http://www.zerohedge.com/news/2014-02-13/us-taxpayer-bailed-out-bnp-paribas-probed-doj-fed-sudan-iran-libya-deals

US Taxpayer "Bailed Out" BNP Paribas Probed By DoJ & Fed On Sudan, Iran, Libya Deals

Submitted by Tyler Durden on 02/13/2014 13:32 -0500

The story of how JPMorgan, Goldman and the rest of the Too Big To Fails and Prosecutes, cornered, monopolized and became a full-blown cartel - with the Fed's explicit blessing - in the physical commodity market is nothing new to regular readers: to those new to this story, we suggest reading of our story from June 2011 (over two and a half years ago), "Goldman, JP Morgan Have Now Become A Commodity Cartel As They Slowly Recreate De Beers' Diamond Monopoly." That, or Matt Taibbi's latest article written in his usual florid and accessible style, in which he explains how the "Vampire Squid strikes again" courtesy of the "loophole that destroyed the world" to wit: "it would take half a generation – till now, basically – to understand the most explosive part of the bill, which additionally legalized new forms of monopoly, allowing banks to merge with heavy industry. A tiny provision in the bill also permitted commercial banks to delve into any activity that is "complementary to a financial activity and does not pose a substantial risk to the safety or soundness of depository institutions or the financial system generally." Complementary to a financial activity. What the hell did that mean?... Fifteen years later, in fact, it now looks like Wall Street and its lawyers took the term to be a synonym for ruthless campaigns of world domination."

The story of how JPMorgan, Goldman and the rest of the Too Big To Fails and Prosecutes, cornered, monopolized and became a full-blown cartel - with the Fed's explicit blessing - in the physical commodity market is nothing new to regular readers: to those new to this story, we suggest reading of our story from June 2011 (over two and a half years ago), "Goldman, JP Morgan Have Now Become A Commodity Cartel As They Slowly Recreate De Beers' Diamond Monopoly." That, or Matt Taibbi's latest article written in his usual florid and accessible style, in which he explains how the "Vampire Squid strikes again" courtesy of the "loophole that destroyed the world" to wit: "it would take half a generation – till now, basically – to understand the most explosive part of the bill, which additionally legalized new forms of monopoly, allowing banks to merge with heavy industry. A tiny provision in the bill also permitted commercial banks to delve into any activity that is "complementary to a financial activity and does not pose a substantial risk to the safety or soundness of depository institutions or the financial system generally." Complementary to a financial activity. What the hell did that mean?... Fifteen years later, in fact, it now looks like Wall Street and its lawyers took the term to be a synonym for ruthless campaigns of world domination."

TARP Recipient BNP Paribas got $4.9bn of bailouts from the U.S. Taxpayer - Today, as the WSJ reports we learn BNP Paribas has been funding transactions in Iran, Syria and other countries subject to U.S. Sanctions since 2002. The bank set aside $1.1 billion to settle investigations by the Department of Justice and the Federal Reserve but as the NY Times reports, investigations are playing out on multiple fronts - centering on whether the firm did "a significant amount" of business in "blacklisted" countires (and routed the deals through the US financial system).

Via WSJ,

“...an internal probe conducted over the past few years "a significant volume of transactions" between 2002 and 2009 that could be "considered impermissible under U.S. laws and regulations...” “involving entities that were doing business in U.S.-sanctioned countries, such as Iran, Cuba, Sudan and Libya during the 2002 to 2009 period.“BNP Paribas SA on Thursday became the latest bank to disclose the extent of its litigation problems in the U.S., saying it has set aside $1.1 billion against potential penalties related to transactions in countries under sanctions...In most cases, BNP provided dollar-denominated financing to companies, both French and non-French...BNP is a major provider of export financing for the oil and mining industry...The transactions didn't necessarily get routed through BNP units in the U.S. Yet, the U.S. is asserting jurisdiction simply by claiming that its currency was involved...”

Via NY Times,

The problem could worsen, as the American authorities might ultimately assess fines higher than $1.1 billion. The bank said that there had not yet been any discussions about the size or timing of any penalties, so the $1.1 billion provision essentially amounted to a guess.“The actual amount,” the bank acknowledged, “could thus be different, possibly very different, from the amount of the provision.”The bank, based in Paris, also acknowledged that it had “identified a significant volume of transactions that could be considered impermissible.” The final penalties would be linked to the number of illicit transfers....The case is the latest sanctions investigation to buffet a major global bank (e.g. HSBC). Several major banks have been caught and penalized by United States authorities for violating international sanctions on financial transaction with countries like Cuba, Iran, Myanmar and Sudan.

We are sure no actual human beings were involved in these decisions and thus no actual human being will see any jail time.. .but when you can borrow (for practically free) almost $5bn from the US taxpayer (for their own good) to fund your shady dealings, then a $1 or $2 billion fine is simply "cost of doing business"...

Wednesday, February 12, 2014

Towering Over Our Little French Friend in Tall Cotton…Candy

A progressive leftist known for his blatant cronyism, corruption and scandal hit the shores of the Potomac this week; nobody noticed.

Although I’ll grant you, it does show better “standing” than “mooving.”

Unfortunately, since François’ most recent peccadillo - involving another woman – resulted in the breakup of his 7 year affair with another “another” woman, for whom he left the mother of his children.

Butt buy a new dress, throw a big party, and everybody sits up and takes notice.

If I may say so, I think it’s a lovely dress; designed by Carolina Herrera and fashioned from luxurious fabric in black and liberty blue.

Although I’ll grant you, it does show better “standing” than “mooving.”

