http://rt.com/business/162084-dollar-collapse-monetary-system/

'Death of money': Author Rickards predicts collapse of global monetary system

The collapse of the monetary system awaits the world in the near future, says financial expert James Rickards. Russia and China's desire to rid the US dollar of its global reserve currency status is an early sign of the “increasingly inevitable” crisis.

“China has three trillion dollars, but they are buying gold as fast as they can. China worries that the US is going to devalue the dollar through inflation so they want to have a hedge if the dollar goes down, so the gold will go up,” Rickards told RT.

As one of the key events in support of his forecast, Rickards points to the words uttered by Russian President Vladimir Putin at the 18th International Economic Forum in St. Petersburg that took place earlier this month.

“Putin said he envisions a Eurasian economic zone involving Eastern Europe, Central Asia, and Russia. The Russian ruble is nowhere near ready to be a global reserve currency, but it could be a regional reserve currency,” he said, as quoted by ETF Daily News.

Rickards’ book about the demise of the dollar was released in April under quite an apocalyptic name – 'The Death of Money.' However, the author is surprised that the events are unfolding much faster than he predicted.

“If anything, the tempo of events is faster than expected. Therefore, some of these catastrophic outcomes may come sooner than I wrote about.”

Last Wednesday, China and Russia signed a historic US$400 billion gas deal which will provide the world's fastest growing economy with the natural gas it needs to keep pace for the next 30 years. Experts say this could be the catalyst that dethrones the greenback as the world's reserve currency.

The best-selling author writes that the “linchpin” of the collapse is the approaching failure of the dollar since it is at the foundation of the system. Powerful countries such as Russia, China, Iran, and India do not rely on the US in their national security and would benefit from the US economy being weaker, thus desiring to break free from the dollar standard.

He elaborates that the dual collapse “looks increasingly inevitable.”

“The mistakes have already been made. The instability is already in the system. We’re just waiting for that catalyst that I call the snowflake that starts the avalanche,” he said, as quoted by ETF.

There are three big international factors that are pressuring the dollar right now – Russia, China, and Saudi Arabia.

“Since the 1970s, Saudi Arabia [has been] the leader in what’s called the petrodollar. It basically means that Saudi Arabia and, by extension, OPEC, price oil in dollars, so the world market is in dollars.

“Russia is a major natural resource exporter; they price their exports in dollars as well. But Russia now is engaged in a financial war with the US around the issues in Crimea and Ukraine.”

“Putin said he envisions a Eurasian economic zone involving Eastern Europe, Central Asia, and Russia. The Russian ruble is nowhere near ready to be a global reserve currency, but it could be a regional reserve currency,” he said, as quoted by ETF Daily News.

Rickards’ book about the demise of the dollar was released in April under quite an apocalyptic name – 'The Death of Money.' However, the author is surprised that the events are unfolding much faster than he predicted.

“If anything, the tempo of events is faster than expected. Therefore, some of these catastrophic outcomes may come sooner than I wrote about.”

Last Wednesday, China and Russia signed a historic US$400 billion gas deal which will provide the world's fastest growing economy with the natural gas it needs to keep pace for the next 30 years. Experts say this could be the catalyst that dethrones the greenback as the world's reserve currency.

The best-selling author writes that the “linchpin” of the collapse is the approaching failure of the dollar since it is at the foundation of the system. Powerful countries such as Russia, China, Iran, and India do not rely on the US in their national security and would benefit from the US economy being weaker, thus desiring to break free from the dollar standard.

He elaborates that the dual collapse “looks increasingly inevitable.”

“The mistakes have already been made. The instability is already in the system. We’re just waiting for that catalyst that I call the snowflake that starts the avalanche,” he said, as quoted by ETF.

There are three big international factors that are pressuring the dollar right now – Russia, China, and Saudi Arabia.

“Since the 1970s, Saudi Arabia [has been] the leader in what’s called the petrodollar. It basically means that Saudi Arabia and, by extension, OPEC, price oil in dollars, so the world market is in dollars.

