http://market-ticker.org/akcs-www?post=228604

http://www.infowars.com/chase-imposes-new-capitol-controls-on-cash-deposits/

http://wallstreetonparade.com/2014/02/as-bank-deaths-continue-to-shock-documents-reveal-jpmorgan-has-been-patenting-death-derivatives/

The probability of two vibrant young men in their 30s who are employed by the same global bank but separated by an ocean dying within six days of each other is remote. And few companies are in as good a position to understand just how remote as is JPMorgan: since 2010, it has received four patents on quantifying longevity risks and structuring wagers via death derivatives.

The probability of two vibrant young men in their 30s who are employed by the same global bank but separated by an ocean dying within six days of each other is remote. And few companies are in as good a position to understand just how remote as is JPMorgan: since 2010, it has received four patents on quantifying longevity risks and structuring wagers via death derivatives.

We're A Bank. FU Peasant

Jesus.....

Now that would be just dandy, right? Your card company shows up at your place of employment? Gee, that might not get you fired. Oh wait....

But it gets better:

Is this illegal? Nope, not if you consent to it.

Now there might be a violation of anti-harassment laws and similar somewhere, or a fair credit problem at some point, but that's not the issue.

The issue is this: You are consenting to this company engaging in deception on an active basis when you accept one of their cards.

So why would you want that "in your wallet" when by having it you're inviting the company to actively deceive you?

The company tried to claim that it really didn't mean what it said when the LA Times called them. Well, if they really didn't mean it why did they put it in their contract terms?

Just like the guy who is standing there with a literal smoking gun says "I didn't shoot him!" and you believe him despite the smoking gun..... right?

What's NOT in my wallet?

I'll give you three guesses but I suspect you only need one.

Credit card issuer Capital One isn't shy about getting into customers' faces. The company recently sent a contract update to cardholders that makes clear it can drop by any time it pleases.A personal visit? Oh yes, they apparently go on to tell you that this "visit" could be to your office.

The update specifies that "we may contact you in any manner we choose" and that such contacts can include calls, emails, texts, faxes or a "personal visit."

Now that would be just dandy, right? Your card company shows up at your place of employment? Gee, that might not get you fired. Oh wait....

But it gets better:

"We may modify or suppress caller ID and similar services and identify ourselves on these services in any manner we choose."In other words, while contacting you they can also lie about who they are.

Is this illegal? Nope, not if you consent to it.

Now there might be a violation of anti-harassment laws and similar somewhere, or a fair credit problem at some point, but that's not the issue.

The issue is this: You are consenting to this company engaging in deception on an active basis when you accept one of their cards.

So why would you want that "in your wallet" when by having it you're inviting the company to actively deceive you?

The company tried to claim that it really didn't mean what it said when the LA Times called them. Well, if they really didn't mean it why did they put it in their contract terms?

Just like the guy who is standing there with a literal smoking gun says "I didn't shoot him!" and you believe him despite the smoking gun..... right?

What's NOT in my wallet?

I'll give you three guesses but I suspect you only need one.

http://www.infowars.com/chase-imposes-new-capitol-controls-on-cash-deposits/

Chase Imposes New Capital Controls on Cash Deposits

Customers have to show ID, can no longer deposit cash into another person’s account

Paul Joseph Watson

Infowars.com

February 17, 2014

Infowars.com

February 17, 2014

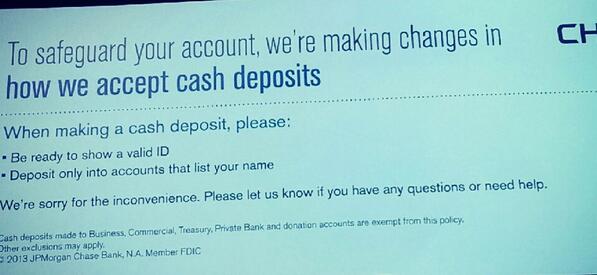

JPMorgan Chase has irked its customers by imposing new capital controls that mandate identification for cash deposits and ban cash being deposited into another person’s account.

@karaxsue @ShepardAmbellas @PrisonPlanet new policy, starts in march, no longer can use cash; attempt to derail BTC?

Air Force veteran Kristen Meghan received a letter from Chase informing her of “changes in how we accept cash deposits.”

“When making a cash deposit please; be ready to show a valid ID – deposit only into accounts that list your name,” states the letter.

