http://hat4uk.wordpress.com/2014/02/05/wiping-out-the-whistleblowers-four-jumpers-a-missing-person-spell-panic-in-the-establishment/

( Is it a coincidence that the Argentina fire followed the spate of suicides of bankers / financial industry individuals ? )

The interconnected worlds of hedge funds, energy, banking, defence, globalism and geopolitics have the ability at times to make the characters from a John Le Carre novel seem one-dimensional and honourable by comparison. The Slog delves further into the the double-dealing world of the élite, and concludes that perhaps at last its members fear they might have a fight on their hands.

Four funerals and an abduction

Like me and millions of others, you’ve probably been following the growing death-toll among financial persons of late. Following the demise of one Morgan pirate last Sunday week, A Deutsche Bank executive followed last weekend.

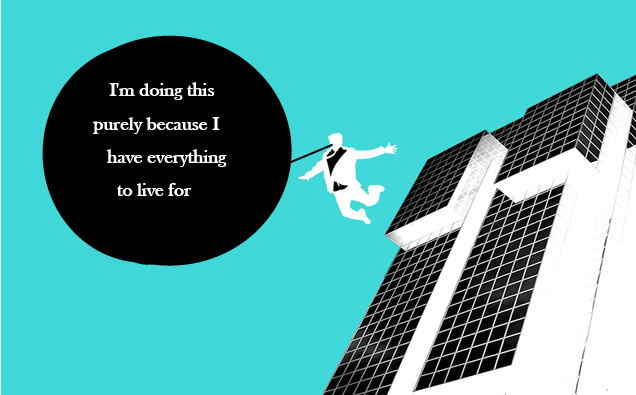

Next came (or rather, went) Russell Investments’ Chief Economist and former Fed economist Mike Dueker, this week found devoid of life by a Washington State roadside. Of this last, police said it looked like suicide, which is all well and good, except he seems to have chosen the most athletic way of leaving this world in history: the 50 year old jumped over a 4-foot (1.2-meter) fence before plummeting down a 40- to 50-foot embankment, Pierce County Detective Ed Troyer said yesterday.

The link, however, doesn’t seem to be merely banking and suicide: still unexplained is the disappearance of David Bird, the oil markets reporter who had worked at the Wall Street Journal for 20 years, who vanished on January 11 2014.

And another death hitherto largely ignored may provide a link as to WTF is going on here: last Monday week, Tata Motors managing director Karl Slym was found dead after falling from a high floor at the Shangri-La hotel in Bangkok. Tata Motors is the automotive arm of the Tata Sons Ltd. group, a business empire headed by Cyrus P. Mistry that includes companies engaged in oil, power generation…and solar.

The immediate commonalities here are jumping, energy, market rigging and whistle-blowing.

All of these men had expressed, at some point or another, a willingness or intention to talk to the authorities about fixes in various financial and commodity markets….oil being an especially prominent one. All fell off things (although we don’t know what happened to Bird yet) none of them were felt to be even remotely depressed, and all were either partnering with, reporting on or working far large global concerns facing very serious regulatory and criminal investigations.

The most definitive way to silence somebody is murder, but even with something as final as death, no motive is ever quite as it seems high up in in the Gods.

Greece, I have always maintained, is most definitely not about a relatively piddling debt that was (it now seems almost certain) exaggerated in the first place: much larger considerations are the country’s importance as a Mideast military base, the alliances of Turkey’s Recep Erdogan, and the vast amounts of new century industrials, gas and oil to be found beneath its territorial waters. Geopolitics and energy are always in the mix somewhere: and you should never assume that energy, Wall Street, the Pentagon and the White House are separate players.

If you can’t get the ship of State to heave to, torpedo it

The same Hedge Fund fate that doomed Greece may yet befall Denmark. Owl Creek Asset Management, a leading high-performance hedge-fund firm, has begun betting against Denmark’s sovereign bonds “in anticipation of a debt crisis”. In turn, Owl Creek has taken up a massive posiiton in credit default swaps on Danske Bank, Denmark’s biggest lender. Nice little pincer movement there, guys.

While the Danes’ debt to disposable ratio is World No 1 at 320%, methinks there is another factor underlying this sudden interest in a relatively obscure Scandinavian country. You see, it just so happens that the Arctic is believed to contain 22% of the technically recoverable oil and gas resources still left in the world. Also, guess what? Denmark has the most solid claim to the largest part of it…and leads the technology race to get it out at a commercial price. But as Offshore technology Magazine reported two years ago,

‘…there are disputes between Canada, Denmark, Norway, Russia and the US regarding rights to use resources and security of transportation through Arctic shipping routes.’