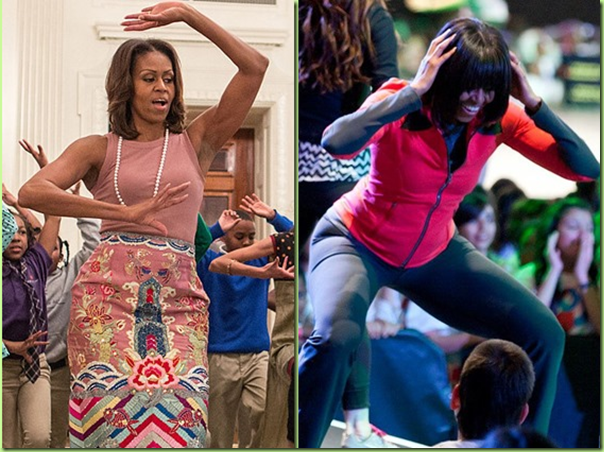

Still, do you see what proper fit and sleeves can do for a woman? Compare:

So let’s have no more complaining; as usual, it could have been much worse.

Unfortunately, since François’ most recent peccadillo - involving another woman – resulted in the breakup of his 7 year affair with another “another” woman, for whom he left the mother of his children.

As we’ve discussed before, Hollande is proof that Henry Kissinger was right about power being the ultimate aphrodisiac: women sexually attracted to powerful men by the vicarious power-surge associated with riding the proverbial coat tails.

Now, on to the intimate dinner for 350 we threw for our little French friend: under the bigtop on the south lawn. Naturally pictures were banned butt I snagged this contraband for you. That’s “Big Guy” way up in front. Worth a short trolley ride to attend, no?The big top was all done up in mauves and blues, reminiscent of Monet’s Water Lily's paintings (he was French, you know!).Lady M sat between François and Stephen Colbert – what a hoot! Mary Jane Blige sang her little heart out butt, sadly, no dancing. Since the French President arrived stag, the protocol chief decided dancing would be too awkward. As if that’s ever stopped us in the past.The menu was elegant as usual, starting with cocktails (on the “short trolley ride”) and smoked Maine salmon, and moving on to a first course with American Osetra Caviar (from fished raised in tributaries to the Big Muddy!), a "Winter Garden Salad," billed as a homage to Lady M’s Kitchen Garden. As you might imagine, in the middle of this Arctic Vortex our winter garden crops are not terribly prolific right now. In fact, there were barely enough weeds to go around, so we tried to magnify their effect (like unemployment payments) by serving them in a goldfish bowl.Naturally there was “Dry-aged Rib Eye Beef”, from a family farm in Greeley, Colorado, served with a“Jasper Hill Farm Blue Cheese Chip” and accompanied with “Charred Shallots, Oyster, Mushrooms, and Braised Chard.” And for dessert: “Hawaiian Chocolate-Malted Ganache and a bon bon plate with house made cotton candy.”And not that anyone cares, butt if past experience is at all indicative of future performance, this little affaire de France cost us a cool half a million dollars. And not even any dancing!

Is Goldman the new black ( as JP Morgan appears to firmly be in the faux Regulatory and Law Enforcement penalty boxes ) ?

"The Vampire Squid Strikes Again"- Matt Taibbi Takes On Blythe Masters And The Banker Commodity Cartel

Submitted by Tyler Durden on 02/13/2014 - 13:01 The story of how JPMorgan, Goldman and the rest of the Too Big To Fails and Prosecutes, cornered, monopolized and became a full-blown cartel - with the Fed's explicit blessing - in the physical commodity market is nothing new to regular readers: to those new to this story, we suggest reading of our story from June 2011 (over two and a half years ago), "Goldman, JP Morgan Have Now Become A Commodity Cartel As They Slowly Recreate De Beers' Diamond Monopoly." That, or Matt Taibbi's latest article written in his usual florid and accessible style, in which he explains how the "Vampire Squid strikes again" courtesy of the "loophole that destroyed the world" to wit: "it would take half a generation – till now, basically – to understand the most explosive part of the bill, which additionally legalized new forms of monopoly, allowing banks to merge with heavy industry. A tiny provision in the bill also permitted commercial banks to delve into any activity that is "complementary to a financial activity and does not pose a substantial risk to the safety or soundness of depository institutions or the financial system generally." Complementary to a financial activity. What the hell did that mean?... Fifteen years later, in fact, it now looks like Wall Street and its lawyers took the term to be a synonym for ruthless campaigns of world domination."

The story of how JPMorgan, Goldman and the rest of the Too Big To Fails and Prosecutes, cornered, monopolized and became a full-blown cartel - with the Fed's explicit blessing - in the physical commodity market is nothing new to regular readers: to those new to this story, we suggest reading of our story from June 2011 (over two and a half years ago), "Goldman, JP Morgan Have Now Become A Commodity Cartel As They Slowly Recreate De Beers' Diamond Monopoly." That, or Matt Taibbi's latest article written in his usual florid and accessible style, in which he explains how the "Vampire Squid strikes again" courtesy of the "loophole that destroyed the world" to wit: "it would take half a generation – till now, basically – to understand the most explosive part of the bill, which additionally legalized new forms of monopoly, allowing banks to merge with heavy industry. A tiny provision in the bill also permitted commercial banks to delve into any activity that is "complementary to a financial activity and does not pose a substantial risk to the safety or soundness of depository institutions or the financial system generally." Complementary to a financial activity. What the hell did that mean?... Fifteen years later, in fact, it now looks like Wall Street and its lawyers took the term to be a synonym for ruthless campaigns of world domination."

No comments:

Post a Comment