http://www.bloomberg.com/news/2014-08-11/money-market-investors-risk-losses-on-african-bank-write-down.html

http://hat4uk.wordpress.com/2014/08/13/africa-bank-rescue-breaking-south-african-depositors-already-being-press-ganged-into-bailin/

****

Investors in South African money-market funds holding African Bank Investments Ltd. (ABL)securities are facing capital losses even as money managers slash interest payments to offset writedowns of the debt.

Funds may use one day’s worth of accrued interest to offset losses, the Financial Services Board said in a circular to money managers yesterday. That may not be enough to cover losses for some funds, according to Andrew Canter, chief investment officer at Futuregrowth Asset Management. The funds could also cancel units rather than impair their value, the FSB said.

“The fact is that some customers are going to wake up with less money than they had the day before,” Canter said by phone from Cape Town yesterday. “It’s likely to be an industry-wide phenomenon, and some funds will be more affected than others.”

African Bank, known as Abil, got emergency support from the Reserve Bank after the Johannesburg-based provider of unsecured loans lost most of its market value over three days last week. The lender will be split to create a bad bank with soured loans, while senior and wholesale debt instruments will be transferred to the another bank at 90 percent of face value, the central bank said on Aug. 10.

***

http://www.bloomberg.com/news/2014-08-12/african-bank-s-top-shareholder-apologizes-after-loss.html

African Bank Investments Ltd. (ABL)’s largest shareholder, Coronation Fund Managers Ltd. (CML), apologized to investors and said it had learned a “sobering lesson” after its stake in the failed lender was wiped out.

South Africa’s central bank put Abil, as it’s known, into curatorship, akin to Chapter 11 bankruptcy, on Aug. 10 after the lender said it needed at least 8.5 billion rand ($800 million) of capital to survive. Abil’s shares were suspended on Aug. 11 after the South African Reserve Bank split the firm into a “good” bank and a “bad” book, and arranged for institutions to underwrite a 10 billion-rand capital increase.

Coronation held about 22 percent of Abil before the company released a trading update on Aug. 6 that precipitated a drop of more than 90 percent in its share price, according to data compiled by Bloomberg. The Cape Town-based fund manager then cut its holdings to less than 9 percent by Aug. 8, it said.

“Losses have been incurred, for which we apologize,” Coronation, which manages the equivalent of about $54 billion, said in a statement. “This has been a humbling experience for us. We do not like to make mistakes.”

****

http://www.iol.co.za/business/companies/african-bank-needs-deposits-as-model-fails-1.1734787#.U-09IbxdWI0

African Bank needs deposits as model fails

Independent Newspapers

Photo: Simphiwe Mbokazi.

Johannesburg - African Bank Investments Ltd, the failed South African lender being rescued by the central bank, needs to attract depositors to finance lending as risks increase that equity and bond investors will shun it after losses.

African Bank may need to offer consumers interest rates of as much as 15 percent, according to Chris Gilmour at Absa Asset Management Private Clients.

That compares with a top rate of 9 percent at Capitec Bank, a competitor in unsecured lending that began taking retail deposits in 2002.

Abil, as the bank is known, spiralled toward collapse last week after saying it needed to raise at least 8.5 billion rand to survive, causing the stock to lose most of its value in three days and bond prices to fall by more than 50 percent.

The Central Bank will split the business to create a bad bank with soured loans, while a group of lenders agreed to underwrite a 10 billion rand capital raising for the good bank.

“Our desire to fund the new, good bank is very, very limited,” Conrad Wood, head of fixed income at Momentum Asset Management, which holds Abil debt, said by phone from Johannesburg on August 12.

“That Abil will need to take deposits is valid. I’m not sure of the success rate they’ll have, but retail deposits will have to form part of the new model.”

For 15 years African Bank loaned money to low-income earners who didn’t have collateral, funding the business by raising money in debt or equity markets because it didn’t take deposits.

With investors now facing losses, the central bank said August 10 Abil needs a “strategic rethink” of its business.

****

http://www.news24.com/MyNews24/African-Bank-A-disgraceful-failure-of-the-regulatory-system-20140813

African Bank: A disgraceful failure of the regulatory system

13 August 2014, 13:51

Everyone is quick to blame the management of African Bank for their failures, and rightly so. I have already pointed out some of their failures here.

But much of the blame should be put on the regulators.

We supposedly have one of the best regulated financial systems in the world, yet African Bank’s troubles of the past 3 years were not picked up by anyone in government, by anyone at the reserve bank, or even by their own auditors. The ‘system’ has failed the shareholders, management, employees, and clients who are dependent on the company.

Has the reserve bank been asleep for the past 3 or 4 years? What is the point of having a registrar of banks if they can’t regulate? We have seen dozens of articles and comments over the past week stating that this crisis was entirely foreseeable. Yet no one in government, and no one at the privately owned reserve bank saw this coming and sounded the alarm bells.

In our opinion, the financial statements present fairly, in all material respects, the financial position of African Bank Limited as at 30 September 2013, and its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards and the requirements of the Companies Act of South Africa. ~ Deloitte Audit TeamThe auditors opinion is blatantly incorrect. It came out mere months later that the provisions for bad debt were entirely underestimated. Whether this is due to incompetence or fraud is a good question. It misled shareholders credit providers. Surely SAICA should hold an enquiry and take action? The prestigious ‘Chartered Accountant’ title is being brought into disrepute.South Africa’s banking sector remains healthy and robust. There have been no indications that other South African banks have been affected negatively by ABIL’s trading update or African Bank’s current situation. ~ Gill MarcusHow can we trust this statement? We have witnessed such blatant regulatory failure, yet we should take their word for it that the rest of the sector is ok.African Bank’s business model is not that complex. It is not like some American investment bank with billions in tangled webs of volatile off-balance sheet derivatives. The business itself is simple, and should be easy to regulate.If I were an investor, I would no longer place my trust in the unaccountable, politically appointed ‘authorities’.

http://hat4uk.wordpress.com/2014/08/13/africa-bank-rescue-breaking-south-african-depositors-already-being-press-ganged-into-bailin/

AFRICA BANK RESCUE BREAKING…..South African depositors already being press-ganged into Bailin.

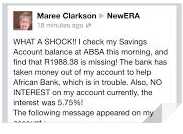

REPORTS REACH THE SLOG OF DEPOSIT CONFISCATION IN OTHER SA BANKS

Last Sunday, South Africa’s central bank placed African Bank Investments Ltd. under what it calls ‘curatorship”, scoping out ‘a plan’ to provide the doomed lender with nearly $1 billion in fresh capital. Most of the informed financial community already knows this. What they probably don’t know, however, is that the plan involves stealing the deposits of the country’s bank customers….and that the plan is already under way.

A South African Slogger has sent me this Facebook page capture:

No comments:

Post a Comment