Most market-rigging is not done for profit first.

If you look at gold, QE, Zirp, Libor, derivatives and now oil, more often than not the primary motive lies with the Sovereigns and central banks around the developed world. When I first began writing about gold fundamentals in 2006, I was showered with news to the effect that I was bonkers. Now it is an accepted fact, but it is being done for survival, not profit. The price of the Euro is another example: traders can profit from it, but it has been manipulated by the ECB nonstop since 2009 for entirely political reasons. Oftentimes, the price of oil makes little sense, and the excuses given for ups and downs simply don’t check out…until you think about who wants low prices at the pumps, and who has done what deal with which Mideast maniac.

Are the MoUs finally on the run?

Twenty years ago, I used to dismiss oil conspiracy theory as bunk. Now you’d be blind to do so. To cloak the interference in Iraq, Iran, Libya and now Syria as genuine concern about human rights means merely that you suffered concussion when toppling off the Christmas tree.

However, one senses that it is increasingly important for those Uptop that no further evidence emerges of malign sovereign/central banker motives…especially in the light of Wikileaks and Philip Snowden. Be under no illusion at all: if such were to emerge and show clear evidence of persistent fraud on a global scale, the balance of belief could so easily tip in favour of the cynics. Five deaths to plug holes in the wall of silence are as nothing in that context.

Everything is connected.

Since the start of 2014, we have seen crude and brazen depression of bond yields in Italy and Spain, almost certainly linked to Japan: there are personal Draghi reasons for this, but also EU/Abe geopolitical ones. However – and this is significant I think…..no bond help in the way of rigging was offered to Greece. For it is important in the Global Energy Game that Greece remains a prisoner, made at all times to fell weak and outnumbered: it was promised Christmas debt relief, it didn’t get it. Now – Bloomberg reports today – the new bailout deal from the EU is set to include extending the maturity on rescue loans to 50 years. The plan will be considered by policy makers during March and April…a good idea this one, as Athens will default on its loans bigtime without help in May. And the Sprouts don’t want that: they just want the cowering mouse shivering in fear forever….for in the hole, Greece has riches beyond even Venizelos’s wildest dreams. And the Cat must have his cream.

And the same is true of Denmark. Within ten years, if one believes even 10% of peak oil theory, Denmark could have the highest per capita wealth on the planet, and be the world’s biggest oil exporter. There is no way the Big Boys Club can live with that one. So Denmark too must be torpedoed.

As I suggested at the outset, if this piece reads like vintage John le Carré, then (a) I’m flattered and (b) I make no apology. Sometimes, things really are just Snafu. And at other times, four badly-disguised murders in 18 days by enforced jumping all involving whistleblowers merely shows the lack of imagination of the average security services field operative.

http://globaleconomicanalysis.blogspot.com/2014/02/ukraine-central-bank-imposes-6-day.html

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com/2014/02/venezuela-gives-businesses-until-monday.html

Mike "Mish" Shedlock

http://www.zerohedge.com/news/2014-02-05/argentine-banking-system-archives-destroyed-deadly-fire

( Is it a coincidence that the Argentina fire followed the spate of suicides of bankers / financial industry individuals ? )

WIPING OUT THE

WHISTLEBLOWERS: FOUR

JUMPERS & A MISSING PERSON

SPELL PANIC IN THE

ESTABLISHMENT

Oilman, Banker, Soldier, Spy: everything is connected

The interconnected worlds of hedge funds, energy, banking, defence, globalism and geopolitics have the ability at times to make the characters from a John Le Carre novel seem one-dimensional and honourable by comparison. The Slog delves further into the the double-dealing world of the élite, and concludes that perhaps at last its members fear they might have a fight on their hands.

Four funerals and an abduction

Like me and millions of others, you’ve probably been following the growing death-toll among financial persons of late. Following the demise of one Morgan pirate last Sunday week, A Deutsche Bank executive followed last weekend.

Next came (or rather, went) Russell Investments’ Chief Economist and former Fed economist Mike Dueker, this week found devoid of life by a Washington State roadside. Of this last, police said it looked like suicide, which is all well and good, except he seems to have chosen the most athletic way of leaving this world in history: the 50 year old jumped over a 4-foot (1.2-meter) fence before plummeting down a 40- to 50-foot embankment, Pierce County Detective Ed Troyer said yesterday.

