest commodity bourse, which was hit by a transaction tax on non-farm futures and a settlement crisis at a group firm.

MCX witnessed the delivery of 1,159 kg of gold against the August contract, the highest since that of 1,388 kg in April 2013 and sharply higher than that of just 4 kg in February this year.

Importantly, this was the first time that delivery has crossed the 1,000-kg level after a 0.01 percent transaction tax was imposed by the government on non-farm futures in July last year. With the imposition of the tax on the seller, the costs of trading on the MCX platform have more than tripled from R1.60 on a transaction value of R100,000 in June 2013.

****

Gold is anticipating a worldwide credit disaster, Tocqueville's Hathaway tells KWN

Submitted by cpowell on Thu, 2014-08-07 02:23. Section: Daily Dispatches

10:18p ET Wednesday, August 6, 2014

Dear Friend of GATA and Gold:

Now that the stock market is faltering and there's little difference between interest rates of government and junk bonds, interest in the monetary metals is reviving, the Tocqueville Gold Fund's John Hathaway tells King World News tonight. The gold market, Hathaway says, is beginning to get wind of a "potential worldwide credit disaster." Hathaway's interview is excerpted at the KWN blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Embry expects bailouts because 'bail ins' will collapse the financial system

Submitted by cpowell on Tue, 2014-08-05 17:42. Section: Daily Dispatches

1:40p ET Tuesday, August 5, 2014

Dear Friend of GATA and Gold:

Debt and unfunded liabilities are crushing national economies and being wrapped in lies by government, Sprott Asset Management's John Embry tells King World News today. Embry expects everything to be bailed out because "bail ins" probably will prompt the financial system's collapse. An excerpt from his interview is posted at the KWN blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Financial Times repudiates explanation for removal of gold manipulation report

Submitted by cpowell on Tue, 2014-08-05 15:04. Section: Daily Dispatches

11:20a ET Tuesday, August 5, 2014

Dear Friend of GATA and Gold:

In correspondence with GATA today the Financial Times repudiated its explanation to a subscriber last month that a report about gold market manipulation published by the newspaper February 24 was quickly removed from the newspaper's Internet site because it was "sensitive."

The FT report, its removal from the newspaper's Internet site, and the explanation first extracted from the newspaper's customer service office by an FT subscriber in the United Kingdom after months of effort were described in a GATA Dispatch on July 28:

The newspaper's repudiation today of its customer service office's explanation asserted only that the customer service office had been "misinformed." The repudiation did not explain why the story was removed from the FT's Internet site, stating only the obvious -- that the removal was "an editorial decision."

In correspondence with the FT today your secretary/treasurer has reiterated GATA's eagerness to assist the newspaper with an inquiry into gold market intervention by Western central banks, intervention GATA has been documenting for 15 years.

In fairness it must be noted that the FT is far from the only news organization to decline GATA's request to investigate central bank intervention in the gold market. Other news organizations to which GATA has supplied full documentation without result include Reuters, the Associated Press, Bloomberg News, The New York Times, The Wall Street Journal, the Washington Post, CNBC, CBS News and its "60 Minutes" program, Fox News, Der Spiegel, the London Telegraph, The Economist magazine, Frankfurter Allgemeine Zeitung, the Toronto Globe and Mail, Business News Network in Canada, and Rolling Stone magazine.

Today's correspondence with the Financial Times is appended.

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

* * *

Tuesday, August 5, 2014

Dear Chris:

It was an editorial decision to remove this particular story. The customer services representative you spoke with was not close to the matter and was misinformed.

We have covered this topic extensively (below) and will be returning to it in the future.

Banks Aim to Have New Gold Fix Operational by Year-End:

Time Called on the London Gold Fix:

British MPs Urge Watchdog to Probe Price-Rigging in Gold Market:

German Regulator Warns Deutsche Bank on Commodity Trading:

Reform or Die: Gold Price Fix under Pressure:

The Gold Fix in Less than 60 Seconds (video):

World Gold Council to Explore Gold 'Fix' Reform:

UK Regulator Steps Up Scrutiny of Precious Metals Derivatives:

Trading to Influence Gold Price Fix Was 'Routine':

Historic Gold Fix Pricing System Criticised as Vulnerable:

Barclays Fined L26 Million for Trader's Gold Rigging:

Deutsche Resigns Gold and Silver Price-Fix Seats:

Gold: In Search of a New Standard:

Best wishes,

Kristina Eriksson, Head of Media Relations

Financial Times

1 Southwark Bridge, London

Financial Times

1 Southwark Bridge, London

* * *

Tuesday, August 5, 2014

Hi, Kristina:

Thanks for your latest. I'll be glad to quote your repudiation of the explanation given by the FT's customer service office to the FT subscriber, but please note:

1) Your repudiation is still not an explanation for the story's removal from the FT's Internet site.

2) The FT subscriber had to seek an explanation from the newspaper for months before being told that the story in question was "sensitive." That long delay certainly implies sensitivity, or else the newspaper's contempt for its subscriber.

3) None of your citations addresses the big issue here, the issue GATA has been pressing on the FT for 15 years -- that of surreptitious involvement and intervention in the gold market by Western central banks to suppress the gold price. This issue still seems to have received no attention from the FT, though so much documentation of it has been provided by GATA to the newspaper many times, sometimes even in person.

All that documentation remains archived here --

-- and it is summarized here:

Of course GATA remains ready to assist the FT's review of this issue, if the issue is not considered too sensitive by the newspaper. It isconsidered too sensitive by the governments involved, since they have refused to part voluntarily with much of the documentation. But I have been in the newspaper business myself here in the United States for almost 50 years and have found it good journalistic and civic practice to be suspicious about what government wants to hide.

With good wishes.

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

7 Villa Louisa Road

Manchester, Connecticut 06043-7541

U.S.A.

Gold Anti-Trust Action Committee Inc.

7 Villa Louisa Road

Manchester, Connecticut 06043-7541

U.S.A.

No comments:

Post a Comment