The move is another example of how banks are becoming increasingly invasive and restrictive with how they treat their customers, while crypto-currency alternatives like Bitcoin offer total anonymity.

According to Meghan, when she asked a Chase bank teller why cash deposits couldn’t be made into another person’s account, she was told that the new regulation was imposed by government request.

- VIDEO: Why is Chase Bank Banning Wire Transfers? http://youtu.be/d21tmz6Om8o

@PrisonPlanet @ShepardAmbellas u can't make cash deposits in other people's accts anymore either. Bank teller told me it was govts request

According to Fox Business, Chase is “the first big bank to enact such a change.” Customers are already being asked for ID as of February 1, while cash deposits into accounts bearing someone else’s name will be banned from March 3 onwards.

Chase claims it is imposing the changes to prevent money laundering, although the policy is likely to cause massive inconvenience for families, such as parents who wish to deposit cash in accounts belonging to children who are away at college.

Representatives from Bank of America, Citigroup and Wells Fargo did not respond to questions on whether they would also be looking to impose the same rules.

Some analysts have speculated that such measures are a sign that banks are preparing for economic turmoil and potential bank runs. Last year it was reported that two of the biggest banks in America were stuffing their ATMs with 20-30 per cent more cash than usual in order to head off a potential bank run if the U.S. defaults on its debt.

- Chase Imposes New Capital Controls on Cash Deposits - http://www.infowars.com/chase-imposes-new-capitol-controls-on-cash-deposits/ … @geraldcelente @stacyherbert

@PrisonPlanet Ridiculous. JPM will still make it easy for the next Madoff; it's just families as the article says who will be hassled.

This is by no means the first example of Chase imposing capital controls on their customers’ accounts.

In October last year, we reported on how Chase instituted policy changes which banned international wire transfers while restricting cash activity for business customers (both deposits and withdrawals) to a $50,000 limit per statement cycle.

The bank’s reputation was already under scrutiny after an incident last year when Chase Bank customers across the country attempted to withdraw cash from ATMs only to see that their account balance had been reduced to zero. The problem, which Chase attributed to a technical glitch, lasted for hours before it was fixed, prompting panic from some customers.

Other banks have also imposed capital controls in recent months, including HSBC, which is preventing customers from withdrawing larger amounts of money without written documentation proving how it is to be used.

http://www.blacklistednews.com/Ohio_Bank_Erroneously_Files_Many_of_Its_Depositors_for_Bankruptcy/32971/0/38/38/Y/M.html

SOURCE: STRATRISKS

Oops.

What the Fifth Third National Bank’s letter didn’t tell its customers was that their “bankruptcy” status was sent to the credit bureaus Experian, TransUnion, Equifax, and Innovis last October because of an erroneous software update to its IT systems. The bank found the error in November, but it wasn’t fixed until December. The letter also didn’t explain why the bank decided to wait until last week to inform its customers of the problem.

Fifth Third National Bank refused to tell inquiring news agencies exactly what happened, nor how many of its customers the bank falsely reported were in bankruptcy proceedings; it would only say it was a “limited” number. However, a couple of news reports placed the number at over 20 000.

The bank did put out a statement saying that it corrected the false information with the four credit bureaus, and that if a customer did not have a credit issue before receiving the letter, they “should” not have one now. It also stated that, “The accuracy of our customers’ credit history is important to us, and we will ensure that no customer will suffer negative impact.”

As Bank Deaths Continue to Shock, Documents Reveal JPMorgan Has Been Patenting Death Derivatives

By Pam Martens and Russ Martens: February 17, 2014

The probability of two vibrant young men in their 30s who are employed by the same global bank but separated by an ocean dying within six days of each other is remote. And few companies are in as good a position to understand just how remote as is JPMorgan: since 2010, it has received four patents on quantifying longevity risks and structuring wagers via death derivatives.

The probability of two vibrant young men in their 30s who are employed by the same global bank but separated by an ocean dying within six days of each other is remote. And few companies are in as good a position to understand just how remote as is JPMorgan: since 2010, it has received four patents on quantifying longevity risks and structuring wagers via death derivatives.

The two deaths at JPMorgan remain unexplained. Gabriel Magee, a 39-year old technology Vice President was found dead on the 9th level rooftop of JPMorgan’s European headquarters at 25 Bank Street in the Canary Wharf section of London on January 28 of this year. A London coroner’s inquest is scheduled for May 15 to determine the cause of death. Six days later, Ryan Crane, a 37-year old Executive Director involved in trading at JPMorgan’s New York office was found dead at his Stamford, Connecticut home. Wall Street On Parade spoke with the Chief Medical Examiner’s office in Connecticut and was told the cause of death is “pending,” with final results expected in a few weeks.