The link, however, doesn’t seem to be merely banking and suicide: still unexplained is the disappearance of David Bird, the oil markets reporter who had worked at the Wall Street Journal for 20 years, who vanished on January 11 2014.

And another death hitherto largely ignored may provide a link as to WTF is going on here: last Monday week, Tata Motors managing director Karl Slym was found dead after falling from a high floor at the Shangri-La hotel in Bangkok. Tata Motors is the automotive arm of the Tata Sons Ltd. group, a business empire headed by Cyrus P. Mistry that includes companies engaged in oil, power generation…and solar.

The immediate commonalities here are jumping, energy, market rigging and whistle-blowing.

All of these men had expressed, at some point or another, a willingness or intention to talk to the authorities about fixes in various financial and commodity markets….oil being an especially prominent one. All fell off things (although we don’t know what happened to Bird yet) none of them were felt to be even remotely depressed, and all were either partnering with, reporting on or working far large global concerns facing very serious regulatory and criminal investigations.

The most definitive way to silence somebody is murder, but even with something as final as death, no motive is ever quite as it seems high up in in the Gods.

Greece, I have always maintained, is most definitely not about a relatively piddling debt that was (it now seems almost certain) exaggerated in the first place: much larger considerations are the country’s importance as a Mideast military base, the alliances of Turkey’s Recep Erdogan, and the vast amounts of new century industrials, gas and oil to be found beneath its territorial waters. Geopolitics and energy are always in the mix somewhere: and you should never assume that energy, Wall Street, the Pentagon and the White House are separate players.

If you can’t get the ship of State to heave to, torpedo it

The same Hedge Fund fate that doomed Greece may yet befall Denmark. Owl Creek Asset Management, a leading high-performance hedge-fund firm, has begun betting against Denmark’s sovereign bonds “in anticipation of a debt crisis”. In turn, Owl Creek has taken up a massive posiiton in credit default swaps on Danske Bank, Denmark’s biggest lender. Nice little pincer movement there, guys.

While the Danes’ debt to disposable ratio is World No 1 at 320%, methinks there is another factor underlying this sudden interest in a relatively obscure Scandinavian country. You see, it just so happens that the Arctic is believed to contain 22% of the technically recoverable oil and gas resources still left in the world. Also, guess what? Denmark has the most solid claim to the largest part of it…and leads the technology race to get it out at a commercial price. But as Offshore technology Magazine reported two years ago,

‘…there are disputes between Canada, Denmark, Norway, Russia and the US regarding rights to use resources and security of transportation through Arctic shipping routes.’

Most market-rigging is not done for profit first.

If you look at gold, QE, Zirp, Libor, derivatives and now oil, more often than not the primary motive lies with the Sovereigns and central banks around the developed world. When I first began writing about gold fundamentals in 2006, I was showered with news to the effect that I was bonkers. Now it is an accepted fact, but it is being done for survival, not profit. The price of the Euro is another example: traders can profit from it, but it has been manipulated by the ECB nonstop since 2009 for entirely political reasons. Oftentimes, the price of oil makes little sense, and the excuses given for ups and downs simply don’t check out…until you think about who wants low prices at the pumps, and who has done what deal with which Mideast maniac.

Are the MoUs finally on the run?

Twenty years ago, I used to dismiss oil conspiracy theory as bunk. Now you’d be blind to do so. To cloak the interference in Iraq, Iran, Libya and now Syria as genuine concern about human rights means merely that you suffered concussion when toppling off the Christmas tree.

However, one senses that it is increasingly important for those Uptop that no further evidence emerges of malign sovereign/central banker motives…especially in the light of Wikileaks and Philip Snowden. Be under no illusion at all: if such were to emerge and show clear evidence of persistent fraud on a global scale, the balance of belief could so easily tip in favour of the cynics. Five deaths to plug holes in the wall of silence are as nothing in that context.

Everything is connected.