“Russia is a major natural resource exporter; they price their exports in dollars as well. But Russia now is engaged in a financial war with the US around the issues in Crimea and Ukraine.”

The threats to the dollar are “ubiquitous,” the author states in his book. The only way the US can pay off its $17 trillion debt is with inflation, which would drive other countries away from the dollar while the accumulation of gold by Russia and China presages the shift to a new reserve asset.

“The next time we will have a liquidity crisis in the world it’s going to be bigger than the ability of central banks to deal with it. The IMF will basically have to bail out the world by printing the SDRs (an international reserve asset created by the IMF in 1969 to supplement its member countries' official reserves). By that time, you will see the SDR emerge as the new global world currency,”Rickards told RT.

“The next time we will have a liquidity crisis in the world it’s going to be bigger than the ability of central banks to deal with it. The IMF will basically have to bail out the world by printing the SDRs (an international reserve asset created by the IMF in 1969 to supplement its member countries' official reserves). By that time, you will see the SDR emerge as the new global world currency,”Rickards told RT.

Good Q&A......

Waiting on snow flakes....

IMF to be forced to bail out insolvent Fed ( and ECB as well ? )

http://www.zerohedge.com/news/2014-05-28/what-happened-last-time-bonds-stocks-were-so-disconnected

What Happened The Last Time Bonds & Stocks Were So Disconnected?

Submitted by Tyler Durden on 05/28/2014 17:21 -0400

Tomorrow the June gold and silver contracts take center state.

Overall the markets will be watching the first revision of 1Q GDP tomorrow morning. Even if it is negative I am going to be surprised if it has a negative affect on stocks.

I do think we are in for a major correction in equities this year, but probably not yet barring some exogenous event. I am watching for the characteristic signature of a major market top. I'll let you know if one shows up.

Let's see how June goes. There was nothing on the delivery side, and the Comex warehouses are scrambling to put some gold on the books ahead of another delivery month.

Silver held 19$ like a champ. Gold is a sleeping giant.

Have a pleasant evening.

Good thing fundamentals don't matter anymore......

http://davidstockmanscontracorner.com/japans-great-keynesian-rebuke-abenomics-has-wiped-out-japans-trade-accounts-exactly-opposite-the-theory/

Presented with little comment aside to note that bond shorts have not covered (in fact they added last week) and the last time we got this disconnected (with negative breadth in stocks and super low volatility) - things went south very quickly...

It's different this time though...

As an FYI - Treasury shorts lag the moves in rates - as rates rise, momentum gains and the world piles in short for the end of the multi-decade bond bull market... then each time they get over their skis and bond yields collapse... especially in 2011 when this last happened...

Market Breaks Out - Is This The Mania Phase?

Submitted by Tyler Durden on 05/28/2014 18:00 -0400

Submitted by Lance Roberts of STA Wealth Management,

http://jessescrossroadscafe.blogspot.com/2014/05/gold-daily-and-silver-weekly-charts_28.html

28 MAY 2014

Gold Daily and Silver Weekly Charts - Silver Stonewalls the Metals Bears At $19

“Never take counsel of your fears.”

Stonewall Jackson

|

| STONEWALL JACKSON |

Overall the markets will be watching the first revision of 1Q GDP tomorrow morning. Even if it is negative I am going to be surprised if it has a negative affect on stocks.

Let's see how June goes. There was nothing on the delivery side, and the Comex warehouses are scrambling to put some gold on the books ahead of another delivery month.

Silver held 19$ like a champ. Gold is a sleeping giant.

Have a pleasant evening.