Magee’s death was originally reported by London newspapers as a jump from the 33rd level rooftop of JPMorgan’s building with the strong implication that eyewitnesses had observed the jump. The London Evening Standard tweeted: “Bankers watch JP Morgan IT exec fall to his death from roof of London HQ,” which then linked to their article which said in its opening sentence that “A man plunged to his death from a Canary Wharf tower in front of thousands of horrified commuters today.”

When Wall Street On Parade contacted the Metropolitan Police in London a few days later, there was no assurance that even one eyewitness was on record as having seen Magee jump from the building.

Crane’s death is equally problematic. The death occurred on February 3 but the first major media to report it was Bloomberg News on February 13, ten days after the fact, and making no mention of Magee’s unexplained death just six days prior.

According to information available at the U.S. Patent and Trademark Office, JPMorgan created the LifeMetrics Index in March 2007 as an “international index designed to benchmark and trade longevity risk.” The index was said to enable pension plans to hedge the risk of payments to retirees and incorporated “historical and current statistics on mortality rates and life expectancy, across genders, ages, and nationalities.” From 2010 through 2013, JPMorgan has received patent approval on four longevity related patents.

Reuters reported on August 26, 2013 that the long-term longevity bets taken on by the big banks have now started to cause pain as international capital rules known as Basel III require more capital to be set aside for longer-dated positions. The article noted that “JPMorgan likely has the biggest holdings of long-dated swaps because it is the biggest swaps trader on Wall Street, responsible for about 30 percent of the market by some measures, traders at rival firms said.”

One extremely long longevity bet taken on by JPMorgan was reported by Insurance Riskon October 1, 2008. According to the publication, JPMorgan entered into a 40-year £500 million notional longevity swap with Canada Life whereby Canada Life would make a fixed annual payment in return for a floating liability-matching payment that would increase if the annuitants lived longer than expected. JPMorgan was believed to have passed on some of the risk to hedge fund investors but retained the counterparty risk. Because many of these deals are private, the full extent of JPMorgan’s exposure in this area is not known.

Wall Street veterans have also commented on the fact that JPMorgan may actually stand to profit from the early deaths of the two young men in their 30s. As we reported in March of last year, when the U.S. Senate’s Permanent Subcommittee on Investigations released its report on JPMorgan’s high risk bets known as the London Whale debacle, its Exhibit 81 showed that JPMorgan’s Chief Investment Office was also overseeing Bank Owned Life Insurance (BOLI) and Corporate Owned Life Insurance (COLI) plans which allow the corporation to reap huge tax benefits by taking out life insurance policies on workers – even low wage workers – and naming the corporation the beneficiary of the death benefit. Both the buildup in the policy and the benefit at death are received tax free to the corporation.

According to the exhibit, the Chief Investment Office was tasked with “Maximization of tax-advantaged investments of life insurance premiums” for the BOLI/COLI plans. According to a report in the Wall Street Journal in 2009, JPMorgan had $12 billion in BOLI, noting that a JPMorgan spokesperson had confirmed the figure. Other insurance industry experts put the total for both BOLI and COLI at JPMorgan significantly higher.

In September of last year, Risk Magazine reported that the Basel Committee on Banking Supervision, the International Organization of Securities Commissions and the International Association of Insurance Supervisors had published a report in August warning regulators that longevity swaps may expose banks to longevity tail risk – meaning, for example, that actual death rates in a given portfolio may vary dramatically from a large population index.

One advisor is quoted as follows in the article: “You can see from the position paper that this market has a lot of characteristics that regulators don’t like in terms of banks getting involved in it. It’s based on long-dated risks, upfront payments and a serious element of hubris in assuming that the banks can model these risks better than the people who originated them. It’s potentially a market big enough to cause serious problems if it caught on and went wrong.”

That things are starting to go seriously wrong was evident in a Bloomberg News report that emerged last Friday. AIG reported that it was taking a $971 million impairment charge before taxes for 2013 on its holdings of life settlement contracts because people were living longer than expected. AIG is the company that was bailed out by the U.S. taxpayer to the tune of $182 billion during the financial crisis because of bets gone wrong.

No comments:

Post a Comment