Since the start of 2014, we have seen crude and brazen depression of bond yields in Italy and Spain, almost certainly linked to Japan: there are personal Draghi reasons for this, but also EU/Abe geopolitical ones. However – and this is significant I think…..no bond help in the way of rigging was offered to Greece. For it is important in the Global Energy Game that Greece remains a prisoner, made at all times to fell weak and outnumbered: it was promised Christmas debt relief, it didn’t get it. Now – Bloomberg reports today – the new bailout deal from the EU is set to include extending the maturity on rescue loans to 50 years. The plan will be considered by policy makers during March and April…a good idea this one, as Athens will default on its loans bigtime without help in May. And the Sprouts don’t want that: they just want the cowering mouse shivering in fear forever….for in the hole, Greece has riches beyond even Venizelos’s wildest dreams. And the Cat must have his cream.

And the same is true of Denmark. Within ten years, if one believes even 10% of peak oil theory, Denmark could have the highest per capita wealth on the planet, and be the world’s biggest oil exporter. There is no way the Big Boys Club can live with that one. So Denmark too must be torpedoed.

As I suggested at the outset, if this piece reads like vintage John le Carré, then (a) I’m flattered and (b) I make no apology. Sometimes, things really are just Snafu. And at other times, four badly-disguised murders in 18 days by enforced jumping all involving whistleblowers merely shows the lack of imagination of the average security services field operative.

This is, without any doubt, a story to which you really should stay tuned.

Thursday, February 06, 2014 6:45 PM

Ukraine Central Bank Imposes 6-Day Waiting Period on Foreign Currency Purchases; Capital Controls Hit Ukraine in Effort to Halt Money Exodus

Yet another country has gone the route of capital controls hoping to stave off an outflow of currency. Bloomberg reports Ukraine Imposes Capital Controls as President Meets Putin.

Ukraine’s central bank imposed limits on foreign-currency purchases after its interventions failed to alleviate pressure on the hryvnia, while President Viktor Yanukovych left to meet his Russian counterpart, Vladimir Putin.Add Ukraine to the list of countries alleged to have been helped by the parasitic practices of the IMF. Greece and Spain are both suffering because of bailouts designed to help bank creditors, not taxpayers in countries under financial stress.

The monetary authority’s measures include a waiting period of at least six working days for foreign-currency purchases by companies and curbs on individuals’ market access, according to a statement on its website late yesterday. It also moved the hryvnia’s official exchange rate, used for accounting purposes, to 8.7 per dollar from 7.99, the first change since 2012.

Ukraine’s political crisis, in its third month, is rocking the country’s currency as reserves are stretched too thin to finance a record current-account deficit. As the U.S. and the European Union discuss potential aid, Yanukovych traveled to the opening ceremony of the Sochi Olympics. He will meet the Russian president, who halted payments from a $15 billion bailout after the unrest led to the cabinet’s collapse.

Risk of Default

“The political stalemate, exacerbated by a suspension of the Russian financial aid package, increases the risk of a sovereign default later this year,” Tatiana Orlova, an economist at Royal Bank of Scotland Group Plc in London wrote in a report yesterday.

The IMF in 2010 agreed to lend $15.6 billion to Ukraine, only to freeze disbursements the following year after the government refused to raise domestic natural-gas prices to trim the budget deficit.

Reserves Shrivel

Foreign reserves probably shrank to $18.7 billion in January, the lowest since 2006, from $20.4 billion a month earlier, according to the median estimate of eight analysts polled by Bloomberg before the central bank publishes the data tomorrow. Reserves fell to $17.8 billion as of yesterday, the Interfax news service reported today, citing a person it didn’t identify.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com/2014/02/venezuela-gives-businesses-until-monday.html

Thursday, February 06, 2014 9:27 AM

Venezuela Gives Businesses Until Monday to Comply with "Fair Prices Act" or Face State Takeover

There will be no goods at all on shelves of any stores in Venezuela if the president follows through with his latest warning.

Via translation from El Economista, please consider Maduro Threatens to Expropriate Businesses for Violation of Fair Prices Act.

Via translation from El Economista, please consider Maduro Threatens to Expropriate Businesses for Violation of Fair Prices Act.

The president of Venezuela, Nicolas Maduro, has threatened to expropriate businesses that do not comply with the new Fair Prices Act. "I have called for self-regulation of products and prices. 'll Give businesses until Monday to comply. Come Monday, if I find companies violating the Law of Fair Prices I'll take more radical measures," Maduro warned.For additional details please see my January 25 post Venezuela Enacts "Law of Fair Prices" Banning Profits Over 30%, with 10-Year Imprisonment for Hoarding.