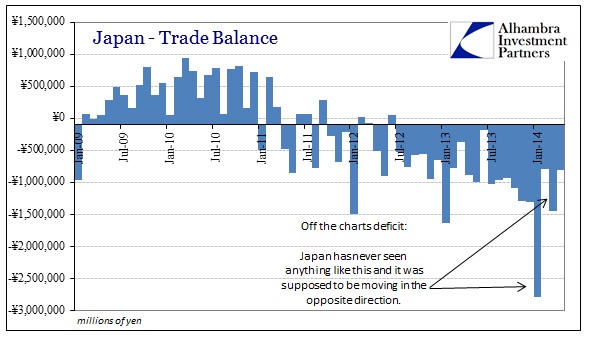

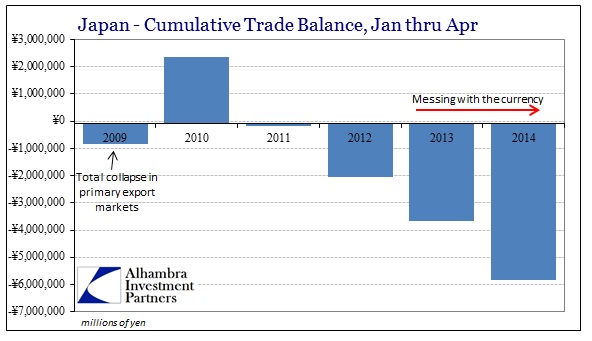

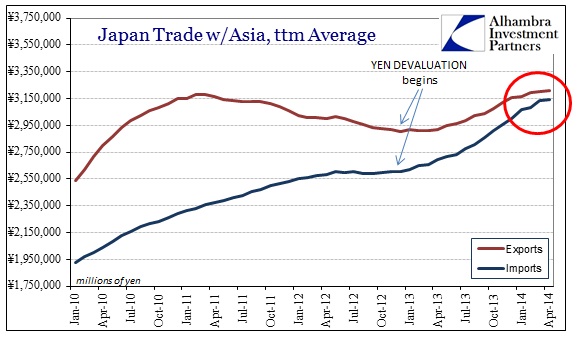

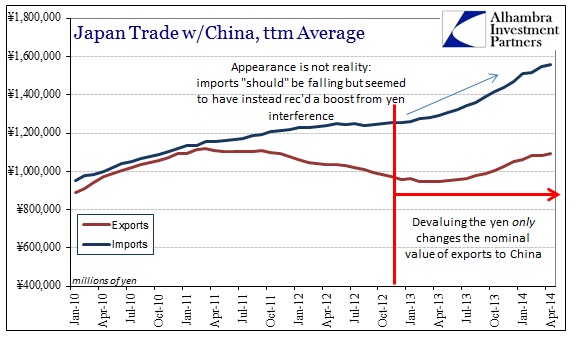

ALHAMBRA PARTNERS

Japan’s Great Keynesian Rebuke: Abenomics Has Wiped Out ItsTrade Accounts—-Exactly Opposite The Theory

by Jeffrey P. Snider •

Japanese Retail Sales Collapse By Most On Record

Submitted by Tyler Durden on 05/28/2014 20:53 -0400

Given the pre-tax-hike surge, the oh-so-smart economists around the world were expecting some give-back from dragged-forward demand but the 13.7% MoM decline missed expectations by 2 percentage points. This was the largest MoM decline on record. Talking heads are already blaming the tax hike (but they knew all about it?) and year-over-year was just as dismal (and less immediately prone to events) as it fell by the most since the 2011 Tsunami. Bad news (the worst) is good news though right? Well no - USDJPY is down as is Nikkei as remember, Japanese inflation pressures are building and Kuroda has pushed off any actions from the BoJ for now.

Japan Retail Sales MoM - worst on record...

and YoY this is the biggest drop since the Tsunami...

Well played Abe...no wonder you are begging rich people to sya for vacation and spend...

Japanese govt considers extending duration of stay for affluent foreign tourists to maximum 1 year from current 90 days, Nikkei newspaper reports, without attribution.Govt plans to set income, asset and age requirements by summer and implement new measures as early as this year: NikkeiMeasures aim at boosting consumption and property investment: NikkeiGovt aims to double no. of foreign visitors to 20m by 2020, when Tokyo hosts the Summer Olympics: Nikkei

Please stay and spend money... cuz the Japanese people sure can't now everything they need is going up.

No comments:

Post a Comment