"Do not underestimate sectors of the bourgeoisie on whether to expropriate. You will discover on Monday we are going to apply more drastic measures," added the Venezuelan president, who was quoted by the newspaper La Truth.

Maduro also reported Tuesday the arrest of a businessman on the border with Colombia. Maduro assured the businessman will face the maximum sentence of 14 years in prison for trafficking in consumer products.

Mike "Mish" Shedlock

http://www.zerohedge.com/news/2014-02-05/argentine-banking-system-archives-destroyed-deadly-fire

Argentine Banking System Archives Destroyed By Deadly Fire

Submitted by Tyler Durden on 02/05/2014 13:57 -0500

Brazil Cancels Debt Auctions

Today, Bloomberg reports Brazil Government Yields Fall After Auctions Canceled.

This kind of head-in-the sand move won't work long. In fact, it did not work at all, it only created an illusion of working. Unless underlying conditions change quickly, and favorably (both doubtful), there is a strong likelihood of increased volatility when auctions resume.

Mike "Mish" Shedlock

http://www.zerohedge.com/news/2014-02-05/japocalypse-wow-foreigners-dump-most-japanese-stocks-2010

While we are sure it is a very sad coincidence, on the day when Argentina decrees limits on the FX positions banks can hold and the Argentine Central Bank's reserves accounting is questioned publically, a massive fire - killing 9 people - has destroyed a warehouse archiving banking system documents. As The Washington Post reports, the fire at the Iron Mountain warehouse (which purportedly had multiple protections against fire, including advanced systems that can detect and quench flames without damaging important documents)took hours to control and the sprawling building appeared to be ruined. The cause of the fire wasn’t immediately clear - though we suggest smelling Fernandez' hands...

While first print is preliminary and subject to revision, the size of recent discrepancies have no precedent. This suggest that the government may be attempting to manage expectations by temporarily fudging the "estimate " of reserve numbers (first print) while not compromising "actual" final reported numbers. If this is so, it is a dangerous game to play and one likely to back-fire.During a balance of payments crisis - as Argentina is undergoing - such manipulation of official statistics (and one so critical for market sentiment) is detrimental to the needed confidence building around the transition in the FX regime.

And today the government decrees limits on FX holdings for the banks...

Argentina’s central bank published resolution late yday on website limiting fx position for banks to 30% of assets.Banks will have to limit fx futures contracts to 10% of assets: resolutionBanks must comply with resolution by April 30

And then this happens...

Nine first-responders were killed, seven others injured and two were missing as they battled a fire of unknown origin that destroyed an archive of bank documents in Argentina’s capital on Wednesday.The fire at the Iron Mountain warehouse took hours to control...The destroyed archives included documents stored for Argentina’s banking industry, said Buenos Aires security minister Guillermo Montenegro.The cause of the fire wasn’t immediately clear.Boston-based Iron Mountain manages, stores and protects information for more than 156,000 companies and organizations in 36 countries. Its Argentina subsidiary advertises that its facilities have multiple protections against fire, including advanced systems that can detect and quench flames without damaging important documents....“There are cameras in the area, and these videos will be added to the judicial investigation, to clear up the motive of the fire and collapse,” Montenegro told the Diarios y Noticias agency.

I'm sure it had nothing to do with this.......

Argentina mulls opening its banks to money launderers

A money-laundering amnesty? Don't be ridiculous. AP Photo/Natacha Pisarenko

Have some dirty money you need to launder? You may want to consider Argentina as an option. Lawmakers there are considering a measure that would give amnesty to anyone who wants to pull undeclared cash out of tax havens and deposit it in Argentinian banks.

The government of President Cristina Kirchner is behind the proposal, saying the country needs to do something drastic in order to prop up its investment-starved economy—especially its stalled energy and construction sectors. The idea has a certain logic. Currency pressure in the country is so intense that the black market exchange rate is double the official rate of about 5.2 pesos per US dollar, and even the most upstanding of Argentines stash their money anywhere but banks as a hedge against inflation. Foreign reserves have fallen by nearly a quarter in the last two years to $40 billion, the lowest level since Kirchner took office. With an election coming up in October, Kirchner, her popularity already plummeting, can’t afford further devaluation.

But the proposal has wide-ranging implications, including making Argentina a magnet for global money-laundering. If passed, the amnesty would last at least three months. During that window, banks would issue tax-free energy bonds and certificates of deposit to invest in construction or real estate—without asking where the cash came from.

And there’s a lot of that illicit cash floating around Argentina, thanks to all of the organized crime, drug trafficking, illicit trading, fraud and political corruption in the region. Crime groups and cells of terrorist organizations like Hezbollah have long made the country a kind of Wild West for criminal activity. The tri-border area Argentina shares with Brazil and Paraguay is considered the largest illicit economy in the Western Hemisphere.

So an amnesty program would likely benefit the criminals at well as much as their upstanding countrymen. At a Senate hearing Tuesday, Argentina’s auditor general,Leandro Despouy, warned that the proposal is an invitation for virtually anyone with dirty money to have it “legitimized through fictitious groups.”

In a previous amnesty in 2009, the government replenished its coffers with $4 billion. No doubt some was illicit. The current proposal’s supporters say it prohibits elected officials and anyone facing money-laundering probes from participating. But tax lawyer Roberto Durrieu told lawmakers that because of gaping holes in the proposed law, “we run the risk that organized crime would see a window to enter Argentina.”

Some financial experts also warn that an amnesty would prompt global regulators like the Financial Action Task Force to penalize Argentina for encouraging money laundering. Argentina is already on the outs with such agencies for not aggressively following international anti-money laundering processes. And in its 2012 report,Transparency International says the country ranks far down the list of corrupt governments, between Mongolia and Gabon.

The vote is slated for next week. That may be bad timing for Kirchner, given the media’s interest in a criminal probe into her friend, the businessman Lazaro Baez, for alleged corruption and money laundering. (He has denied the allegations). And Miriam Quiroga, Kirchner’s former personal secretary, recently declared in a TV interview that she saw bags of cash being carried through the Casa Rosada government house.

Wednesday, February 05, 2014 11:55 AM

Brazil, Russia Cancel Debt Auctions; Head-in-Sand Move Won't Work

Russia and Brazil don't like escalating interest rates. Their "solution"? Cancel government debt auctions.

Russia Cancels Debt Auctions Second Week

Yesterday, Reuters reported Russia cancels domestic bond auction citing market conditions

Russia Cancels Debt Auctions Second Week

Yesterday, Reuters reported Russia cancels domestic bond auction citing market conditions

Russia's finance ministry cancelled its weekly domestic bond auctions for the second week in a row on Tuesday, saying in a statement the decision was "based on an analysis of current market conditions".

Yields on so-called OFZ bonds have risen by 70-80 basis points since the start of the year. A new ministry sale could have potentially pushed the rates higher, analysts said.

Brazil Cancels Debt Auctions

Today, Bloomberg reports Brazil Government Yields Fall After Auctions Canceled.

Brazilian government bond yields extended their drop from a four-year high after the Treasury canceled auctions of fixed-rate and zero-coupon bonds amid a selloff in emerging-market assets.Head-in-Sand Move Won't Work

Yields on local bonds maturing in 2017 declined 18 basis points, or 0.18 percentage point, to 12.80 percent at 3:20 p.m. in Sao Paulo after increasing Feb. 3 to 13.14 percent, the highest since January 2010.

The Treasury cited market conditions for its decision and said the last time it canceled auctions to sell zero-coupon LTNs and fixed-rate NTN-Fs was in July. The government had planned to sell zero-coupon bonds maturing in 2014, 2016 and 2018 and fixed-rate bonds maturing in 2021 and 2025.

This kind of head-in-the sand move won't work long. In fact, it did not work at all, it only created an illusion of working. Unless underlying conditions change quickly, and favorably (both doubtful), there is a strong likelihood of increased volatility when auctions resume.

Mike "Mish" Shedlock

The "Toxic Mix For Risk-Assets" In A Post-Taper World

Submitted by Tyler Durden on 02/05/2014 16:58 -0500

From Guy Haselmann of ScotiaBank

Risk-Off

Markets have been unwelcoming and volatile since Janet Yellen’s swearing-in ceremony on Monday morning. She should not take it personally as market agita is the result of a confluence of factors. Certainly, the FOMC deserves a large portion of the blame as years of ‘pedal to the metal’ strategy demolished the ability of the Fed to know what the market’s reaction function would be once they eased off the accelerator. Few should be surprised that there were a number of risk-seeking investors who were waiting for ‘tapering’ as the catalyst to reduce risk and to remove capital from a few EM countries.

To be fair, some of the troubles that have arisen in EM countries are isolated country-specific problems, but few should dispute that capital outflows have occurred due to ‘tapering’; thus, exacerbating their challenges.

A quick reminder is in order. One main goal of the extraordinary measures of Fed policies (QE and ZIRP) was to lift asset prices. In this regard, the Fed was successful as the S&P rose 160% above its 2009 low (from 676 to 1848). The S&P is also coming off of a 32% year and posted double digit gains in 4 of the last 5 years. Credit spreads have had an equally impressive surge. Junk bond yields (oops, they are called ‘high-yield’) have declined more than 1500 basis points from 2009 spread levels.

Despite recent market weakness, the S&P is only 5.2% below all-time high prices; yet, investor worry seems quite substantial. Part of the reason is due to the speed of the descent (5%+ in three weeks). However, the magnitude (not speed) of the decline is quite small given the enormous gains in recent years; and therefore, it will not prevent the Fed from continuing its tapering path.

The drop in the 10 year yield to 2.65% should actually provide further encouragement and cover for further QE withdrawal. The hurdle to ‘taper the taper’ (i.e. pause) is exceptionally high.

There is only one way that the lofty asset price levels could have been maintained and that was for enough economic growth to be generated in order for the economic fundamentals to justify the prices. For too long, investors have given the Fed the benefit of the doubt that its policies would be able to achieve this outcome; consequently, they loaded-up on risk assets. They believed that if the economy should falter, the Fed would merely react by staying accommodative until economic activity improved. The ‘Fed put’, clearly, resulted in wide-spread moral hazard and investor complacency.

The shift to ‘tapering’ when the global economy appears under strain now leaves investors in a quandary. The fact that investors have begun to question the effectiveness of further asset purchases and whether much more can be provided without causing financial instability has roiled investor mindsets. The most recent Fed Minutes have unveiled these as valid concerns. The impact of ‘tapering’ along with the challenges exposed in China (Trust securities), Japan (Abenomics and imported energy costs), and EM countries (capital outflows and interest rate hikes) are forming a toxic mix for risk-assets.

The toxic brew, after several years of double digit portfolio gains, means that prudent investors and portfolio managers are well-advised to reduce risk (and stop justifying out-sized risk exposures by ‘fear of missing the upside’).

Risk positions have accumulated over several years, therefore three weeks of volatility (and the resulting minor correction) witnessed recently are probably only a small fraction (and indication) of what is yet to come.

Poor market liquidity will likely intensify capital flows and force transactions at sub-optimal prices. The most liquid instruments will start to command higher liquidity premiums. Should global challenges deteriorate further or contagion advance, a meaningful reduction in growth and inflationary expectations are likely to arise. This potential scenario may (be necessary to) propel Treasury prices higher and through the 2.5% yield on the 10-year note.

“Every closed eye is not sleeping and every open eye is not seeing”.

– Bill Cosby

Japocalypse Wow - Foreigners Dump Most Japanese Stocks Since 2010

Submitted by Tyler Durden on 02/05/2014 21:15 -0500

It would seem, in the case of momo-chasing levered fast-money flows, that Propertius was correct - "fickleness has always befriended the beautiful..." and Japanese stocks are no longer the once beautiful trend that Abe had promised them to be. A tapering of the US flow; a ripple across the bow of emerging markets; and suddenly Kyle Bass' sarcastically-named "macro tourists" are running for exits as Shakespeare himself once wrote, "was ever feather so lightly blown to and fro as this multitude." Historical quotations aside, the last time flow swung so violently negative, the Nikkei ended up losing 55% in the next 18 months. We love the smell of nay-sayers in the morning...

Foreigners sold the most Japanese stocks last week since 2010 and before that since the credit crisis started to implode...

This outflow was 3x the size of the entire selling following the tumble in May/June last year.

and just in case you are banking on that flowing back to the US... think again - as we are trying to explain - it's not real money, it's credit-created leverage...

The ironists among market punters will even attempt to construe all this as a reason to buy more developed world stocks on the premise that the money flooding out of such places as Thailand, the Ukraine, Turkey, and Argentina will be parked in the S&P and the DAX (perhaps overlooking the fact that the purchase price of these now-unwanted positions was most likely borrowed, meaning that their liquidation will also extinguish the associated credit, not re-allocate it).

A gentle reminder of days gone by when rational investors roamed the markets...

No comments:

Post a Comment